Key Insights

- Recently, the trend of celebrity-endorsed memecoins came to a complete halt.

-

The endorsement of a new cryptocurrency named Libra by Argentine President Javier Milei proved to be a controversial decision

- According to LookOnChain, the orchestrators of this scheme began selling a mere three hours after the project’s launch.

- Bubble Maps noted that 82% of the token’s supply was unlocked and could be sold at any time, even before the launch.

- This incident reveals the problems with celebrity-backed memecoins and the issues with them.

By now, the launch (and endorsement) of crypto tokens by world presidents is no new matter.

However, what appeared to be a starting trend of presidential crypto endorsements turned out to be a disaster sometime this week.

President Javier Milei of Argentina endorsed the Libra (LIBRA) token, which quickly lost over 94% of its value.

This token erased billions in market cap in such a short amount of time, leaving investors reeling.

Here’s how this disaster happened and what it means.

The Rise and Fall of Libra Token

Libra’s brief but chaotic journey started on Valentine’s Day (14 February).

The token was launched on decentralized exchanges and initially saw a surge in value to a market cap of around $4.56 billion.

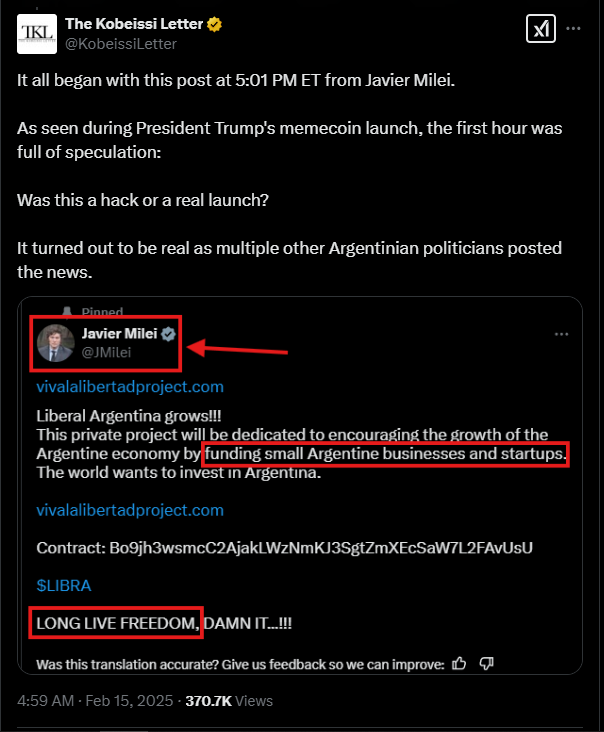

This massive price rise came amid support from Argentine president Javier Milei, who had promoted it on social media earlier.

Libra was endorsed as part of a “private project” aimed at helping small businesses and entrepreneurs in Argentina, thereby boosting the country’s economy.

However, within a matter of hours, the market value of the token began to decline, seemingly a result of manipulation.

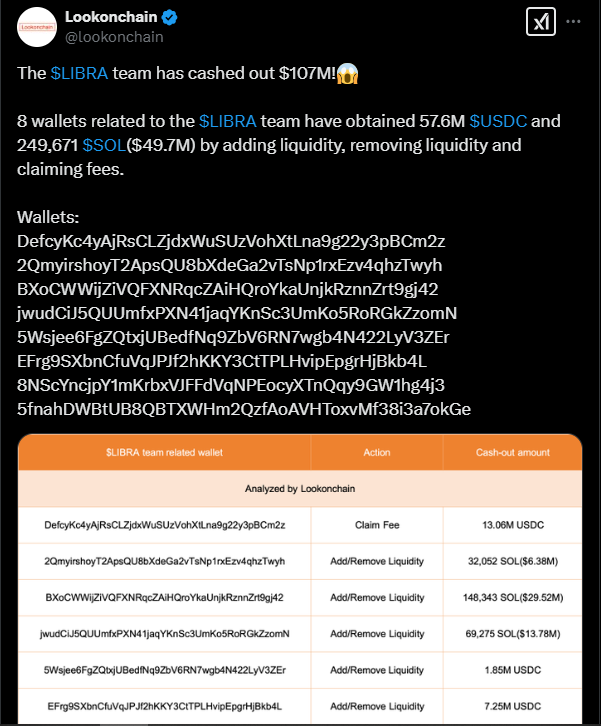

Interestingly, blockchain analytics platform LookOnChain noted that at least eight wallets connected to the Libra team ran off with over $107 million.

The operators of these wallets drained liquidity from the token almost instantly, causing the 94% crash.

When all was said and done, a token that once had a market cap of over $4.5 billion was now worth just $257 million.

In essence, the rug pull orchestrators stole a staggering $4 billion from investors.

How Did the Rug Pull Happen?

One of the most interesting aspects of this rug pull was the timing.

The insider wallets went to work just three hours after the token trading went live. They began cashing out, exchanging the new cryptocurrency for USDC and $SOL, and initially made away with around $49.7 million.

This sharp trend of liquidations caused panic among investors, who could only watch as their investments plummeted almost overnight.

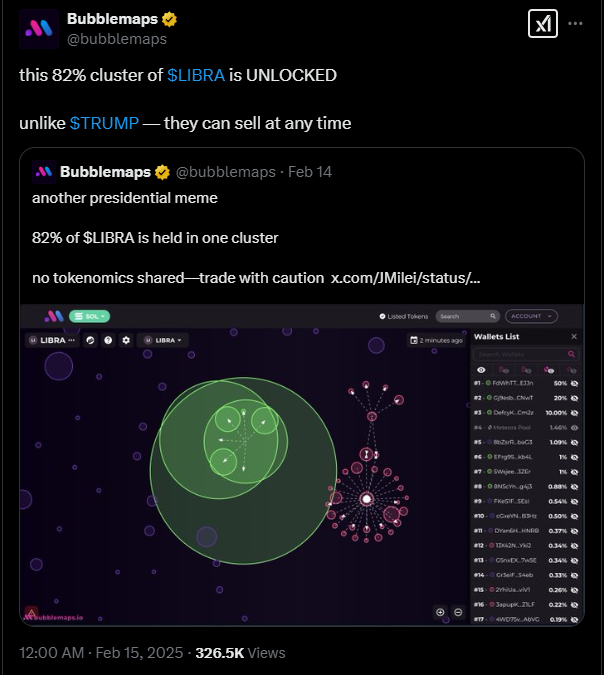

Another interesting aspect of this incident is how BubbleMaps, another blockchain analytics platform, raised concerns about Libra’s tokenomics—even before it launched.

The analytics platform noted that around 82% of the token’s supply was unlocked and could be sold at any time.

Milei’s Role and the Political Fallout

The biggest scandal wasn’t the token’s sell-off by a few anonymous wallets.

It was the involvement of President Javier Milei in the entire scheme. The Argentine president previously posted on X that Libra was a “private initiative” designed to boost the country’s economy.

The post even included a link to the project’s website and the token’s contract address.

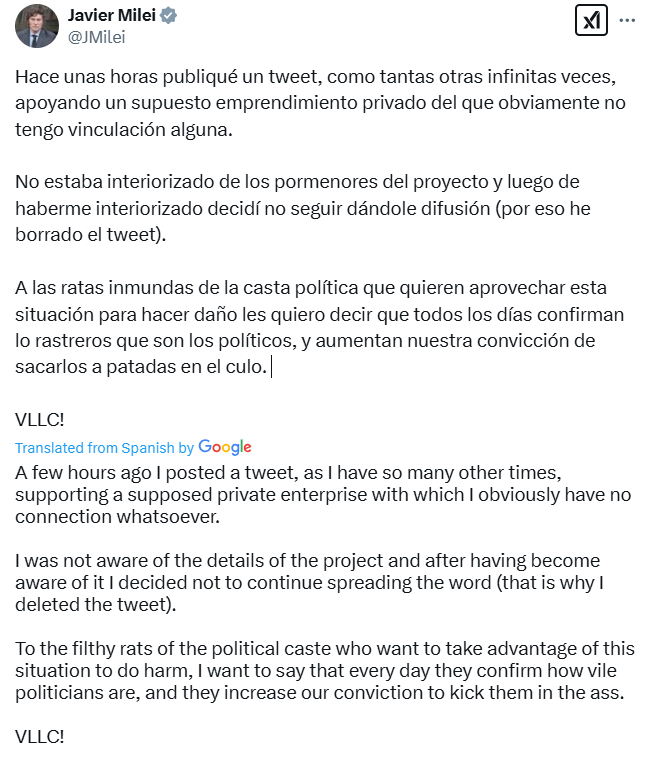

However, soon after Libra imploded, Milei hurriedly deleted the post and distanced himself from the project.

He claimed that he had not been aware of the details and that he would not continue to promote it—despite the damage that had already been done.

The incident has so far led to widespread backlash from Milei’s political opponents and other industry experts.

Critics have argued that Milei behaved “irresponsibly” by promoting a token without fully understanding the mechanics behind it.

Others have even suggested that Milei’s involvement was a deliberate scam.

Former Argentine president Cristina Kirchner even went as far as calling him a “crypto-scammer,” according to Yahoo Finance.

So far, Milei has launched an investigation into the incident with the Anti-Corruption Office (OA) to determine if any members of the government were involved.

The Problem with Celebrity-Endorsed Memecoins

The recent crash of this memecoin shows the growing risks of celebrity-endorsed memecoins.

Over the last year, high-profile individuals have been involved in one way or another with this class of cryptocurrencies.

For example, US President Donald Trump recently launched his own memecoin called “Official Trump” ($TRUMP).

Soon after the launch of $TRUMP on 17 January, US First Lady Melania Trump launched a similar $MELANIA token, both of which raked in billions of dollars in market cap within a few hours.

These types of tokens attract retail investors who are eager to cash in on the hype.

They are therefore prime breeding grounds for bad actors to launch all kinds of scams.

Milei’s Apology and the Future of Crypto in Argentina

Milei took to X after the incident to issue a statement (which has since been deleted).

He apologized for his involvement in the token and expressed regret over the situation.

He blamed his political opponents for attempting to take advantage of the failure of Libra for their own gain.

Milei also reaffirmed that he was committed to fighting corruption and protecting Argentina’s economic interests.

Still, Milei’s apology hasn’t done much to protect his political and economic plans.

His administration continues to struggle with foreign investment, especially after the failure of the Libra token.

Argentina’s economy continues to suffer from setbacks like high inflation and a series of other setbacks.

Overall, the collapse of Libra serves as a reminder of the dangers involved with the memecoin/crypto industry.

While the call for quick profits can be tempting, the lack of regulation in the memecoin space makes the crypto space vulnerable.

Investors must conduct proper research before investing in any new or established tokens going forward.