Key Insights

- Solana has become wildly popular over the last five years, across niches like Defi, NFTs, gaming, and trading.

- The network offers several advantages compared to Ethereum, including scalability and cheap fees.

- Solana is more efficient than Ethereum and runs on a combination of proof-of-stake and proof-of-history.

- The network’s native cryptocurrency, $SOL, is the backbone of the entire process and has become just as popular over the years.

- $SOL is expected to maintain its standing as one of the strongest networks in defi, compared to Ethereum.

Solana has become one of the most widely used crypto networks after its rapid growth between 2020 and now.

This network is now the most direct rival to Ethereum, considering its speed and scalability.

What’s more, the SOL network is capable of processing thousands of transactions per second, earning it more of a reputation in the blockchain space.

But what exactly is Solana? What should you know about $SOL, and why is it important?

Let’s take a look at the details.

What Is Solana?

Solana is very similar to Ethereum in many ways. It is a blockchain platform designed to support decentralized applications (also known as Dapps).

This network is capable of processing transactions at lightning-fast speeds and is superior to Ethereum in this regard.

SOL is unlike many other mainstream blockchains, which often struggle with congestion and high fees.

Solana is efficient and cheap in comparison and makes all of this possible through its innovative PoH/PoS consensus mechanism.

This means that it combines Ethereum’s Proof of Stake mechanism with another special kind of mechanism, called Proof-of-History (PoH).

$SOL, in essence, puts timestamps on transactions “before” they are validated.

This allows it to process multiple transactions in parallel and therefore beat Ethereum in speed.

What is $SOL?

Like many other blockchain networks, Solana has a native cryptocurrency with the ticker symbol $SOL.

This cryptocurrency serves many purposes within the ecosystem, including payments for transactions and smart contract execution.

In addition, users can stake their $SOL to secure the network and earn rewards (remember that aside from PoH, $SOL runs on PoS as well).

In addition, many Solana-based applications use $SOL as their backbone currency.

Lending, staking, trading, and many other protocols often require $SOL for things like payments and rewards.

How Can You Buy $SOL?

If you are interested in Solana, understanding the right ways to participate in its ecosystem is highly important.

Here’s a breakdown of how to go about it:

-

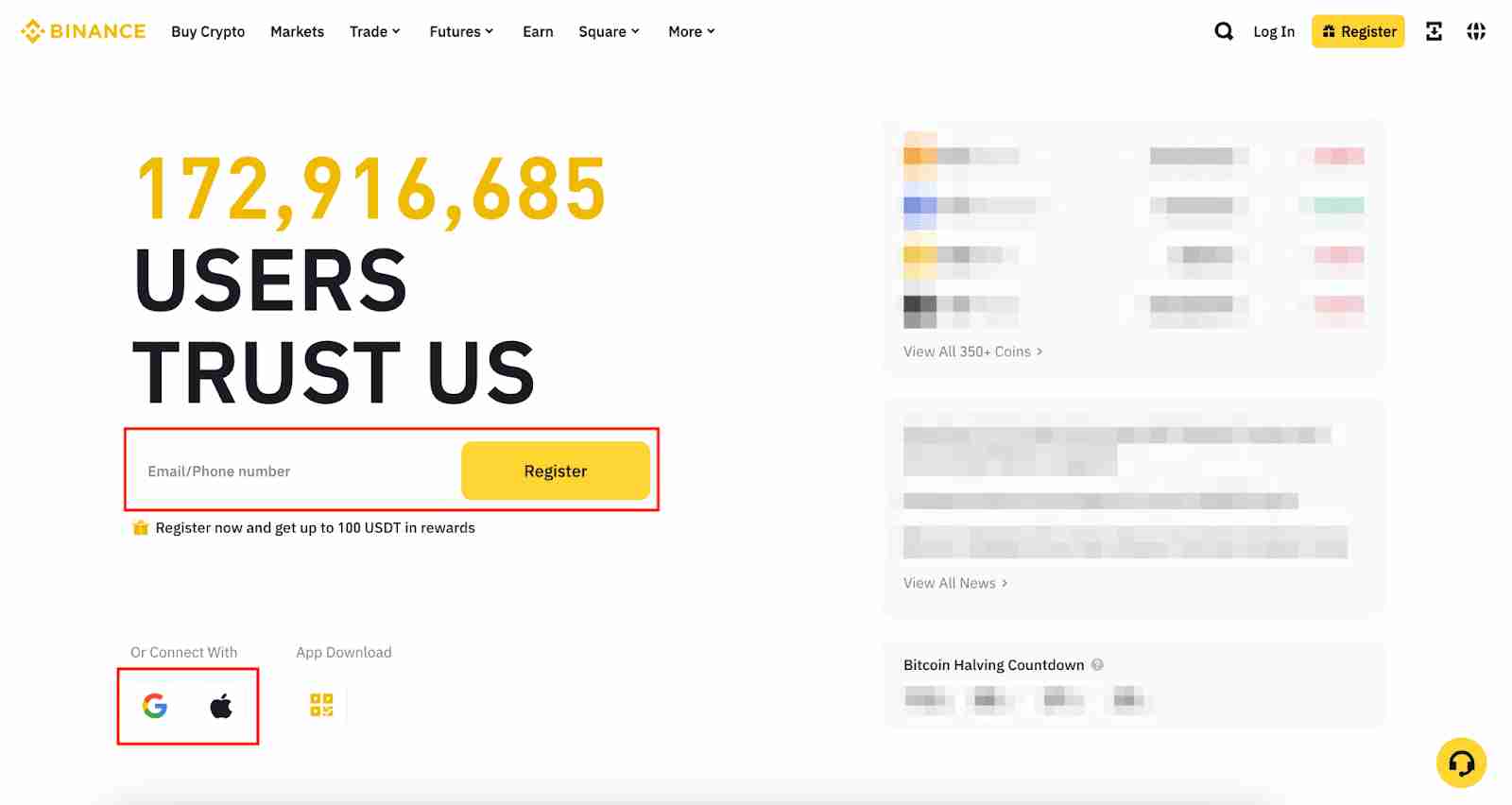

Choosing a Platform

You can choose to buy some SOL on a centralized exchange (CEX) like Binance, Coinbase, Kraken or Gemini. These platforms have some of the most user-friendly interfaces, especially for beginners.

On the other hand, you can also choose to opt for decentralized alternatives on the Solana ecosystem, like Raydium or Orca.

This option typically applies to investors with more crypto experience.

-

Creating An Account

Once you have chosen a platform, It is time to create an account (for centralized entities), if you didn’t have one.

Decentralized exchanges require no registration, and allow users to buy crypto on the fly.

On the other hand, centralized exchanges typically require registration and some form of KYC verification process.

This will involve providing some personal information and uploading a few documents.

-

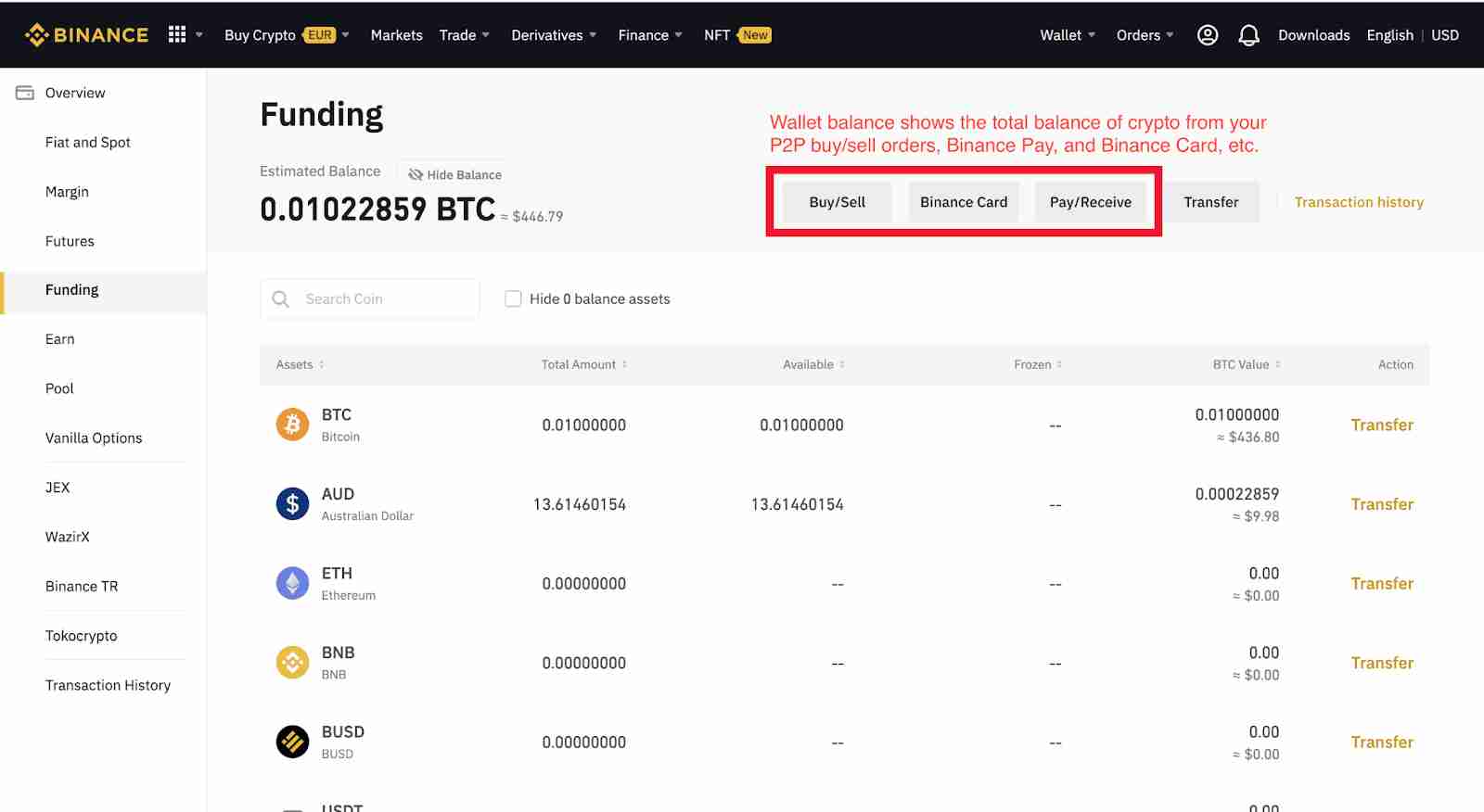

Funding Your Account

Once your account has been verified, you will need to fund it.

Most centralized exchanges accept payment methods like bank transfers, debit/credit cards, and payment processors like Apple Pay or Google Pay.

You can even fund your account with other cryptocurrencies.

-

Purchasing Some SOL

After funding your account, you can head over to the’markets’ section on any CEX to place an order.

Decentralized exchanges typically have the exchange section on their homepages and require little to no navigation

You will be required to input the amount of crypto or fiat you would like to exchange for SOL before confirming your transaction.

-

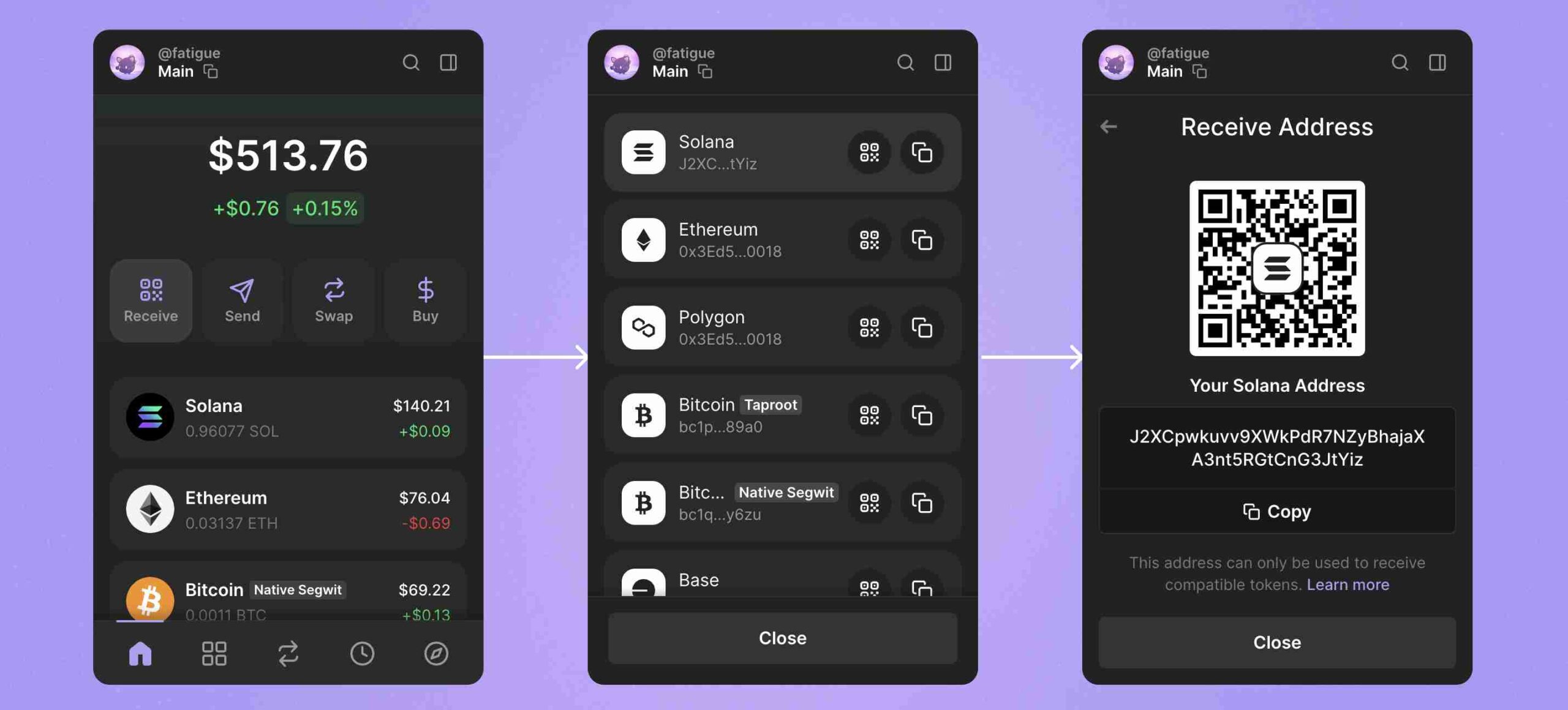

Storing Your SOL

On successful purchase, your crypto should appear in your wallet. However, this is where security comes in.

You can always leave your crypto in the exchange’s integrated wallet (in the case of CEXs).

However, for added security, consider moving your crypto to a personal hardware/software crypto wallet like a Ledger, Trezor, or Phantom wallet.

Why is Solana Unique?

Several factors set Solana apart from other blockchains. The first of these is its speed.

Solana is capable of handling a theoretical 65,000 transactions per second. This puts it far ahead of competitors like Ethereum, which only processes around 15 transactions per second.

Because of this, Solana is increasingly being favored for applications like gaming, DeFi, NFTs, and many other applications.

Solana even features some of the lowest transaction fees in the crypto space, with gas fees usually being around $0.01.

Finally, Solana is at the forefront of a growing ecosystem and now features some of the biggest projects like Raydium, Serum, and Orca in the defi category, and Magic Eden or Solanart among NFT marketplaces.

It is also a major player in the gaming/metaverse ecosystem with projects like Star Atlas and Aurory.

The Future of Solana and $SOL

Solana’s future looks promising, especially as it continues to expand. Several factors are currently contributing to its growth, including the calls for a Solana ETF market in the US.

More financial institutions are also jumping on the bandwagon and are exploring Solana’s use cases in traditional finance.

In addition, developers are working on improving the network’s stability, even at the time of writing.

Investors must understand that Solana presents both opportunities and risks, as any other investment class does.

However, with its current rate of growth, the network and its native cryptocurrency are poised to remain major players in the crypto space over the future.