Key Takeaways

- Bitcoin (BTC) saw a decline in recent times, dragging the rest of the altcoins down with it.

- This decline comes amid a series of bullish developments, including the White House crypto summit and the strategic Bitcoin reserve announcement.

- Investors may have been disappointed by the lack of demand in the reserve announcement, leading to the ongoing crash.

- Analysts like Arthur Hayes believe that a crash to $70,000 might be possible from here.

- The ongoing bearish pressure is likely due to panic selling from scared investors rather than general market weakness.

The crypto market is in the middle of yet another crash, especially as Bitcoin dropped below the $84,000 zone.

This crash came as a surprise to investors, considering the strong bullish factors that popped up during the week, including the White House Crypto Summit.

Many investors are now left wondering why the flagship cryptocurrency is struggling, despite the announcement of the much-awaited Strategic Bitcoin Reserve.

Let’s see the key reasons for BTC’s decline so far and what the future could have in store for the market as a whole.

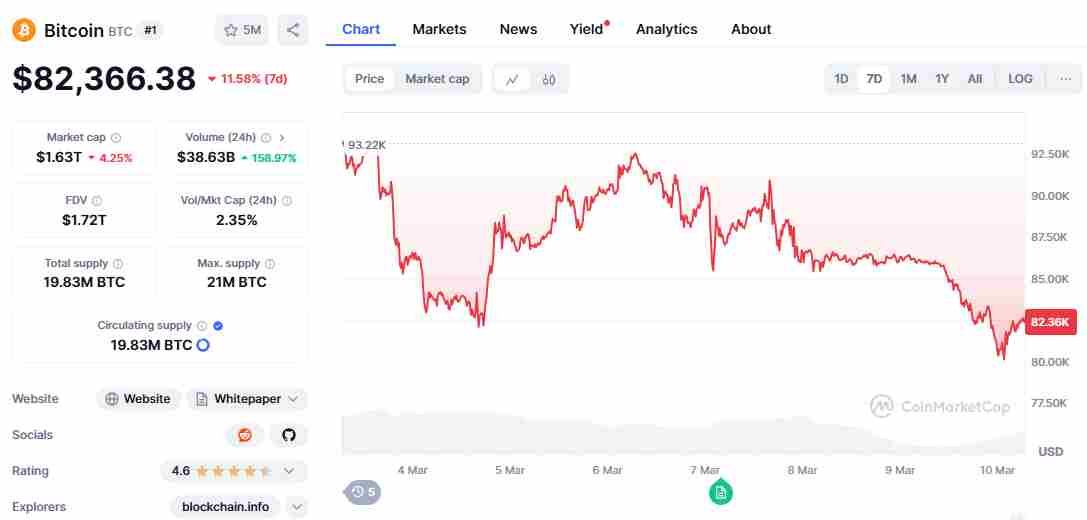

Bitcoin Drops Over 6% in 24 Hours

The last 24 hours have been extremely volatile for BTC. The cryptocurrency dropped to as low as $80,909 on Sunday, marking a 6% drop within a single day.

CoinMarketCap data shows that the cryptocurrency has now normalized to around $82,404.

However, the cryptocurrency is down by more than 10% over the last week.

An interesting part of this crash is how the whales have been seizing the opportunity to accumulate more BTC.

According to insights from independent analyst Ali on X, this cohort of investors have purchased around 22,000 coins in just three days:

A clear “buy the dip” strategy from the whales.

Another interesting thing about this decline is that it comes at a time when investors expected bullishness from Bitcoin.

Donald Trump, the US president, signed an executive order for a Strategic Bitcoin Reserve, during a high-profile Crypto Summit at the White House.

This also comes amid positive statements from the U.S. Office of the Comptroller of the Currency (OCC).

Yet instead of rallying, there is a possibility that BTC might not be done dropping just yet.

Why Is Bitcoin’s Price Action Out of Sync with the News?

This drop in Bitcoin’s price continues to baffle many analysts. However, there might be a few explanations for why it happened.

To begin with, President Trump signed the aforementioned executive order on 7 March.

However, instead of this order being geared towards purchasing more BTC for the US, investors were disappointed to learn that the US government planned to merely use Bitcoin it had already seized.

This unexpected decision caused the initial drop in Bitcoin’s price from above $90,000 to as low as $84,979.

Many analysts believe that this “repositioning” of the US government’s holdings does little or nothing to drive BTC demand.

As such, it wasn’t the immediate bullish catalyst that investors had hoped for—explaining the dip.

How Low Can Bitcoin Go?

Bitcoin’s drop has dragged the altcoins down along with it. Ethereum, XRP, and Solana, for example, are down by between 4% to 10% overall.

This broad decline across the market shows that the crypto industry has turned bearish, despite the positive news.

Bitcoin is currently facing a major test, especially as it continues to decline.

Many analysts continue to hold on to the $75,000 predictions, and there are currently no indications of an immediate BTC recovery.

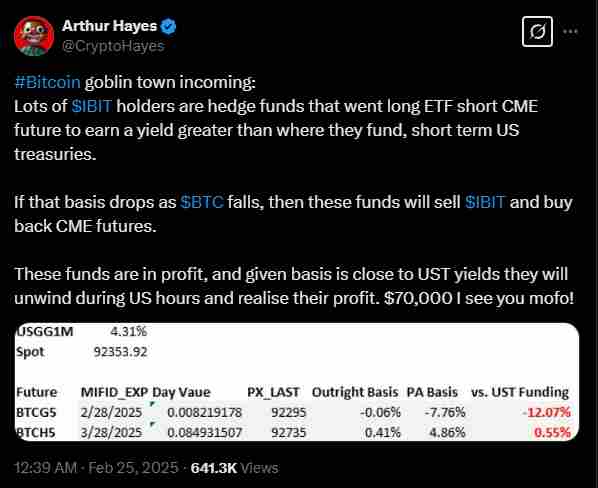

Arthur Hayes Sees More Downside—Could BTC Drop to $69,000?

Bitcoin has already lost the 200-day SMA on the daily chart, as shown below. This has led analysts to believe that the cryptocurrency could fall further.

This has led many analysts to believe that the cryptocurrency could be headed for its 50-week Simple Moving Average around $75,616.

This level could act as temporary support, which could provide some degree of help to Bitcoin’s case.

However, if this level fails to hold, BTC might drop to as low as $69,000.

BitMEX co-founder Arthur Hayes also recently weighed in on the conversation, describing Bitcoin’s latest drop as an “ugly start” to the week.

He believes that a retest of the $78,000 zone is entirely possible. And if this level fails, $75,000 could be the next target.

Hayes also pointed out that a large number of Bitcoin options contracts are open between $70,000 and $75,000.

This means that if BTC enters this range, the market could become even more volatile as traders adjust their positions.

Market Volatility Continues

Bitcoin’s volatility has become even more severe in recent weeks, especially as the price continues to fluctuate between $80,000 and $95,000.

This comes in response to macroeconomic data on the positive and negative fronts, like the trade tariff news and White House crypto announcements.

Hayes predicted in late January that BTC could dip to $70,000 before eventually reaching $250,000 this cycle.

While he mentioned that he could be wrong, the current market shows that Hayes could have been on to something after all.

The Bitcoin fear and greed index continues to trade in the “extreme fear” zone, and whether this trend continues remains to be seen.

Despite the ongoing bearish trend, many analysts believe that the ongoing price action is part of a wider market correction, and things could go back to being green soon.

According to insights from 10x Research, around 70% of the recent selling is coming from investors who bought BTC within the last three months.

This shows that the ongoing bearish wave is due to panic-selling, not general weakness in BTC’s price.