What Is Arbitrage Trading in Crypto?

What Is Arbitrage?

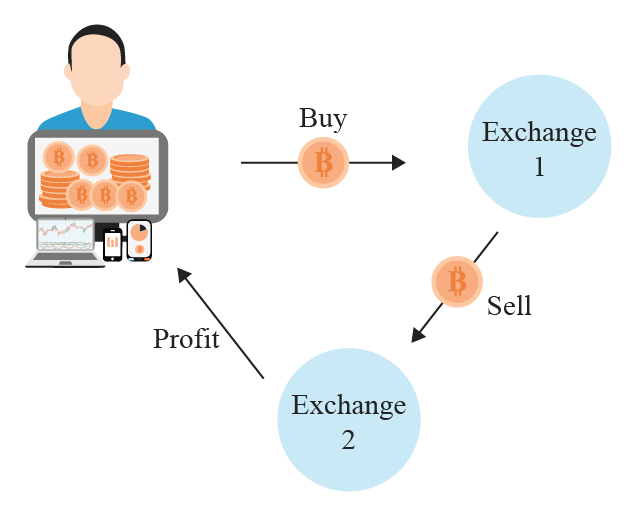

Arbitrage is a simple yet clever way to make a profit by taking advantage of price differences for the same asset in different markets. It works like this: a trader or investor buys something at a lower price in one market and, at the same time, sells it in another market where the price is higher. The profit comes from the difference between those two prices. The real trick to arbitrage is doing both transactions simultaneously, which helps keep the risk low.

Key Insights

- Trading via Arbitrage is one of the best and most riskless ways to trade crypto.

- It involves finding and exploiting price differences between multiple crypto exchanges.

- A trader simply buys low and sells high on these exchanges, in a way that results in net profit.

- Some challenges of Arbitrage, however, include liquidity, fee, and delay issues.

- The best Arbitrage tools include ArbiTool, HaasOnline and BitsGap.

Arbitrage trading is one of the biggest (and arguably safest) ways to navigate the crypto market.

The core principle behind it is simple:

A trader simply searches for and attempts to capitalize on price differences between two or more exchanges.

Here’s what this means:

Crypto, web3, and blockchains in general are decentralized. This means that the price of Bitcoin, Ethereum, NFTs, or any other asset will sometimes vary from one platform to another.

An arbitrage trader simply finds these price variations to buy low on one exchange and sell high on another.

This allows them to make profits without the market itself having to move much.

With this being said, arbitrage is one of the lowest-risk strategies to make a profit off the crypto market.

Here’s everything to know about this in a little more detail.

How Does Arbitrage Trading Work?

As mentioned earlier, this form of trading involves taking advantage of different prices across multiple platforms.

Here’s a simple breakdown of how it really works:

- Price Discrepancy:

This is the first step to starting as an arbitrage trader. One crypto, say Bitcoin, can be priced at $20 on Uniswap for example.

However, on Pancake Swap, the same crypto is priced at $22. This presents a very valid opportunity to move to the next step.

- Buying Low, Selling High

The trader can then purchase this $20 Bitcoin on Uniswap at a lower price. Without wasting any time, they navigate to PancakeSwap and then sell again for $22.

This allows them to lock in a $2 profit (minus transaction fees) with very little effort.

No chart analysis, no HODLing and no hours of staring at a screen.

But where do Arbitrage opportunities come from?

These “holes” in the market exist because of differences in supply and demand. Other reasons include sluggish price updates on one exchange compared to another, or even differences in liquidity on both.

The only disadvantage of these opportunities is that they are very short-lived.

This means that they pop up in one instant, and are gone in another: Because the market ALWAYS balances itself out.

Types of Arbitrage Trading

While the main idea behind this form of trading is simple enough, there are several ways to do it.

Here are some of the most popular ones that traders should be aware of:

- Spatial Arbitrage

This method is very straightforward. It simply involves buying on one exchange and selling on another for a higher price.

This works right off the bat and requires speed to carry out. It also requires a lot less skill or knowledge compared to the other forms and is great for semi-beginners.

- Triangular Arbitrage:

This one is a lot less straightforward compared to the first.

It involves more than one crypto and a lot of swapping. To carry this out, traders simply buy one coin (say, Bitcoin).

They can then convert this to Litecoin, then trade it for Ethereum—all before converting it back into Bitcoin at different rates.

The trader does this in such a way that the swaps eventually result in a net profit.

This method requires more skill, patience, and perfect timing to carry out—not to mention the transaction fees.

- Statistical Arbitrage

This method is more sophisticated than the other two. With Statistical Arbitrage, traders use algorithms and even AI to analyze these differences across different exchanges.

They can then execute these trades automatically for profit.

Instead of relying on skill like the other two, this method’s success is very dependent on the technology and speed of a trader’s tools.

This means that profits are only as good as the tech.

- DeFi Arbitrage

This one mostly occurs between decentralized exchanges. The very definition of Defi is that exchanges are completely detached from one another.

This detachment (or decentralization) means that price differences will come up more often.

In essence, a trader only needs to monitor DEXs like Uniswap, PancakeSwap or SushiSwap instead of others like Binance and Kucoin.

The Risks of Arbitrage Trading

This form of trading sounds very straightforward compared to other forms—but it isn’t—not even in the slightest.

Like other ways of making money in the crypto market, it also comes with its own set of challenges.

Some of these are outlined below:

- Transaction Fees

Sometimes, arbitrage trading just isn’t worth it.

This is because the price differences a trader finds can be so small, that the transaction fees they use for all that swapping, eventually eats into their profits.

More swaps equal more fees. More fees, in turn, result in less profit:

Especially when the cryptocurrency to be swapped features relatively higher transaction fees.

Like Bitcoin and Ethereum, for example.

- Timing and Speed

Trading via Arbitrage can be frustrating too. These opportunities pop up in seconds, but can also disappear as fast.

This means that before a trader even approves the “buy” or “sell” transaction, said opportunity could be gone—with no refunds on transaction fees already spent.

- Liquidity Issues

Some exchanges have a lot more trading volume than others. This means that if one of them has relatively low liquidity, large Arbitrage trades can affect price.

This results in less profit and more frustration.

- Transfer Delays

Some blockchains just aren’t fast enough. Moving crypto from one exchange to another can sometimes take time. Especially in times of heavy market volatility.

By the time the funds arrive in the trader’s wallet, the opportunity might be gone.

Again, no refunds on spent transaction fees.

Is Arbitrage Trading Profitable?

- This is a very valid question, and the answer is yes.

- While this form of trading is a game of thin margins, it is also very profitable.

- Moreover, it is generally less risky, doesn’t depend on price predictions, and requires a different skill set.

- However, considering the fast-paced nature of Arbitrage, many traders resort to using bots.

- These bits of code can easily find, exploit and execute trades faster than any human.

- They are designed to monitor prices across multiple exchanges and catch these opportunities when they arise.

- Some of the best platforms that offer arbitrage bot services include Bits gap, HaasOnline and ArbiTool.

Crypto Land is an impartial marketing and educational platform, not a financial advice service. Therefore any content provided, hosted, or expressed by Crypto Land does not constitute financial advice or recommendation, and as such Crypto Land will not be liable for any losses incurred during trading or investing.

![Top Altcoins in October [2024] You Should Look Out For 20 Top Altcoins in October [2024] You Should Look Out For](https://cryptolandoff.com/wp-content/uploads/2024/10/Top-Altcoins-in-October-2024-You-Should-Look-Out-For.jpeg)