Key Takeaways

- Decentralized exchanges are becoming more and more popular over the years.

- They offer more security and control to users compared to centralized counterparts.

- Some of the most popular of these include Raydium, Uniswap, PancakeSwap v3, and more.

- It is important to consider things like security and fees before choosing DEX.

Decentralized exchanges have become a major part of crypto investment over the last decade.

These secure and non-custodial trading platforms have become so popular because, unlike decentralized exchanges, they operate without intermediaries.

Users have the freedom to trade directly from their wallets and avoid some of the biggest risks in the crypto space altogether.

Here are some of the best of these platforms to know about, based on things like security, fees, liquidity, and user experience, among others.

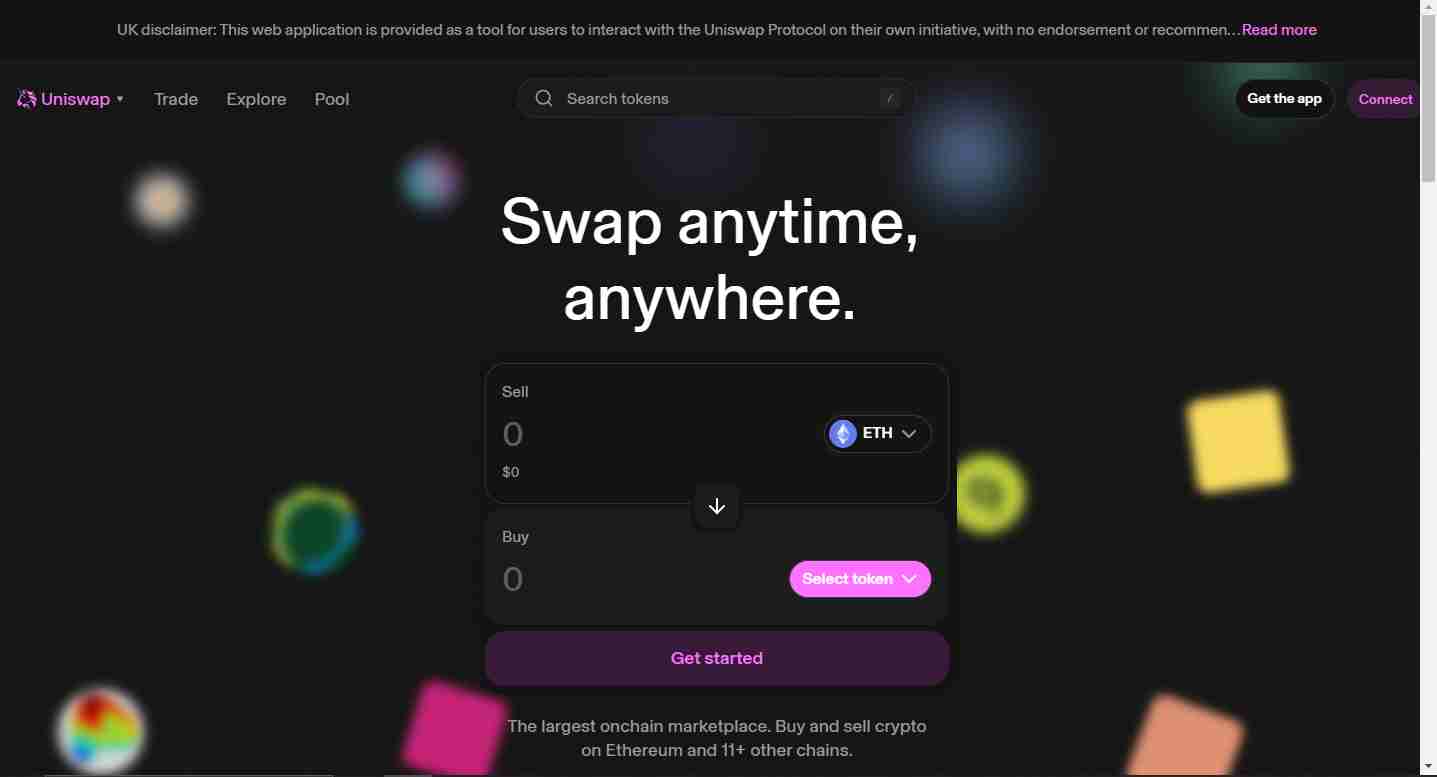

1. Uniswap

Uniswap is one of the most dominant decentralized exchanges and is known for its so-called “concentrated liquidity model.”

This platform supports over 11 blockchains and offers traders a great deal of interoperability.

Uniswap also comes with a developer-friendly protocol that helps developers to build decentralized applications.

Over the next few years, Uniswap is expected to introduce even more security features, and further expand its multi-chain support.

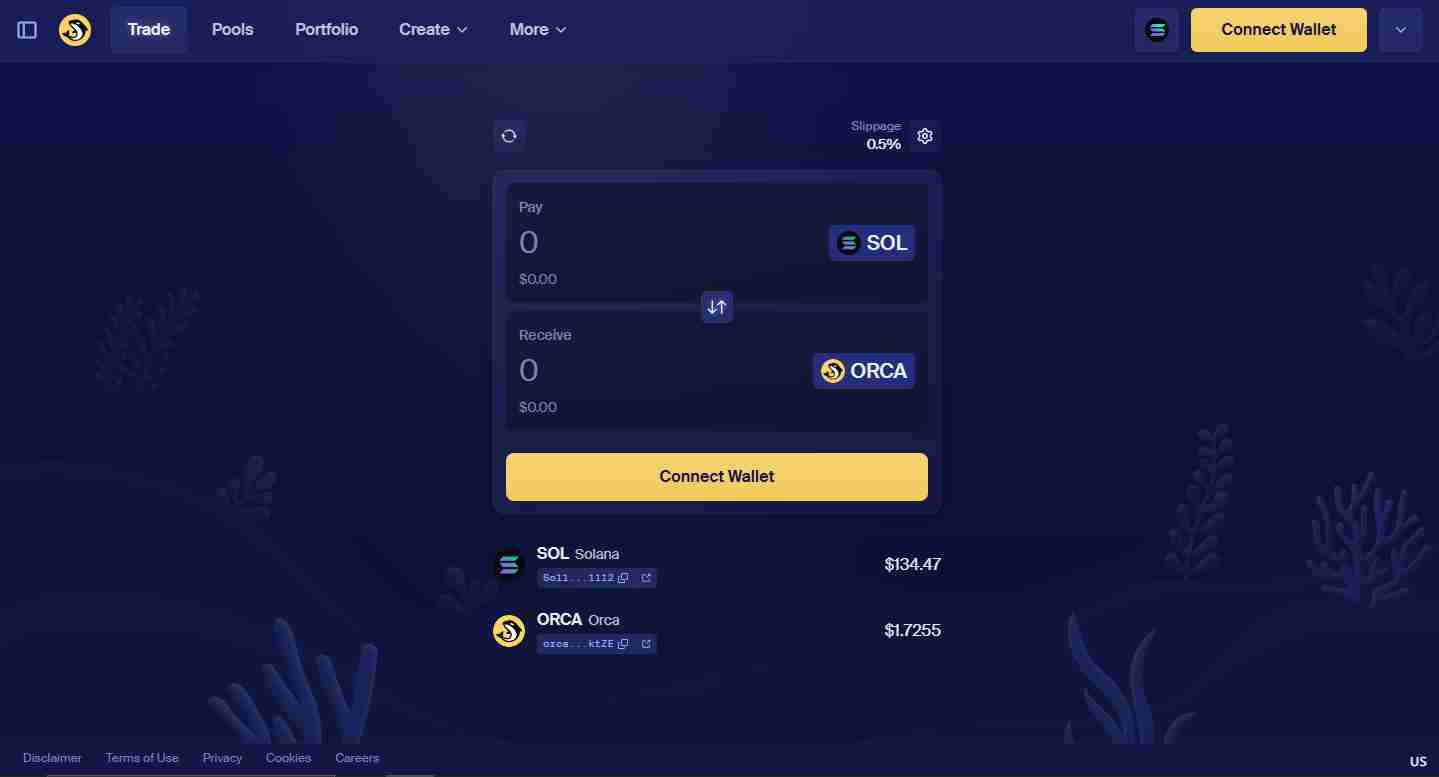

2. Orca

This platform is known as one of the first automated market makers (AMMs) on Solana.

Orca is well known for its speed and efficiency, especially with its enabling of easy token swaps and liquidity provision.

It features low trading fees and strong community support, which are important for the success of any DEX.

Solana is an increasingly popular chain for developers and traders alike. The more popular it gets, the more likely Orca is to integrate new tokens and security measures into its offerings.

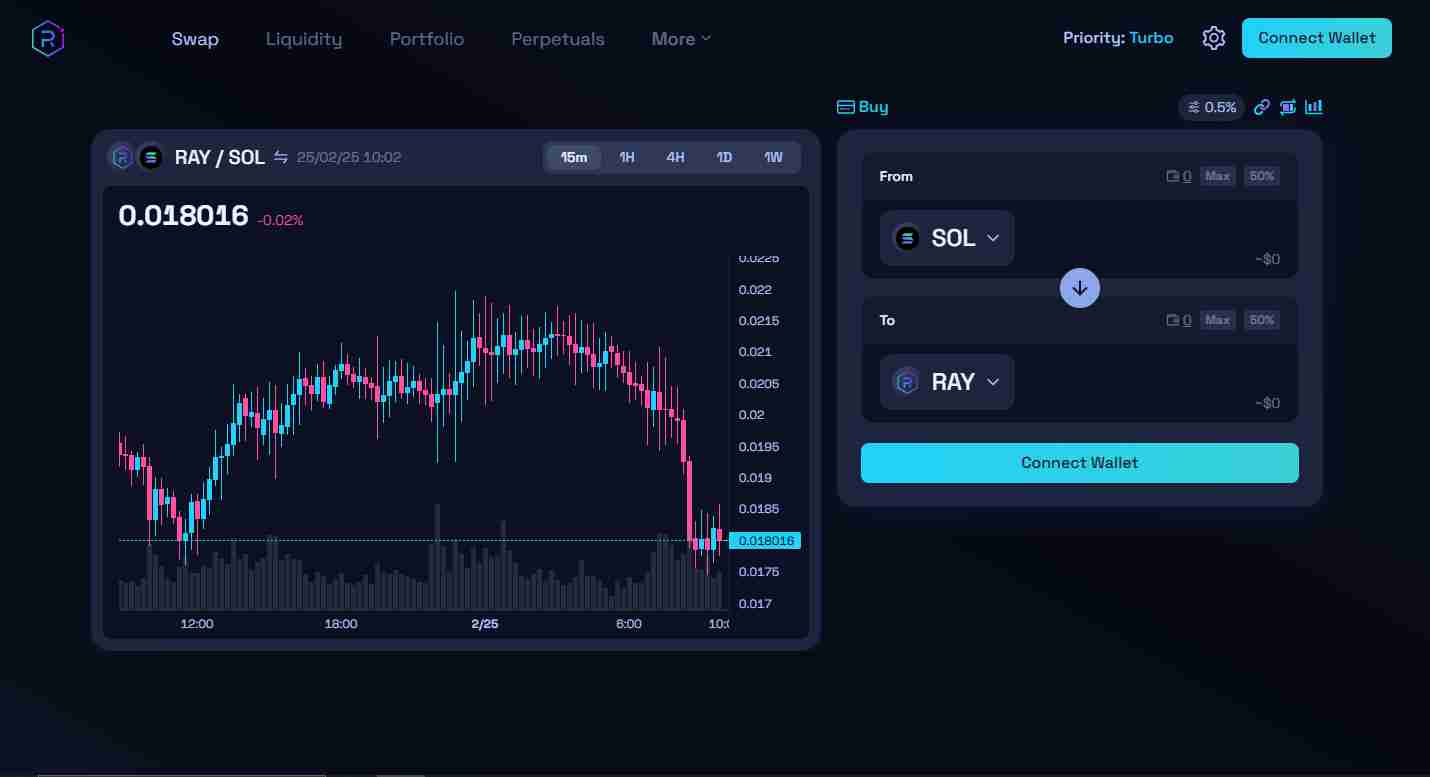

3. Raydium

Raydium is another popular option when it comes to Solana-based decentralized exchanges. It offers things like deep liquidity, yield farming, and staking options, in addition to its integration with Serum.

All of the above means that Raydium is highly efficient when it comes to trading.

Raydium features a wide range of tokens, along with compatibility with Serum order books. It is also underway with plans to expand its launchpad (AcceleRaytor) to support more and more new projects.

4. IDEX

This exchange combines the best of centralized and decentralized exchanges into a single platform.

It offers high-speed trading with self-custody and operates on multiple blockchains. These include Ethereum, Binance Smart Chain, Polkadot and many others

Some of its key features include its user-friendly interface for new traders, its advanced security with 2FA, and its multi-chain support.

The DEX is expected to launch new mobile apps soon, along with more device integrations to accommodate new users.

5. Curve Finance

Curve is the go-to platform for stablecoin trading. This is considering how it minimizes slippage through its advanced AMM algorithms.

It supports things like cross-chain trading on Ethereum-compatible networks and allows its users to participate in its governance through its CRV token.

Curve Finance is also a highly secure platform with its regular smart contract audits for security.

6. Aerodrome SlipStream

This service combines all the great aspects of Uniswap, Curve, and Convex into a single platform.

In essence, Aerodrome Slipstream is a specially crafted trading experience on its own, with the help of its SlipStream liquidity model.

The Aerodrome Slipstream offers users fast transactions with minimal fees, along with NFT-based governance and profit-sharing.

It has one of the most optimized liquidity management schemes and is likely to expand further over the years.

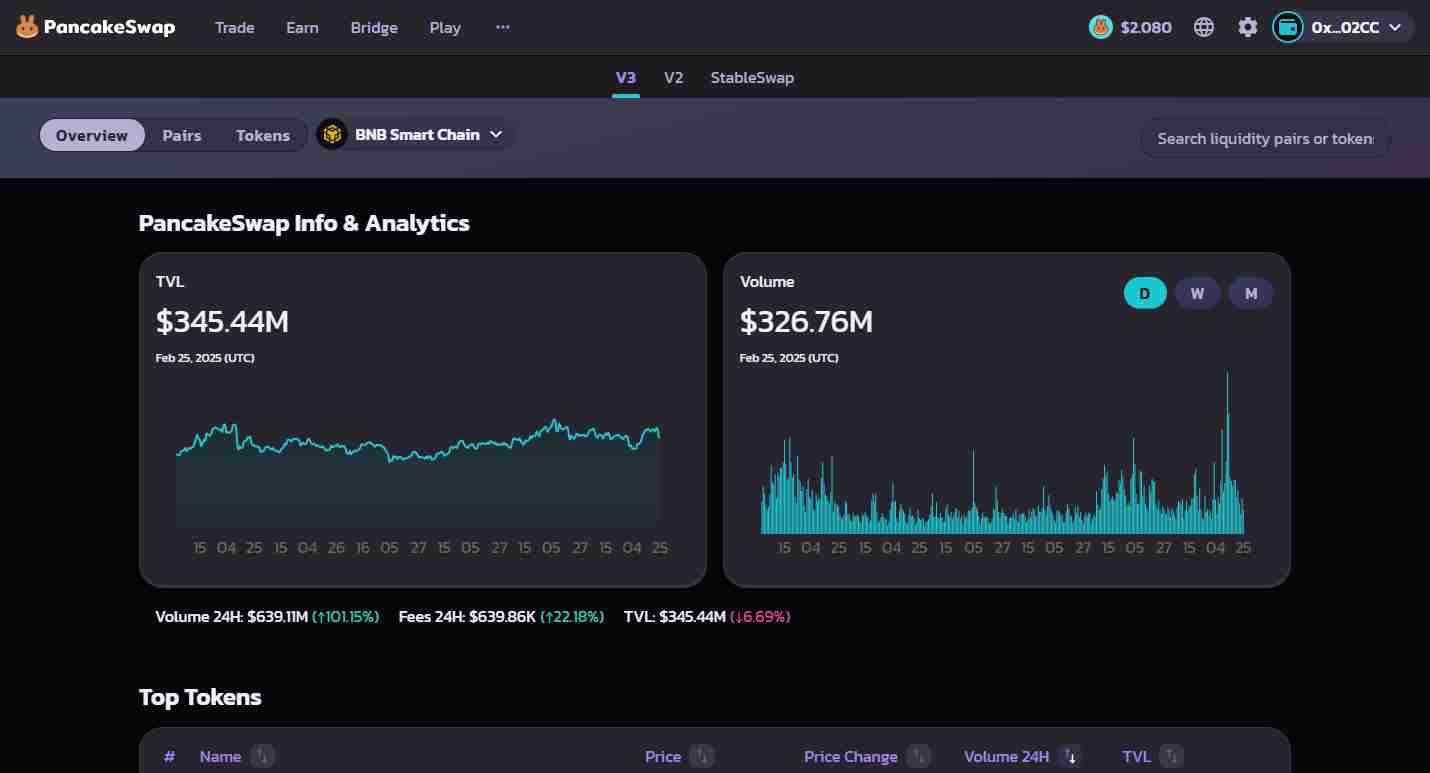

7. PancakeSwap

This DEX was built on the BNB chain and on Ethereum. Its core feature is how it offers capital efficiency for liquidity providers, along with its user-friendly interface.

The DEX features improved liquidity management, along with lower fees, cross-chain compatibility and is primed for continuous upgrades.

Choosing the Best Decentralized Exchanges

Choosing the best decentralized exchanges for your needs is a lot more than merely going after the most popular names in the space.

Here are some of the biggest aspects to watch out for before making a choice.

Security

Security should hold top priority when choosing a decentralized exchange. Make sure to go for platforms with things like smart contract audits, 2FA, cold storage options, and insurance to cover possible hacks.

Trading Fees

Fees are some of the distinguishing factors between decentralized exchanges. While some charge a percentage of transactions as fees, others have fixed fees. Consider things like gas fees, maker/taker fees, possible hidden costs and so on.

User Interface

Decentralized exchanges aren’t known for being the most user-friendly services. However, many of them feature great interfaces that even beginners can navigate easily. Look for simple navigation (or at least an interface you understand), mobile app support, customizable dashboards, and more.

Liquidity and Trading Volume

Higher liquidity in any exchange makes trading smoother without significant price slippage.

This means that you should go for platforms with things like faster order execution and a wider range of trading pairs, especially the ones you are looking to trade.

Overall, decentralized exchanges will likely continue to be a major part of the way crypto is traded around the world.

They offer more control and security compared to centralized platforms, but should be approached with caution.