Key Insights

- The crypto market has many opportunities compared to other financial markets.

- These opportunities often come with their fair share of risks, like hacks and scams.

- Among scams, one of the most common in the crypto space is pump and dump schemes.

- These schemes involve scammers artificially pumping up the price of a token, luring investors in, and then dumping on the market suddenly.

- You can avoid becoming a victim of this kind of scam by watching out for red flags like sudden price spikes and unreasonable social media hype.

- More red flags include low liquidity, anonymous developers, and unrealistic promises

The crypto industry has arguably more opportunities than any other financial market.

However, the downside to this is that the risks often match or even outweigh the rewards.

One very common issue the crypto industry has constantly had to deal with is the issue of pump and dump schemes, where the price of a cryptocurrency is artificially inflated.

Unsuspecting investors are encouraged to buy at high prices before the scheme’s masterminds sell and crash it all.

Here are five of the biggest red flags to watch out for to avoid falling victim.

1. Sudden and Unexplained Price Spikes

This is a very common red flag in the crypto space, and it helps to be aware of it.

If a relatively unknown cryptocurrency suddenly surges in price—no major news or development milestone—it “might” be a pump and dump.

This is especially hard to spot and happens most commonly in memecoins, which have little to no real-world use cases.

Genuine prices are often tied to real developments—partnerships, technical upgrades, regulatory approval, and so on.

If the price of a cryptocurrency jumps by a wide margin for no good reason, it might be because a group of manipulators are buying in bulk and are trying to lure unsuspecting traders in.

It always helps to investigate before investing.

2. Heavy Promotion on Social Media and Forums

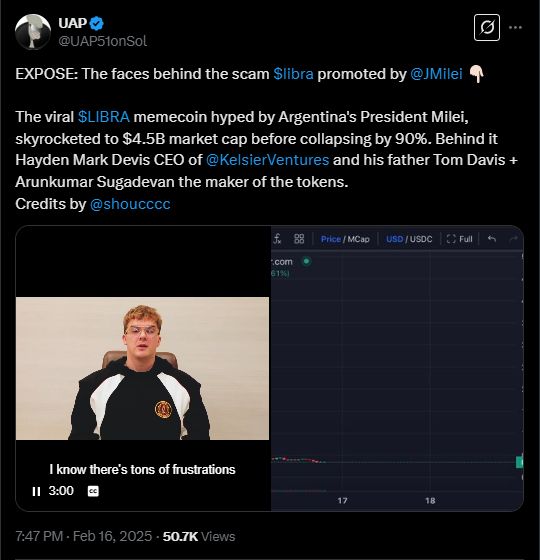

Another major red flag of pumps and dumps is hype.

Scammers often flood platforms like Twitter, Telegram, Discord, and Reddit with messages that promote scam tokens.

You might see phrases like “This is going to the moon!” or “Get in before it’s too late!”.

This is done to create a sense of urgency and can turn out to be a scam if invested in before proper research.

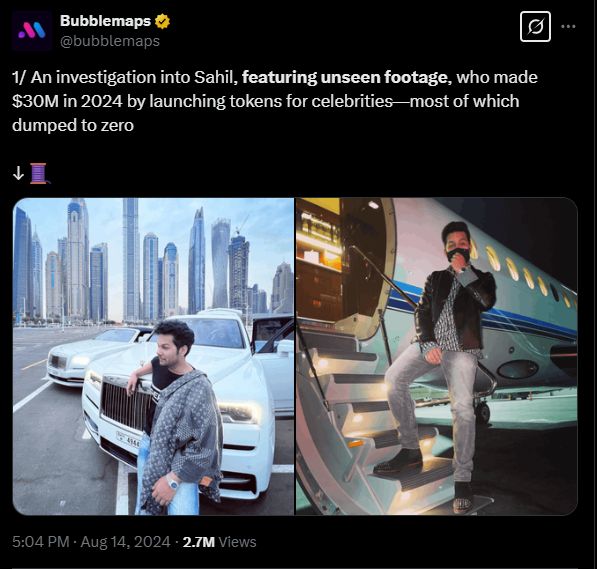

A good real-world instance of this was the memecoin frenzy from last year, where several celebrities launched and promoted memecoins.

Some of these included Andrew Tate, Jason Derulo, Alexis Texas, Davido, and so on.

The “hawk tuah” memecoin scam was also a prime example.

These promotions can also come from unknown or even newly created accounts.

Be careful of excessive hype from any source, without any credible sources.

3. Low Liquidity and Market Manipulation

Legit cryptos often have strong trading activity across multiple exchanges. This is another factor that memecoin scams often miss the mark on.

If a coin has low liquidity, it means that there aren’t many buyers or sellers, and it is easier for manipulators to control the price.

Scammers often take advantage of this issue by artificially driving up prices and luring victims in.

Once they dump their holdings, the price crashes more easily because there aren’t many real buyers to hold it up.

Before investing in any kind of token whatsoever, remember to check the trading volumes and order books first.

4. Anonymous Developers and Lack of Transparency

Another major red flag in pump and dump scams is the anonymity of their developers.

A legitimate team should have its information made public to allow investors a chance at making the right decisions.

If a coin’s developers are anonymous or hard to trace, you should consider this a major red flag.

Scammers often hide their identities to avoid legal consequences when the scam “does” happen.

Before putting a dollar into any project, read through its website. Make sure that the project has a transparent roadmap, and make sure that its whitepaper makes sense to you.

Check if it has active community engagement and whether its developers dodge important questions.

If a project checks any of these boxes, it might be best to stay away.

5. Extreme Promises of High Returns

This is especially true for the memecoin space: If something sounds too good to be true, it probably is.

Pump and dump schemes often promote unrealistic profits. They claim ridiculous returns in the hopes that investors will get greedy and go all in.

For example, crypto scammers can promise investors that a coin will “10x in a week” or “make them millionaires overnight.”

Investors should be aware that no real or legitimate investment can deliver such outsized returns in so little time.

The best projects to invest in grow over time with real adoption.

With this in mind, be skeptical of any cryptocurrency that relies on hype or promises of high returns.

Crypto pump and dump schemes can be very tempting. However, they almost always turn out to be sources of huge losses for investors.

Be sure to watch out for red flags like sudden price spikes, unreasonable social media hype, low liquidity, anonymous developers, and unrealistic promises.

Always do your own research and rely on credible sources.

Most importantly, never make financial decisions based solely on hype.