Key Insights

- The crypto industry is filled with many great ways to invest and make an income.

- One of the most stable of these strategies is HODLing.

- It involves holding on to a cryptocurrency for the long-term, regardless of short-term price fluctuations.

- This term originated from a drunken post in BitcoinTalk forum from 2013, and has been expanded to “hold on for dear life”.

- While this strategy presents numerous benefits to investors, it is not suited to everyone and should be combined with proper research.

The crypto market is notorious for being extreme when it comes to price swings.

Many investors have made and lost fortunes in an instant due to bad or unfortunate decisions when investing.

However amid this volatility, one investment strategy has stood the test of time:

This strategy is known as HODLing.

What started out as a simple typo has grown into one of the best guiding principle for crypto enthusiasts around the world.

What does HODL mean, and what can it do for you?

What Is HODL?

At its core, HODLing is a simple investment strategy. It involved buying and holding onto cryptocurrencies, regardless of how much the market fluctuates.

The idea is to resist the urge to sell crypto, even when prices are soaring or crashing.

Instead, investors who practice this strategy are focused on the long-term prospects of their digital assets.

The term has grown over the years and has now been humorously expanded to mean “Hold On for Dear Life.”

Unlike day trading, which requires investors to time the market perfectly and enter or exit positions at the right times, HODLING is based on the belief that prices will rise over time.

In essence, by holding on to one crypto despite the market rising and falling, traders hope to sell for a much higher price after a long time in the future.

This stands as a stark contrast to short-term speculation and staring at price charts.

The History of HODL

So where did HODL come from?

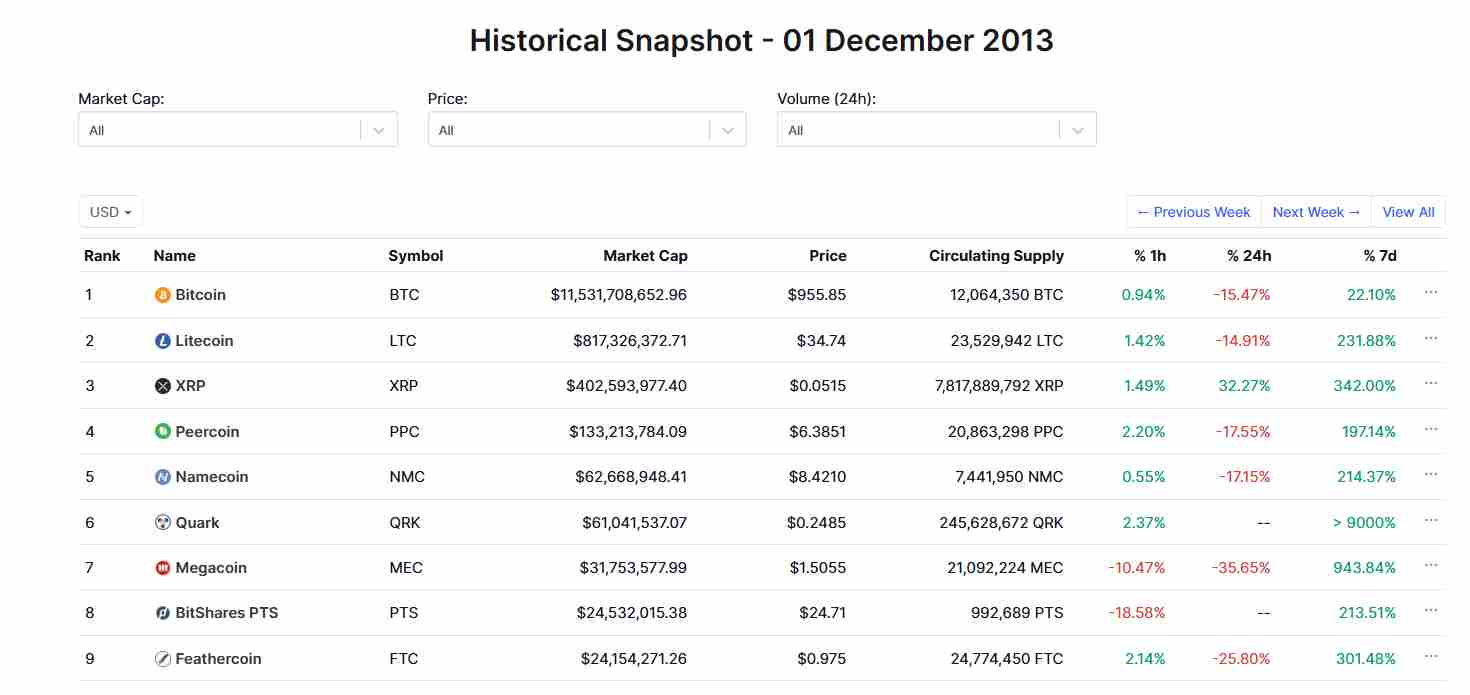

The term “HODL” originated from a literal drunk-post from a BitcoinTalk forum user in December 2013.

This user had the username GameKyuubi, and took to the forum to send a post titled “I AM HODLING.”

Within the post, he admitted that he was a bad trader and had decided to hold on to his Bitcoin instead, despite the ongoing market downturn.

The post was full of typos, but still resonated with the crypto community and later turned into a meme and an investment philosophy.

Over time, HODL has become more than a mere typo in a drunk man’s post.

It has become a mindset that encourages investors to be patient and look at the long-term rewards of investment in the crypto space.

Why Do Investors HODL?

As mentioned, HODLing has its roots in the belief that a certain asset will become more popular and will increase in value over time.

Many investors see Bitcoin and other similar assets as major tools that will soon replace traditional money (also known as fiat).

This strategy is also effective because it protects investors from the stress of short-term market fluctuations, as well as trying to predict market movements.

Investors often make decisions based on emotion during market downturns, which can lead to panic selling—or buying at the top due to FOMO (or the Fear of Missing Out).

It helps investors stay committed to their long-term vision. It also reduces the risks of impulsive trading, which rarely ends well.

How Long Should You HODL?

The crypto community has two more interesting terms that are worth noting.

They include NGMI (Not Gonna Make It) and GMI (Gonna Make It).

For starters, NGMI is the term for investors who panic sell or make poor financial decisions that they end up regretting.

GMI, on the other hand, includes investors who hold onto their assets with confidence despite short-term volatility.

HODLing is generally a GMI mindset, considering how it holds on to faith in the future of a cryptocurrency.

However, it is worth noting that while GMI investors typically win at the end of the day, it is not an indicator that investors should blindly hold on to every asset.

This is where thorough research and informed decisions come in.

Pros and Cons of HODLing

Like any investment strategy, this strategy also comes with its own advantages and disadvantages. Here are some of them:

Pros

- It is the most simple form of investment, considering how it doesn’t require investors to constantly monitor the market.

This makes it very accessible to even beginners, as long as proper research is carried out. - This investment strategy comes with High Return Potential. Historically speaking, some of the biggest Bitcoin gainers are its long-term holders.

- It also helps to reduce the risks of emotional trading, such as panic selling and FOMO-buying.

Cons

- Crypto prices can swing massively, making HODLing emotionally draining for many investors

- HODLing also does not come with ways of making passive income, like direct trading. This makes HODLing crypto a lot unlike stocks, which pay dividends, or real estate that generates rental income.

- In case HODLing goes bad or a project fails, HODLers would have gone through emotional stress for nothing as prices can crash to zero.

Tips for Becoming a Successful HODLer

If you’re considering becoming a HODLer as opposed to a regular trader, here are some tips to increase your chances of success:

- Do your research before investing in any cryptocurrency. Understand what its fundamentals are, along with its use cases and how likely it is to succeed in the long term.

- Diversify your portfolio across multiple projects to reduce your risk exposure to a single one.

- Prepare yourself emotionally for volatility, as crypto prices can fluctuate wildly. Remember to stay calm and stick to your plans.

- Invest only what you can afford to lose.

- HODLing crypto is a long-term strategy, so don’t expect immediate results.

Overall, this strategy can be very effective for investors who believe in the future of crypto, and are willing to weather the storm.

Investors must understand that this strategy is not a one-size-fits-all approach, and some investors are better suited to HODLing than others.