Key Takeaways

- The crypto industry has evolved strongly over the last few years, with new networks springing up everyday.

- Two of the most popular ones include Ethereum (ETH) and Solana (SOL), both of which are smart contract enabled and run on PoS.

- Ethereum is arguably more secure and mature than Solana, as shown by its dominance in the crypto space.

- Solana is faster on the other hand and features cheaper fees in exchange for security.

- There is no inherently superior network between both, as either comes with its own set of advantages.

Ethereum and Solana are among two of the best-known blockchains in the crypto space.

While Ethereum has been the go-to network for dapps and smart contracts since its creation in 2015, Solana has emerged as a strong competitor.

The network has even earned the name “Ethereum Killer” over the years due to its faster transactions and lower fees.

But which of these two is the better one? Let’s find out.

ETH and SOL are two of the most well-known blockchain platforms in the crypto space. While Ethereum has long been the go-to network for decentralized applications (dApps) and smart contracts, Solana has emerged as a strong competitor, promising faster transactions and lower fees. But which one is better? Let’s break it down.

Understanding the Basics

Ethereum was launched in 2015, 6 years after Bitcoin. While ETH was similar to Bitcoin in many ways, it was the first to introduce the concept of smart contracts to the world.

The basic idea of smart contracts is that they are self-executing agreements that run on the blockchain itself.

Ethereum had the “first mover advantage” by being the smart contract pioneer, which helped it to establish dominance in the defi space to begin with.

However, as ETH grew, so did its problems.

The network began to get congested as more users and Dapps were deployed on its infrastructure.

It also struggled with high gas fees and slower transaction speeds, especially with the initial Proof of Work (PoW) consensus mechanism and how it consumed large amounts of power.

In an effort to address the issue, the network transitioned to Proof of Stake (PoS) with Ethereum 2.0 in 2022. This upgrade, dubbed “The Merge,” allowed the network to become even more efficient and scalable.

However, has the so-called “Merge” been enough?

Why Solana Is Such a Strong Challenger?

Similar to how Ethereum was launched 6 years after Bitcoin, Solana hit the market in 2020 and immediately became popular.

Unlike Ethereum, it was designed to offer lightning-fast transaction speeds, along with the cheapest fees.

It also has an advantage compared to Ethereum in that it combines two consensus mechanisms to achieve these speeds.

Not only does Solana run on Ethereum’s Proof of Stake, it also combines this uniquely with a Proof of History (PoH) mechanism.

Because of this merger, Solana is much faster than traditional blockchains and can theoretically handle up to 65,000 transactions per second (TPS).

In comparison, Ethereum’s TPS speeds sit at around 30 transactions per second. This alone has been the key to Solana’s strength.

Performance and Scalability

As mentioned, Ethereum’s PoS transition improved its scalability. However, it still relies on layer-2 solutions like Optimistic Rollups and zk-Rollups.

These solution networks, like Polkadot and Optimism, allow it to increase its transaction speeds and reduce congestion.

Despite these upgrades though, the Ethereum mainnet is still incredibly slow compared to Solana’s.

Solana, on the other hand, can handle high throughput with its hybrid PoH-PoS mechanism.

It achieves faster confirmation times and higher TPS compared to Ethereum and is therefore an attractive option for Dapps that require real-time interactions.

Gaming and defi, for example.

Network Stability and Downtime

Ethereum is known for being congested at times. However, it is regarded as the second most secure decentralized network aside from Bitcoin.

It is also known for being reliable and rarely experiences outages despite its size.

This makes Ethereum the go-to platform for large-scale DeFi applications, especially with institutional use.

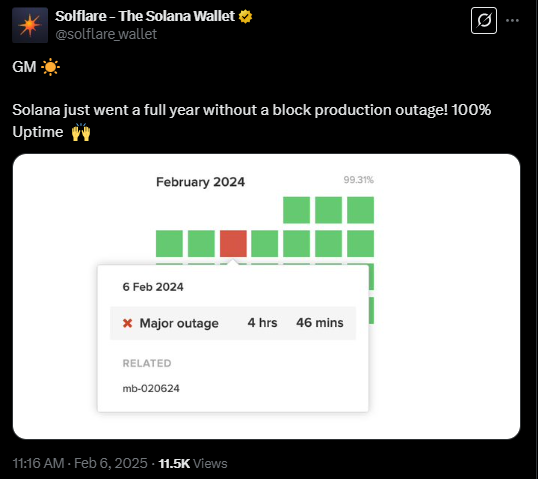

On the other hand, Solana is fast but was especially vulnerable to network outages as it grew.

The network crashed frequently between 2015 and 2023, leading to questions about its reliability.

Recently, though, the Solana network celebrated an entire year without a single outage.

This has led to a comeback in developer/investor confidence to a large degree.

Transaction Fees

One of the biggest pain points in Ethereum’s journey has been the issue of gas fees.

When the network becomes congested, transaction fees tend to skyrocket, making the network inaccessible to small users.

However, the network fixes this problem with its layer-2 solutions like Arbitrum and Optimism.

These features significantly reduce fees and provide a better user experience by far.

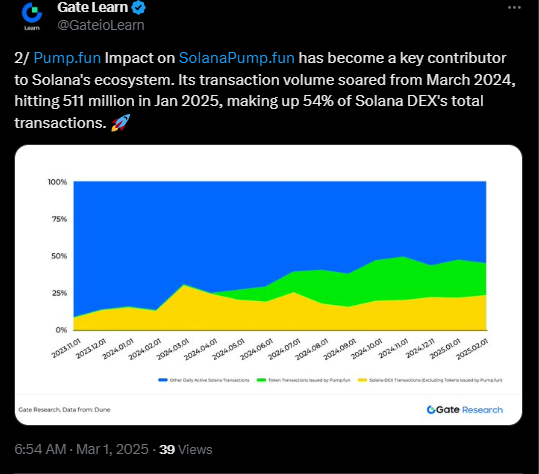

On the other hand, Solana’s transaction fees are incredibly low and come in at only a fraction of a cent.

This means that it is highly attractive for users and developers who need to make frequent transactions without worrying about high fees.

It is also why Solana heralded the “memecoin frenzy” of this cycle, compared to Ethereum, which held the last one.

Security and Decentralization

Ethereum is widely regarded as one of the most secure networks in the world. It features thousands of nodes securing its infrastructure and is highly resistant to attack and even censorship.

On the other hand, Solana is fast but is less secure than Ethereum.

This is because it sacrifices a large part of its decentralization for performance. The network has even fewer validators compared to Ethereum and is especially vulnerable to centralization on a relative scale.

Ecosystem and Developer Adoption

Ethereum takes the cake in this category and has the largest developer community in the blockchain space.

It features a wide ecosystem of DApps, NFT market places, exchanges, yield protocols, and more.

Its dominance in this space also means that most new blockchain projects start on the network before expanding elsewhere.

Solana, on the other hand, is newer and has gained traction in gaming, NFTs, and DeFi. It has attracted developers looking for high-speed and low-cost transactions. However, it still has a long way to go and is unlikely to beat Ethereum in terms of scale.

Which One Is Better?

There is no straightforward answer to this question because use cases differ and so do requirements.

If you value security and robustness, Ethereum is the better choice. The network is great for healthcare, finance, banking, and many other solutions within the space.

On the other hand, Solana is great for speed and low fees, and can be great for DEXs, gaming, memecoins and even NFTs.

Overall, both of these networks have their own strengths, and neither is inherently superior to the other.