Key Takeaways

- Bitcoin crashed even further down over the last few days, bringing the rest of the market down with it.

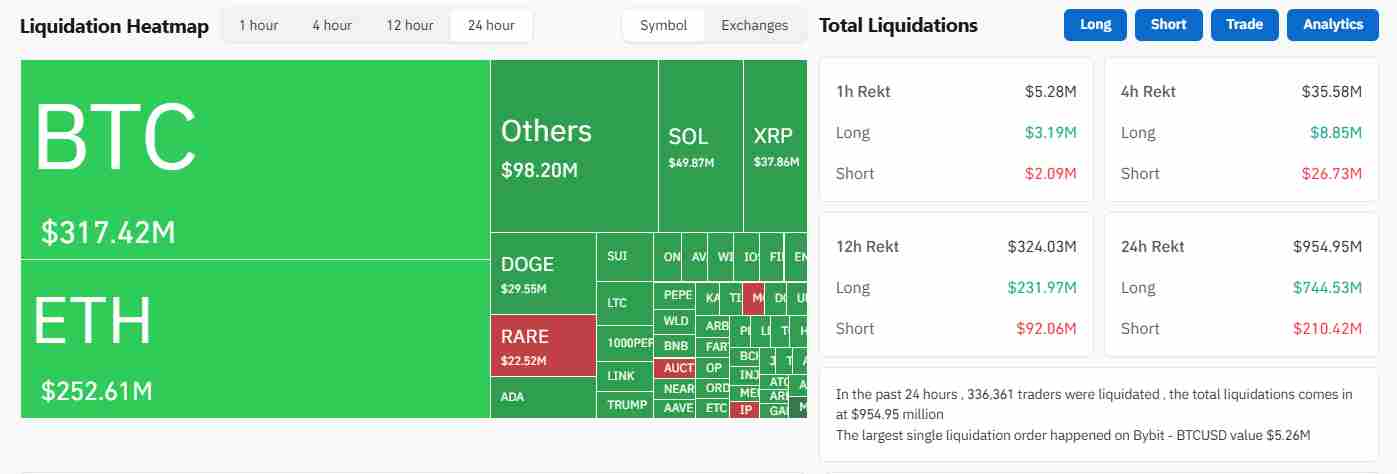

- This crash affected the leveraged traders, leading to nearly $1 billion in liquidations across the board.

- The decline isn’t an isolated event, as the stock market is also crashing heavily.

- According to crypto commentator Anthony Pompliano, Donald Trump and the US government might be crashing the market deliberately.

The crypto market is in the middle of a brutal downturn, with Bitcoin leading the downward charge.

Over the last week, the flagship cryptocurrency has posted more than a 10% loss, triggering nearly $1 billion in liquidations across the market between Monday and Tuesday.

This sharp decline in prices has sent shock waves through the crypto market, as more traders scramble for stability.

Here’s the extent of the damage so far.

Massive Liquidations Shake the Market

Data from Coinglass shows that the crypto market has seen a staggering $956 million in liquidations over the last 24 hours alone.

The majority of these liquidations come from long positions and amount to around $744 million.

Comparatively, only $211 million in short liquidations occurred with Bitcoin and Ethereum.

This liquidation spree has led to a 3% drop in Bitcoin’s price over the last 24 hours, with a current price of $80,000 and a total weekly decline of 4%.

The entire crypto market has so far taken a 6% hit, with no end to the onslaught in sight.

Why Are Liquidations Surging?

Many of these liquidations seem to be linked to the behaviour of short-term and inexperienced traders.

These traders entered the market during the “extreme greed” phase in the hopes of some quick profit.

While Bitcoin soared due to the “Trump Pump,” these traders took on excessive leverage, expecting the uptrend to continue.

However, the sudden dump in Bitcoin’s price caught many off guard and led to forced selling as the market crashed.

This data was brought to light by CryptoQuant analysts in late February, when the market decline first began.

According to the on-chain data aggregation resource, Bitcoin short-term holders (holding their coins for up to 155 days) appear to have lost their cool during the latest crypto market downturn.

As Bitcoin fell underneath the $90,000 zone, these traders started by sending $79,300 BTC to exchange wallets in 24 hours.

Bitcoin Faces Further Downside Risks

With Bitcoin now trading at around $80,000, there are no indications that the liquidation spree is over yet.

Some analysts now warn that if the selling pressure continues, Bitcoin could drop even lower to the $75,000-$78,000 range.

In worst-case scenarios, the cryptocurrency could be on its way below the $70,000 zone as market volatility becomes worse.

Bitcoin isn’t the only cryptocurrency in danger, though. Ethereum, the second largest cryptocurrency on the market, suffered through $252 million in liquidations over the last day, as its price crashed down to $1900.

Other major altcoins are also feeling the heat, like XRO with $2.69 million in liquidations, Solana with $22 million, Dogecoin with $21 million, and Cardano with $11 million.

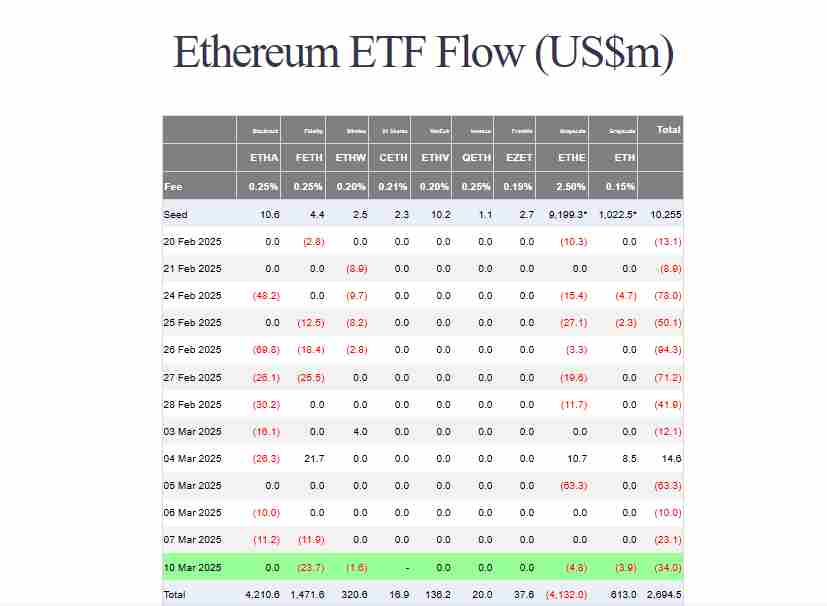

Ethereum’s Struggles Worsen Amid ETF Outflows

Ethereum continues to struggle on more than one front.

According to data from Farside, the cryptocurrency has been struggling with investor confidence along with its declining prices, as shown by the ETF netflows.

As illustrated above, the spot Ethereum ETF market has been through a losing streak.

Over the last two weeks alone, this sector has seen a continued loss of nearly $500 million, including nearly $120 million in outflows last week alone.

Several factors could be contributing to the decline, with one of them being the lack of staking options for the Ethereum ETFs.

These, unlike regular holdings, do not allow investors to earn passive rewards through staking.

In essence, Ethereum ETF investors are left on the sidelines and miss out on the benefits of staking.

Despite the ongoing bearish sentiment, both Bitcoin and Ethereum can recover very easily.

However, a recovery will depend on many factors. For example, Bitcoin needs to reclaim key support levels near $86,000 to regain bullish momentum.

If the price of the cryptocurrency fails to hold above $80,000, it could crash lower and trigger more liquidations.

Did Donald Trump Trigger the Market Crash?

Another layer of complexity in the ongoing situation is how some believe that the US government might have something to do with the ongoing market decline.

According to Bitcoin commentator Anthony Pompliano, U.S. President Donald Trump may be deliberately creating the ongoing financial uncertainty.

Pompliano says that Trump may be doing this to pressure the Federal Reserve into cutting interest rates.

He says that the Trump administration is pushing the prices of many assets, including stocks and crypto, lower in an attempt to force Fed Chair Jerome Powell into action.

In essence, by engineering a market crash, Trump can create the perfect conditions for a lowered interest rate—all in a bid to boost economic growth.

While this theory is still largely speculative, the broader market downturn has been spectacular.

On 10 March alone, the S&P 500 index dropped 2.66%, while the Nasdaq fell 3.8%.

These two indexes have seen harsh declines of around 7.32% and 10.7%, respectively, over the past month, with Bitcoin itself seeing a staggering 10% dump from its all-time high of $108,786.

What’s Next for Crypto?

The current downturn is a major reminder of how volatile the market can be at times.

While many long-term investors see this as a major buying opportunity, short-term investors are at losses and continue to sell as a result.

For now, all eyes are on Bitcoin’s ability to hold the fort around $80,000.

If the cryptocurrency plunges down further, it could drag the rest of the market down with it.

On the flip side, if a recovery above key resistance levels occurs, it could spark a renewal in optimism as the new phase of the market comes in quicker than expected.