Key Takeaways

- Crypto investment can be a very rewarding experience for many traders, especially if done right.

- Getting involved in this market depends on several factors for success. These include proper research and risk management.

- Investors must be security-conscious and have a proper strategy in place before getting in.

- Investors must diversify their portfolios and understand market cycles. This helps to manage risk and predict price action.

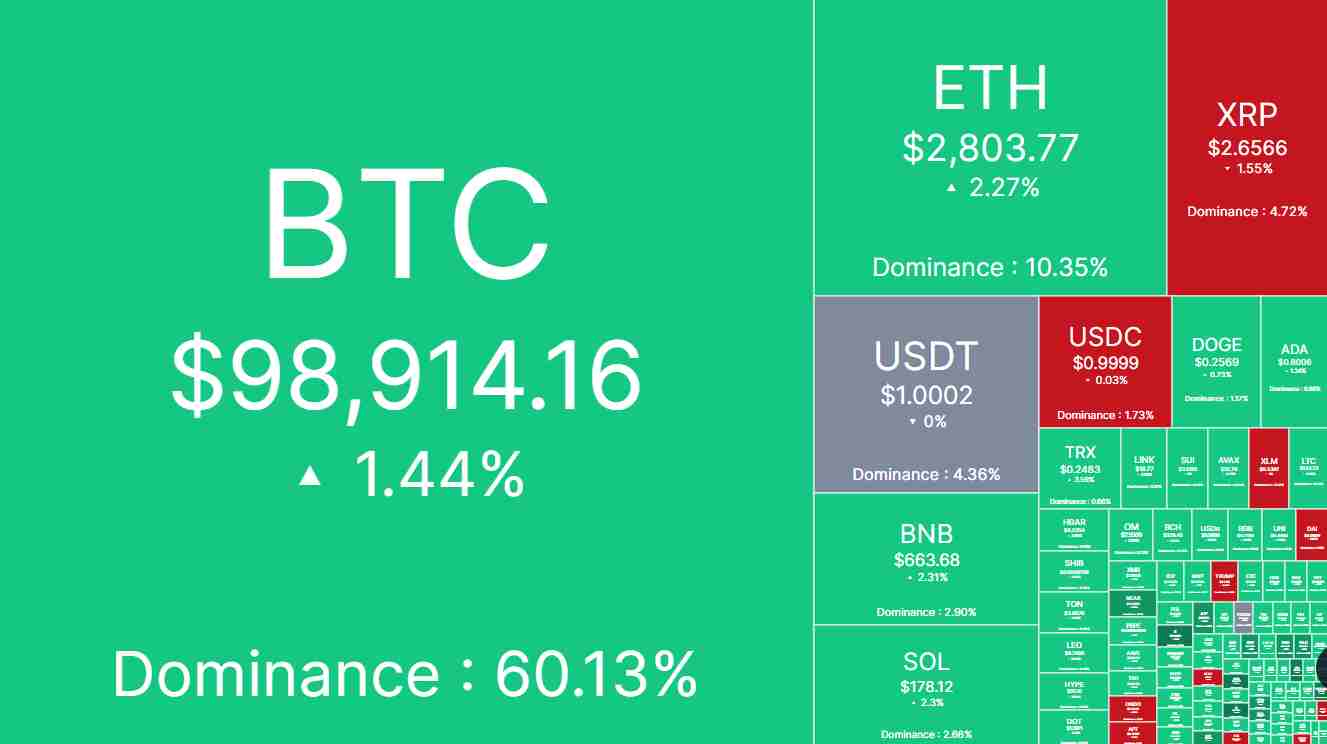

Cryptocurrencies are becoming more and more popular by the day, especially with Bitcoin’s performance over the last few months.

This means that whether you’re looking to diversify your portfolio, make short-term trades, or invest for the long term, taking the right approach to things is important.

Here is a breakdown of everything you need to know about investing in crypto, from choosing the right coins to managing the risks.

What You Need to Know About Cryptocurrencies?

Before diving headlong into investment, it is important to understand what cryptocurrencies are.

Think of them as digital assets that run on blockchain technology. This means that transactions conducted with cryptocurrencies are secure and transparent.

This is a lot unlike traditional cryptocurrencies, which are often controlled (and easily manipulated) by central authorities.

Ethereum, Bitcoin, Solana, and several others are well-known cryptocurrencies. However, there are thousands of others, each with their own special use cases and strengths.

Steps to Start Investing in Cryptocurrencies

Getting involved with cryptocurrencies is as straightforward as can be. Here’s a step-by-step guide to getting started and doing things right.

1. Do Your Research

This is the most important aspect in any kind of investment, be it crypto or otherwise.

The crypto market is highly volatile, and many projects tend to fail. With this in mind, try to study different cryptocurrencies before putting money into any asset.

Find out what your chosen crypto is, what technology it runs on, what use cases it might have, and so on.

Also source information from websites like CoinMarketCap or CoinGecko on things like rankings and historical data.

2. Choose a Reliable Exchange

You’ll need some kind of exchange to buy or sell cryptos. Consider choosing a reputable one, depending on your experience level and your risk appetite.

Decentralized exchanges like Uniswap and Sushi Swap have a wide range of cryptocurrencies but are not very beginner-friendly.

On the other hand, centralized exchanges like Binance, ByBit, OKX, Kucoin, or MEXC are trusted and are easy to access by even absolute beginners.

Make sure to choose an exchange that fits your fee and security needs.

3. Secure Your Investments

Security is very important when it comes to crypto investments.

Unlike traditional banks, which can easily recover accounts and funds in case of password mismanagement, if you lose access to your wallets or fall for a scam, your funds might never be recovered.

Consider following the steps below to stay safe:

- Use strong passwords and enable two-factor authentication (2FA).

- Store all your assets in a secure wallet. Consider a software wallet like Trust Wallet or Metamask, or hardware wallets like Ledger or Trezor for long-term holdings.

- Avoid phishing scams, and be on alert for fake emails. Scammers often use fake websites and social media accounts to source for victims, so remember to keep this in mind.

- Never share your private keys or seed phrases. If someone has this information, they can steal your funds.

4. Decide on Your Investment Strategy.

Decide what kind of investor you want to be. Different kinds of investors make different decisions based on their risk tolerance and targets.

- Do you want to be a long-term holder? Long-term holders keep their assets for months or years and are unconcerned with small-scale price movements.

Instead, they bet on long-term growth. - Are you a trader? This class of investors buy and sell crypto based on short-term trends as a way to make profit from short-term trends.

- Are you a staker? Stakers lock up their cryptocurrencies for predefined periods in order to earn passive income as rewards.

- Are you a yield farmer? This class of investors uses defi platforms like lending and borrowing protocols to generate passive income from their crypto holdings.

Regardless of which path you choose to take, always pick a strategy that aligns with your targets and risk appetite.

5. Diversify Your Portfolio

Remember to never put all your money into a single cryptocurrency. Diversification helps to manage risk, and you should consider spreading out your asset.

Consider the following classes of cryptos for diversification:

- Blue-chip cryptos like Bitcoin or Ethereum for stability.

- Altcoins like Solana and Avalanche, both of which have massive growth potential.

- Stablecoins like USDT or USDC for liquidity and stability.

- DeFi tokens like Aave and Uniswap for defi exposure.

Spreading out your portfolio like this can help to manage risk, while taking advantage of price gains.

6. Understand Market Cycles

Another way to do well in the crypto space is to understand the market’s cycles. Crypto markets go through cycles of boom and bust. Prices tend to skyrocket in bull runs and then crash hard in bear markets.

Understanding these cycles can help to make informed decisions and avoid the panic of mass-selling when downturns come.

7. Manage Risks Wisely

You must also understand that the market is highly volatile, and investors tend to lose it all in a short period of time.

- Invest only what you can afford to lose.

- Use stop-loss orders to manage your risk effectively.

- Never invest based on hype.

- Beware of Ponzi schemes, rug pulls, fake airdrops, and many more.

Common Mistakes to Avoid

The crypto market’s popularity also comes with many ways to lose it all. Interestingly, investors who DO lose it all tend to make the following common mistakes:

- Never “Ape” or buy into projects without proper research.

- Users failing to secure their wallets can lead to hacks and lost funds.

- Learn to take breaks and avoid making impulsive decisions based on fear or greed.

- Constant buying and selling can rack up fees and accumulate losses.

Overall, investing in crypto can be very rewarding. However, it comes with its own set of risks.

Always take the time to do research and secure your assets to increase your chances of success.