Key Insights

- Bitcoin recently crashed downwards after losing the $95,000 support.

- The cryptocurrency is now making its way to the upside, and analysts are divided.

- Interestingly, a four-year-old tweet from then-CEO of Binance Changpeng Zhao indicated that Bitcoin (BTC) would crash from $100,000 to $85,000, which it currently has.

- Analysts are expecting a comeback and a rally towards the $96,000 zone at least.

- Bitcoin could be set for more upside, even if the downtrend is expected to continue.

The latest Bitcoin price drop sent shockwaves across the crypto community this week, especially as prices dropped sharply across the board.

BTC lost the $95,000 support and crashed towards $85,760 after hitting an all-time high of $109,000 in January.

Many short-term holders panicked. However, the long-term holders and the whales have seen this as an opportunity and are loading up.

Here’s why a single tweet from four years ago could have accurately predicted this.

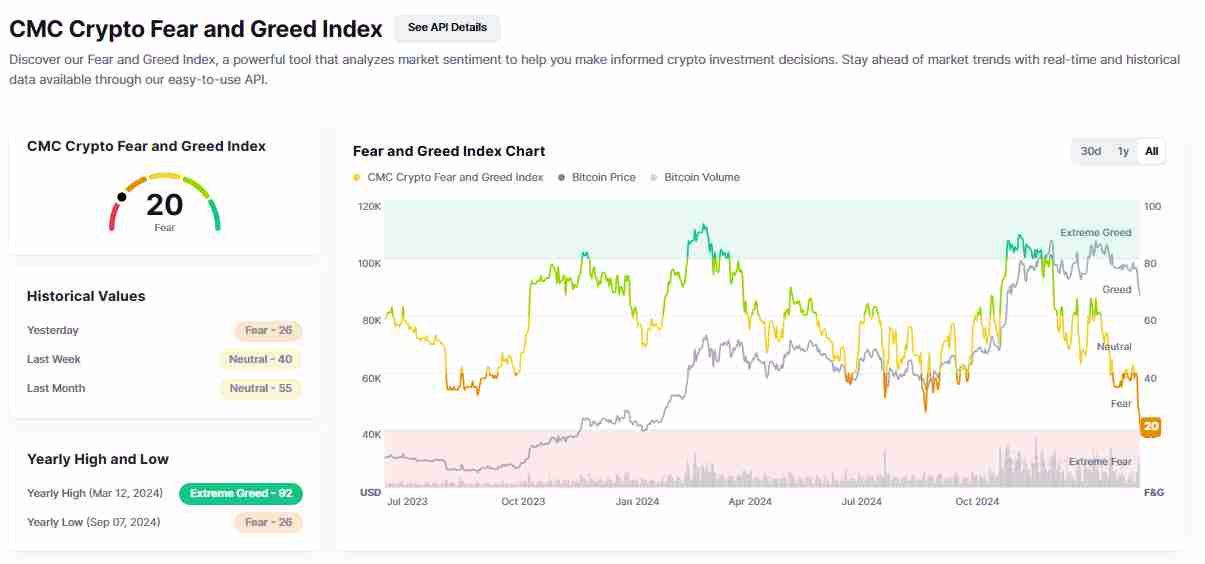

Fear and Greed Index Hits Extreme Lows

Investor sentiment took a massive hit, especially after BTC’s decline.

The fear and greed index plunged to around 21/100 according to data from CoinMarketCap, showing that the fear levels were extreme across the market.

This fear level also marked the lowest level seen in months and raised concerns about where the market was headed.

However, historically speaking, extreme fear often leads to strong rebounds, and the whales know it.

According to on-chain data, this sentiment shift was a very valid one.

For example, the Short-term Holder Spent Output Profit Ratio (SOPR) for 26 February shows fell below the 1 mark to 0.9908, as shown below:

This shows that many investors sold at a loss. It also shows that many newcomers to the market sold hastily, under fears that the downturn would continue.

The Long-Term Holder SOPR, on the other hand, remained stable in comparison.

This shows that the seasoned holders were more confident than the newcomers, holding their bags until the end.

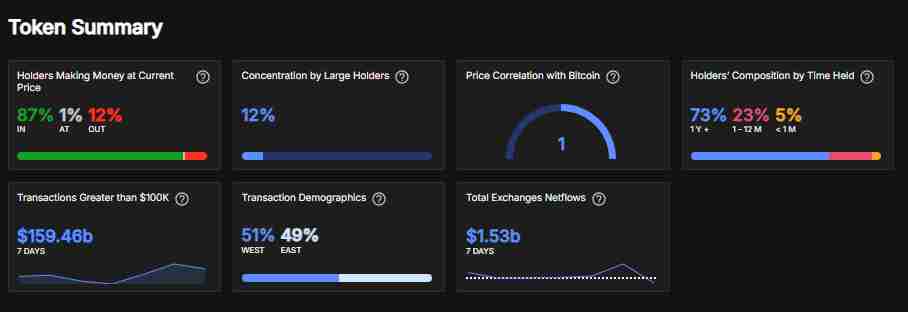

Whales Capitalize on Discounted Bitcoin Prices

While the retail traders scrambled to sell their tokens, the Bitcoin whales took advantage of the dip and continued to buy.

While retail traders scrambled to sell, BTC whales took advantage of the dip.

According to data from IntoTheBlock, BTC transactions above the $100,000 cost mark sit at around $159 billion.

More importantly, there has also been an observed spike in large transaction volumes, all the way from 22 February until date.

This indicates that the whales knew to sell their holdings before the crash but pumped money into the market in bits, just as prices went lower.

Interestingly, the sharp price movement also led to massive liquidations across the board.

For example, 25 January alone saw Bitcoin kick out thousands of bullish traders with nearly $560 million worth of positions.

This shows that the crash was partly driven by a leverage shakeout. Overleveraged traders were forced to sell, and prices crashed all the more because of it.

CZ’s Prediction Comes True

The interesting thing about BTC’s journey over the last few days is a single tweet.

This tweet was from December 2024 and was authored by Changpeng Zhao (CZ), the CEO of Binance at the time.

“Waiting for the new headline: #Bitcoin “CRASHES” from $101,000 to $85,000.” the Binance CEO said “Save the tweet.”

Many dismissed the prediction back then, especially as BTC traded under the $20,000 zone at the time.

However, the recent Bitcoin drop to $82,000 proved CZ right, as BTC is showing signs of a recovery.

CZ topped the earlier tweet with another bold prediction involving a future BTC rally to over $1 million, followed by a correction to $985,000.

While this tweet seems far-fetched at current prices, it seems highly likely that it looked the same back in 2020.

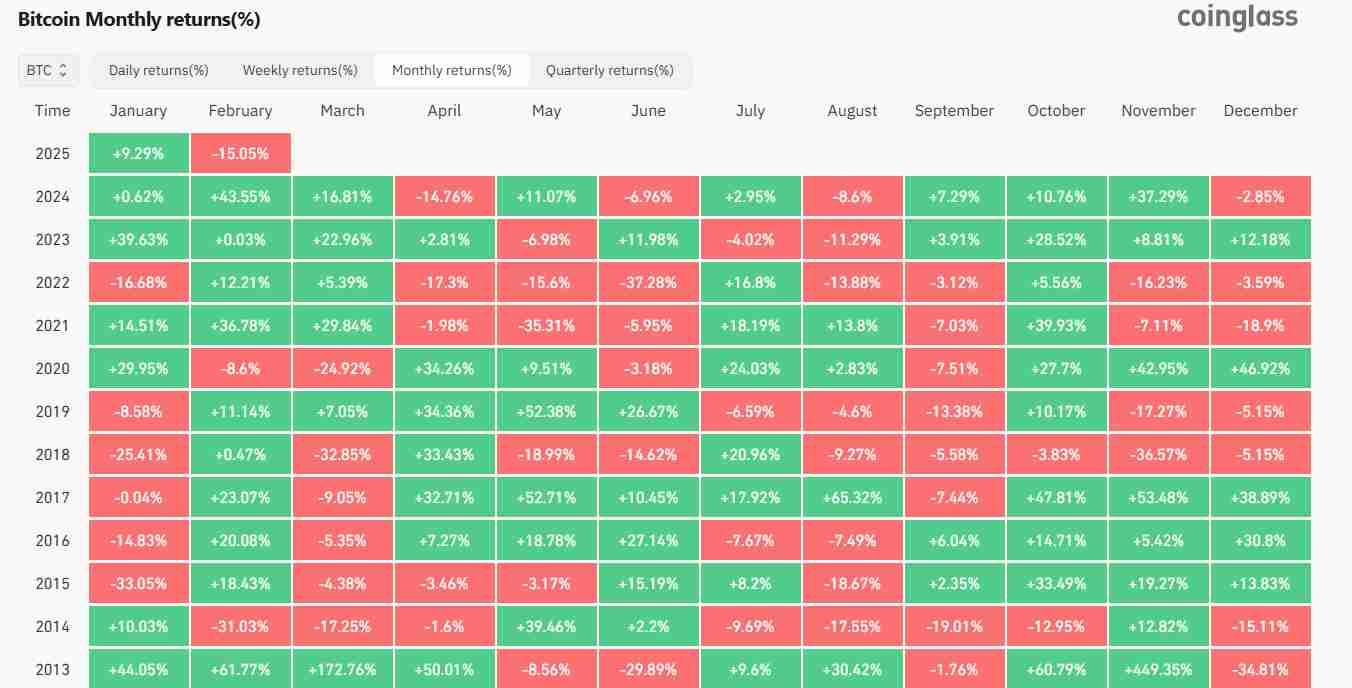

Will Bitcoin Recover in March?

The outlook for BTC in March is currently unclear. However, many experts believe that Bitcoin might remain range-bound between $89,000 and $108,000.

Historically, March has been a green month for bitcoin since 2021.

At the same time, February had been a bullish one for Bitcoin for that long as well, before the ongoing 15% monthly dip.

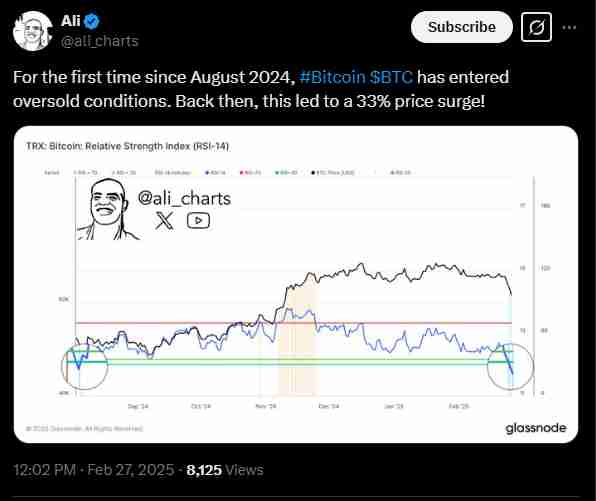

Bitcoin’s Relative Strength Index (RSI) has dropped to 31.16 on the daily chart though, indicating that it is currently oversold.

This means that a rebound is underway.

If we see a recovery come in for Bitcoin, it could retake $90,000 and hit $92,325. However, if selling pressure persists, another drop to $80,835 is possible.

Macroeconomic Factors and the “Trump Effect”—Buy The Dip?

Investors are increasingly speculating on how US President Donald Trump’s pro-crypto stance might impact Bitcoin’s price.

However, experts argue that most of the “Trump effect” has already played out.

His administration’s regulatory policies could support long-term adoption. However, in the short term, Bitcoin remains at the mercy of market forces.

Bitcoin’s outlook has divided investors and analysts so far.

Short-term holders are panicking, and whales are accumulating.

If history is any guide, Bitcoin is bound to trek upwards slightly, even if the rebound is expected to continue.

Overall, the coming weeks will determine whether this is a temporary pullback or if a prolonged downturn has only just begun.