Key Insights

- The crypto market started the year with positive inflows and generally encouraging prices.

- Most of this success came from speculation about a positive regulatory landscape in the US after the Donald Trump election victory.

- However, February presented its fair share of challenges for Bitcoin with the Deepseek crash in late January and the ByBit hack recently.

- The bull run being over is a matter of speculation at this point, as the market is currently in recovery.

- Until a break above major resistance zones occur for major cryptocurrencies, the downturns might continue.

Bitcoin has been through a real roller-coaster ride over the last few months.

Some of the positive ones at the start of the year came from the expected pro-crypto policies under the Trump administration.

However, new challenges have emerged since then including geopolitical tensions, regulatory shifts and massive hacks.

These events have cast doubt on the ability of Bitcoin to continue its rally above the $100,000 mark once again.

Is Bitcoin’s bull run truly over, or is this merely another correction its volatile history?

Bitcoin’s Rise Under Trump

Donald Trump’s election victory on 5 November caused a Bitcoin surge from the $70,000 mark to a new all time high of around $109,356.

Several factors contributed to this rally including the regulatory support from the presidency, after former SEC Chair Gary Gensler was replaced with Paul Atkins

The speculation from the strategic Bitcoin stockpile also fueled this rally, along with the appointment of Silicon Valley investor David Sacks as the first U.S. ‘crypto czar.’

The Trump family’s ties to the crypto world created an even more welcoming environment for the sector, especially with how Trump disclosed that his family benefits financially from the World Liberty Financial venture.

The Federal Reserve’s 100 basis points interest rate cuts in 2024 also boosted investor appetites for risk and fueled the Bitcoin climb.

The Headwinds Facing Bitcoin

Despite this bullish sentiment, several factors have challenged the cryptocurrency so far.

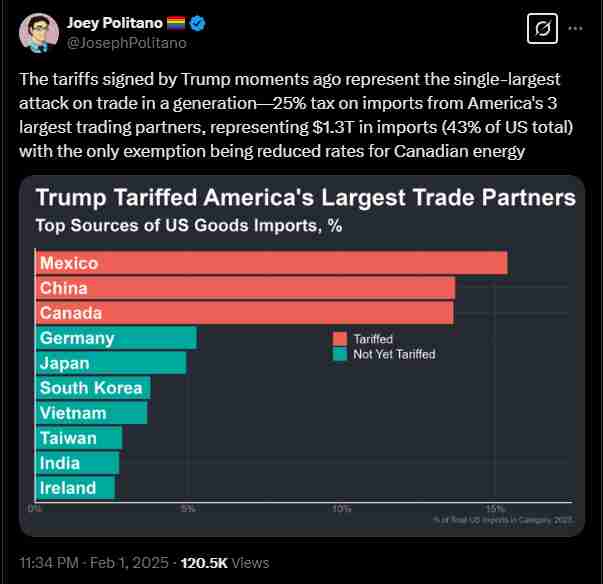

One major concern that has caused much pain for the crypto industry is the Trump Tariffs and Geopolitical Uncertainty.

US president Donald Trump announced a staggering 25% import tariff on countries like Mexico, China and Canada sometime in early February.

This announcement caused a massive shift in investor confidence, and may have played a role in the recent Bitcoin crash from above $95,000 to as low as $78,000.

Traditionally, Bitcoin is viewed as a hedge against economic instability.

However, its status as a risk asset also means that it is vulnerable to major sentiment shifts in the market.

DeepSeek and ByBit’s Hack Contributed

Sometime in late January, a cheaper (and reportedly more powerful) Chinese AI model took the market by storm.

This model was known as DeepSeek, and caused a major crash across major US stocks like Nvidia, Open AI and many more.

Bitcoin also took a step backwards from the $100,000 zone, considering its strong correlation to the US tech sector.

The rise of this new and powerful AI raised concerns about the long-term valuations of companies in the US tech sector, and cast doubts about Bitcoin’s ability to stand its ground.

More investors became more cautious about holding speculative assets as prices struggled to stabilize.

The stabilization effect had been ongoing for a while, before a new and devastating event hit the market.

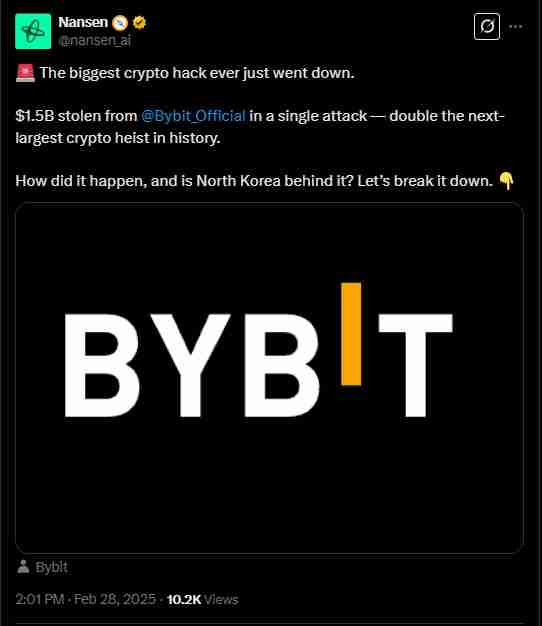

Bybit, one of the largest crypto exchanges in the world suffered a massive hack in late February.

This hack led to the loss of over $1.5 billion in Ethereum and other cryptocurrencies, with major platforms like the BBC and Bloomberg calling the event the “biggest hack in the history of crypto”.

The market remained relatively stable at the time of the hack, with ByBit assuring users that it had secured bridging loans to cover the loss.

However, less than a few days later, Bitcoin slid down in value by nearly 30% from around $98,00 to as low as $78,000 between 21 to 28 February.

Have The Alts Tokens Hit Their All Time Highs Yet?

According to top analysts like Atlas in a recent tweet, the bull run of 2025 might be over.

The analyst cited issues like the ongoing decline in market volume, which might be a sign that the bulls are exhausted.

Liquidity has also not been as strong in the market, considering how institutional investors tend to exit risk markets quickly.

This is without mentioning the declining dominance of Ethereum and Solana, especially after the fade of the memecoin mania on the latter network.

On the other hand, analysts like Crypto Rover believe that the bull run is still intact, especially for cryptocurrencies like Ethereum.

Other analysts continue to hold on to hopes that the recent dip was merely a retest of the bull trend support, and a recovery could be inbound at any minute.

What’s Next for Bitcoin?

While Bitcoin still has a whole uphill battle to fight in its climb towards recovery, several factors could contribute to a comeback.

For example, more and more financial institutions are integrating Bitcoin into their portfolios.

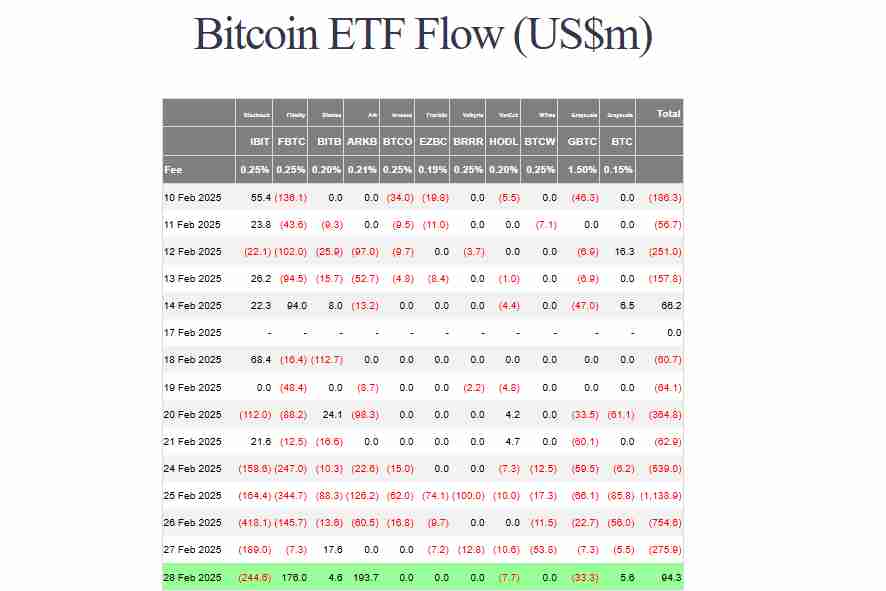

The US Bitcoin ETF market also shows that after eight straight days of consistent outflows, the netflows for 28 February were positive with $94.3 million entering the market according to Farside Investors.

The crypto industry also expects a more defined legal framework from the SEC, which could attract even more investors if passed.

In the coming months, further rate cuts fro the FED could push investors back into riskier assets and “beef-up” the market’s liquidity.

On the other hand, any more major hacks on exchanges could further damage investor confidence.

Moreover despite Trump’s pro-crypto stance, regulatory agencies may still impose restrictions on crypto in the future.

Is the bull run really over?

For now, investors must maintain a neutral outlook at the market, especially considering its signs of a recovery.

One major signal of renewed influence would be more inflows into the spot and ETF market, along with better Open Interest values for Bitcoin.

As always, the crypto market remains unstable. If a break above the $100,000 mark does not occur again for Bitcoin, investors must keep their fingers crossed.