Key Takeaways

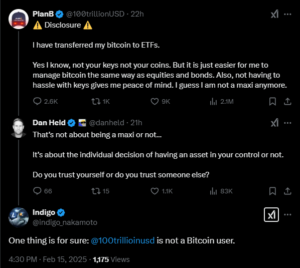

- Crypto influencer and analyst PlanB recently announced the move of his assets into the spot Bitcoin ETF market.

-

This move has drawn both support and criticism from Bitcoin investors all over the community.

- Bitcoin Maxis continues reiterating the “not your keys, not your crypto principle.”

- On the flip side, supporters have stated that the spot Bitcoin ETF market offers a simpler way to invest in Bitcoin.

-

Regardless, the spot Bitcoin ETF market is here to stay and will likely play a huge role in mainstream cryptocurrency adoption.

A major Bitcoin analyst and crypto influencer has just announced a big move.

The analyst in question, PlanB, announced that he had shifted all of his Bitcoin holdings from self-custody services into the spot Bitcoin ETF market.

He shared this decision with over 2 million followers on social media, in what now appears to be a growing trend of traditional finance in the crypto space.

Here are the details of PlanB’s reasoning and why investors are increasingly choosing the “simplicity” and the “peace of mind” that the spot Bitcoin ETFs offer.

Why Did PlanB Choose Spot Bitcoin ETFs?

In a recent post on X, PlanB explained the move of his Bitcoin into the ETF industry.

He mentioned that he was trying to avoid the “hassle” of managing private keys and was choosing simplicity.

PlanB has always been a major member of the crypto industry and is no stranger to the “not your keys, not your crypto” principle.

However, after years of managing his own Bitcoin, PlanB has found the complexities (and not to mention the risks) of self-custody are no longer worth the effort.

According to the analyst, his decision was driven by the need to take a more hands-off approach to managing his assets—a lot like the way stocks and bonds are handled.

This shift also represents a growing trend in the crypto industry, where investors are looking for more and more ways to access or store their Bitcoin without the issues of holding it directly.

The Controversy Around Bitcoin ETFs

PlanB’s reasoning is practical and straightforward—at least to many members of the crypto industry.

However, the move has created a wave of mixed reactions, especially among Bitcoin maximalists (also known as Bitcoin Maxis).

This group of investors continued to stress the importance of self-custody and were quick to criticize PlanB’s decision.

Many in the community argued that the analyst giving up control of his assets undermines one of the foundational principles of defi:

Decentralization and self-sovereignty.

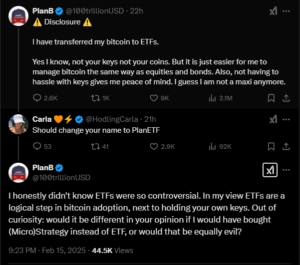

In response to this critique, PlanB showed surprise at the level of controversy surrounding this class of financial instruments.

He wondered whether the backlash would have been different if he had chosen to buy MicroStrategy stock.

For context, MicroStrategy used to be a business intelligence firm before rebranding to “Strategy” and going fully down the Bitcoin-buying road.

PlanB perceived the ETF market as the subsequent logical progression towards the widespread acceptance of Bitcoin worldwide.

This asset class offers a regulated (and not to mention simpler) alternative to holding the cryptocurrency directly.

The Role of Spot Bitcoin ETFs in Bitcoin Adoption

PlanB is not alone in this decision to move its holdings.

Ever since the launch of these financial products in January of last year in the United States, it has opened a new chapter for Bitcoin itself as a financial asset.

These ETFs serve as a bridge between the traditional financial system and the crypto world.

They serve as a regulated method for investors to gain exposure to the cryptocurrency without having to deal with the often-tedious process of creating a wallet and then figuring out a way to keep private keys secure.

The spot Bitcoin ETFs were designed to operate the same way as actual Bitcoin ETFs.

They track the price of Bitcoin itself by holding the cryptocurrency in reserves.

Investors can then purchase shares of these ETFs, which have the same market price as the actual product.

This setup allows investors to simply buy the cryptocurrency while removing the technical barriers that come with real Bitcoin ownership.

As Bitcoin continues to be embraced all over the world, investors like PlanB believe that the ETF market offers a major solution that aligns with the interests of the general public.

Bitcoin is becoming more accessible to both retail and institutional investors, and the ETF industry might have a huge role to play.

Tax Implications of PlanB’s Decision

One of the major concerns that often comes from crypto transactions is the issue of tax.

When Bitcoin is moved between wallets or converted into fiat, investors typically have to worry about capital gains taxes.

In PlanB’s case, the Netherlands (where he lives) does not require this on realized profits.

Instead, the country imposes what is known as an unrealized capital gains tax (also called a wealth tax).

According to PlanB, this tax is calculated based on the assumed annual return of 6% on a person’s total wealth.

In essence, PlanB is looking at a tax of around 2% on his total net worth each year—more importantly, he is required to pay these taxes regardless of whether he makes money or not from his Bitcoin holdings.

This tax system therefore allows him to make the transfer to the ETF market without having to pay any capital gains—as long as he doesn’t sell his assets.

A New Era for Bitcoin Investment

PlanB’s decision to move his holdings into the ETF market shows a growing trend of mainstream adoption in the market.

This trend is unlikely to go away, especially as more and more investors continue to look for secure ways to gain exposure to Bitcoin.

The removal of technical barriers when it comes to self-custody makes the ETF market easier for anyone to invest in Bitcoin without the need for any expertise.

Over the years, this new form of Bitcoin investment will continue to play a major role in how Bitcoin is perceived, as more and more of a financial asset.