Key Insights

- The crypto market crashed, with Bitcoin plunging below the $95,000 zone.

- This crash caused nearly $300 million in liquidations as more than 110,000 traders got kicked off the market.

- Some of the reasons for this crash include the possible tariff war between the US and others, the Milei/LIBRA scandal, tightening US FED policies, and so on.

- Analysts aren’t too optimistic about Bitcoin’s ability to hold the $95,000 zone.

- The performance of the market over the next few days remains to be seen.

The recent crypto market crash has dragged major cryptocurrencies into sharp daily declines.

Investors are now as concerned as ever, as bearish sentiment grips the market.

Let’s take a closer look at what has been driving the crash and what it could mean for the market in the future.

Bitcoin Falls Below Key Support Level

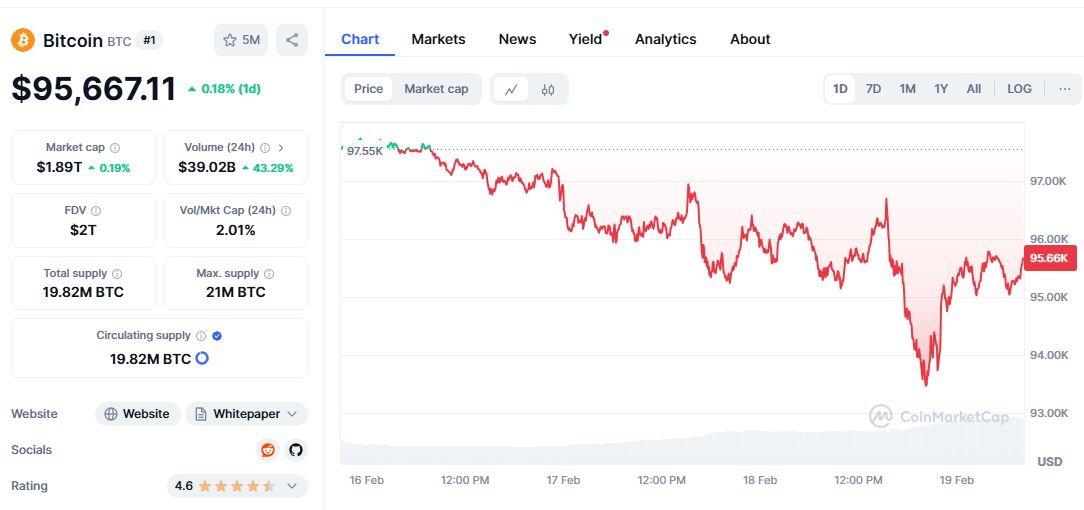

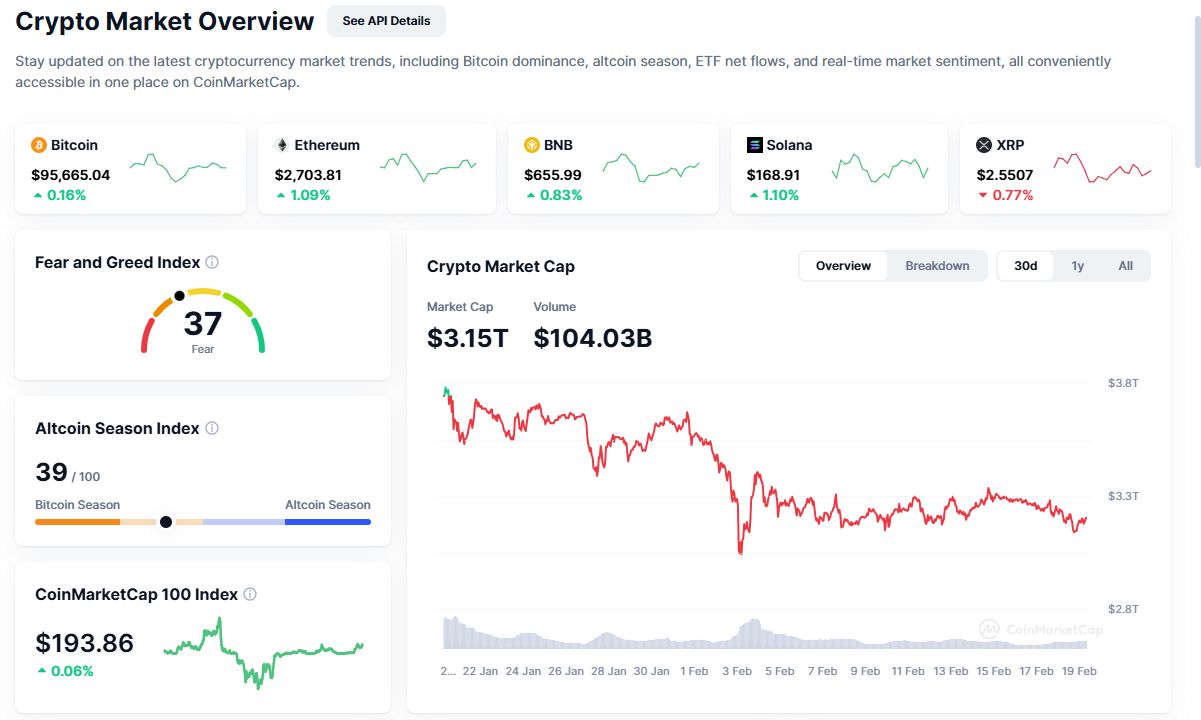

According to data from CoinMarketCap and TradingView, Bitcoin dropped below the crucial $95,000 support on Tuesday.

This breakdown caused a ripple effect that spread across the market and led to declines in other major cryptocurrencies.

The cryptocurrency is already attempting to break above this price level once again, but it still has some strong bearish pressure to overcome.

The general market sentiment has also turned slightly more bearish due to the decline in liquidity.

The crypto fear and greed index now sits at around 37/100, despite breaking above the 40/100 level sometime during the weekend.

Despite Bitcoin’s attempts to break above the $95,000 zone once again, analysts believe that the cryptocurrency could decline further and retest $90,000.

Interestingly, this decline is not happening in isolation. Broader economic concerns have contributed to the market’s instability, and here are some issues:

Macroeconomic Uncertainty Weighs on Crypto

One of the major factors behind this crypto market crash includes aspects of global macroeconomics.

For example, US President Donald Trump’s repeated threats to impose tariffs on countries like Canada, Mexico, and China have raised fears of a possible trade war on a global scale.

The announcement of “revenge tariffs” from these countries has contributed to the overall anxiety, and more investors continue to panic-sell risky assets like crypto.

At the same time, the US Federal Reserve continues to implement quantitative tightening policies on its interest rates.

Traders are now expecting only one interest rate cut this year as hopes for monetary easing continue to dwindle.

This lack of liquidity has been a major factor in the decline, making it hard for Bitcoin and the altcoins to maintain certain support levels.

Declining Capital Inflows and Liquidity Crunch

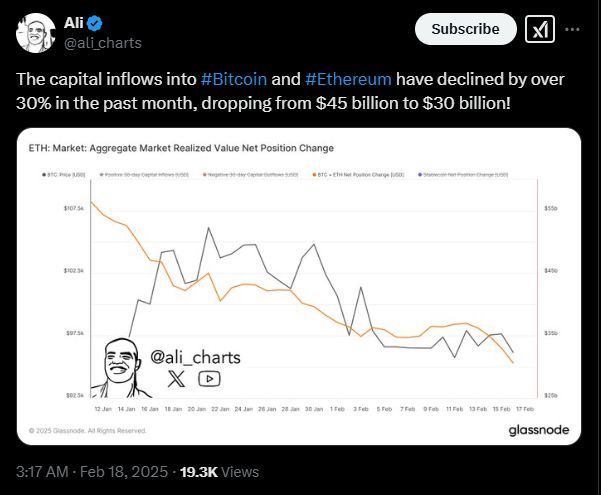

Beyond mere macroeconomics, the decline in capital inflows into the Bitcoin and Ethereum markets has also been instrumental to this crash.

According to crypto analyst Ali Martinez in a recent tweet, capital inflows into Bitcoin and Ethereum have crashed hard by over 30% in the last month.

More importantly, this figure has dropped from around $45 billion to $30 billion so far.

This reduction in liquidity has made it difficult for prices to sustain upward momentum.

Investors also appear to be cautious about pumping more money into the crypto market as fears of further decline continue to climb.

Many analysts believe that the market’s expectations of favorable crypto policies under Donald Trump are already priced in.

More importantly, the lack of follow-through on some of the promised crypto-friendly policies—like the Strategic Bitcoin Reserve initiative—has left many disappointed.

Solana and Memecoin Controversy Add to Market Fears

While all of this has been happening and Bitcoin and Ethereum are struggling because of macroeconomics, Solana is facing a fresh battle of its own.

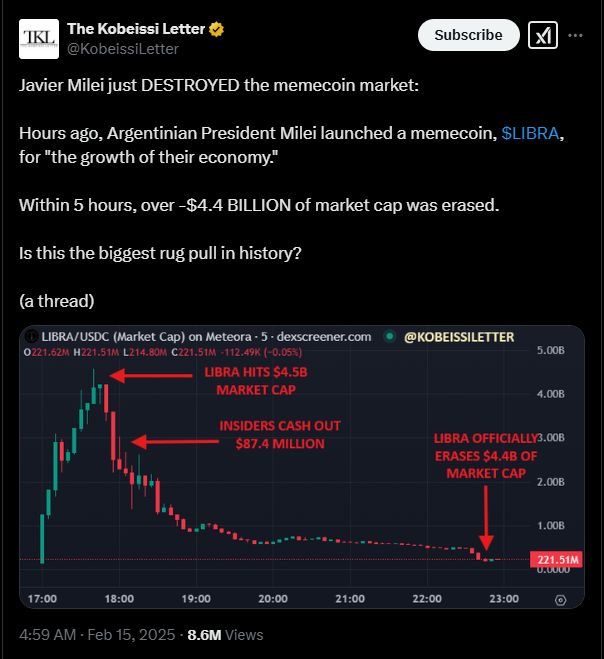

The memecoin hype suddenly hit a wall sometime this week with the LIBRA rug pull, which saw traders lose over $286 million.

The situation became even worse when Argentina’s President Javier Milei was found to have promoted the token on his social media.

This scandal not only caused a Solana price crash; it also brought back memories of similar incidents from other presidents like Donald Trump in the Official Trump ($TRUMP) saga.

Wider Market Liquidations and Sentiment Shift

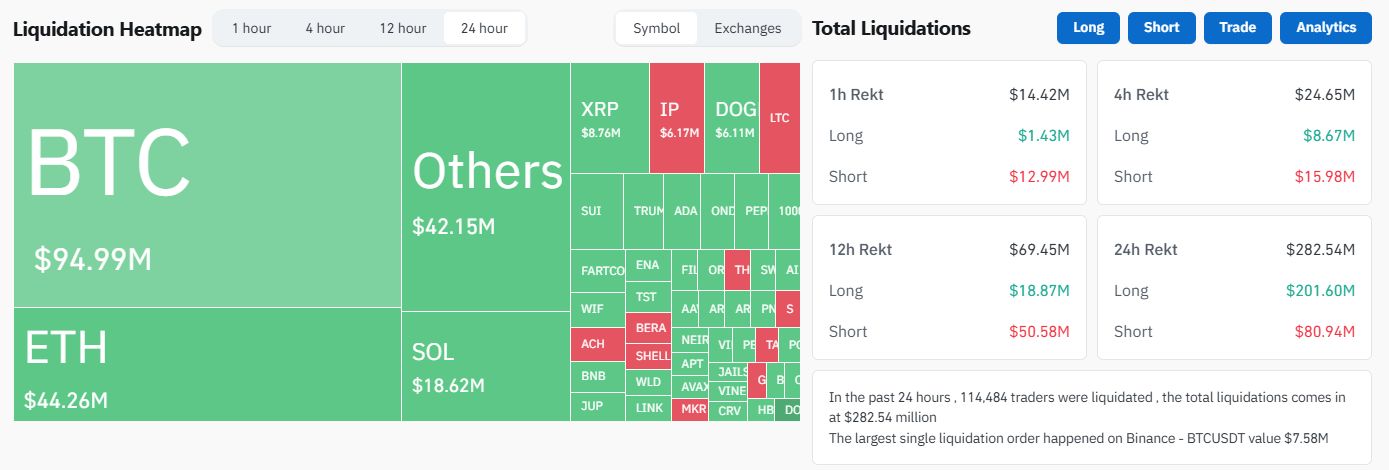

This downturn caused widespread liquidations across the market, according to data from Coinglass.

For example, data shows that more than 110,000 traders were kicked out of their positions worth nearly $300 million in the last 24 hours.

Interestingly, this trend affected the bulls mostly, with $200 million worth of liquidations (compared to $80 million from the bears).

The data also shows that the bulls were heavily positioned for a price move towards the upside—only to be caught off guard when the market did the opposite.

This is without mentioning the recent comments from JP Morgan about the incoming Tether Bitcoin sell-off.

Fears of Tether offloading its Bitcoin holdings to maintain the USDT peg created additional concerns that fueled the crash.

Altcoins Feeling the Heat

Solana, XRP, Dogecoin, and most of the other altcoins crashed hard alongside Bitcoin, with many major ones losing between 3% – 6% of their value.

The broader crypto market cap also lost around 3% of its value, just as Bitcoin hovers around the $95,000 zone.

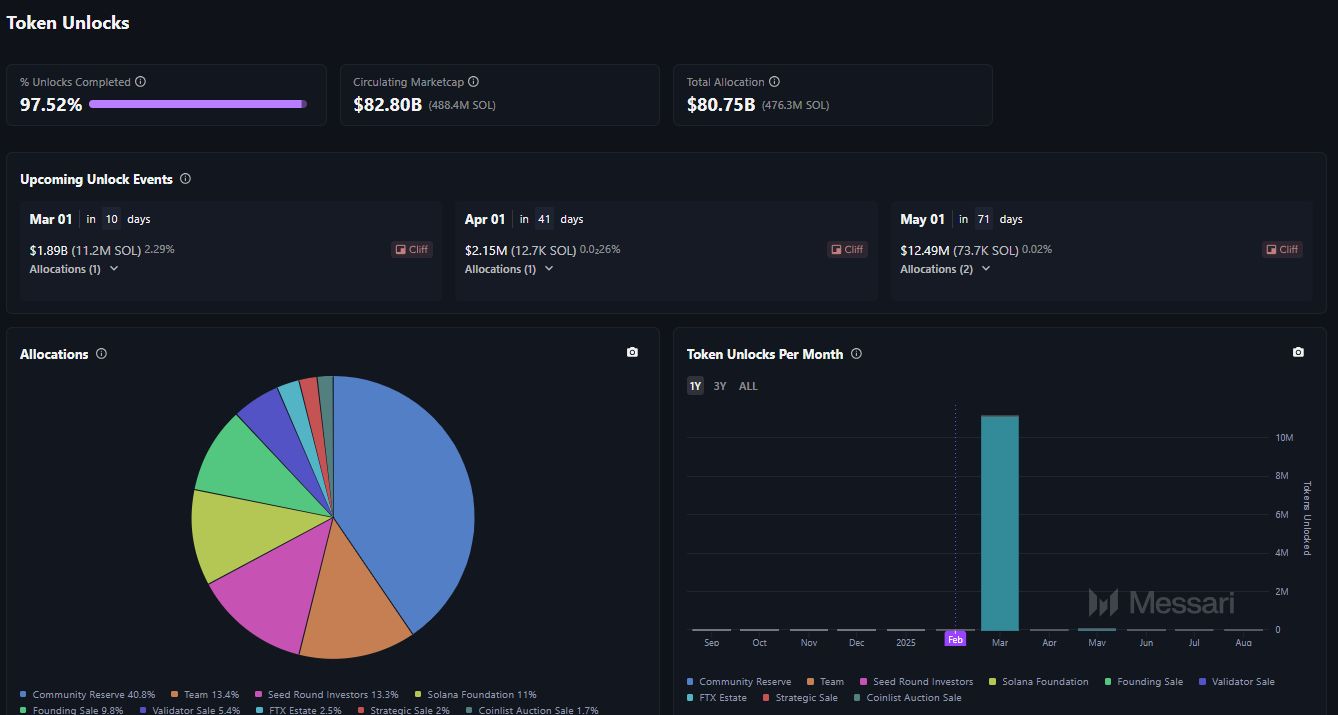

Aside from the issues with Milei and the LIBRA rug pull, Solana’s decline has also been made worse by the incoming token unlock in 12 days, which is set to release nearly 2% of its fully diluted value (worth nearly $2 billion).

Meanwhile, further on-chain data shows that Dogecoin and XRP might continue their downtrends along with several other altcoins.

Will Bitcoin Crash Again?

Bitcoin continues to test the $95,000 range repeatedly, increasing the chances of a break and close below this price level.

Historically speaking, when Bitcoin drops below certain support levels, it tends to trigger even harsher declines before recovering.

In addition, Bitcoin futures liquidations have reached a two-year high, which has affected long positions mostly.

Overall, the explanation for the ongoing crash is a combination of several factors, including economic uncertainty, declining liquidity, the meme coin scandal, growing investor fear, and many others.

While the market has crashed before, the ongoing downturn is especially concerning for many investors.

Bitcoin’s ability to reclaim the $95,000 zone will be important for its next move to the upside or otherwise.