Key takeaways

- Bitcoin (BTC) failed to retake the $94,000 zone on Tuesday.

- Long-term holder accumulation needs to make a comeback.

- March is especially filled with macroeconomic events from the US. Updates like inflation data and Fed policy could play a huge role in Bitcoin’s direction.

- Market sentiment is currently fearful, which means that investors are placing very careful bets.

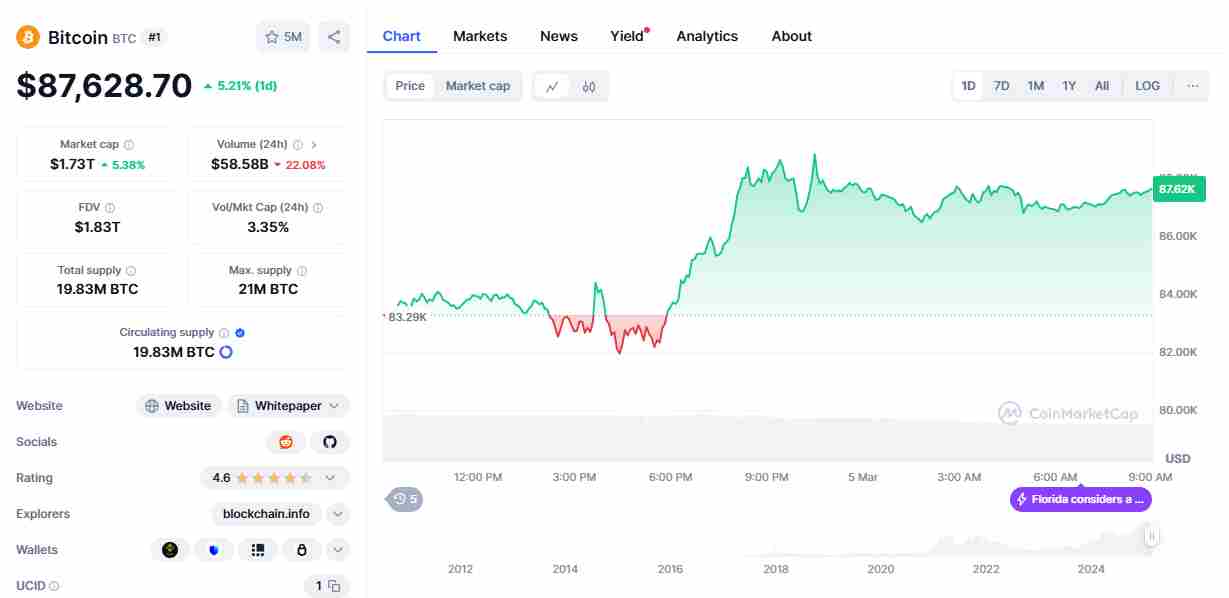

Bitcoin’s price has been on a rollercoaster for nearly two weeks now, especially after it fell sharply underneath the $90,000 zone.

This move caused widespread panic among investors as the price trekked lower to the $78,000 zone.

And even despite a relief rally sometime this week on Donald Trump’s crypto reserve announcement, the cryptocurrency appears to still be under heavy selling pressure.

So what’s next for the world’s largest cryptocurrency? Can we see a recovery?

Bitcoin’s Recent Price Action

BTC crashed in late February to as low as $78,000, bringing the total price movement for February to as low as -15%.

However, soon after this crash, optimism returned when former US president Donald Trump announced his plans to establish a crypto reserve.

The announcement sent the cryptocurrency soaring by over 23%, bringing its price back above $95,000 and to a high of $96,700.

Interestingly, this level was close to the cryptocurrency’s annual VWAP (Volume Weighted Average Price) and the 200-day moving average.

Despite the surge, however, BTC has failed to maintain these gains.

The new week came with a fresh wave of bearish pressure, seeing BTC crash late on Monday to as low as $83,700.

While the long-term trend remains bullish, Bitcoin now trades at around $87,000 and will need some serious bullish intervention to break some strong resistance zones.

Where Is Bitcoin Headed?

It is worth noting that in the charts, BTC is currently hovering around its 200-day simple moving average (SMA).

This is a crucial support zone that has held the cryptocurrency up since mid-October of last year at the time of writing.

With this being said, if a break below this zone occurs, the resulting drop would be devastating.

On the other hand, the short-term moving averages are sloping downward and are complementing readings from the RSI, which shows that the bears hold strong influence compared to the bulls.

In essence, the above signals show that Bitcoin is currently in a pullback phase after its all time high of around $109,000 in January.

This said, investors should expect more consolidation as prices stabilize.

What Analysts Are Saying?

Many analysts have weighed in on X (Twitter) over the last week, with predictions of what could be next for Bitcoin.

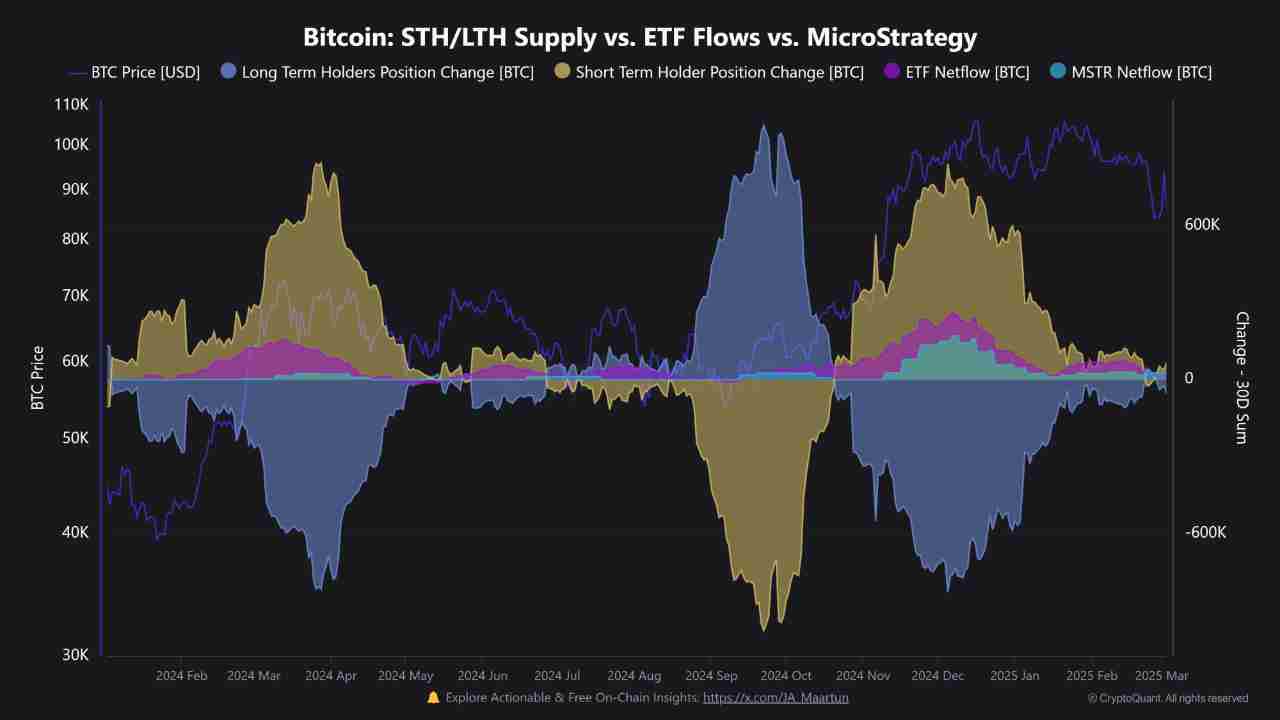

For example, CryptoQuant analyst XBTManager believes Bitcoin will “likely continue to consolidate.”

The analyst says that this will happen due to the current liquidity conditions.

He went further to advise traders to be cautious, warning that the best long (buying) positions only emerge when the long-term holders start to accumulate once again.

On the other hand, short-term holders (those holding BTC for less than 155 days) are offloading their assets.

According to XBTManager, traders must wait for this trend to reverse before Bitcoin sees bullish momentum again.

Resistance Levels and Market Challenges

As it stands, Bitcoin’s decline came after a breakdown from the ascending channel it formed between 12 November and 23 February.

Its late February decline came after a breakdown beneath the $94,000 support level, and according to Bitfinex analysts, this level could be hard to break.

The analysts cited the price rally between Sunday and Monday after the “Trump Pump” as an example, with Bitcoin’s failure to clear this hurdle.

Even if Bitcoin does manage to clear this $94,000 hurdle, it will still need to overcome even more resistances to maintain its trajectory.

Considering how the recent price surge was driven solely by Trump’s crypto-friendly announcement, BitFinex’s analysts believe that Bitcoin will need to see a new wave of genuine buyers—not just hype traders.

Bitcoin’s Price and Macroeconomic Factors

One of the reasons the crash happened in the first place was due to macroeconomic uncertainty.

The cryptocurrency initially fell underneath the $100,000 zone in February amid concerns about a possible Trade war between the US and countries like China, Canada, and Mexico.

The recent rejection around $94,000 and the crash towards $83,000 on Tuesday this week were also caused by Wall Street’s reaction to Donald Trump’s confirmed tariff plans.

In essence, Bitcoin is now more sensitive than ever to macroeconomics, and investors are advised to keep an eye on the news.

Speaking of the news, investors must keep an eye on a few upcoming events that could shape Bitcoin’s trajectory in the short term.

One of these is the U.S. Consumer Price Index (CPI) Report, which is slated for release on 12 March.

This data will be important for insights into the Federal Reserve’s next moves. It will provide a pointer as to how high (or low) investor appetites for risk assets (like Bitcoin) will be over the coming weeks.

Another event to keep in mind is the Federal Reserve Interest Rate Decision, slated for March 19.

Any indication of rate hikes or continued tightness in monetary policy could put more pressure on risky assets like Bitcoin.

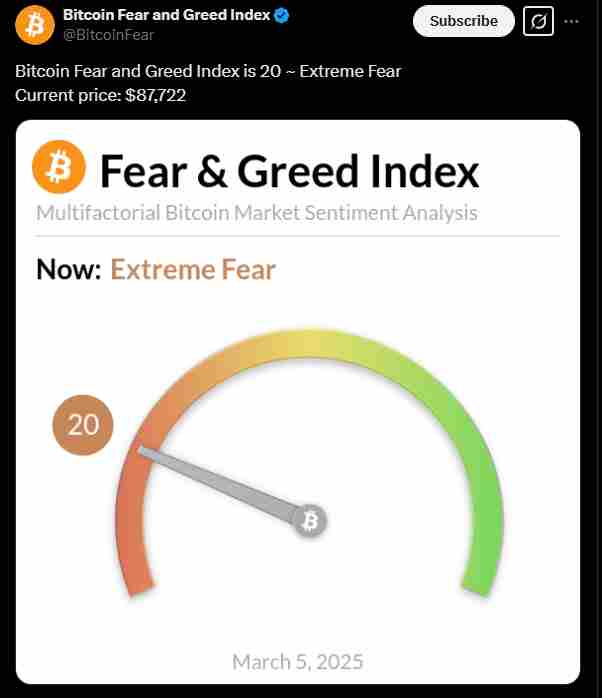

Market Sentiment and Fear Index

Another interesting thing to note about Bitcoin is how the current sentiment is in the “Extreme Fear” territory, as reflected by the Crypto Fear & Greed Index.

This index has hovered around the 20/100 mark as an average since the market crash in late February.

Historically speaking, this trend is more bullish than bearish, considering how fear-driven markets often present buying opportunities.

Overall, Bitcoin’s ongoing price action shows that the market is currently uncertain. While the long-term trends show some degree of positivity, the short-term indicators show that the best-case scenario for bitcoin is a continued consolidation or even a crash.

For now, Bitcoin’s path is still in uncertain territory. A rebound is very possible. But investors must learn to manage expectations and brace for more volatility in March.