Key Insights

- Bitcoin took a massive hit in price and sentiment over the last week.

- The cryptocurrency fell as low as the $88,000 mark as more investors reduced their positions.

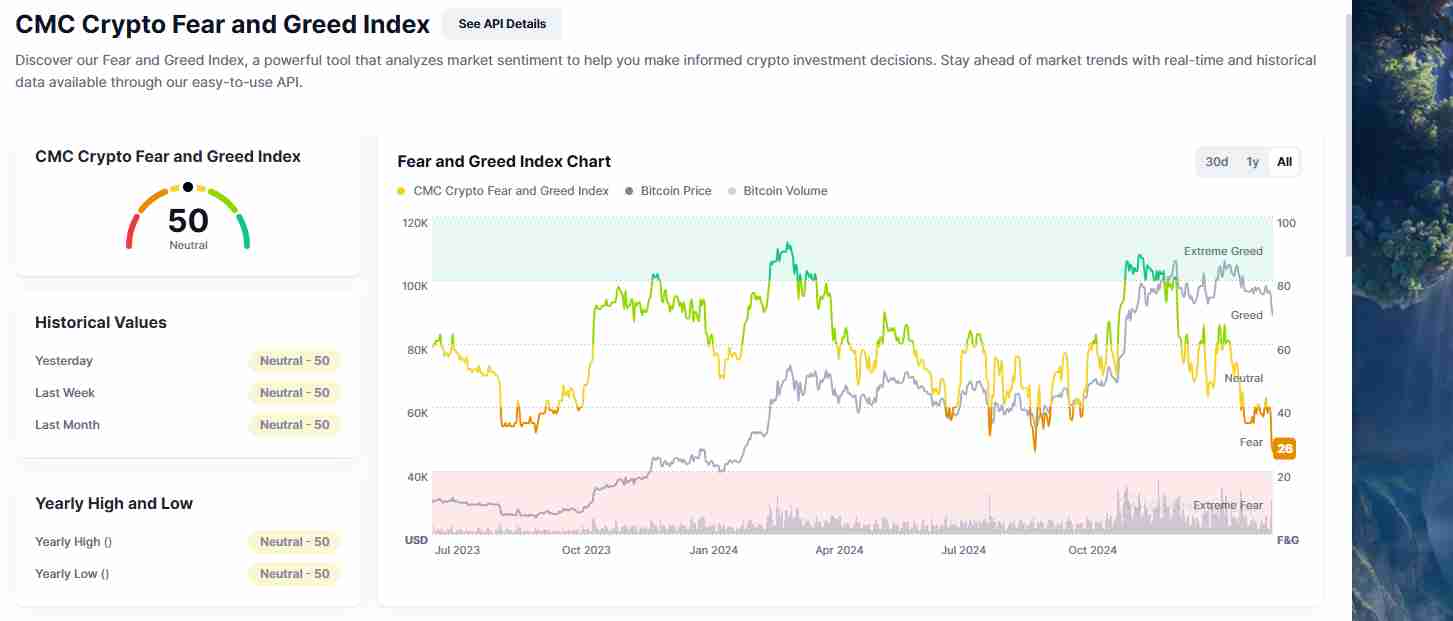

- The fear and greed index shows an extreme level of fear, least seen in the previous year.

- Historically, similar conditions often birth market rebounds, and Bitcoin could be on its way towards better days.

Bitcoin (BTC) plunged underneath the $90,000 mark this week, triggering a wide ripple of fear across the crypto market.

The flagship cryptocurrency saw an insane 7.5% decline between Monday and Tuesday, with its value going as low as $88,830.

This marks its lowest level since mid-November of last year and has been the source of major panic so far.

Amid the market downturn, however, CEO of JAN3 Samson Mow took to social media to say, “Bitcoin is oversold. Run it back.”

Why Is Bitcoin Falling?

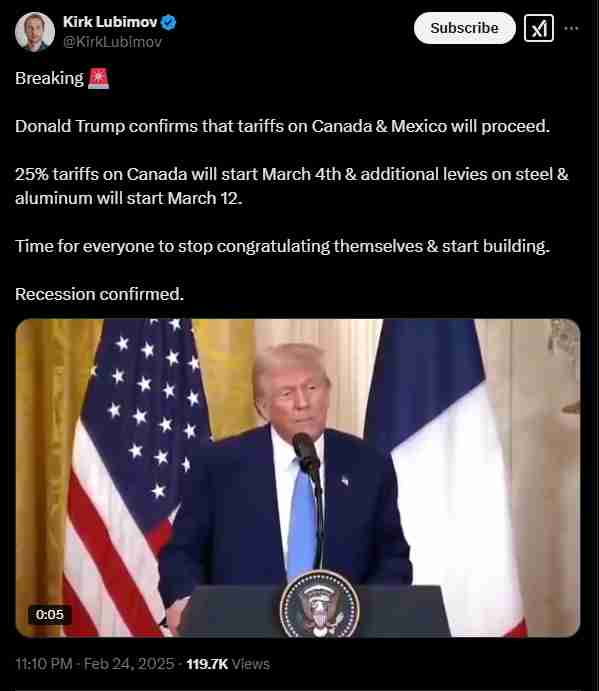

The ongoing BTC crash wasn’t an isolated event. The stock market crashed as well, especially after the announcement from US President Donald Trump about the new tariffs on Canadian and Mexican imports.

These tariffs are as high as 25% and are expected to take effect on 4 March.

This massive move in geopolitics was the major source of uncertainty in the financial markets.

Other traditional assets like gold, stock, and indices also took a nosedive, just as the news broke.

More additions to the selling pressure were more than $1 billion liquidated across the board on Tuesday, along with massive outflows from the spot Bitcoin ETF market.

Many major institutional investors reduced their positions as market sentiment tilted towards fear.

Market Leaders See Opportunity, Not Panic

Amid the widespread panic and many traders showing concerns about the sudden spiral downwards, many market leaders see this as a massive opportunity for entry.

One such Bitcoin maximalist is Samson Mow, who took to Twitter to encourage dip buying, especially with the current prices.

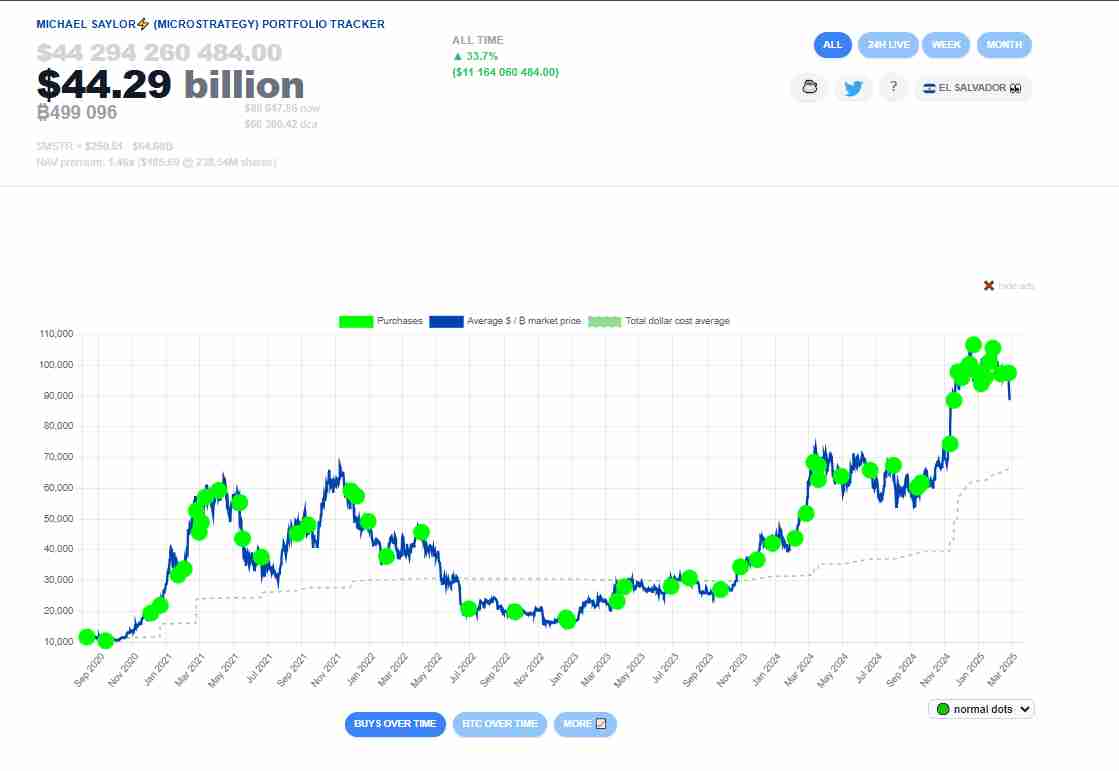

Michael Saylor, the executive chairman of MicroStrategy, also sees the dip as a massive opportunity, even calling it a “Bitcoin sale.”

He reinforced this sentiment by announcing that MicroStrategy (now Strategy) acquired around 20,356 BTC for approximately $1.99 billion recently.

This new buy now brings Strategy’s total Bitcoin holdings to a staggering 449,096 BTC (worth around $44.29 billion according to SaylorTracker).

Saylor’s bullish stance shows that long-term investors still see Bitcoin as a valuable asset, even despite the short-term volatility.

Strategy continues to target a milestone of around 500,000 BTC in its reserves.

These sentiments from both market leaders show confidence in the ability of Bitcoin to grow over the long term.

Binance CEO—This Is a “Tactical Retreat,” Not a Crash

Richard Teng, the CEO of Binance, also weighed in on the market drop and urged investors to take a longer-term view of things.

He reiterated that Bitcoin and the crypto market have endured similar crashes in the past, only to rebound stronger than ever before.

“This is a tactical retreat, not a structural decline,” Teng stated on X.

He also tagged the recent volatility on the ongoing shifts in the macroeconomy, especially the Trump tariffs and the Federal Reserve’s cautious stance on digital assets.

Historically speaking, lower interest rates have always been bullish for crypto, considering how they make traditional investments less attractive compared to assets capable of much growth like Bitcoin.

Fear Grips the Market, But History Suggests a Rebound

As shown by the crypto fear and greed index with its “extreme fear” reading of 26/100, the market’s sentiment has taken a hit.

Interestingly, this index stood at around 49, showing that market sentiment was neutral.

The shift in sentiment shows the emotional nature of crypto trading, where human sentiment plays just as big a role as macroeconomics.

Historically speaking, however, Bitcoin typically rebounds after such downturns.

The last time Bitcoin’s sentiment took this much of a hit was during the August 2024 crash, where the cryptocurrency dropped to $49,000.

The oversold condition led to a strong recovery that birthed the +$100,000 high at the end of the year.

Should You Buy Bitcoin Now?

Bitcoin is now trading at levels last seen in months. This means that many investors are now wondering whether this is a buying opportunity.

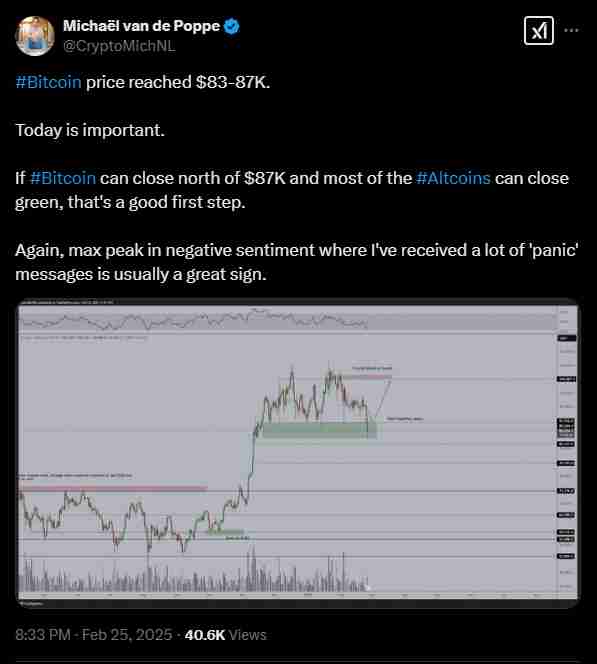

According to insights from crypto analyst Michaël van de Poppe, high levels of fear in the market typically signal a market bottom.

This means that it might be a great time to accumulate.

Meanwhile, the institutional interest in crypto is still at an all-time high.

Ever since the step-down of SEC chair Gary Gensler earlier in the year, more and more asset managers have filed for ETFs related to altcoins like XRP, Cardano, Solana, and Dogecoin.

This spike in demand shows that investors believe in the long-term ability of crypto and other similar assets.

While the outlook for Bitcoin in the short term is still shaky, investors continue to accumulate the cryptocurrency under expectations of a market rebound.

As many industry leaders continue to suggest, Bitcoin may be oversold and waiting for the next demand wave to help it up again.