Key Takeaways

- Solana and Ethereum are two of the biggest names in the defi and NFT spaces.

- However, both of these chains have advantages over one another, especially with scalability and security.

- Ethereum leads in terms of security and adoption. However, Solana leads in terms of fees, scalability and speed .

- Solana remains one of the best competitors to Ethereum on several fronts.

Solana and Ethereum are two of the biggest names in the blockchain space.

Both of these chains power some of the largest decentralized applications, and have the highest Total Value Locked (TVL) among defi chains.

However, while both platforms are important for the industry as a whole, here are some of the key factors that differentiate them.

These factors include things like speed, cost, decentralization, and overall usability.

Understanding these differences can help you as an investor or developer, to make the best decisions about which one to hop on.

Let’s get into things.

1. Transaction Speed

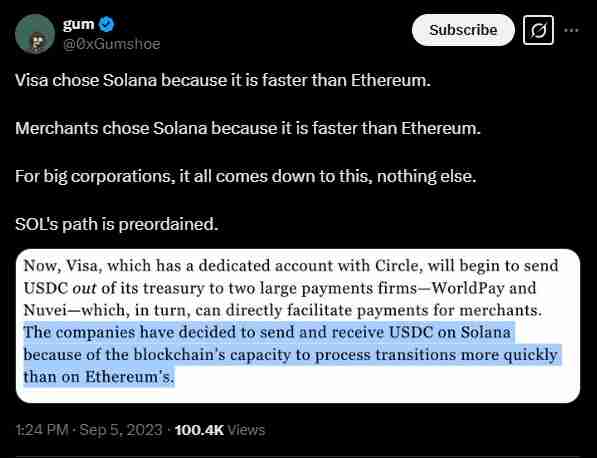

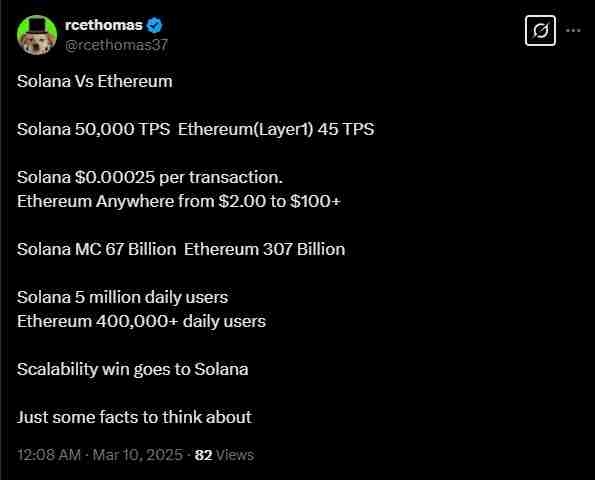

Solana is the clear leader by a wide margin, when it comes to speed. The network boasts a theoretical throughput of up to 65,000 transactions per second (TPS).

This is a heavy figure, compared to Ethereum’s 15-45 TPS on the mainnet.

So why is Solana this fast, and why isn’t Ethereum?

The answer lies in their consensus mechanisms. Solana combines Proof of Stake and Proof of History as its consensus mechanisms.

This combination allows its validators to process transactions more efficiently, without having to constantly waste resources, communicating with one another.

Ethereum on the other hand, still faces block time and network congestion issues, even after transitioning to PoS after the September 2022 Merge.

Ethereum uses its Layer-2 scaling solutions like Optimism and Polygon as solutions to these issues.

However, these are indirect solutions, and Solana takes the lead in the speed department.

2. Transaction Costs

Solana takes the cake again, when it comes to costs of transactions. Ethereum has long been criticized for its high gas fees, especially during times of network congestion.

The simplest of transactions on the Ethereum network can cost several dollars, while complex smart contract deployments can run into hundreds of dollars.

This issue has discouraged many developers and investors from using Ethereum and given Solana the lead.

Solana on the other hand, offers much lower fees. Transactions typically cost fractions of a cent, asides from Solana’s ability to process more transactions per second.

This makes Solana the leader over Ethereum in terms of micro transactions, high-frequency trading, dApp development and much more.

3. Consensus Mechanism

As outlined above, Ethereum now operates under a Proof of Stake model, where validators have to stake certain amounts of ETH to participate in block production.

This approach to running the blockchain is more energy-efficient than the previous Proof of Work the network ran on.

However, this transition to PoS raises concerns about centralization, especially when a small number of entities control a large portion of staked ETH.

On the other hand, Solana’s hybrid PoS and PoH provides a verifiable timeline for transactions.

This allows for parallel processing and higher throughput, and sets Solana apart from Ethereum.

However, the issue with this approach is that while Ethereum has pending centralization concerns, Solana has even more serious risks in this category.

This means that Ethereum is a lot more secure and stable than Solana, despite being slower and more inefficient.

4. Decentralization

Decentralization is one of the key aspects of blockchain technology, especially when it comes to censorship resistance.

Ethereum is considered one of the most decentralized networks, and is second only to Bitcoin.

This network has thousands of validators spread across the world and is very resistant to attacks or censorship.

Solana on the other hand, has a smaller number of validators. On top of this, many of the network’s validators are large professional entities.

In addition, becoming a Solana validator requires high-end hardware, and is therefore closed off to smaller participants.

This provides even more concerns when it comes to network centralization and resistance to attack.

5. Developer Ecosystem

Ethereum is the leader in this category. It has a well-established ecosystem, complete with a vast library of developer tools like documentation and a thriving community.

Many developers prefer Ethereum for smart contract development, especially for defi applications and NFT projects intended to hold huge amounts of funds.

Solana’s ecosystem is newer. However, it is expanding rapidly and offers powerful developer tools.

However, it is still in the growth phase, compared to Ethereum in terms of available resources and developer familiarity.

Another key difference between these two is that of their programming languages.

Ethereum relies on Solidity, while Solana relies on Rust.

Developers are a lot more familiar with Solidity compared to rust, especially because of the learning curve difference between both.

6. Security

Ethereum has a strong track record of security. This record is strengthened by its large validator network and rigorous smart contract auditing processes.

Despite some issues the network has had in the past, its PoS mechanism and ongoing security measures make it a clear leader in terms of security.

Solana on the other hand, has faced several network outages and security incidents.

This has led to concerns about how reliable the network is.

Solana has proven its mettle recently though, especially with the memecoin boom between late 2024 and early 2025.

The network recently celebrated a while year without outages, and withstood millions of new memecoins being deployed and traded on its infrastructure for months.

7. Scalability

Asides from decentralization, scalability is another major factor for blockchains.

Ethereum is currently addressing its scalability issues through its Layer-2 solutions and sharding technology.

While these mechanisms have done much to improve throughput and maintain the mainnet’s security, Ethereum still lags behind Solana in the scalability department.

Solana, by design, is highly scalable.

Its very architecture allows it to handle thousands of transactions per second, without having to rely on external scaling solutions.

However, Solana’s dependence on heavy hard ware could limit its lead over Ethereum.

8. Community and Adoption

These two networks are currently tied in the Community and adoption aspect.

Ethereum has a large and well-established community. It is also widely accepted by developers and users, while being the go-to platform for many blockchain solutions.

Ethereum also has spot ETFs approved in the US, which have done much to improve its adoption, albeit lower than Bitcoin’s.

Solana on the other hand, has a growing community that almost rivals Ethereum’s in the DeFi and NFT sectors.

This is thanks to its speed and low fees. However, it still trails Ethereum in terms of overall adoption.

Solana still has its spot ETF applications unapproved in the US, especially with the asset seen as an innovative, but comparatively riskier alternative to Ethereum.