How to Master Fundamental Analysis in Crypto Investing

Fundamental analysis forms the basis for investing in any crypto. Whether memecoin, layer-1 or a DeFi coin, fundamental analysis gives us the long-term view, sustainability and a look beyond the usual hype.

Though fundamental analysis is a well-understood concept, investors often need clarification about the priority they must give to the factors. This article provides a small guide to mastering fundamental analysis and helps you understand the principles that let you make profitable decisions.

What is Fundamental Analysis?

Fundamental analysis examines an investment’s long-term viability regarding its competitors, external environment, and regulations.

Most fundamental analysts use the following list to denote all the factors that impact investment, which are:

- Political landscape, which regulates the industry.

- Economic factors include the availability of money, liquidity in the market and the purchasing power of customers.

- Social factors tend to influence user behaviour, such as peer pressure, panic selling, and buying, with a fear of missing out (FOMO).

- Technological factors include technology availability, developers’ efficiency, and the open-source resources available to companies.

7 Principles to Master Fundamental Analysis

Evaluate Tokenomics

Tokenomics is an essential part of fundamental analysis. It evaluates how tokens are distributed and held in crypto projects.

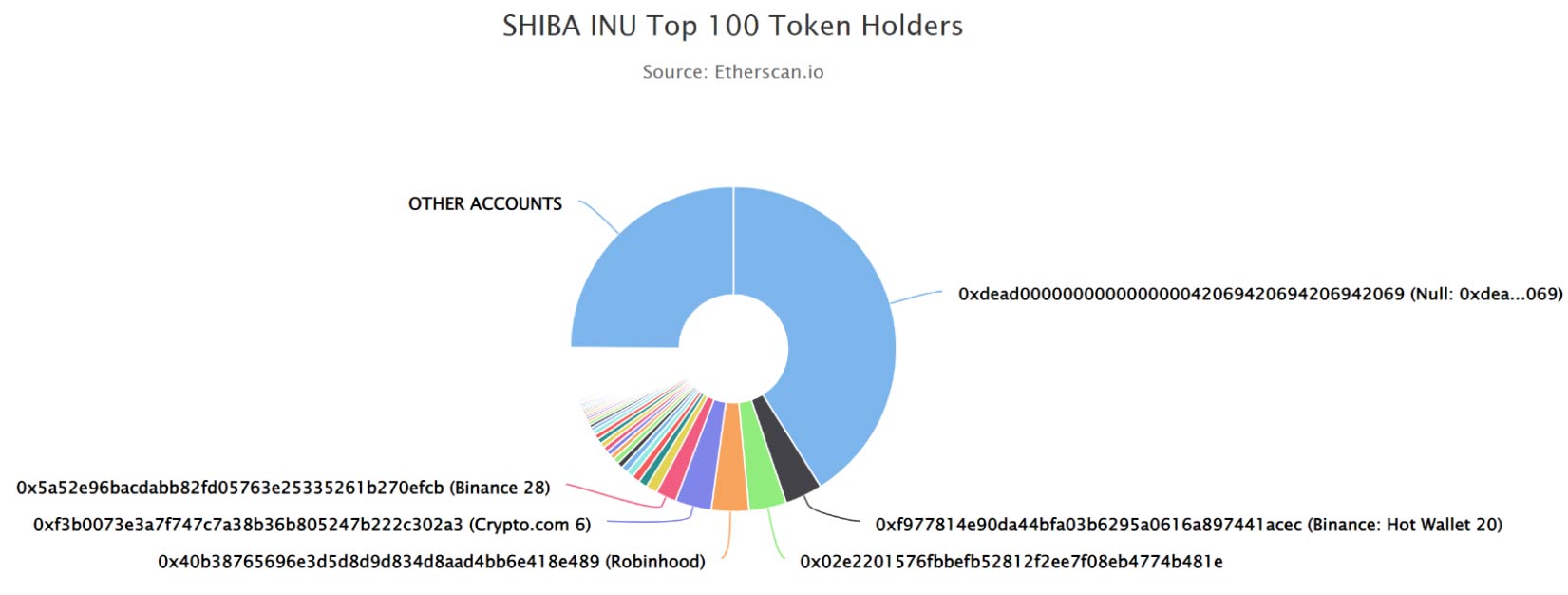

A high number of tokens in the hands of large investors like Shiba Inu can make the coin easily manipulated, while a distributed token like Bitcoin is relatively safer.

Further, the minting rate is an essential factor that shows how many new coins are minted yearly. Too many new coins in the supply can dilute other investors’ token values.

Have a Long Term View

Fundamental analysis often takes a very long-term view, from a few weeks to multiple years. This is because its primary goal is to generate wealth in the long term.

Here, cryptocurrencies are evaluated based on their suitability for long investment horizons.

For example, Ripple, which recently won a case against the SEC, albeit by paying a small fine, is now suitable for long-term investments because it is clear that the SEC will never be able to term it a security.

Always Calculate the Risks

There are several types of risks associated with crypto investments. Often, a cryptocurrency could be vulnerable to multiple risks. A few risks are listed below to give you a better understanding.

- Systemic Risk: This risk is related to the systemic failure of crypto, causing it to implode. An example of this is the Terra Luna crash in May 2022.

- De-peg Risk: This risk is associated with stablecoins. If there are too many shorts or a high level of redemption on a given stablecoin, it risks getting de-pegged. An example is the de-peg of USDT amid the Terra Luna fiasco.

- Risks Related to Hacks: Hacks and subsequent exploits also pose severe risks to projects, causing a fall in their adoption and even forcing them towards bankruptcy. An example of such risk is the Ronin Bridge hack, which caused the token to crash from $3.58 to $0.24.

- Regulatory Risk: Regulatory action on a project might lead to a panic sale that can severely threaten its survival. One example of regulatory risk was the action on Telegram, which caused TON to crash 22% in a day.

Check if the Idea Can Be Copied

If the idea behind a crypto’s success is generic or can be easily copied, such cryptocurrencies should be avoided. Crypto is a highly competitive environment that always suffers from employee poaching, which can easily reveal your secrets to competitors.

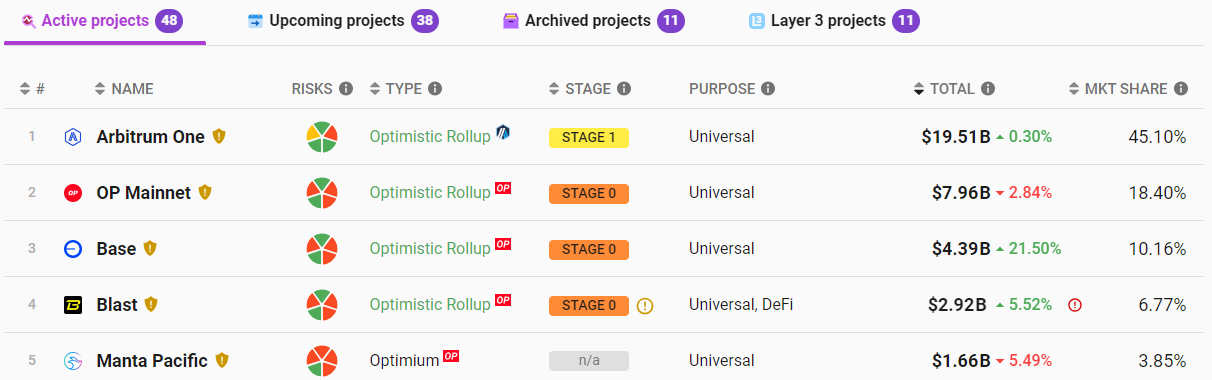

Further, if an idea is too generic, it will be copied soon after some initial success in your project. An example is the existence of dog-based memecoins. After the success of Polygon, several layer-2 chains cropped up, eventually eating its market share.

Always Look for Market Domination

Those cryptocurrencies that heavily dominate the markets are usually better and safer investments. If a project gets too much ahead of its competitors, users generally prefer to buy the more dominant ones, as these have better chances of survival in a market crash or panic sell-off.

Further, more prominent projects have little chance of being rug-pulled or the project dying because of a lack of funds.

Examples of such cryptocurrencies include Bitcoin, Ethereum, Dogecoin, Solana, and Ton.

Check Competitors

The ability of its competitors always limits a project. If the competitors are equally proficient and pose tough competition, it is always better to diversify investments. Since it is unknown which crypto might prevail, placing a bet on a single crypto might be risky.

An example is the Ethereum layer-2 market. Almost all the layer-2 chains are equally capable and also have similar charges. Therefore, rather than investing in any single project, it makes sense to invest equal amounts in the top ones.

Understand Regulatory Impact

Regulatory impact refers to the effects of laws and regulations in the crypto you wish to invest in. This is different from regulatory risk, where action is taken on specific projects. Here, in case of regulatory impact, the action is taken on the market as a whole.

One example of market disruption due to regulatory impact is the impact of col lateralization laws on stablecoin markets. A New York state law mandated that all stablecoins must have 100% collateral. Those stablecoins that adhered to it operated easily, while those that didn’t have to find other states to do business.

Fundamental vs Technical Analysis

Investment Horizon: Fundamental analysis is often used for the long term, while technical analysis is used in the short term.

Trading vs Investing: Fundamental investing suits investors who have more room for error better, while technical analysis suits traders who enter and exit cryptocurrencies more frequently.

Logic vs. Belief: Fundamental analysis has logic behind every move, while technical analysis uses a set of beliefs derived from years of experience.

Fundamental vs On-Chain Analysis

On-chain analysis is a part of fundamental analysis and only relies on the data obtained directly from the blockchain. This data might refer to the number of users, activities, money locked in DeFi protocols, adoption rates, realised gains, etc.

Fundamental analysis has a broader view than on-chain analysis and relies on several more factors to make investment decisions.

Frequently Asked Questions

- Does fundamental analysis involve charts?

- No, price charts are a part of technical analysis.

- Which analysis is best for crypto trading?

- Fundamental analysis is best for investors, while technical analysis suits traders well.

- How do you learn crypto analysis?

- Besides learning fundamental analysis from this article, you can learn technical and on-chain analysis.