Key Takeaways

- The crypto market has seen a spectacular comeback lately, with Bitcoin revisiting the $93,000 zone.

- This move came amid a major announcement from US president Donald Trump, about a strategic Bitcoin reserve.

- Bitcoin surged by nearly 10%, with Ethereum following suit and Solana/Cardano emerging as the best performers.

- The move also cost traders nearly $1 billion in liquidations, with one trader losing $15 million on Binance.

- The future of this reserve asset plan remains to be seen, as Bitcoin aims for a new higher high.

The crypto market experienced a massive surge in prices o Monday this week, especially as Bitcoin revisited the $93,000 zone.

This move was particularly impressive, considering how the cryptocurrency traded at around $78,000 less than a week prior.

The upswing in prices came amid an announcement from US president Donald Trump, about establishing a national strategic crypto reserve.

This stockpile is expected to include cryptocurrencies like Bitcoin, Ethereum, XRP, Solana and Cardano.

Here’s how the market has performed lately, and how it is fueling a great deal of speculation.

Trump’s Crypto Pivot

Trump was a well known crypto critic from the onset. Back in 2021 in a now-famous tweet, he referred to Bitcoin as a “scam” whose value was “based on thin air”.

However, his recent actions show that there has been a major turnaround.

The president made the strategic reserve announcement via Truth Social, announcing that his administration is actively working on the plan.

This reserve plan is expected to include major cryptocurrencues aside the big two, incliding XRP, SOL, and ADA.

He later confirmed that Bitcoin and Ethereum would be central to the plan, saying “I also love Bitcoin and Ethereum!”

The announcement sparked enthusiasm across the market, with investors interpreting the move as a major sign of growth under the Trump administration.

Bitcoin’s Rise To $93K and Climbing

Before the Trump announcement, Bitcoin had been struggling to maintain momentum, especially after the February crash where it dipped to as low as $78,000.

However within hours of the news breaking, the cryptocurrency shot up by a staggering 17% to a fresh new high of $93,000 as of Monday.

According to market analyst Michaël van de Poppe, the ongoing rally is “the final easy cycle.”

In essence, Bitcoin’s recent dump might have hit its bottom, and the next bullish wave may have just begun.

Ethereum was right on Bitcoin’s heels, and climbed as high as 10% to a new high around $2,450.

XRP came next with a 31% price surge, while other altcoins in the proposed reserve like Solana and Cardano saw 15% and 69% gains respectively.

Bearish Traders See Mass Liquidations

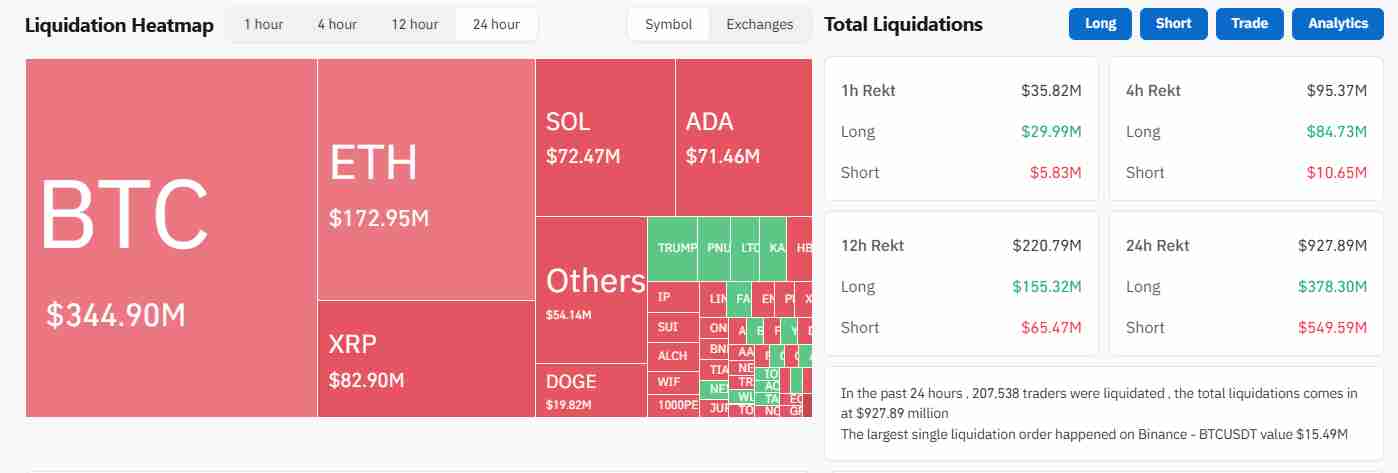

According to insights from Coinglass, nearly $1 billion worth of positions got liquidated over the last 24hours between Sunday and Monday.

Expectedly, most of these positions were held by the bears, who lost around $550 million across the board.

Bitcoin bears alone, lost around $344 million, with Ethereum traders coming in at around $172 million.

Most of these liquidations came from investors betting on further price decline from Bitcoin’s $78,000 low, with a single trader losing as high as $15 million on Binance.

XRP Beats Ethereum in Fully Diluted Valuation

Another interesting aspect of this new “Trump Pump” was with XRP.

This cryptocurrency briefly broke above Ethereum in terms of fully diluted valuation (FDV) according to insights from LookOnChain.

Keep in mind that this metric calculates a cryptocurrency’s total value if all tokens were in circulation.

This has sparked fresh optimism about more institutional adoption with XRP, and how a fresh inflow of capital could help the cryptocurrency to become more of an Ethereum challenger in terms of market cap.

What To Expect From The White House Crypto Summit

Another major factor in the ongoing anticipation is Donald Trump’s hosting of the first-ever White House Crypto Summit this Friday.

Investors and industry leaders are more than eager for details on how the crypto reserve will be put in place.

There are still many questions about whether this initiative requires congressional approval. Donald Trump will also be expected to answer questions about whether this reserve will contain only government-seized cryptocurrencies, or whether it will be funded by taxpayer dollars.

Despite the price surge, however, there has been widespread speculation across the crypto market as expected.

Some analysts like IG’s Tony Sycamore according to Reuters, have warned that if the reserve consists of seized crypto assets rather than new government purchases, the impact might be more hype than substance.

Moreover, there are no clear indications about whether this administration will introduce clearer crypt o regulations, or whether the “federal reserve” move is mostly symbolic.

Overall, this shift in the US’ crypto policy has been the source of much optimism within the market.

Bitcoin has so far recovered from its February losses, where it lost as much as 20% in three days.

Interestingly, despite the February dip being the harshest the cryptocurrency has seen since 2022, investors are now speculating about whether a new all time high is inbound.

A New Era for Crypto?

Donald Trump’s embrace of the crypto sector has strongly changed the narrative around crypto in the US.

While the details of the crypto strategic reserve are still mostly unclear, the mere announcement has helped to push Bitcoin back towards its previous highs.

The White House Crypto Summit is approaching, with traders and investors alike now watching closely for further developments that could shed further light on the industry’s future.

Will this be the ultimate catalyst for the final phase of the bitcoin bull run? Is a new all time high inbound, and will new regulatory clarity follow?

Most of these questions are bound to be answered soon, come Friday.