Key Insights

- A massive Bitcoin whale opened a staggering $368 million short position using 40x leverage.

- This whale is betting that the price of Bitcoin will decline ahead of the incoming Federal Open Market Committee (FOMC) meeting scheduled for 19 March.

- Soon after opening this position, the whale began to get hunted by retail traders, who forced them to deposit an extra $5 million to keep their position open.

- This whale now has a position worth $430 million and a liquidation price of $86,087.

- Interestingly, the whale also opened a long position on $MELANIA, with a leverage level of 5x and 571,715 tokens.

The crypto market has been referred to as one big casino in the past, where everyone is a gambler of some kind.

In many ways, this is true—especially with what just happened within the industry.

A massive Bitcoin whale has just opened a staggering $368 million short position using 40x leverage.

This whale is betting that the price of Bitcoin will decline ahead of the incoming Federal Open Market Committee (FOMC) meeting scheduled for March 19.

Is opening this trade the biggest mistake of this whale’s life, or is the market about to print billions for this anonymous investor in a day or two?

Let’s go over the details of the ongoing bet, and what it means for the crypto space as a whole.

The Whale’s Position

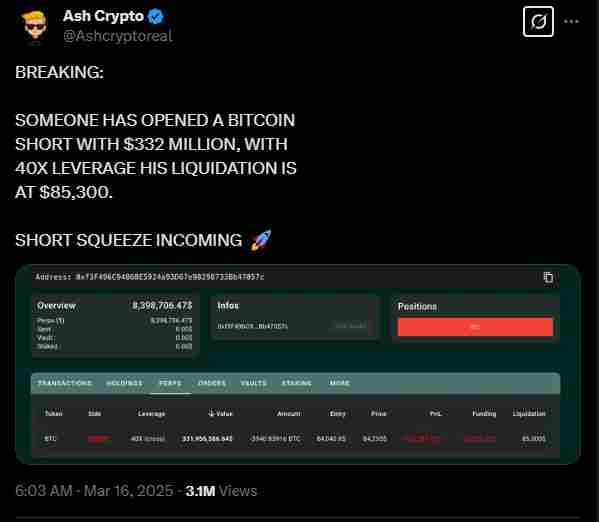

Analyst and crypto commentator, Ash Crypto was one of the first to draw attention to this anomaly.

According to the analyst, the mysterious investor first opened the short position at around $84,043 per Bitcoin.

This meant that they expected the price to drop.

What’s more, this whale spent a staggering $332 million with a leverage level of 40x their initial capital.

Ash Cyrpto highlighted that the whale’s liquidation price sat at around $85,300. However, soon after opening the initial position, the whale increased the short to $365 million, with a liquidation price of $85,592 and $6 million in unrealized profits—

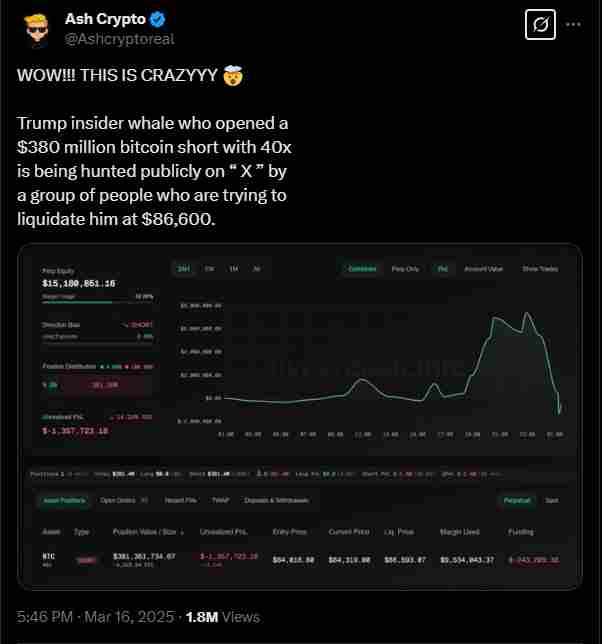

All before increasing it once again to $380 million and a liquidation price of $86,593.

As of writing, this whale has increased their position once again from $380 million to $430 million and a liquidation price of $86,087.

Put simply, a small price movement on Bitcoin in the wrong direction could wipe out this whale’s $430 million position entirely.

Why Is The FOMC Meeting Important?

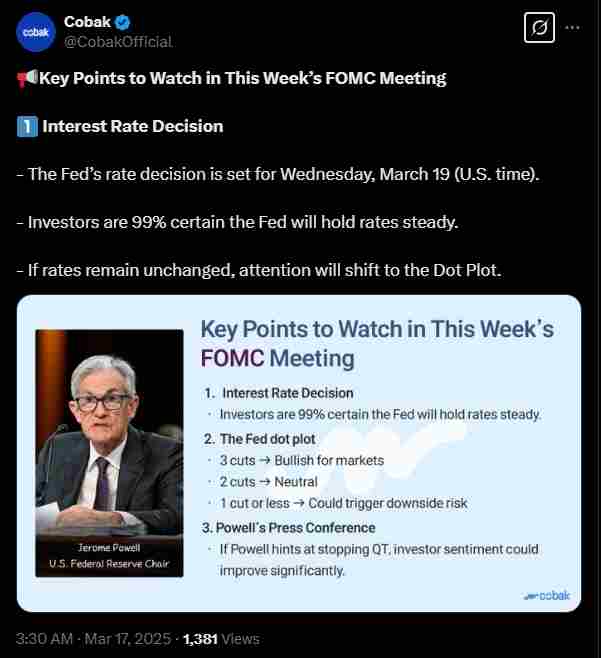

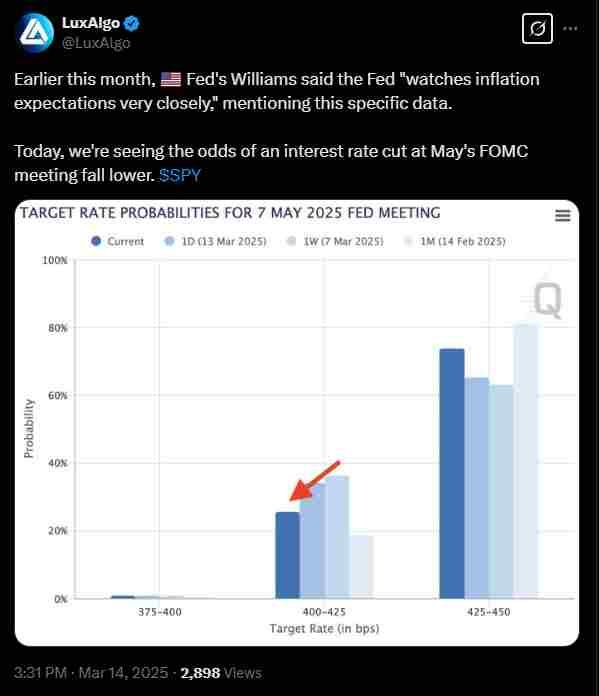

Interestingly, the timing of the bet was intentional. The upcoming FOMC meeting on March 19 will determine whether the Federal Reserve will adjust its interest rates.

This decision will heavily affect investor sentiment, and according to the CME Group’s FedWatch tool, the market currently expects a 98% chance that the FED will keep its interest rates steady.

However, if the FED surprises everyone and takes a hawkish stance, the market could experience a shakeup and push Bitcoin lower.

The Whale Is Being Hunted By Market Makers

The story gets wilder.

This whale’s position sparked heated discussions on social media platforms like X and Reddit.

Some of the participants of these discussions have resorted to forming groups to counteract the bet, according to Ash Crypto.

Pseudonymous trader CBB started the trend by publicly calling for a collective effort to push Bitcoin’s price above the liquidation level.

The traders attempted to drive Bitcoin past $84,690, which forced the whale to deposit an additional $5 million in USDC to maintain their margin.

LookOnChain notes that the efforts of these traders ultimately failed, and the trader is still in profit ahead of the FOMC meeting.

However, the trend shows how transparent trading platforms like Hyperliquid allow traders to monitor large positions and react accordingly.

Short on Bitcoin, Long on $MELANIA

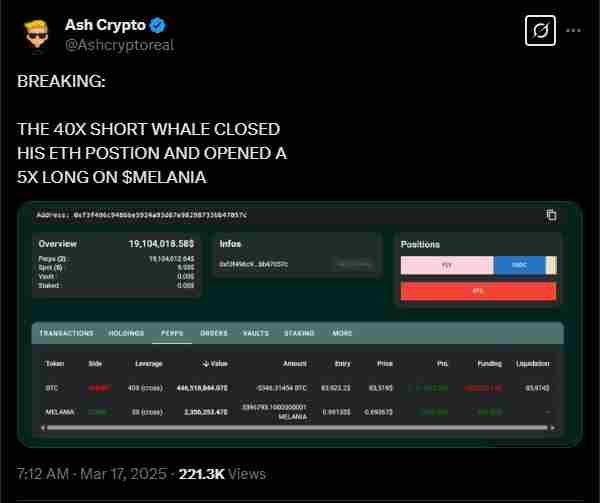

Interestingly, the same trader who shorted Bitcoin also has an open long position on $MELANIA.

Said whale’s position has a leverage level of 5x leverage with 571,715 MELANIA tokens.

This entire position is valued at around $390,000, which is about a tenth of the Bitcoin short.

Ash Crypto noted that this whale opened a 25x ETH position with $40 million soon after the Bitcoin short, with a liquidation price of $2,400.

However, they soon closed this trade down and opened the MELANIA position.

Overall, this whale is showing signs of experience in trading crypto.

Analysts have pointed out that the trader’s exposure to both Bitcoin and MELANIA is a high-risk strategy.

By shorting Bitcoin with this much leverage and taking a long on MELANIA simultaneously, the whale is ensuring that they earn some form of profit, regardless of which direction the general market trends towards in the next few days.

The Broader Market Context

So far, Bitcoin is not the only asset facing uncertainty.

The rest of the market is dealing with extreme instability, including the Trump trade tariffs and other geopolitical concerns between Ukraine and Russia.

Investors continue to watch closely to see whether the FED decision will lead to a shift in risk appetite.

Such a shift could strengthen or weaken Bitcoin’s price movement over the coming month.

As the price of Bitcoin continues to fluctuate, traders continue to monitor its major support and resistance levels.

If Bitcoin stays above $81,000, it could show that the buyers are still in control, and reduce the chances of a strong decline.

However, if the price dips below the $76,000 zone, it could trigger more selling pressure and print massive profits for the whale in question.