Key Insights

- Strategy (formerly known as MicroStrategy) continues to buy more and more Bitcoin, despite the ongoing downturn.

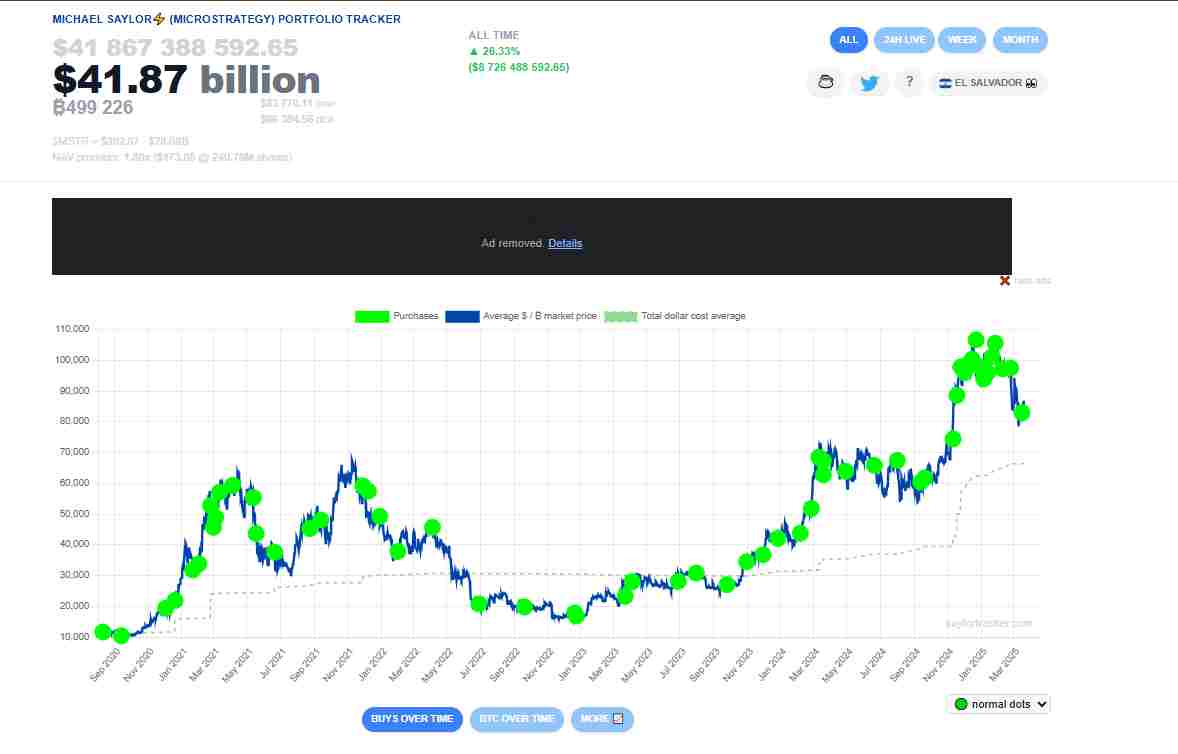

- As of March, Strategy holds an impressive 499,226 BTC, according to Saylor Tracker.

- With Bitcoin’s current value around the $82,620 mark, Strategy’s holdings are now worth around $41.1 billion—nearly $10 billion in unrealized gains.

- On 17 March of this year, the company bought an additional 130 BTC for approximately $10.7 million at an average price of $82,981 per coin.

- The company now has a current profit valuation of $8.4 billion and is 25.36% in unrealized profit along with a liquidation price of $66,380.

Strategy, formerly known as MicroStrategy, continues to double down on Bitcoin (BTC).

This company has now become one of the most influential corporate Bitcoin investors under the leadership of Michael Saylor.

The firm continues to aggressively expand its Bitcoin holdings and is now the largest corporate player in the Bitcoin space.

Here’s how far Strategy has come and how much Bitcoin it now has in store.

Strategy’s Current Bitcoin Holdings

As of March 2025, Strategy holds an impressive 499,226 BTC, according to Saylor Tracker.

Interestingly, this tranche of Bitcoin was purchased at an aggregate cost of around $33.1 billion.

This means that the company bought its BTC at around $66,360 per coin, including the associated fees and expenses.

With Bitcoin’s current value around the $82,620 mark, Strategy’s holdings are now worth around $41.1 billion—nearly $10 billion in unrealized gains.

This accumulation of Bitcoin now puts Strategy as the largest corporate holder of BTC in the world.

Recent Bitcoin Activity

Strategy continues to expand its trend of BTC purchases, despite an ongoing slow-down.

On 17 March of this year, the company bought an additional 130 BTC for approximately $10.7 million at an average price of $82,981 per coin.

This is the smallest Bitcoin purchase from the company on record. However, it still shows the firm’s long-term commitment to the cryptocurrency.

Strategy has turned towards equity-based fundraising methods to sponsor its Bitcoin buys.

The company recently announced the issuance of 5 million shares of its Series A Perpetual Strife Preferred Stock (STRF).

This strategy is aimed at raising around $500 million—all to buy more BTC.

For example, the STRF shares offer a 10% annual cash dividend. Interestingly, this dividend is higher than the 8% yield from the company’s earlier preferred stock (STRK).

In addition, each share is expected to be priced between $80 and $85 and will be listed on the Nasdaq under the ticker symbol STRF.

The move from Strategy shows a major shift in how it handles its BTC acquisitions.

By offering this high-yield preferred stock, the company is targeting income-focused investors who are on the lookout for regular dividend payments.

Market Reactions and Challenges

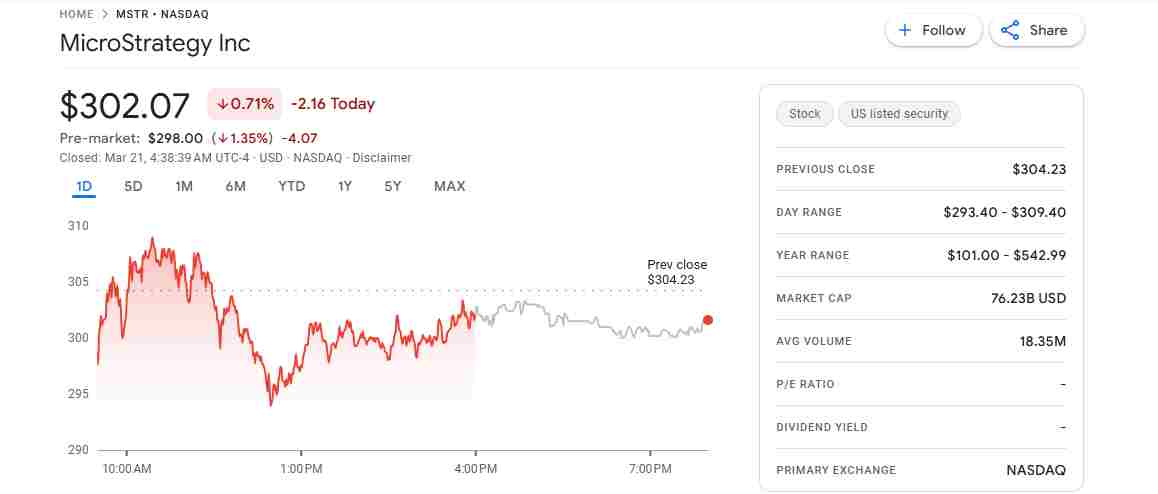

The announcement of the STRF stock issuance has so far led to mixed reactions among investors.

While many of them see it as a great approach to maintaining Strategy’s BTC purchases, others are cautious due to the high yield.

Soon after the news, Strategy’s stock fell 6.8% during the week, to $274.13.

This shows that investors are becoming more and more uncertain about the company’s financial strategy.

In addition, BTC’s price is also on the drop.

The cryptocurrency is now down by around 2.2% to $82,620, with Google Finance data showing an ongoing decline in Strategy’s stock as well.

Many analysts believe that issuing perpetual preferred stock at a 10% yield could mean that Strategy is facing challenges with raising capital.

This would explain its relatively small Bitcoin purchase on 17 March.

Higher-yield financing often points towards greater risk, and investors will likely continue to monitor how Strategy manages these financial obligations.

Saylor Predicts Bitcoin will hit $13 million At Digital Summit

Saylor also doubled down on his belief that BTC is headed over the $1 million mark at the recently concluded Digital Summit 2025. The Strategy chair noted that the price of the cryptocurrency will go to $13 million over 20 years.

He also emphasized that Bitcoin is the only financial asset in human history that is immune to human influence—a byproduct of what he calls an “immaculate conception.”

Saylor stressed that Bitcoin is a lot unlike traditional commodities like gold or oil, which can be manipulated when prices rise or fall.

Instead, BTC has a fixed supply of 21 million coins and is the ultimate store of value.

Considering how the asset has now been recognized by the US government as a strategic asset, Bitcoin is now uniquely positioned to outshine many other asset classes.

The Bigger Picture

Strategy’s ongoing Bitcoin accumulation is a lot unlike anything the stock or crypto markets have seen before.

Its use of equity-based financing has helped the company to build a unique investment model.

However, the risks still remain valid.

MicroStrategy continues to risk diluting its stock by issuing more equity and preferred shares.

In addition, Bitcoin price fluctuations can affect a strategy’s financial position—not to mention how regulators worldwide continue to scrutinize corporate BTC holdings.

Despite these challenges, Michael Saylor remains one of the most vocal advocates of Bitcoin.

The company now has a current profit valuation of $8.4 billion and is 25.36% in unrealized profit.

However, the liquidation price of $66,380 means that the company will begin to trade at a loss if the price of the cryptocurrency falls below this price level.

Considering Bitcoin’s volatility, a price drop towards this level is not unheard of.

On the other hand, Saylor sees the BTC buying as a lot more than simply making a profit.

He believes that Bitcoin is a lot like digital gold, and that it is the currency of the future.