How to Profit From Crypto Crash?

Often, markets crash unexpectedly, and most traders wonder what went wrong. In the typical crypto investing course, we mostly lose in such scenarios. However, there is something that traders can do that would not only recover their losses but also give them a good profit.

This commonly used strategy is called shorting or short selling. It uses a futures or options contract to bet against the markets; therefore, you benefit whenever the market falls.

In this article, we will explain the concept of shorting in-depth and use an example to show how to use it to extract the maximum profits from a market crash.

Short Selling Explained

Short Selling refers to an activity where traders sell a future or options contract at a higher price and re-buy them at a lower price. The difference between the two prices is the trader’s profit. If the trade goes in the opposite direction, i.e., the price of crypto rises, it results in a loss.

For example, if a trader believes that Bitcoin might fall soon, they can either borrow some Bitcoins from someone, sell them while their price is still high, and then buy them again at a lower price. The difference is their profit. However, if the price of Bitcoin rises during that time, the trader has to re-buy Bitcoin at a higher price and hence faces a loss.

This entire process is known as short selling.

But in the real world, traders use a futures contract or options contract rather than borrowing crypto and selling it. Both contracts allow traders to profit or suffer losses, similar to shorting crypto.

A futures or options contract lets two people (with opposite views) bet against each other. If the market rises, the person with a bullish view makes money; if the price falls, the person with a bearish view makes money.

These contracts also exist in leveraged form, allowing users to bet for or against the markets with a higher probability of profit and loss. Hence, buying one 5x leveraged future for BTC equals buying 5 BTC, giving the same return.

Stepwise Guide

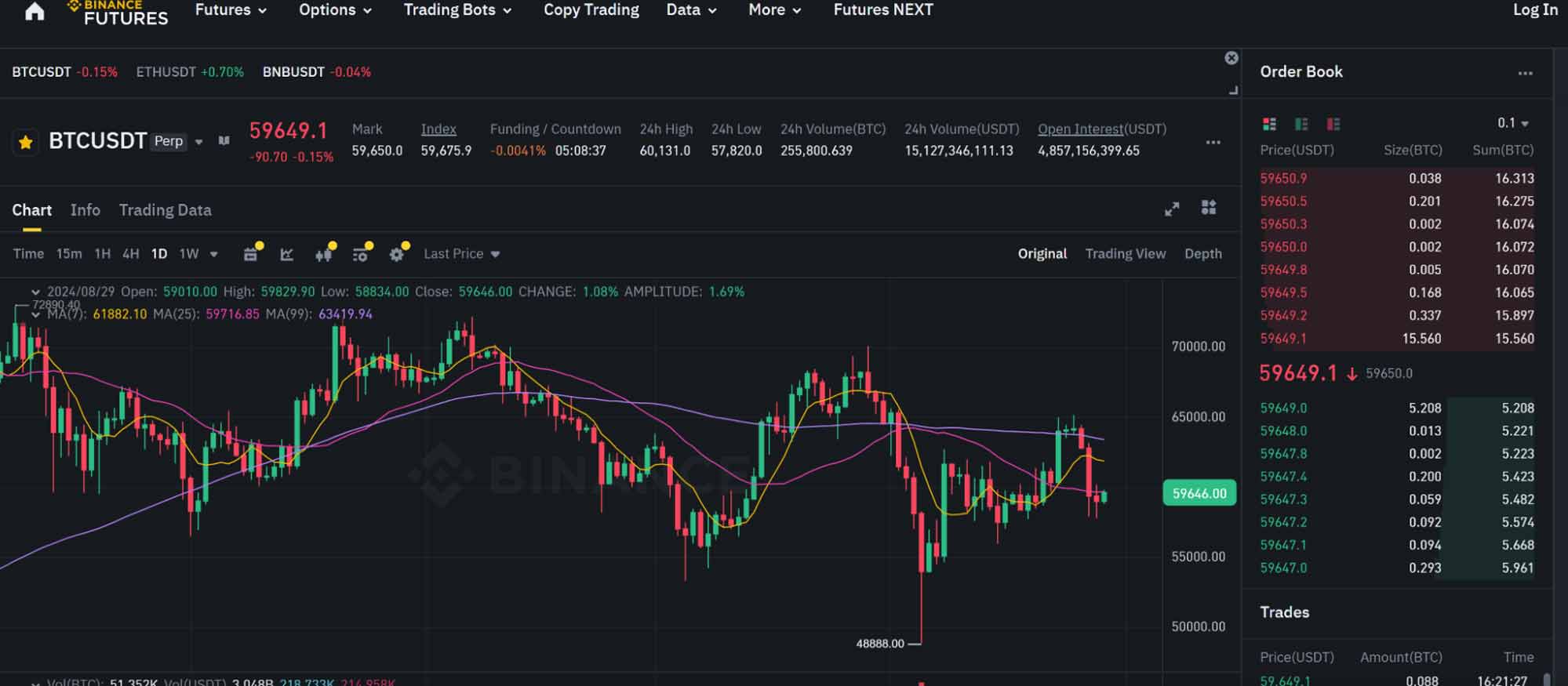

Making money from a crypto crash is easier than it seems. You only need an exchange account like Binance, KuCoin, OKX, or any other crypto exchange with decent volumes. This is essential because the higher the exchange volume, the more quickly you can enter and exit trades.

Once you have signed up, follow these simple steps to short the markets.

- First, decide which cryptocurrency you want to short. Traders usually pick the one that has seen high growth in the recent past and is about to correct or is already in a downtrend.

- Make sure you have the funds required for the trade.

- Then, choose a likely time for the crash to occur and confirm your views using technical charts and indicators.

- Once done, proceed to the exchange and choose a leveraged trade. For example, if ETH might crash tomorrow and you wish to use a leverage of 3x, choose ETH 3X Short/USDT.

Here, USDT is the base currency. You can also select a USDC, FDUSD or DAI-based trading pair.

Note that leverage should only be used when you know the risks. High leverage gives higher returns but also increases the risk proportionally.

- Once you are done selecting, choose buy. This will execute the trade.

- At any point in time, if you wish to exit the trade, just select the trading pair you have bought and click sell. Alternatively, you can also go to the orders section on your profile and end the trade there.

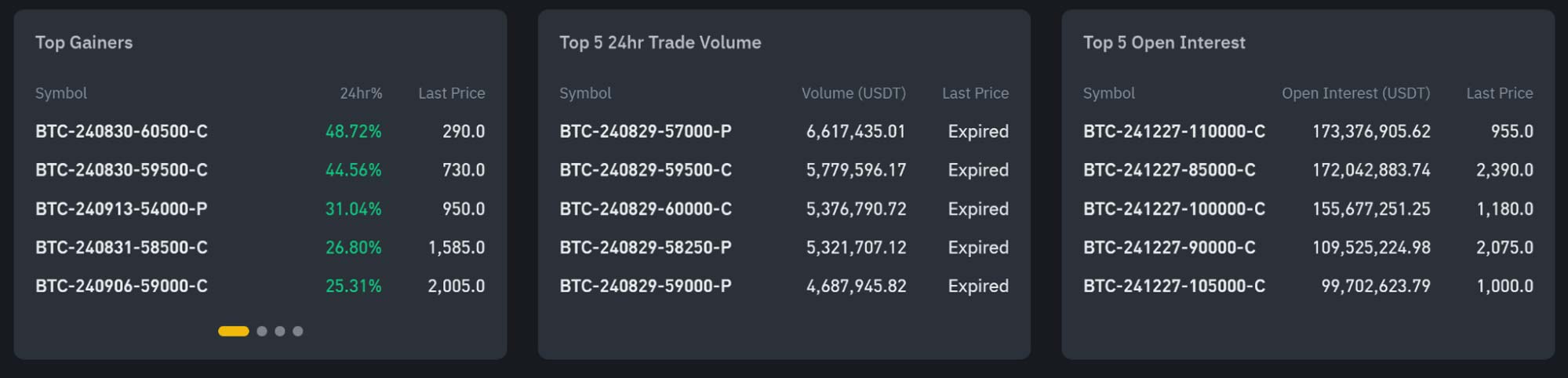

Perpetual vs Expiry Contracts

Among all traders, a point of confusion remains whether to use perpetual contracts or those that expire.

Perpetual contracts are often more pricier but give you a long time to enter and exit trades. On the other hand, expiry-based contracts are cheaper, but they give you a limited time to trade before they finally expire.

The choice is simple. You need a perpetual contract if you are negative on Bitcoin for extended periods, such as the entire year, like during the crypto winter.

On the other hand, if you are positive that a crash is imminent or within the next expiry period (usually every Friday), choose an expiry-based contract.

Do’s and Don’ts While Trading in a Crash

Keeping a few rules handy is essential, and it can help you survive the markets even if your mind gets overwhelmed with emotions and data.

- Make sure to distinguish beginner’s luck with skill. Beginners win big initially before falling into a trap that ends their trading journey.

- Never trade with borrowed funds. Markets are often unpredictable; one wrong move could land you in serious debt.

- Always use a stop-loss. A stop-loss technique prevents you from burning your entire capital in one trade. It can be placed in the same window that you use to place your trade.

- Always confirm your conviction with technical indicators and charts to ensure your analysis aligns with the data.

- Do not try to copy experts. Several experts take contrarian views on the market because they have enough capital to buffer their loss-making trades.

Frequently Asked Questions

What to do when crypto crashes?

You can hedge your funds by buying put options if you are an investor. You can also benefit from the fall if you sell futures.

Can I get money back if I lose in crypto trading?

If you have not lost a considerable amount, you can trade with patience to slowly recover your funds. Otherwise, taking a break from trading is in your best interests.

Is it possible for Bitcoin to go to zero?

Technically, all cryptos can go to zero. However, several buyers will see it as an opportunity in the real world, even if many people are negative.

Can I short-sell in intraday?

Yes, you can short-sell intraday or even take your shorts over weeks or months. But be careful of the nature of the contracts you choose.