Key Insights

- Traders have always found some of the best ways to take advantage of the market’s inefficiencies.

- Crypto sniping is one of the most popular ways this is done.

- This method of trading typically scans the market for arbitrage opportunities, new launches, and more.

- Crypto sniping bots can perform trades in milliseconds, faster than any trader can react.

- This form of trading comes with its fair share of issues, including liquidity, ethics, volatility, and market instability.

The crypto market is highly volatile and can have a few “holes” here and there.

Over the years, investors have found ways to exploit these holes, taking advantage of them for a chance to make a profit.

One of the ways they have done this is via a method known as “crypto sniping.”.

Crypto Sniping is a high-speed strategy in which traders attempt to take advantage of newly launched tokens.

They typically use automated bots to place buy or sell orders within milliseconds.

This way, they can be in and out of the market with newly-cashed profits before anyone can say “crypto.”.

Here is everything to know about this strategy, its risks, and what makes it so popular.

What is Crypto Sniping?

The basic idea behind crypto sniping is the use of bots.

Think of it as a deployed robot that constantly scans the market and rapidly buys or sells certain cryptos when certain conditions are met.

These bots are designed to monitor blockchain activity in a space known as the “mempool.”.

The mempool is simply a waiting area—a place where unconfirmed orders go to wait their turn.

These bots use the size of the mempool and other on-chain indicators to identify profit opportunities faster than any human trader.

One of the biggest areas where these bots are used is in defi ecosystems, where new tokens are launched everyday.

Snipers act quickly and can monitor the mempool, find price differences between several platforms for arbitrage opportunities and so much more.

How Does Crypto Sniping Work?

Crypto sniping typically follows three key steps, as outlined below:

1. Monitoring

The sniper bots constantly scan the blockchain for any indicators. Some of the things they look for include new token launches, sudden liquidity injections, price discrepancies across different platforms, and so on.

2. Analysis

Once these bots find an indicator, they assess them based on how profitable they might be and whether they meet certain criteria.

This is done within milliseconds, considering how quickly opportunities appear and vanish.

3. Execution

If an opportunity meets the criteria, the bots immediately execute (or snipe) the trade.

This allows the bot owner to take advantage of the market’s conditions faster than any human trader can realize or react.

Popular Crypto Sniping Strategies

There are several ways to execute trades using a sniper bot. Some of these target several aspects of trading, including:

1. Token Launch Sniping

This is the most popular way to use a sniping bot. Snipers typically target newly launched tokens in a bid to buy them as soon as they are listed on any DEX.

This allows traders to capitalize on the pump that often follows new launches.

2. Liquidity Sniping

Sniping bots also wait sometimes for massive liquidity injections into a certain trading pair.

For example, a sniping bot monitoring the ETH/USDT pair on Uniswap might watch out for massive inflows and capitalize on the resulting pump before the price stabilizes again.

3. Arbitrage Sniping

This kind of sniping bot typically scans through several platforms to find small price differences between the same asset.

An arbitrage sniping bot might buy Ethereum for $2,550 on one platform and sell again for $2,600 on another.

This allows them to make profits from price gaps before the opportunities disappear.

4. Cross-Chain Sniping

This kind of sniping bot combines aspects of other classes. Instead of monitoring one chain and one platform, they monitor multiple blockchain networks at the same time to find price differences or liquidity events.

This class of bots can be more sophisticated than the rest but are more effective at finding opportunities.

5. MEV (Maximal Extractable Value) Sniping

MEV sniping is slightly more advanced than even the cross-chain sniping class.

They typically work by reordering transactions within a block to gain an advantage.

They are more popular on Ethereum and other ERC-compatible networks where ordering transactions can affect prices significantly.

How Does Crypto Sniping Affect The Market?

Crypto sniping can have some strong effects on the market on both positive and negative fronts. Some of the positive impacts include enhanced liquidity.

Rapid trading activity can help to boost liquidity and even make it easier for regular traders to enter or exit positions. Sniping can also correct price discrepancies across platforms and lead to more accurate prices overall.

On the other hand, sniping bots can have some harsh consequences for the market. For example, sniping with high volumes can cause sudden price fluctuations and make the market unstable.

Advanced bots also give snipers an unfair advantage over regular traders and can raise concerns about market fairness.

Small retail investors will also miss out on opportunities more often, due to the unmatched speed of these bots.

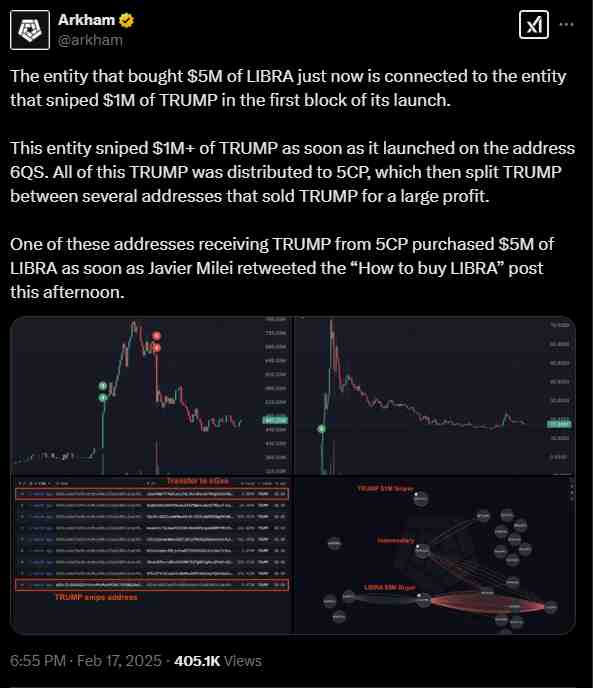

A good example of this is the LIBRA incident involving Argentinian president Javier Milei.

An insider allegedly used sniping bots to rake in about $6 million. This was one of the contributing factors to how the token’s price collapsed from around $4.4 billion to less than $300 million in only three hours.

This insider has also been connected to similar attacks on the $TRUMP and $MELANIA memecoins released earlier in the year.

The Future of Crypto Sniping

Crypto Sniping will continue to evolve as the years go by, as more traders find more ways to exploit the market.

While this method of trading enhances liquidity, it also contributes to some negative side effects for the market.

Traders and investors should consider staying informed about these tools to avoid being left behind.

Overall, crypto sniping is here to stay, especially with the AI agent boom in recent times.