Key Insights

- The crypto market is in the middle of a small-scale recovery, with many major altcoins experiencing gains.

- Bitcoin has managed to maintain its standing above the $80,000 zone.

- Some possible reasons for the upsurge might be possible legislative changes or any other combination of factors.

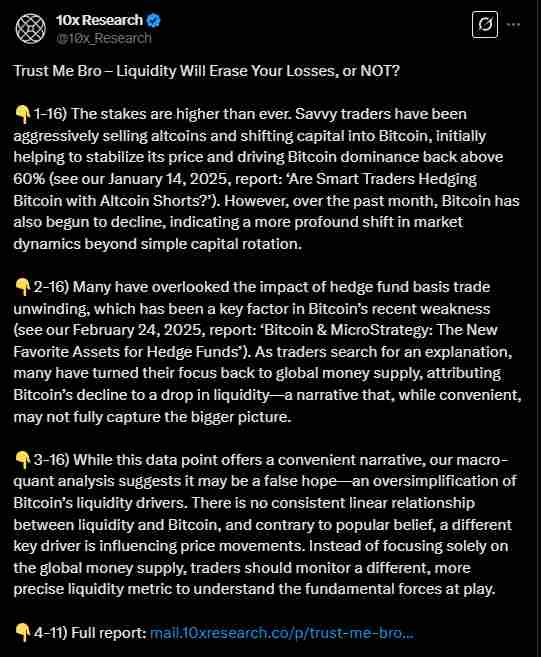

- A recent report from 10x Research shows that the current market environment bears striking similarities to the end of the previous crypto bull run.

- For a recovery to occur, Bitcoin needs “a new narrative.”.=

The crypto market is finally showing signs of a recovery after starting the week on a rough note.

Bitcoin, XRP, Solana, and many other major altcoins have all rebounded after the massive losses driven by the macroeconomic concerns between the US, China, Mexico, and Canada.

However, while the market is bouncing back, how certain is the road to new highs?

Bitcoin Leads the Rebound

The flagship cryptocurrency, Bitcoin, has climbed by nearly 2% over the last 24 hours.

Said cryptocurrency now trades at around $82,617 with greens across other altcoins like Ethereum, Solana, Cardano, and others.

This marks a major step-up from the brutal crash on Monday, where Bitcoin dipped below the $78,000 zone.

Interestingly, the loss was triggered in the first place by the fears of a possible US recession and the possible trade war between the US, Canada, Mexico, and China.

While the ongoing recovery is a relief, Bitcoin is still down by around 24% from its $109,000 peak from January.

Altcoins Follow Suit—XRP and Solana See Gains

Bitcoin’s recovery has extended to the rest of the market, with XRP being up by over 6% over the last 24 hours.

The same is true for Solana, which now sits above the $127 price level.

Most of the top cryptocurrencies on the market have experienced gains as well, despite being in the low single digits.

In general, the total crypto market is up by more than 2% over the past day, in a show of renewed investor confidence.

What’s Driving the Crypto Market Rebound?

The reasons behind the ongoing market recovery aren’t very clear, even for many analysts.

Some possible reasons for the upsurge might have been due to possible legislative changes with Senator Cynthia Lummis’ GENIUS Act and the US’ crypto reserve, the $21 billion initiative by Strategy, and any other combination of factors.

In addition, the traditional markets have also stabilized, with stocks like the S&P 500, Nasdaq, and Dow Jones all recovering from deeper losses from earlier in the week.

In total, the sentiment across the stock and crypto markets appears to be recovering strongly.

Macroeconomic Uncertainty and Its Effects

An interesting aspect of the downturn is how cryptocurrencies have been trading in tandem with US tech stocks.

This has made them highly sensitive to broader macroeconomics, the tariff announcements from Trump, and so on.

In particular, the Trump administration’s shifting stance on tariffs has fueled concerns about an incoming trade war.

A recent report from 10x Research even shows that the current market environment bears striking similarities to the end of the previous crypto bull run.

As it stands, factors like the rising interest rates, geopolitical tensions, and fading enthusiasm for key crypto narratives have been instrumental to the ongoing downturn.

Memecoin Frenzy Fizzles Out

Another factor that has caused the market instability so far has been the collapse of the memecoin craze.

As it stands, major tokens that once drove retail enthusiasm have been bleeding value.

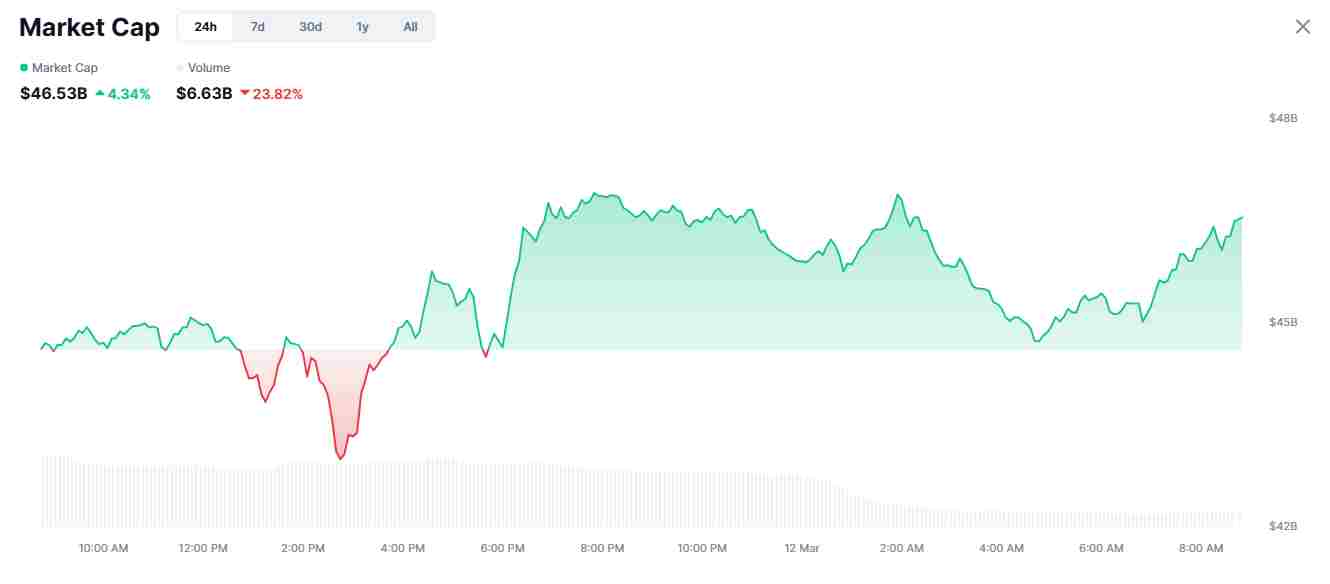

The entire sector is down by more than 50% over the last month, with a capitalization of $46.53 billion—down from a high of over $100 billion.

Dogecoin itself has collapsed by around 33% over the last month alone and has deleted most of the gains it accumulated after President Trump’s election victory last November.

This trend has also held up in the Solana memecoin scene, especially with projects launched on Pump.fun.

10x research weighed in on this fact, noting that the memecoin platform facilitated 8.4 million memecoin launches over the past year.

Interestingly, its activity peaked right after Trump’s inauguration before experiencing a massive decline in launches from 62,000 to 24,000.

The enthusiasm continued when Argentina’s President Javier Milei endorsed the LIBRA token.

However, soon after the failure of this project, daily fees on the platform have since plummeted from January’s highs of $15.5 million.

Bitcoin’s Next Moves—A Drop to $70K or a New Narrative?

Bitcoin’s short-term recovery is encouraging.

However, analysts are still cautious about its price movements. 10x Research analysts, for example, cited the ongoing “fade” of speculative hype and macroeconomic headwinds as reasons why more downside might follow.

Recall that BitMEX co-founder Arthur Hayes also recently warned, sometime in January, that BTC could fall closer to $70,000 before finding a stable floor.

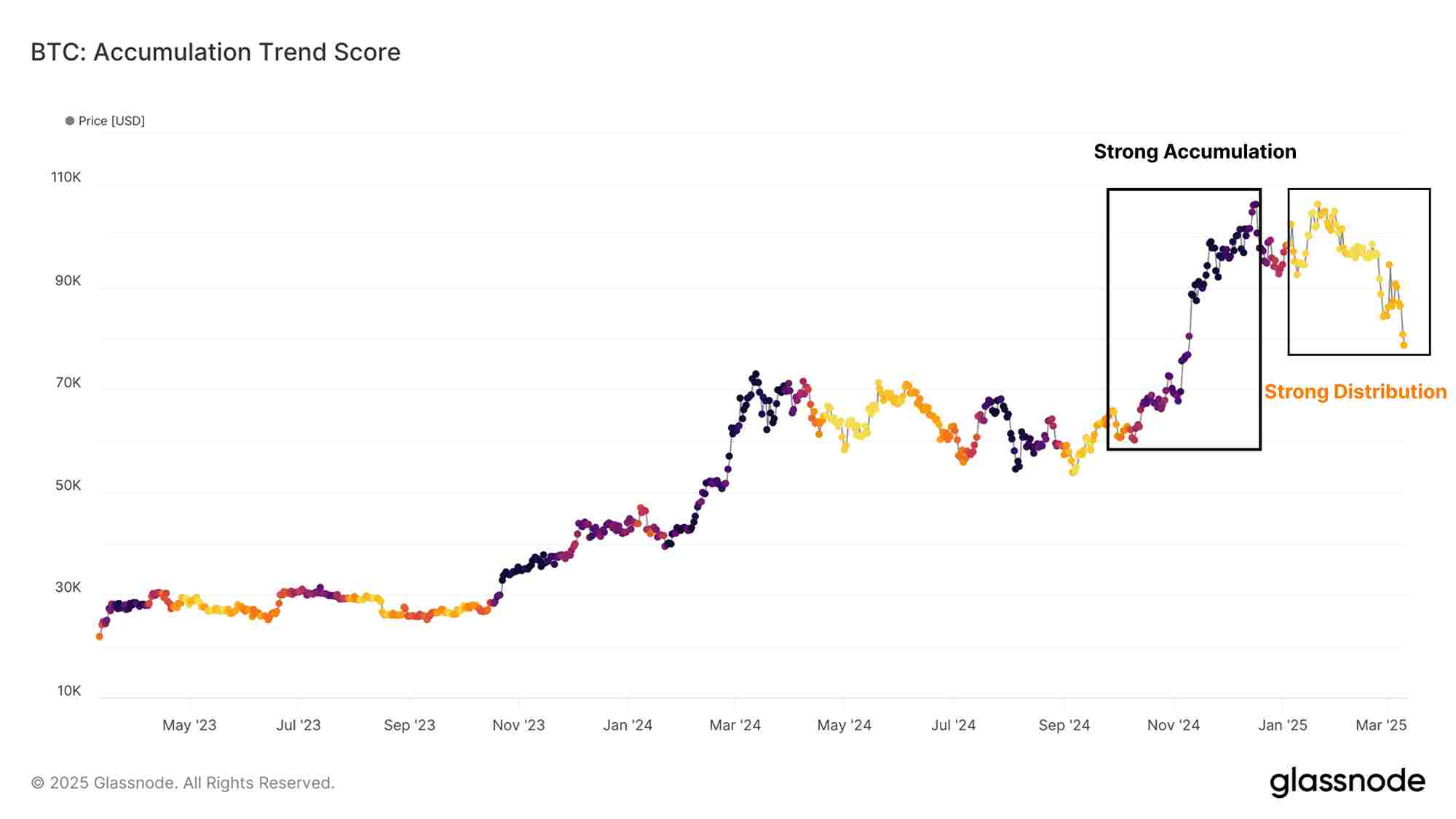

On-chain analytics from Glassnode also shows that most of the panic sellers are high-entry buyers.

These investors bought near the January peak, expecting Bitcoin to continue further upwards.

Glassnode describes the ongoing price decline as a “moderate capitulation event,” where many short-term holders are realizing losses.

Put simply, for Bitcoin to resume its uptrend, market sentiment will likely need a fresh catalyst.

10x Research believes that “If history is any guide, the next major up move will require a new narrative.”

A Market at a Crossroads

The crypto market’s current recovery offers investors a small glimmer of hope. However, the uncertainty remains real.

While short-term traders are taking advantage of the bounce between Tuesday and Wednesday, long-term investors continue to watch key support levels.

Will Bitcoin reclaim its all-time highs, or are further declines ahead?