Key Insights

- Staking is one of the most attractive ways to make passive income in the crypto space.

- The two best networks for this include Solana and Ethereum, both with their strengths.

- Stakers who prefer versatility and simplicity in comparison to security might consider staking directly on a centralized platform like Binance or Kraken.

- Other alternatives like Uniswap, Aave, and Curve Finance offer services that allow locking of funds in liquidity pools, similar to staking.

The crypto industry has grown by a great deal over the last few years.

However, amid all of this growth, staking remains one of the best ways to make passive income within the space.

So what is staking? What are some of the best chains for staking, and which platforms are the best to choose from?

Here’s an overview:

Proof of Stake and Its Appeal

Before jumping ahead to how to stake crypto and which platforms to choose from, we must first understand the core idea.

What exactly is staking?

To begin with, several blockchains have emerged over the years, most of which run on a consensus model called Proof of Stake (PoS).

This method of consensus allows token holders to actively participate in validating transactions and securing the network.

To do this, they only have to stake (or lock up) a certain amount of tokens within the network for a set period in exchange for rewards.

In essence, you simply lock your crypto for a while and have it increase in quantity over time.

Staking is so popular because it provides a great way for investors to earn interest on their crypto holdings without having to trade and risk their portfolios.

This stream of passive income is particularly appealing to long-term investors and can pull in massive returns if done right.

Best Staking Platforms You Should Know

Ethereum used to be a Proof of Work blockchain like Bitcoin. However, it shifted to a Proof of Stake mechanism with the 2022 merge.

Since then, Ethereum has become a leading PoS chain, with staking rewards now more accessible than ever.

This means that most of the best staking platforms on the market are likely built on the Ethereum network.

However, several more platforms have emerged over the years on other networks like Solana, Polkadot, Cardano, and others.

Some of the major platforms to stake crypto on include:

-

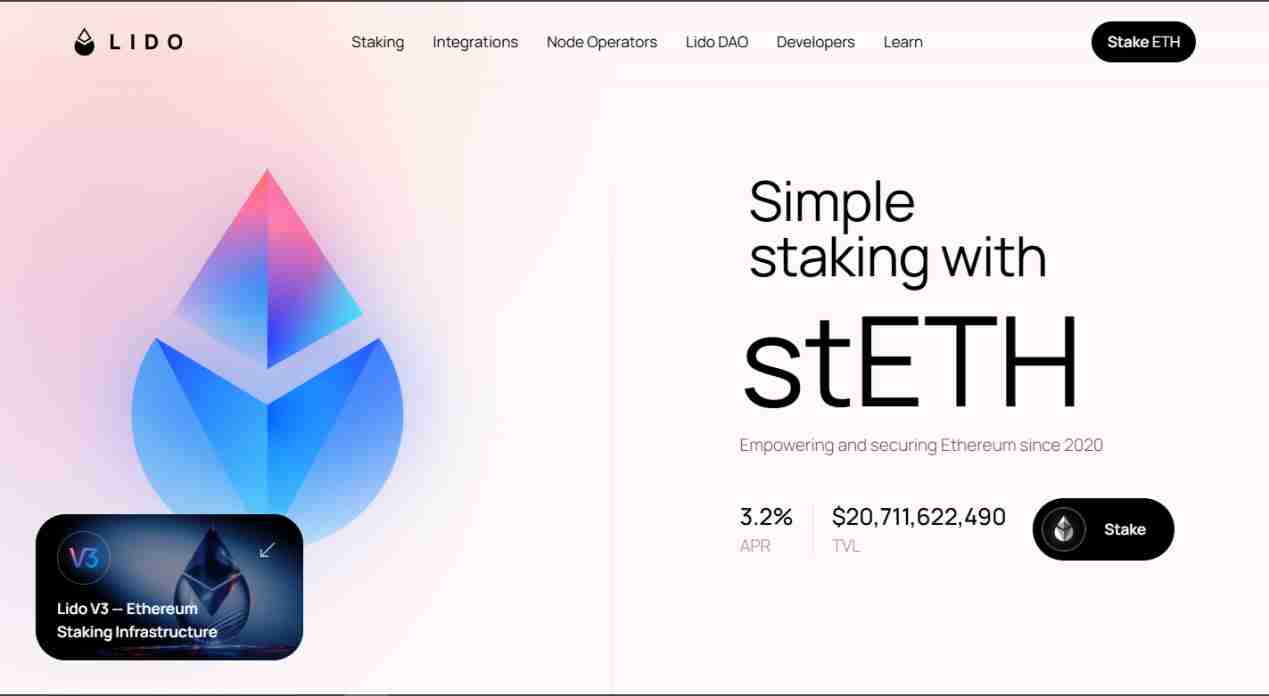

Lido Finance

This is one of the most popular liquid staking platforms on the Ethereum ecosystem and is great for any use case.

Users simply deposit their ETH onto Lido and receive stETH tokens in return.

These stETH tokens represent the user’s staked Ethereum and can be used in any defi application, like borrowing, lending, or even trading in certain cases.

This means that investors can have their ETH generate passive income while having a substitute to spend.

-

Rocket Pool

This service is similar to Lido, only that it allows users to run their own Ethereum validator nodes with a smaller ETH requirement.

Rocket Pool makes the whole staking process a lot more decentralized and empowers individual stakers a lot more than Lido does.

-

Coinbase/Kraken/Binance (General purpose staking)

Staking services can also be accessed on most centralized exchanges. The major advantage of this is that they are a lot more user-friendly than traditional solutions.

They handle the technical aspects of the staking journey, making it incredibly easy for even beginners.

However, centralized exchanges often have issues with custody. This means that investors should ensure that they trust the exchange with their funds before committing.

The best part about staking on a centralized service is that users can stake an even wider range of cryptos from Ethereum to Polkadot and even memecoins in some cases.

-

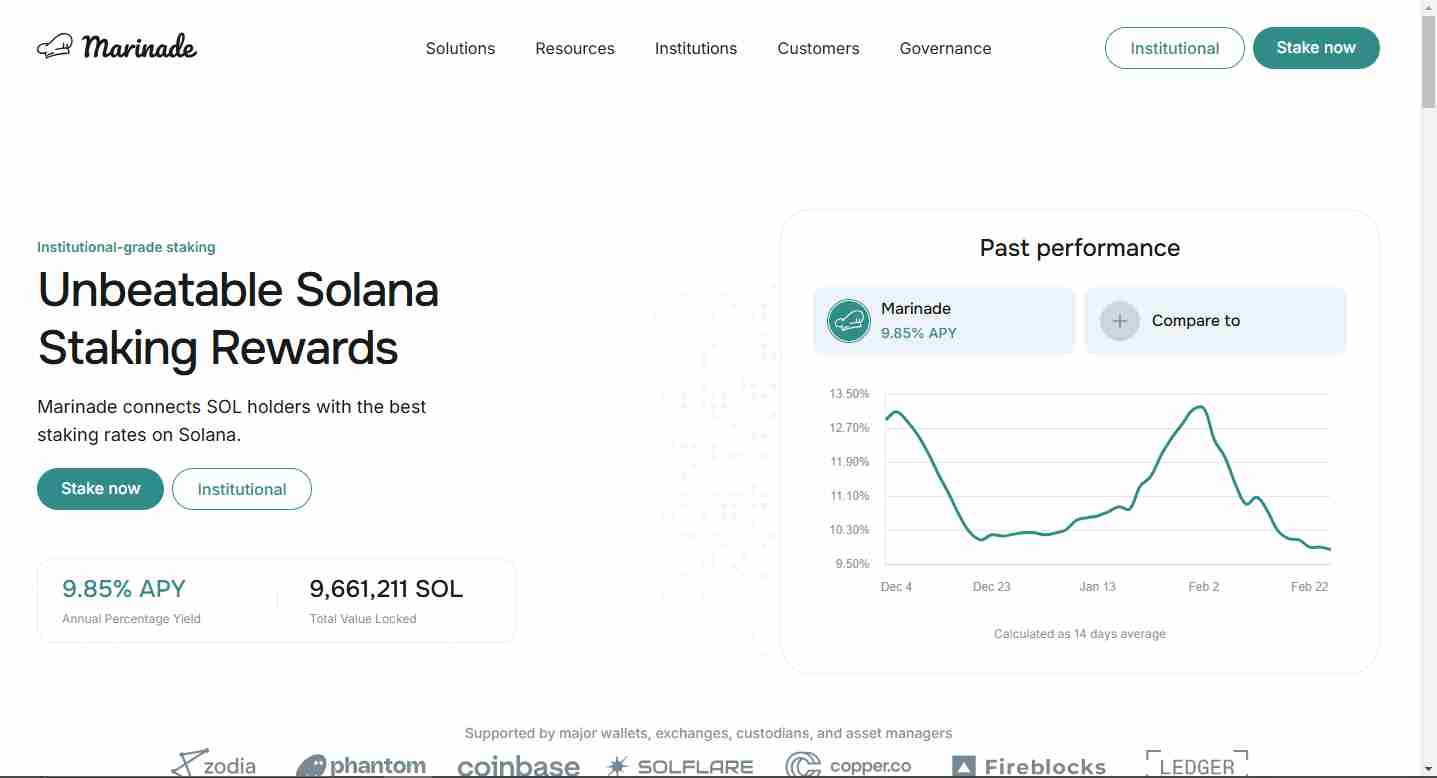

Marinade Finance (Solana)

This platform is a lot like Lido for Ethereum and is the leading liquid staking protocol on Solana.

Like Lido and its stETH offerings, it offers mSOL tokens to users, which represent their staked SOL.

This allows them to participate in DEFI while earning staking rewards.

-

Solflare Wallet (Solana)

The Solflare is a non-custodial wallet on the Solana network, much like Metamask.

This wallet allows users to stake their SOL directly within the wallet and therefore have full control over their own funds.

-

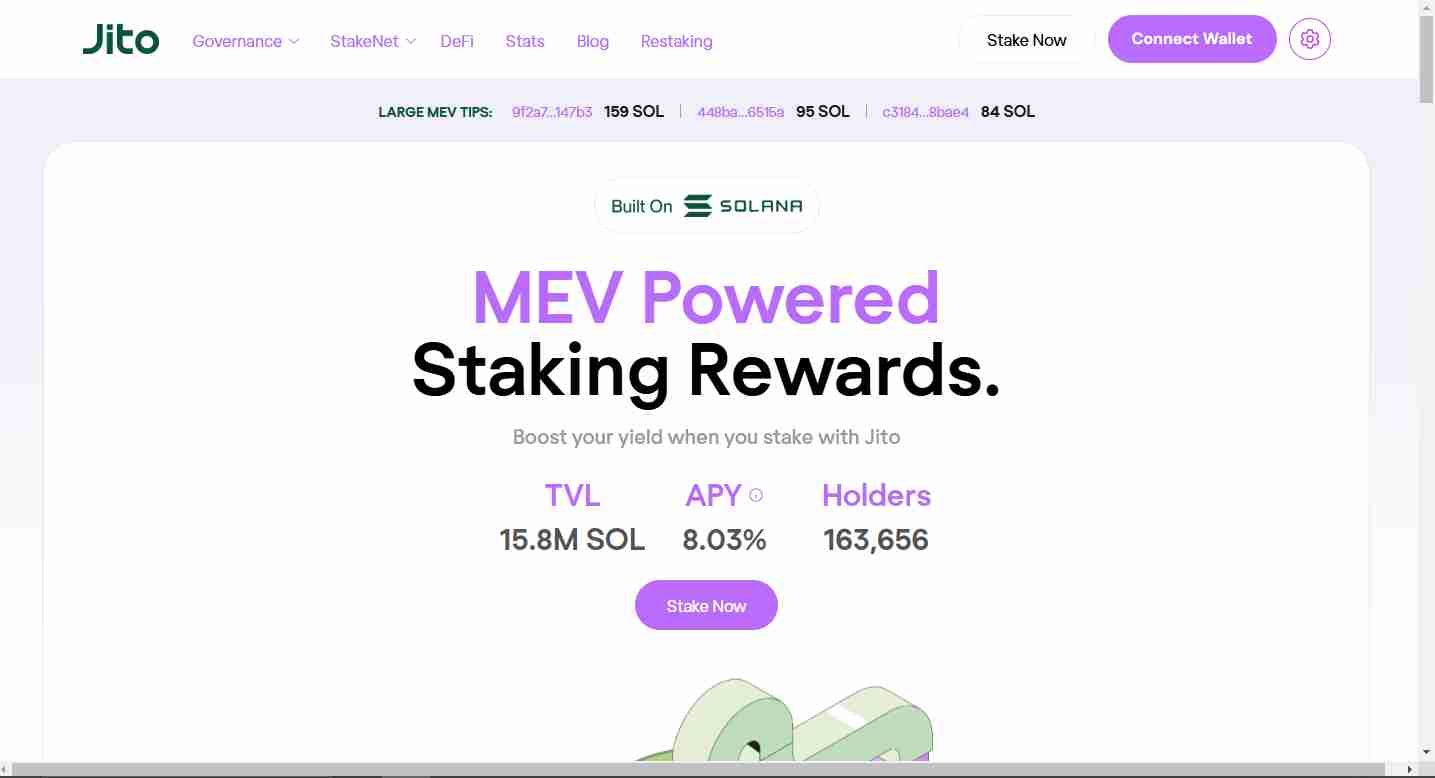

Jito (Solana)

This platform focuses on Solana liquid staking and is particular about increasing user rewards through MEV (Maximal Extractable Value) methods.

Jito can be great for investors who do not mind a little more complexity in exchange for more rewards.

Like Marinade Finance and Lido, Jito offers users the JitoSOL token, which performs the same function as stETH and mSOL.

-

Aave and Uniswap (Ethereum)

Aave is a lending and borrowing platform at its base, while Uniswap is a decentralized exchange.

However, both of these platforms also offer opportunities for users to earn staking yields by supplying assets to their liquidity pools.

While locking up funds in the Uniswap or Aave protocol isn’t “staking” in every sense of the word, it provides a mechanism that is highly similar, rewards and all.

-

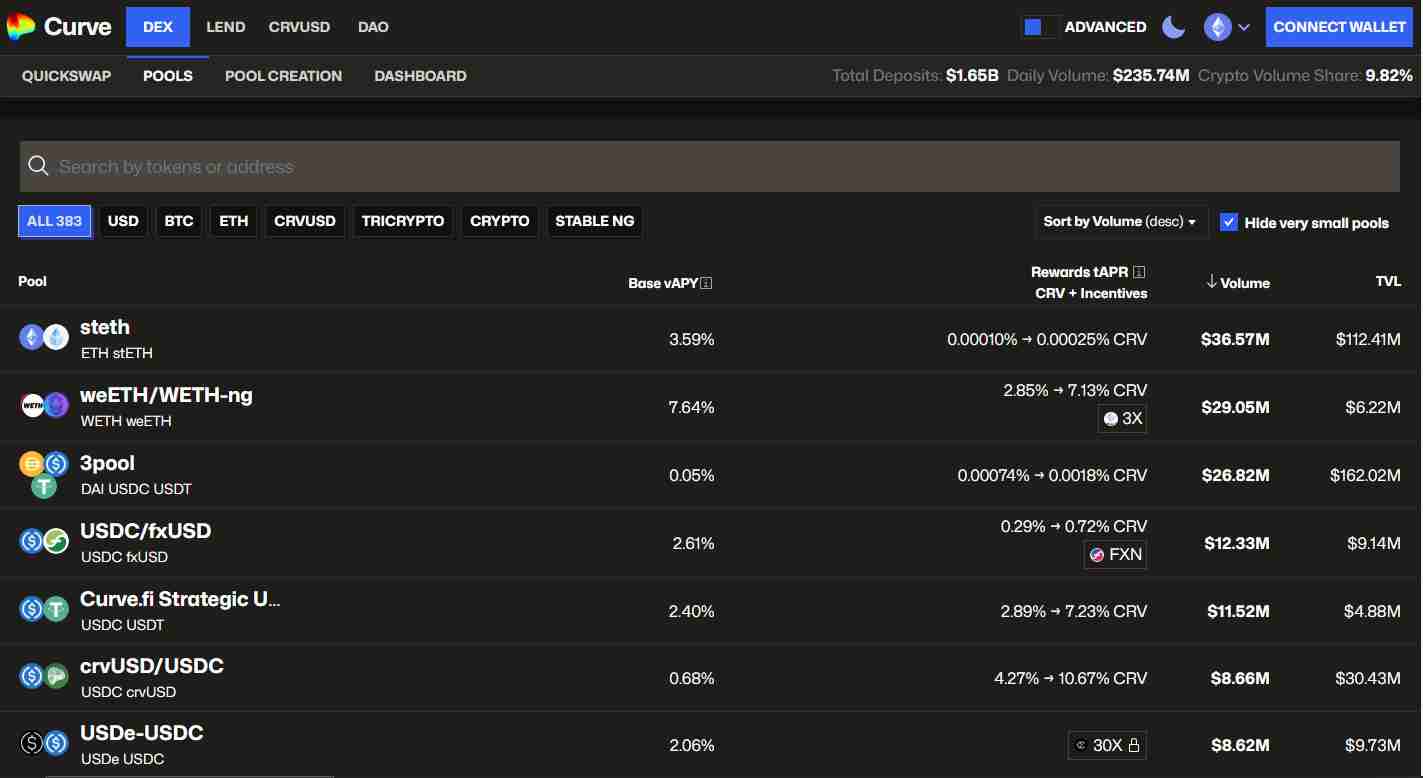

Curve Finance (Ethereum, Polygon, Celo and TON)

This platform specializes in stablecoin liquidity pools and offers some of the lowest-risk yield opportunities.

While Curve Finance is similar to Uniswap or Aave and isn’t directly a staking platform, it is a welcoming substitute for users who wish to lock up their funds in exchange for rewards.

Curve Finance also has the advantage of being open to more blockchains than staking platforms like Lido and Marinade Finance.

This means that users can stake more cryptocurrencies for the same level of rewards.

Which Chains Should You Stake On?

Considering the length of the list, the best chains to stake on are apparent.

Ethereum and Solana have dominated the defi landscape for years, with DefiLlama data showing that Ethereum controls about 56% of all defi TVL and Solana controls less than 30% of the rest.

However, which one is the best for staking your crypto?

The go-to strategy for staking for investors who prefer versatility is to stake on a centralized exchange.

However, for decentralized, chain-specific platforms, Ethereum is considered to be far more secure than Solana, considering how it is more mature and battle-tested.

Solana has achieved massive success so far but is still developing compared to Ethereum.

Ultimately, Ethereum is far more decentralized than Solana but is arguably slower in terms of transaction processing.

At the end of the day, the best staking platform for you depends on your needs and risk tolerance.