What is Crypto Market Cap?

The cryptocurrency market capitalization is the sum of the market values of all cryptocurrencies open for the public to buy at their current price. It is a handy tool and exists in several formats. Further, several publishers calculate their cryptocurrency market cap with minor differences.

The value is used to gain direct insight into the market as a whole. From trading volume to the overall direction of the market, the crypto market cap indicates the position and direction of the entire market.

How to Calculate Cryptocurrency Market Cap?

The cryptocurrency market cap is the sum total of all the individual market caps. It is derived from the share market cap, which is used to gauge market size, direction, and activity.

There are several ways to calculate a cryptocurrency’s market cap. Some may sum up the individual market caps, while others assign weightage to each crypto depending on their importance.

Further, publishers like CoinMarketCap, Coingecko, Coindesk, and others each have different views on which cryptos to include. CoinMarketCap and Coingecko typically list all the cryptos, irrespective of their size, audits or genuineity, while indices like Coindesk are very selective.

Assume that three cryptocurrencies are in the market on a given day: A, B, and C. A has 100k coins at $1, B has 500 coins at $1000, and C has 3 million coins at $0.001.

We simply obtain the individual market caps for the simple market cap calculation and then sum them up.

Market Cap of A = 100,000 coins x $1 = $100,000

Market Cap of B = 500 coins x $1000 = $500,000

Market Cap of C = 3 million x $0.001 = $3,000

Total Market Cap = Mkt Cap of A + Mkt Cap of B + Mkt Cap of C =$ 603,000

Now, as the price of each crypto in the calculation changes every second, so does its market cap, which in turn changes the total market cap.

For the second method, weights are assigned to each component to calculate the weighted market cap for each crypto.

In the above example, suppose the weights of 1, 0.5 and 10 are assigned to each crypto in the same ratio of their network capacity (transactions per second).

The new weighted market cap is

= 1 x Mkt Cap of A + 0.5 x Mkt Cap of B + 10 x Mkt Cap of C

= 1 x $100,000 + 0.5 x $500,000 + 10 x 3,000

= $380,000

Professional investors and firms use this second method more to meet their needs.

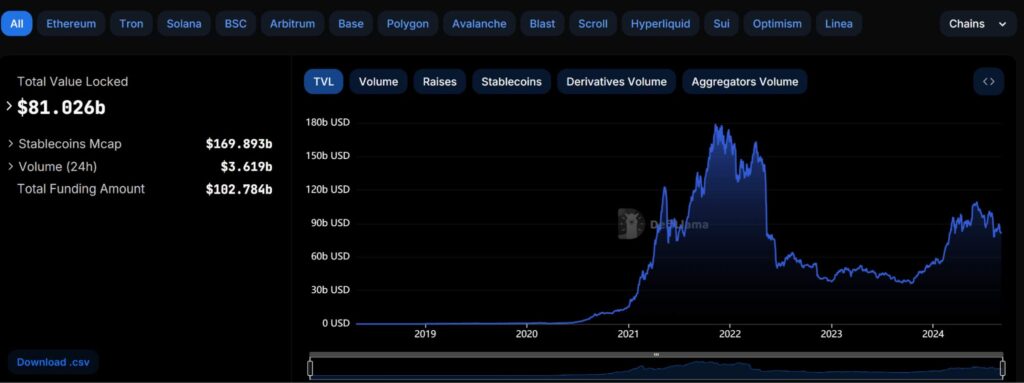

The chart below shows the crypto market cap over 5 years.

The graph shows that the total market cap is $2 trillion. The top 10 components with the highest domination in the crypto market share are listed below.

- Bitcoin (BTC) – $1.153 trillion

- Ethereum (ETH) – $304 billion

- Tether (USDT) – $118 billion

- BNB (BNB) – $75 billion

- Solana(SOL) – $61 billion

- USDC(USDC) – $34 billion

- XRP (XRP) – $31 billion

- Dogecoin (DOGE) $14 billion

- Tron (TRON) – $13.6 billion

- Toncoin (TON) – $13.2 billion

The sum of the top 10 market caps is almost $2 trillion, which means the entire value of crypto markets is in these top 10 coins.

Crypto Market Cap vs TVL

Many beginners might confuse the crypto market cap with the total value locked, or TVL, which is the sum of all the deposits people have made on on-chain protocols like Rocketpool to earn extra money from their cryptocurrencies.

The TVL is currently around $81.83 billion across all chains, which is much less than the crypto market cap of $2 trillion.

3 Uses of Cryptocurrency Market Cap

The crypto market cap isn’t just a fancy number but is useful in many important calculations and decision-making.

Trading

Crypto traders often see the overall changes in crypto market cap over a day or month. This gives them an idea of where the markets might be headed.

To take a directional view and trade in that way (either bullish or bearish), traders compare the direction of the markets over a given period. They also see the quantum of movements, i.e., how much percentage did the markets rose or fell over the last day or week.

Long Term Investing

Investors use the crypto market cap differently. They evaluate the change over a period of time, such as a year, which helps them estimate the returns on their future investments.

Gauging Market Activity

Market volatility can also be calculated from the change in the crypto market cap. Too volatile markets are better for traders, while markets with low volatility attract investors.

Does an increase in market cap increase the crypto value?

The rise in individual market caps of cryptocurrencies leads to a rise in overall market cap, but the reverse is not true, as all cryptocurrencies do not rise or fall together.

Is it good to buy crypto with a high market cap?

Yes, because larger cryptos are more stable and carry less risk than the smaller ones.

How many cryptocurrencies constitute the crypto market cap?

As of Sep 2024, more than 2.4 million individual cryptocurrencies constitute the crypto market cap.