Key Insights

- Solana has been through rough weather over the last few weeks, with endless sell-offs from the bears.

- Solana (SOL) has also declined by around 60% from its $261 January peak.

- One of the contributing factors to Solana’s volatility has been the success and failures of its memecoin ecosystem.

- Technical analysis shows that the bears are currently dominant. However, a bullish reversal is still possible.

- VanEck predicts a yearly high of $520 for SOL.

Solana, one of the largest altcoins by market cap recently crashed massively this week.

The cryptocurrency plummeted nearly 60% from its January peak of $261 amid widespread investor panic.

This sharp decline has also raised concerns about how sustainable its January rally was, and here are all the reasons why the crash happened in the first place.

The Solana Memecoin Boom and Bust

The December/January SOL price increase was mostly driven by the memecoin craze.

Solana, which is known for its low transaction fees and fast processing, has been the go-to platform for memecoin deployers over the last few months.

The network has grown into a hot spot for speculative trading, especially with thousands of memecoins being deployed on its infrastructure every week.

However, most of these new projects tend to lack real utility, leading to many pump-and-dump incidents that devastated investors.

Once the Solana memecoin hype faded, the price of SOL began to weaken.

One of the most recent and notorious examples of these memecoin cases was LIBRA, which surged to a market cap of around $4 billion within mere hours after being endorsed by Argentinian president Javier Milei.

Just three hours after its launch, this memecoin crashed and wiped out billions in value.

At the time of writing, the price of $SOL is still trading under bearish waters, just as Milei continues to face fraud allegations.

Similarly, other memecoins like MELANIA and Harry Bolz (HARRYBOLZ) ended up the same way, after skyrocketing and then crashing massively.

In the case of HARRYBOLZ, the value of the cryptocurrency soared to around 54,637% after Elon Musk temporarily changed his Twitter name to match the coin.

These events revealed the speculative nature of major coins in the SOL ecosystem and have contributed to the lack of confidence in $SOL.

The Broader Crypto Market Decline

Interestingly, Solana’s struggles aren’t an isolated event.

The broader crypto market has also faced downward pressure lately, with Bitcoin falling below the $100,000 mark.

Ethereum itself also slipped below the $2,700 mark and hit a weekly low of around $2,630 as the rest of the altcoin market followed suit and turned red.

Some other macroeconomic factors, like the rising interest rates and regulatory uncertainty, played a major role in the sentiment decline.

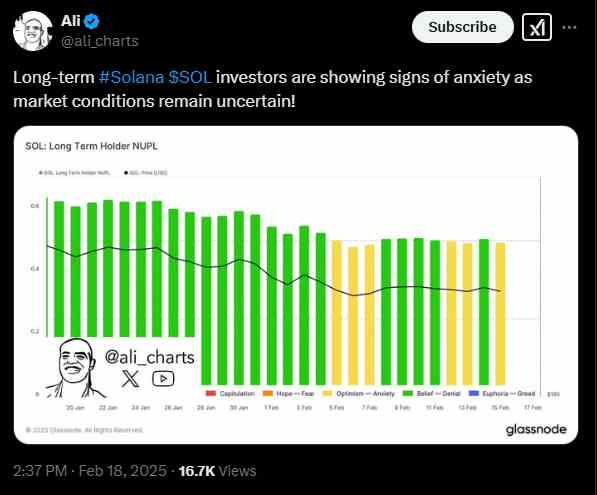

Furthermore, the lack of fresh capital inflows into the market also made it difficult for SOL and many others to sustain their rallies, according to insights from Ali.

Solana’s Technical Analysis—Is a Reversal Possible?

SOL is currently oversold from a technical standpoint.

A quick look at the daily chart shows an RSI reading of 31, which is the cryptocurrency’s lowest point since December of last year.

The Solana decline came just as the cryptocurrency broke below the crucial $187 price level, which held its price down between March and November of last year—before holding it up between November and mid-February.

Overall, the RSI reading indicates that while the bears are stronger than the bulls, they might also be considering profit-taking.

This could lead to an opportunity for the bulls to gain strength and push the cryptocurrency back above this $187 price level.

It is also worth noting that SOL now trades underneath its 50-day (red) and 200-day (blue) moving averages as shown above, which further proves that the bears have the upper hand.

The next support level for Solana at this point is the $135 zone. The cryptocurrency now trades at around $170 and if it fails to hold this level, a dump towards $135 or lower could occur.

On the flip side, the bulls stepping in could help SOL recover above the $187 price zone once again.

Upcoming Token Unlock—More Selling Pressure?

The Bulls have a lot more than beating the Bears in the charts, though.

Another aspect of the ongoing battle is the upcoming token unlock event on 1 March, which is set to release approximately 11.2 million SOL tokens.

This tranche is valued at over $2 billion and is part of the liquidation process from the FTX collapse in November 2021.

The inflow of new supply could add even more selling pressure to Solana’s movements, creating an uphill battle for the bulls.

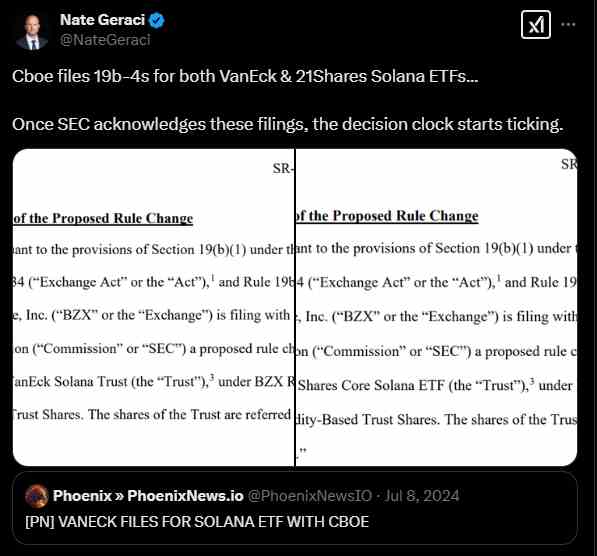

Despite the short-term struggle, the institutional interest in SOL is on the rise.

Firms like VanEck and Bitwise have filed for Solana-based exchange-traded products (ETPs) and are waiting on approval.

This shows a great deal of confidence in the long-term value of $SOL.

It is also worth mentioning that Solana has spent a full year without a single network outage, which is a big deal considering how frequently it suffered from downtimes in the past.

Can Solana Rebound?

While the near-term outlook for Solana is uncertain, some experts believe that SOL still has major prospects ahead of it.

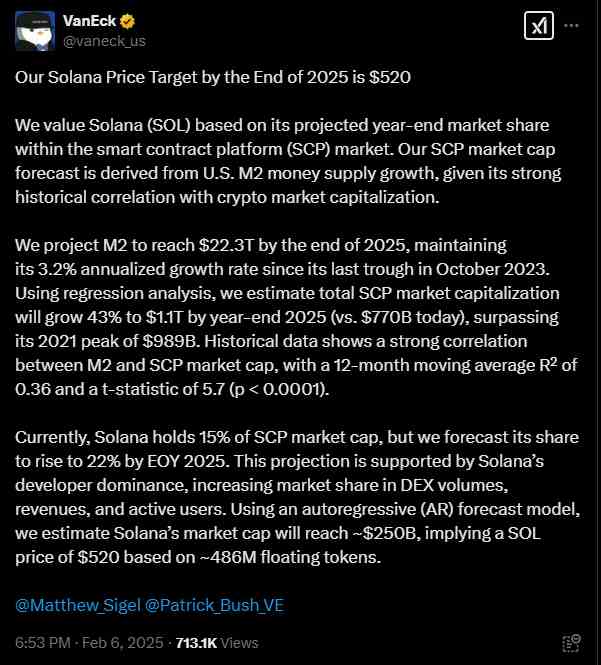

According to a recent prediction from asset management firm VanEck, Solana is looking towards a yearly high of $520.

This rally, according to VanEck, will be driven by increased adoption in the DeFi and DEX markets.

However, to achieve this level of growth, Solana must move past the speculative trading phase and focus on real-world use cases.

Its ecosystem will need to gain more strength, include more projects, and become more reliable in terms of scalability.