Key Takeaways

- Cardano was down by around 30% over the last week, and is now registering a 15% price increase over the last week.

- Cardano currently trades at around $0.8 and could be in for another rally to the $1 price level.

- If a breakout from this price level occurs, Cardano could be ready for a revisit of its $3 ATH.

- Technical and on-chain indicators support a bullish future for Cardano as far as predictions go.

- Expected targets for ADA range anywhere from $3 to $20 in the medium to long terms.

Cardano has been on the radar of many investors so far, especially with its impressive rally over the last day.

Data from CoinMarketCap shows that the cryptocurrency is up by more than 15% over the last week.

This momentum appears to be continuing into the new week, with metrics and technical indicators showing that ADA is ready for a new upsurge.

Here’s a breakdown of what’s been going on, and which factors are driving this growth.

Bullish Momentum Builds for Cardano

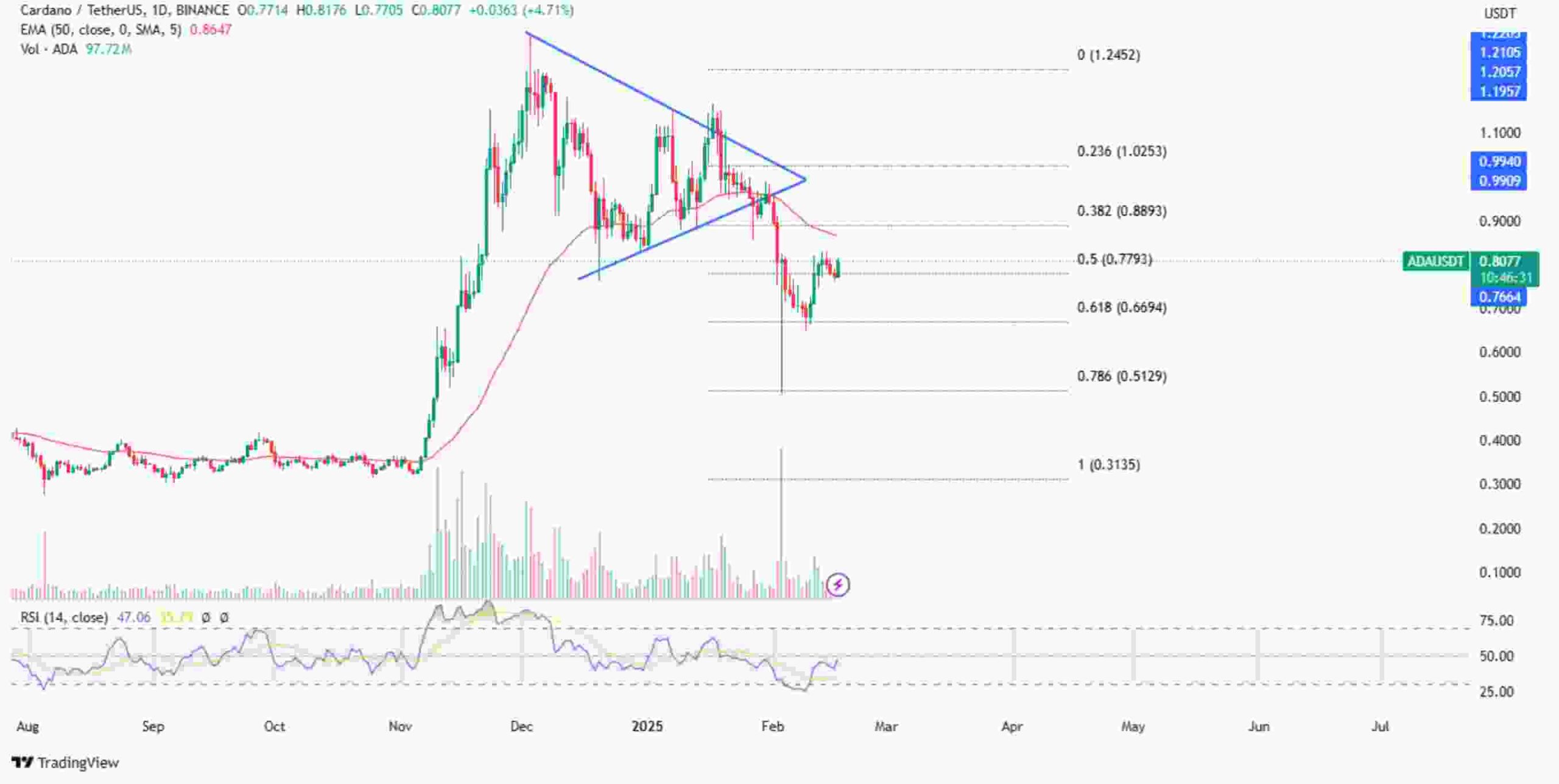

Starting from the charts, TradingView data shows that Cardano found support somewhere around the 61.8% Fibonacci retracement level, as shown below:

This support helped the cryptocurrency t climb by more than 10% over the last two weeks, as it reclained the weekly resistance around $0.779 (which happens to be the 50% Fibonacci retracement level).

Keep in mind that this resistance that Cardano has successfully reclaimed was important for holding the cryptocurrency all through November until its breakdown on 3 February.

Cardano appears to have successfully reversed for a retest of this price level, and is looking towards a rebound .

The cryptocurrency has a current price of $0.8. This means that if this $0.779 – $0.74 support holds, Cardano could be looking towards extending its rally to the next weekly support around the $1 mark.

This price level serves as one of the cryptocurrency’s most important psychological resistances, and looks to be fully in view.

Investors must note though, that the status of the $1 mark as a psychological resistance, means that the bears are laying in wait around this price level and could cause a price rejection.

If this rejection does not occur, however, Cardano could continue further up to $1.24.

Long-to-Short Ratio Signals Positive Sentiment

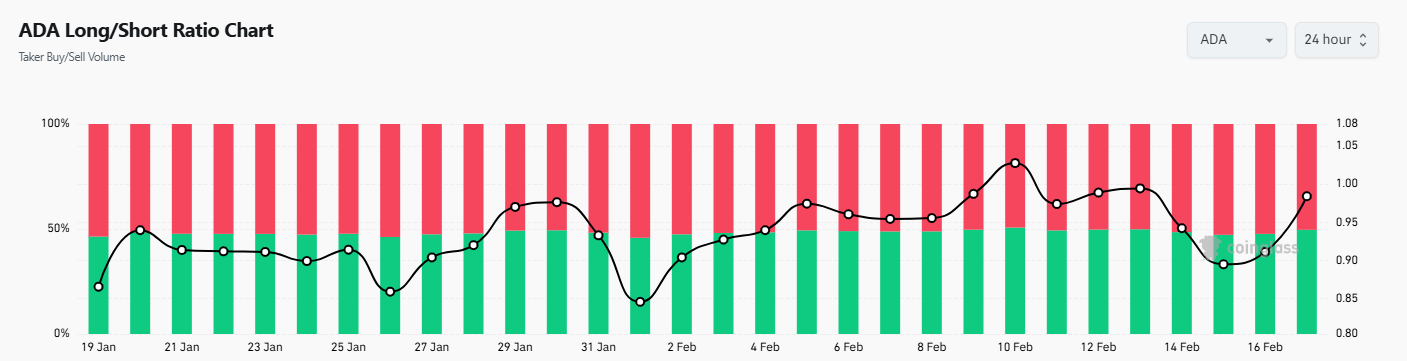

One of the major indicators in support of Cardano’s price movement is the long-short ratio according to Coinglass.

Data shows that the cryptocurrency’s ratio currently sits at around 1.09, which is its second highest in over a month.

The ratio currently shows that the bulls outnumber the bears. In essence, more traders are betting on ADA’s continued price increase.

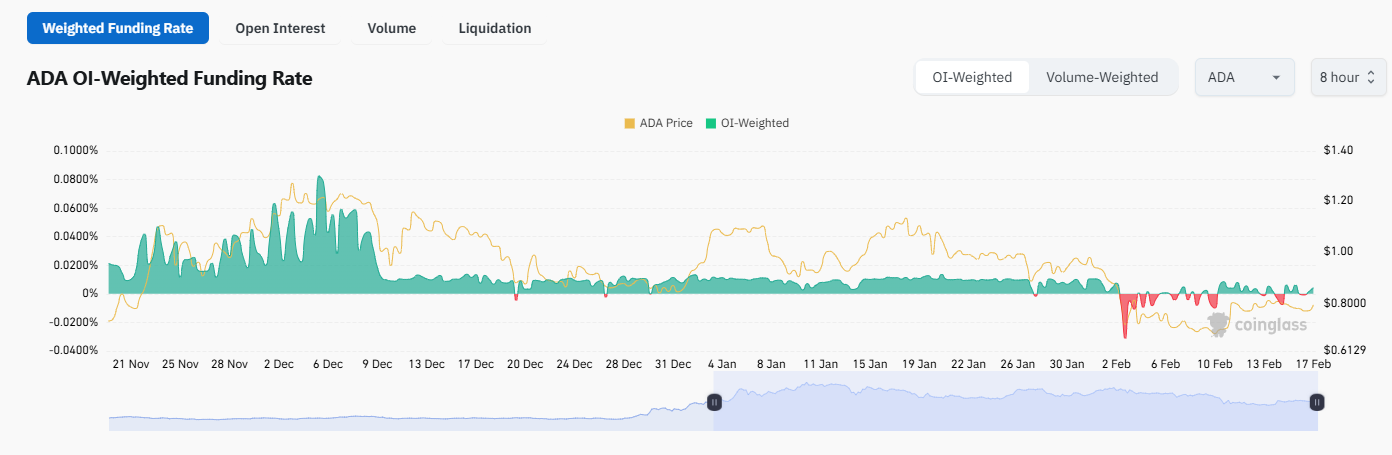

Another major supporting factor for this trend Is Cardano’s OI-Weighted Funding Rate data.

This metric shows a current shift from the bearish -0.0007% on Sunday to 0.0016% on Monday.

It also further reflects the outlook that more bulls are taking advantage of the situation and are kicking the bears out.

The funding rates are nowhere near what they used to be in December of last year. However, they are still bullish, considering the long phase of bearishness in the first two weeks of February.

Analysts Predict ADA’s Surge to $20

Analysts are also incredibly bullish on Cardano’s price. Some of them have predicted price rallies to $3, $5, $10 and even $20 in some cases.

These analysts believe that a series of developments could contribute to this price increase including the possible ETF approvals, and the news of an incoming partnership with Microsoft.

Grayscale recently filed for a Cardano ETF with the NYSE amid excitement from investors.

If this ETF is approved, it could allow traditional investors to gain exposure to ADA and create demand for the cryptocurrency.

Cardano Founder Charles Hoskinson didn’t disclose any details about the strategic alliance with Microsoft in the YouTube live session on 10 February.

However, the possibility of the ETFs happening, as well as the collaboration with MicroSoft has become one of the key drivers of optimism in the community.

This is without mentioning Hoskinson’s role as an adviser on crypto to the Trump administration

Can Cardano Hit $20?

Cardano currently trades underneath the $1 mark. However, analysts are confident that a bullish comeback is underway.

A breakout above $1 (as mentioned earlier) could lead Cardano upwards to retest its previous all time high of $3.

Analysts like Nala have called Cardano highly “undervalued” on several occasions, predicting a $3 price tag soon.

Others like Sssebi have even loftier predictions of Cardano rallying by more than 2,000% to the $20 mark.

This prediction is based on several factors including the incoming Cardano-Bitcoin merger as a Defi layer, Hoskinson’s position as a Trump advisor, the possibility of an ETF soon, and so much more.

It should be noted that if Cardano were to hit this price level of around $20 between press time and 2030, it would shoot its market cap up from a mere $12 billion to a staggering $704 billion.

Considering the current state of the market, it is sensible to assume that while such a price target is achievable, it should be considered as more of a long-term tag.

In the short to medium terms though, despite Cardano’s price decline of 30% over the last month, it appears to be making a comeback.

Several analysts are optimistic about the cryptocurrency;’s future as more and more investors jump on the bullish bandwagon.