Should You Buy Crypto During a Market Dip?

Market dips create fear and excitement among crypto investors. While a fall in price may look alarming to most, some regard it as an opportunity to enter the market at a relatively cheaper price.

As Warren Buffett famously said, “Be fearful when others are greedy and greedy when others are fearful.”

Here are the factors to consider when deciding whether to invest in crypto during a dip:

Understanding Why Dips Occur

The crypto markets tend to fluctuate widely because of multiple factors and triggers, such as changes in policy news, general macroeconomics, social media madness, and several others, that create price fluctuations and dips rather than being part of an essential fundamental over a long duration.

The early November (2024) price dip was due to election uncertainty and extremely high calls in Bitcoin option contracts around the $70,000 mark. The reason behind a dip can thus help determine whether it is just a temporary fluctuation or part of a trend.

Buy the Dip: A Popular Strategy

It involves buying assets when prices decline, hoping they recover or grow in value. Therefore, this relies on the idea that the dips will be temporary and that, once again, the prices will rise, leaving behind potential profit. Still, one cannot time the market effectively without patience and a degree of market knowledge.

We recommend buying only when the correction is more than 5% over a week or a month rather than getting caught by small intraday fluctuations.

Origin of the Practice: This practice originated from the stock markets where investors used market dips to build long-term positions. The strategy is often confused with Dollar Cost Averaging which is more about buying at regular intervals irrespective of market conditions. This was for investors without sound knowledge of stocks, dips, peaks, etc.

Buying the dip is more suited for investors with some technical knowledge.

Assess Market Sentiment and Trends

Before diving in, gauge the broader market sentiment. Bearish trends can lead to prolonged dips, meaning prices could fall further before they recover. Analyzing whether the dip is part of a larger bearish trend or simply a short-term correction can help you make a more informed decision.

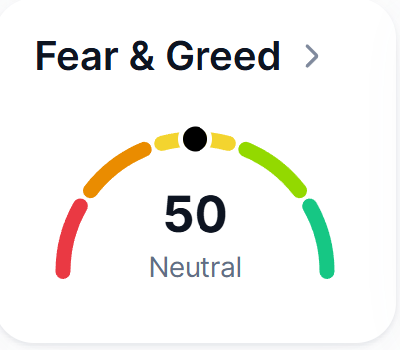

You can use tools like the Fear and Greed Index to assess market sentiment; both Alternative.me and CoinMarketCap offer tested and reliable data sources for this indicator.

- Bearish Trend: Sustained downturn, where dips may persist or worsen.

- Bullish Correction: Short-term decline within an overall positive trend, often followed by a recovery.

Look at your investment horizon

If you are a long-term investor, then dips may be an opportunity to buy assets at a lower cost, hoping they will grow over several years.

For short-term traders, buying during a dip may be riskier because it may take longer for the price to rebound than the trader expects. Bitcoin especially rewards long-term holders.

For instance, those who invested at the last all-time high of $69,000 in November 2021 just broke even, while those who invested earlier or later during bearish phases are now making substantial profits. .

Knowing exactly what you are investing for can help you decide whether buying during a dip is a good fit for your objectives.

Focus on Quality Projects

Quality assets with good fundamentals tend to recover faster at dips. Look for coins with solid use cases, established communities, and strong development teams. Coins related to real-world utilities are more resilient and set to grow in the long run.

Memecoins and NFTs usually thrive on hype and tend to lose their value in the long term, so they are not really worth investing in.

A report by Binance shows that over 97% of memecoins created in the past eventually died within a few months.

Risk Management is Key

There is no promise of making a profit when investing in a dip. Invest only what you can afford to lose. Never use emergency or tied funds.

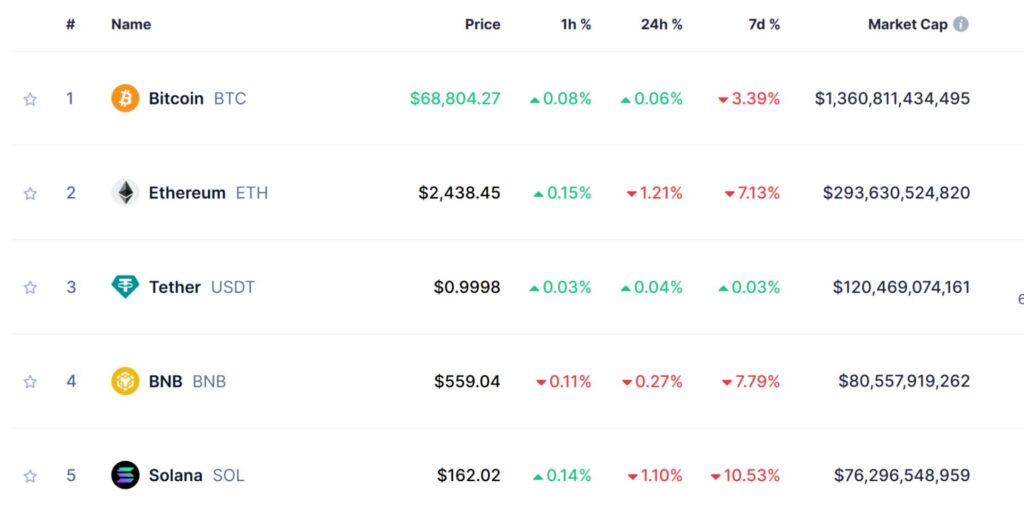

Diversify your portfolio to reduce risks further. A strategy to average down or buy more assets as their price dips can reduce the average buying price and also losses that might be incurred. An average portfolio contains major allocations to Bitcoin, Ethereum, XRP, and Solana while minor allocations go to volatile cryptocurrencies like memecoins. A 5-10% part also goes to emerging projects like RWAs.

In addition, you must set stop-loss orders to limit your losses in case the prices do not recover. If this feature is not manually available, try placing a stop loss using a reminder or writing it down somewhere.

Emotional Regulation

The fear of “missing out” or panic-selling during a dip often shrouds the calculated judgment in emotions. Remember that the market constantly changes; gains and losses are often temporary.

Even those people who bought in at the November 2021 all-time high of $69,000 have now broken even. Calmness and reasonableness can atone for a lot here. Stay on track with your investment plans, avoiding impulsive decisions.

A few common emotional decisions are:

- Buying when there is FOMO.

- Selling around FUD that has no concrete reason.

- Buying or selling due to the remote “possibility” of something to happen.

- Buying or selling on peer advice.

- Buying or selling in projects without due diligence.

This is one strategic move: buying during a market dip. But it’s not risk-free. Success depends on knowing the market trends, keeping an eye on long-term gains, and careful risk management. Never forget that crypto investments are volatile, and while dips offer discounted prices, they also require patience and a willingness to withstand market fluctuations.

![Top Altcoins in October [2024] You Should Look Out For 8 Top Altcoins in October [2024] You Should Look Out For](https://cryptolandoff.com/wp-content/uploads/2024/10/Top-Altcoins-in-October-2024-You-Should-Look-Out-For.jpeg)