Could Microsoft Be the Next Big Buyer of Bitcoin?

Key Insights

- Microsoft is considering adding Bitcoin to its balance sheet.

- On 10 December, the company’s shareholders will vote on whether to proceed with the plan.

- Although the majority of the board leans towards the “no” vote, notable members like Reid Hoffman are huge Bitcoin proponents.

- MicroStrategy’s Michael Saylor has offered to help “transform Microsoft into a trillion-dollar company” with Bitcoin.

- Microsoft could be buying billions of dollars worth of the cryptocurrency.

Something big is headed Bitcoin’s way!

This week, news surfaced about Microsoft shareholders preparing to decide on the company’s investment strategy.

On 10 December this year, shareholders of the Bill Gates-founded company will vote on whether Microsoft should consider adding Bitcoin to its Balance sheet.

Even though the company’s board currently recommends a “no” vote because its current investment strategy already includes diversified assets:

This proposal is still open for discussion and could be massive for Bitcoin.

MicroStrategy’s Michael Saylor is already offering to help, and Bitcoin could be set to experience one of its strongest bull runs in history.

Here’s a closer look at how massive this could be:

The Push for Bitcoin as an Investment Asset

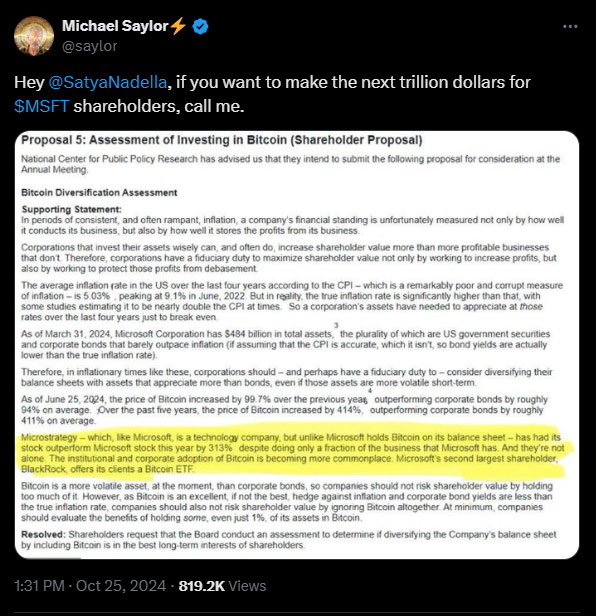

The proposal in question was submitted by the National Center for Public Policy Research, a conservative think tank.

According to Yahoo! Finance, this group is pushing for Bitcoin to hedge against inflation.

The upcoming Bitcoin vote

Source: Twitter

They cite its ability to provide valuable stability, especially in a world where currencies fluctuate and food and energy prices rise.

According to this group, Bitcoin’s resilience as an investment makes it a great addition to Microsoft’s balance sheet.

However, the company’s board remains skeptical. They are currently advising against the proposal because the company already owns diverse asset classes (including Bitcoin).

This cautionary approach aligns with Bill Gates, who, according to CNBC, has long been a critic of crypto and NFTs.

What’s At Stake In The Upcoming Shareholder Vote

The aforementioned vote on 10 December could be massive, not just for Bitcoin but for the broader perception of Bitcoin as an option for corporate investment.

If the shareholders vote in favor, it could encourage Microsoft (and many other companies) to seriously consider the benefits of crypto as a reserve asset.

A positive vote could boost Bitcoin’s reputation as a legitimate investment class, and more companies may join the movement.

Conversely, if the shareholders reject the proposal, it could signal that Microsoft isn’t ready to follow in the footsteps of others like MicroStrategy and Tesla.

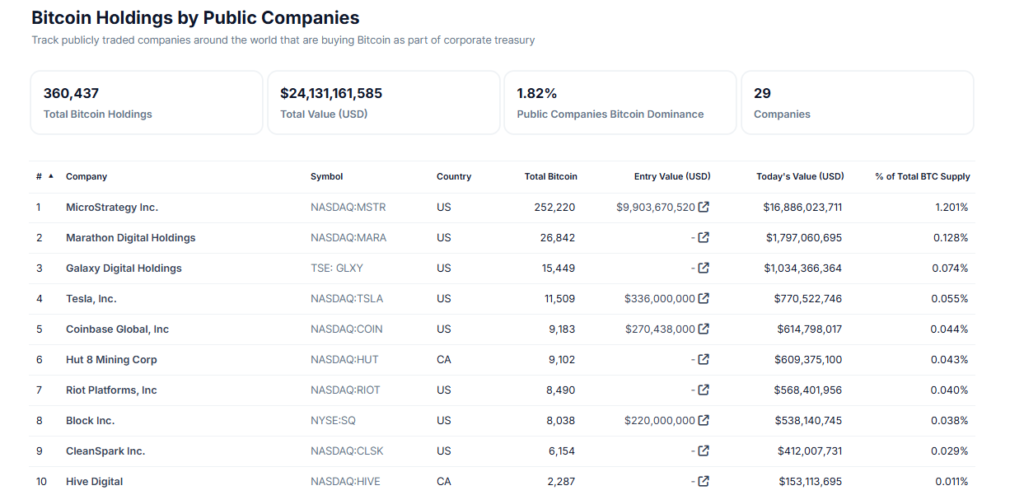

Both of these companies (and many others) have already integrated Bitcoin into their corporate treasuries.

MicroStrategy’s Bitcoin holdings

Source: Saylor Tracker

In fact, MicroStrategy holds hundreds of thousands of Bitcoins and is sitting on more than $15 billion worth of the cryptocurrency.

Michael Saylor Offers To Help

Founder and chairman of MicroStrategy, Michael Saylor, has taken a keen interest in this vote.

Keep in mind that under Saylor’s leadership, MicroStrategy has positioned itself as one of the Biggest corporate Bitcoin giants in the world.

In a recent tweet, Saylor encouraged the current Microsoft CEO, Satya Nadella, to consider using Bitcoin as a vehicle to become the next trillion-dollar company.

“Call me,” Saylor says

Source: Twitter

How Would Bitcoin React?

Microsoft currently holds around $76 billion in cash and cash equivalents, according to its second-quarter 2024 financial report.

Consider a scenario in which the company decides on a yes vote and allocates a small amount—say, 10%—to Bitcoin.

This would amount to a staggering $7.6 billion investment.

At the current Bitcoin price of $67,000, Microsoft could purchase around 110,000 $BTC.

This would automatically position it as the second-largest corporate Bitcoin holder in the world, ahead of Marathon Digital, Galaxy Digital, and Tesla.

Source: CoinGecko

This would drastically reduce Bitcoin’s circulating supply, leading to higher demand and, therefore, higher prices.

While there is no real way to tell how high Bitcoin will spike if this happens, the supply shock that results from 110,000 Bitcoin leaving the market would likely result in a major price jump for the cryptocurrency.

Keep in mind that the supply shock from the first few months of spot Bitcoin ETF trading in the US played a major role in Bitcoin’s jump towards $73,800.

Microsoft’s Investment Strategies for Bitcoin

If the vote ends up being a yes, Microsoft has several options.

Direct Purchase of Bitcoin

Microsoft could follow Tesla’s example and buy the cryptocurrency directly through exchanges.

This would allow it to gain full control over the asset. However, the company would also have to deal with the storage and security risks associated with holding billions in crypto.

Investing in a Bitcoin Spot ETF

Another approach would be investing in a Bitcoin spot ETF. This way, Microsoft avoids the storage/security risks and enjoys better liquidity and regulatory clarity.

Its bitcoin would become more easily accessible.

Leveraged Exposure Using Derivatives

Microsoft could also explore derivatives like options or futures contracts. This would allow the company to take advantage of leverage and buy even larger Bitcoin shares.

Leveraged exposure is the most risky of the three and is less likely to be chosen by the board.

Overall, notable figures like Reid Hoffman, a Microsoft board member and LinkedIn founder, have supported Bitcoin as a financial asset.

In a recent interview with Yahoo Finance, Hoffman highlighted Bitcoin as a “digital store of value” and endorsed its use as a means of shaping any financial system.

Hoffman is also an early investor in Xapo, a major Bitcoin custody service.

Overall, Microsoft’s decision on Bitcoin could influence the future of the cryptocurrency as more public companies opt for it.

![Top Altcoins in October [2024] You Should Look Out For 20 Top Altcoins in October [2024] You Should Look Out For](https://cryptolandoff.com/wp-content/uploads/2024/10/Top-Altcoins-in-October-2024-You-Should-Look-Out-For.jpeg)