Key Takeaways

- Crytpo is becoming more popular, and so are ways to steal it.

- Understanding the ways to keep one’s assets safe is the first step towards staying afloat in the crypto space.

- Some of the best practices include choosing a hardware wallet, not leaving assets on an exchange, and avoiding phishing vectors.

- Others include securely storing recovery phrases, using strong passwords, and taking physical security seriously.

Bitcoin is one of the fastest avenues to financial freedom, which explains its massive popularity over the last few years.

However, despite the rush for this highly popular digital asset, many users still make mistakes that put their portfolios at risk.

Whether you’re a new or seasoned investor, try to avoid these common errors and keep your digital assets from theft and other unfortunate ways of losing your assets.

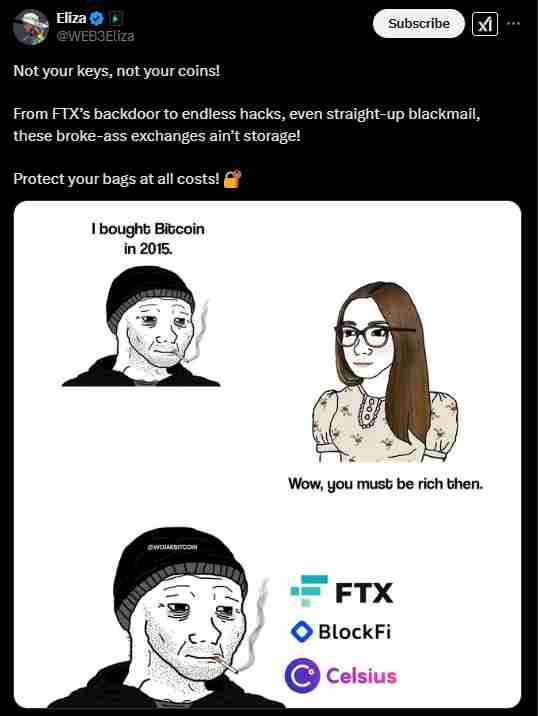

1. Keeping Bitcoin on an Exchange

One big mistake that crypto investors make is leaving their Bitcoin on an exchange. Many of these exchanges offer convenience. However, due to the large amounts of crypto they hold, they are also prime targets for hackers.

You, as the holder, could lose your funds if the exchange gets hacked.

Additionally, exchanges hold private keys on your behalf. Which means that technically, you do not own your Bitcoin.

Instead, transfer your Bitcoin to a private wallet where you control the keys. Only use exchanges for trading, not for storing crypto.

How to Avoid It: Transfer your Bitcoin to a private wallet where you control the keys. Use exchanges only for trading, not long-term storage.

2. Failing to Back Up Wallets

Losing access to your Bitcoin can be a huge pain. However, without backing up your wallet(s), this problem can move from being a mere pain to a complete disaster.

Without backing up your wallets, your coins could be gone forever if you forget your password or lose your device.

Always create multiple backups of your wallet’s recovery phrase and store them in secure locations.

Never save them digitally, where a hacker can easily access them and steal your assets.

3. Storing Recovery Phrases Digitally

The previous point leads to the current one. Many people successfully back up their wallets.

However, they soon make the mistake of storing their recovery phrases in the cloud, in emails, in their computer’s notepad, or in other digital note-taking apps.

This makes them vulnerable to cyberattacks and could be a quick way to lose everything.

Try writing down your recovery phrase on a piece of paper, or even engrave it on a metal backup plate if you must.

Then store it somewhere only you can access.

4. Using Weak or Reused Passwords

A weak password is one of the weakest links in any security scheme. Never reuse passwords on multiple platforms, as it increases the risks of you getting hacked.

Always use strong passwords for your wallets, and never use them across two or more.

Consider using a password manager to generate complex passwords for every account.

5. Falling for Phishing Scams

The basic idea behind phishing is tricking users into revealing their wallet credentials or recovery phrases.

These scams can come in the form of emails, fake websites, fake customer support, and so much more.

Always check website URLs before entering sensitive information. Never share your recovery phrase with anyone, regardless of who they may be.

If you need support, contact your wallet providers only through official channels.

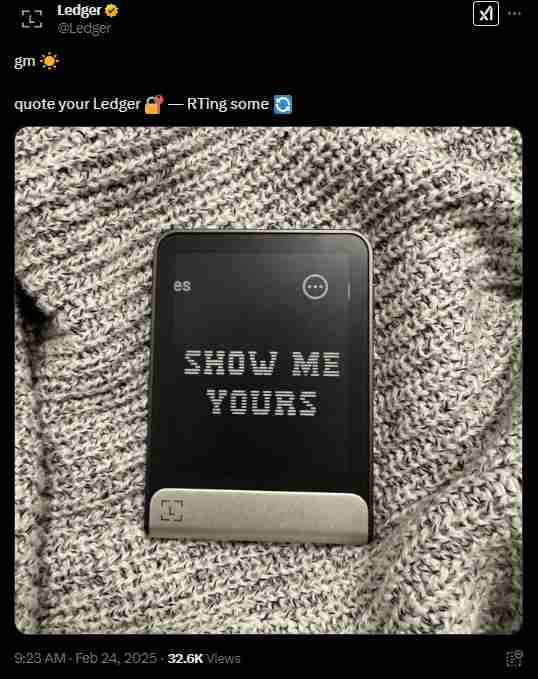

6. Using Hot Wallets for Large Holdings

The attractive aspect of hot wallets is that they are easy to access. However, the downside to this is that they are connected to the internet and can therefore be hacked remotely.

Never keep large amounts of Bitcoin stored in a hot wallet.

Instead, purchase a hardware wallet like the Ledger Nano or a Trezor wallet of any kind and only use hot wallets for transactions and smaller amounts.

7. Not Updating Wallet Software

If you choose to use a hot wallet, outdated software can be a major attack vector.

Many users tend to neglect updates and therefore leave their funds exposed to unnecessary risks.

Ensure to regularly check for updates and install them when available.

These updates often include security patches and better threat definitions, not to mention performance improvements.

8. Forgetting to Secure Your Private Keys

Your private keys are your only way to access your Bitcoin. This means that losing it leads to the permanent loss of your assets.

Always keep your private keys offline and in a secure location. Use multi-signature wallets or hardware wallets for an extra layer of protection.

9. Ignoring Two-Factor Authentication (2FA)

Many wallets and exchanges offer 2FA for extra security. Make sure that this option is always enabled to prevent unauthorized access, even if your password is compromised.

Try solutions like Google Authenticator or Authy and avoid using SMS-based 2FA. This is because SMS-based 2FA is especially vulnerable to SIM-swapping attacks.

10. Not Having a Plan for Inheritance

The future is always unknown, and it always helps to plan for it. If something happens to you, your Bitcoin could quickly become inaccessible to your loved ones.

Remember to put a plan in place to access your Bitcoin if needed.

Consider using a legally recognized method, like a secure document with instructions. Either this or a multi-signature wallet with a designated co-signer should get the job done.

11. Trusting Unknown or Unverified Wallets

There are many wallet providers on the market. However, not all of them are trustworthy. Avoid using unverified or shady wallets that could lead to the theft or loss of your funds.

Only use well-known wallets with positive user reviews. Make sure that its code is open source and audited extensively by third-party security experts.

12. Overlooking Physical Security

While digital security is important for your wallet itself, keeping your physical assets safe is also crucial.

Consider keeping your wallet recovery phrase or hardware wallet as safe as possible.

Store backups securely, never discuss how much you hold with others, and keep security in mind at all times.