Meme Coin Crash: Hawk Tuah Girl’s $HAWK Token Accused of Fraud, Wiping Out Millions

In December, a new playground was set to lure investors with promises of great returns but it came out to be fraud at prima-facia which has wiped out around $450m in just a couple of hours (meme coin crashes from $500m to $50m)

This is not the first time such a thing happened with the investors. Right? But this case is a bit different because a celebrity with a good follower base was not only the brand ambassador for the project but was also the face of the meme coin.

Blockchain’s Trust Crisis: The $HAWK Incident

If we look at the evolution of Web3, there are a few pillars that make it distinguishable from the traditional Web2. Some of these are decentralization of data and protocols, decentralized governance, creating a robust financial ecosystem without any third-party interference, etc. However, the success of Web3 would be largely determined by how much we evolve in the banking and financial sector and can move away from the traditional BFSI ecosystem.

The adaptation rate of Web3 in BFSI would majorly depend on winning the trust of a retail investor, institutional investors, etc. How secure they feel when it comes to investing on any cryptocurrency/token which is again powered by blockchain technology under the Web3 space.

Such news about millions of dollars getting quashed away in just a couple of hours is the biggest hindrance in winning the confidence of an investor and reposing the faith of all in the financial-related schemes/platforms powered by blockchain. An investor should trust an ecosystem before we expect him to start investing any amount of money.

A famous quote suits this circumstance – ‘It is trust, more than the money, that makes the world go round.’

These incidences become the dent in the road of blockchain’s journey to becoming an alternative to the traditional financial ecosystem.

So, the bigger picture here is – “Hawk Tuah Girl Accused Of ‘Crypto Scam’ After Meme Coin Crash, May Faces Lawsuits

Before we delve into what is the real issue and how it all happened, let’s try to understand the people associated with it.

Who is Hawk Turah Girl?

Haliey Welch, known globally as the “Hawk Tuah Girl,” is a cultural icon and vocal about positive social change. She creates engaging content and is a very popular figure, especially among the youth audience. In her content, she promotes values of friendship, community and inclusivity.

She has leveraged her social media account to promote $HAWK token and try to influence and persuade her community to join the $HAWK community.

The Illusion of Celebrity Endorsements in Crypto

Haliey’s inclination towards cryptocurrency started when she got real experience in the industry at the Bitcoin Conference in Nashville earlier this year. This is the place where she built the relationship with some of the crypto stalwarts. Apart from this, she also spoke at Korea Blockchain Week (KBW) which eventually brought her more closer to the crypto industry.

Due to all these exposure and real experiences, she has decided to delve deeper into the crypto world and decided to launch a meme coin.

Why Memecoin?

Being one of the popular faces and the personality behind one of 2024’s most popular memes, Haliey Welch has tried to leverage her meme status. She regularly engages with her audience on her social media platforms, especially on X at @halieywelchx, where she shares and creates memes with her fans.

What is $HAWK Memecoin?

$HAWK memecoin was launched to capitalize the face value of TikTok star ‘Hailey Welch’ also known as the “Hawk Tuah Girl”. The coin aimed to leverage her massive popularity among her community on various social media platforms. She wanted to create excitement and buzz among her followers, just like other successful memecoins like Dogecoin and Shiba Inc.

What has happened exactly?

The Hawk Tuak (HAWK) memecoin was launched on 4th December and it quickly rose exponentially by 900 percent bringing the market cap of $HAWK to nearly half a billion dollars (~$500 million)

The price of the token then plummeted and was trading at a valuation of $41.7 million at the time we are writing this article, marking an almost 91% fall in less than three hours, according to DexScreener data .

According to data from reliable sources like Bubblemaps and Dexscreener, a mix of insider wallets and snipers — entities that rapidly buy up huge amounts of a token’s supply at launch — controlled between 80%-90% of HAWK’s supply at launch.

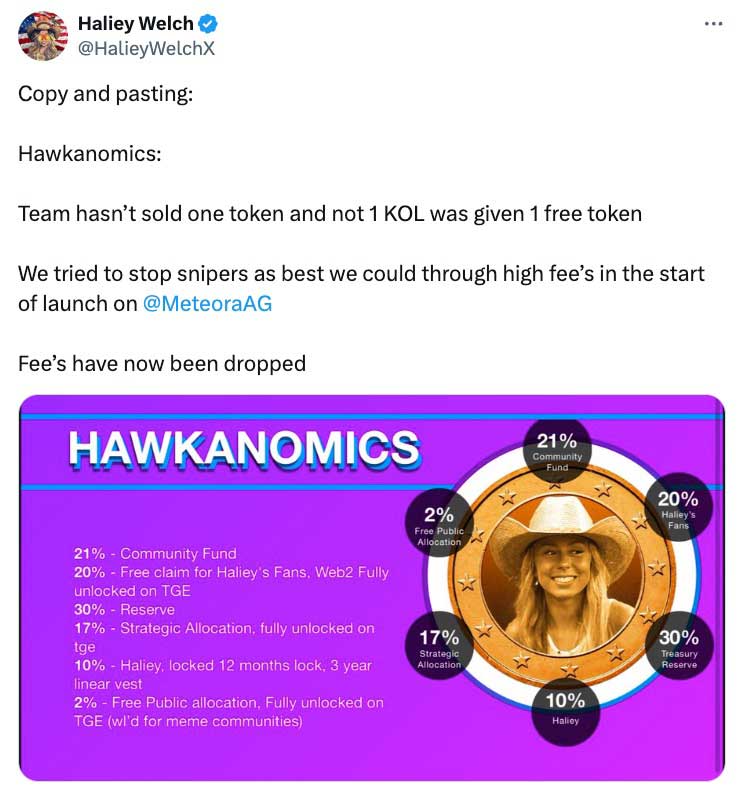

In her 5th December post to X, Welch’s official account said that the team hadn’t sold any tokens and no key opinion leaders were given free coins. In fact, it has been said that they had launched the token on the decentralized liquidity protocol Meteora in order to avoid the sniping risk.

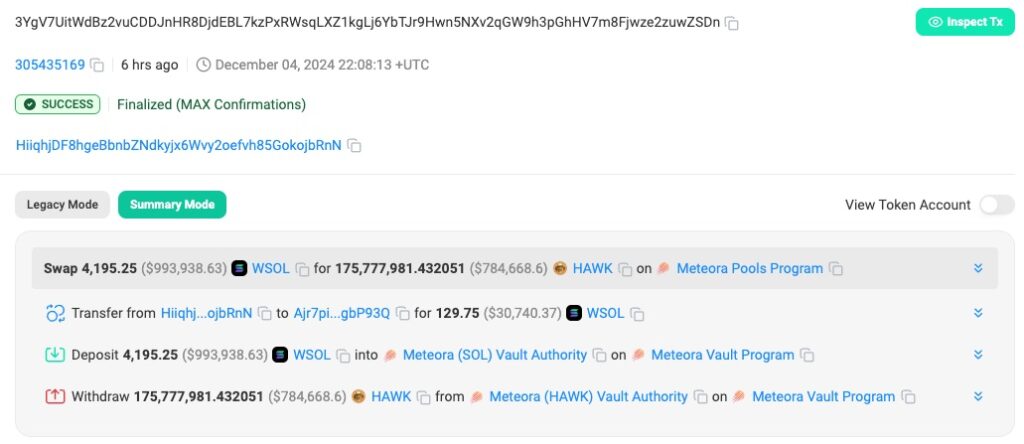

According to data from Solana block explorer Solscan, one wallet managed to snipe HAWK seconds after launch, purchasing 17.5% of the supply of the memecoin for 4,195 Wrapped Solana (WSOL) — worth $993,000 at the time.

Over the next 90 minutes, the wallet sold 135.8 million HAWK tokens for a profit of $1.3 million.

A Weak Defense from the $HAWK Team

Welch and her team appeared in one of the audio events on X space on Wednesday evening while trying to attempt some damage control. But in the entire conversation, she and her team were not able to give any concrete answer as to why and how this had happened. In fact, Welch was mostly silent in the whole 1 hour long conversation, allowing her crypto partners at the platform overHere, which had launched $HAWK, and an individual known as “Doc Hollywood” to answer questions.

On asking the question about what had gone wrong, the team talked in evasive circles, insisting that the team of 18 people behind $HAWK had not sold their tokens.

Later, she has removed the ‘The Space’ discussion from her X account. Although it remains available through a YouTube upload, and the link of the conversation is –

Potential Legal Ramifications for the $HAWK Team

Apart from the investor’s anger and outrage at the token’s deployment, some of the industry experts started saying that it could put Welch and her team into big trouble.

Welch may also face legal repercussions from the US Securities and Exchange Commission (USEC), which has previously gone after other celebrities including Kim Kardashian and Lindsay Lohan.

Let’s see what the events unfold as the time progresses.

Learn from the $HAWK Disaster

It doesn’t matter whether any digital token/cryptocurrency is backed by some celebrity or not, a thorough scrutiny from the investor side is a must to avoid losing his hard-earned money.

And trust those platforms that have some sort of checklist for any token launch and put the interest of the investor everything above.

Let us know your thoughts in the comments section below.

I’m Manak Ahuja, a business administration graduate with a passion for digital marketing. With experience from my family’s business, I understand how to scale in competitive markets. My entrepreneurial spirit and digital marketing expertise drive me to create growth and innovation. I’m excited to continue my journey and make a significant impact in the field.