Key Takeaways

- Shiba Inu has been declining lately, and data shows that the whales might be dumping their holdings.

- The whales are selling far more SHIB than they are buying, indicating a heavy interest in shorting the memecoin.

- CoinMarketCap data now shows that prices have plummeted strongly so far, to fresh lows of around $0.00001166.

- This now stands as Shiba Inu’s lowest point in over a year. However, the price of the cryptocurrency has formed a falling channel pattern on the daily chart.

- If a rebound occurs from here, SHIB will likely target the $0.000013 resistance level, where a breakout could push the price to $0.00001493.

Shiba Inu has been through a steep decline over the last two weeks, and data shows that the whales might be dumping their holdings.

This trend has caused a significant dip in the price of SHIB, which has erased most of the gains it made in February and has left investors anxious.

The token now hovers around some key support levels, and many are wondering:

Will the sell-off continue, or is a recovery on the horizon?

Shiba Inu Whales Are Offloading SHIB

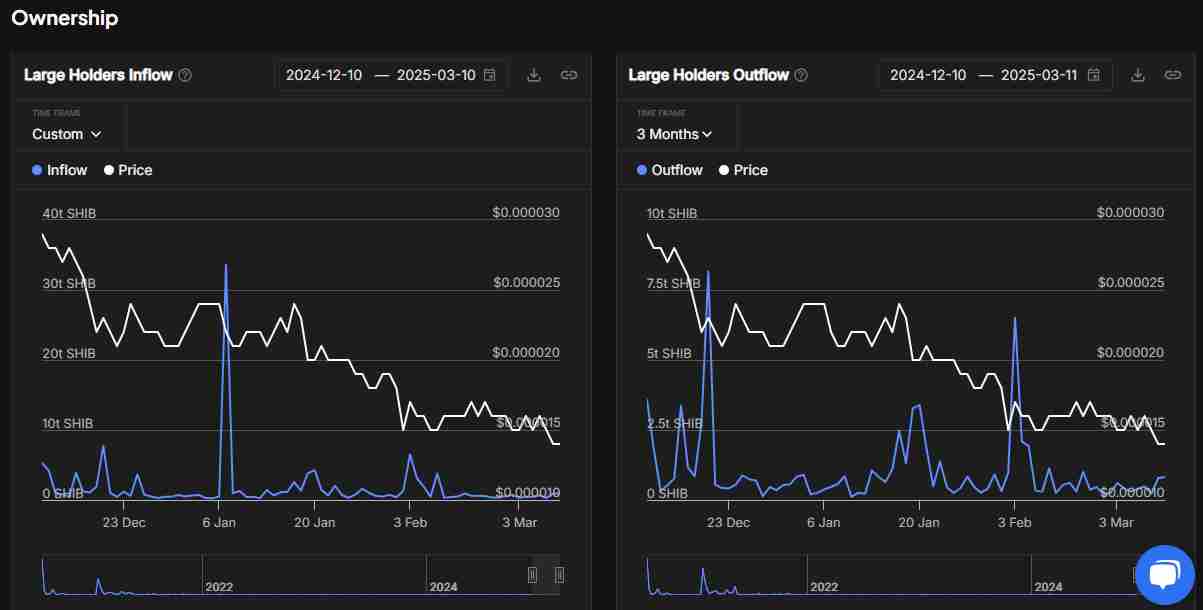

According to insights from blockchain analytics firm IntoTheBlock, whale investors are reducing their SHIB holdings at a massive rate.

The last week alone has seen the Large Holder Net flow plummet from around 6 trillion SHIB in early February to around 900 billion SHIB at the time of writing.

To put things simply, the whales are selling far more SHIB than they are buying, indicating a heavy interest in shorting the memecoin.

To put things into further perspective, these whales have been cutting down their balances for weeks and continue to intensify this activity everyday.

The large-scale exit from positions has contributed to the downward pressure on SHIB’s price so far, leading to more and more losses for investors.

How Has the Market Reacted?

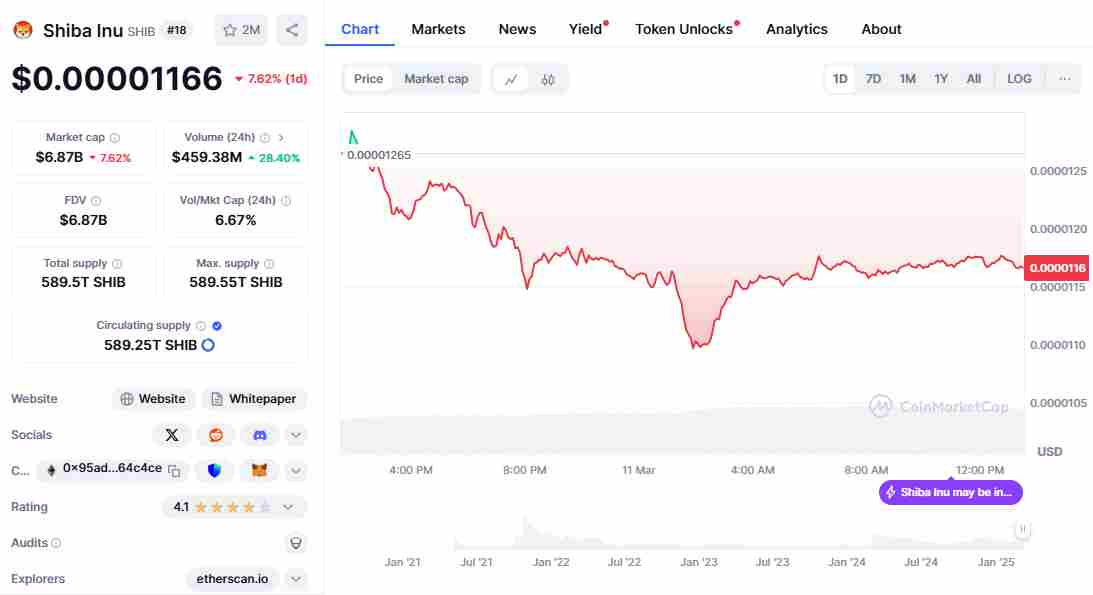

So far, it hasn’t been surprising that the price of SHIB has taken a hit. As of last week, this memecoin traded at around $0.000014.

CoinMarketCap data now shows that prices have plummeted strongly so far, to fresh lows of around $0.00001166.

This now stands as Shiba Inu’s lowest point in over a year, with the community sentiment on CoinMarketCap turning bearish.

This shows a deep sense of fear among traders who fear that the sell-off could worsen from here.

According to past trends, when whales offload large amounts of crypto, prices tend to decline.

This is reflected by the large holders net-flow from IntoTheBlock, which shows that whale activity has declined by around 63% over the last 90 days, with a meager 8% increase over the last day.

Can SHIB Break the Falling Channel?

Despite the recent downturn, there might still be hope for SHIB. The price of the cryptocurrency has formed a falling channel pattern on the daily chart, which ends up bullish after a short period of bearishness.

This trend has been made worse so far with the decline of the general crypto market.

Bitcoin recently fell below the $80,000 zone during the last two weeks, dragging the memecoin market down to a capitalization of around $44 billion.

CoinMarketCap data even shows that SHIB itself has been down by around 15% over the same timeframe.

The cryptocurrency is now approaching a crucial psychological support level at $0.000010 and should be open to a rebound soon.

The daily RSI on SHIB shows that the cryptocurrency is close to becoming oversold.

In essence, if buying pressure picks up, the rebound could be imminent.

On-Chain Resistance—Can SHIB Overcome Key Barriers?

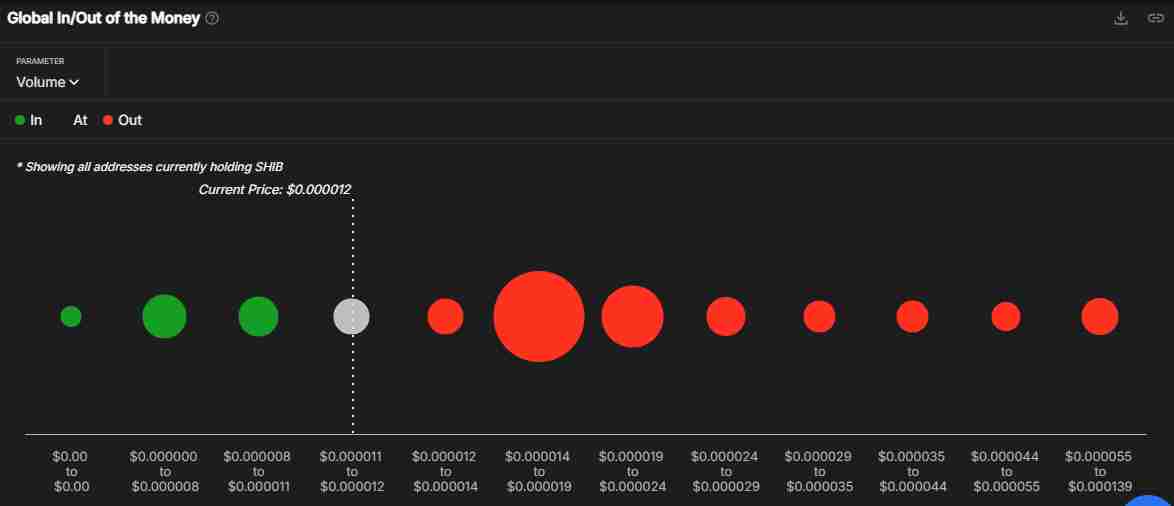

While a rebound is possible, SHIB continues to face strong resistance ahead.

According to IntoTheBlock’s Global In/Out of the Money Indicator, the $0.000012–$0.000014 range could be difficult to break above, with nearly 30 trillion SHIB held by around 60,000 addresses.

This would mean that a break above this level from SHIb could lead to even tougher resistance between $0.000014 and $0.000019, where nearly 550 trillion SHIB tokens are distributed across 165,000 addresses.

If a break above this zone occurs, it could serve as rocket-fuel for a recovery, leading to a comeback on Shiba Inu.

What are SHIB’s Next Price Targets?

Shiba Inu is currently close to the $0.00001061 support zone.

If a rebound occurs from here, it will likely target the $0.000013 resistance level, where a breakout could push the price to $0.00001493 (the next major pivot point).

On the flip side, if the selling pressure persists and SHIB fails to hold its current levels, a dip below the $0.000010 mark could occur and put more pressure on the token.

The current SHIB decline is likely driven by whale liquidations, especially as market sentiment is now at its weakest.

However, signs of a possible rebound are emerging, and SHIB could be on its way towards higher highs soon.

The big question remains:

Will the whales continue to offload more SHIB, or will the buying pressure that results from a retest of $0.00001 be enough to reverse the downtrend?

For now, traders must watch the $0.000010 support level closely.

If it holds, a bullish reversal could be in play. Otherwise, more pain could be ahead for SHIB holders.