Key Insights

- XRP has been one of the best-performing cryptocurrencies so far, considering its growth over the last 6 months.

- One of the biggest catalysts of this growth has been the ETF speculation, the ongoing case between the SEC and Ripple, as well as the expansion of XRP.

- Speculators seem to be sure of an XRP listing in the ETF market so far on PolyMarket.

- XRP has enough potential to hit $4 very soon. However, a break below the $2.6 zone could invalidate its medium-term targets.

XRP has been through some of the harshest hurdles since its creation in 2012.

However, despite these challenges, the cryptocurrency has persevered and emerged as one of the most resilient cryptocurrencies on the market.

This token has so far grown to become the third largest cryptocurrency by market cap, second only to Ethereum itself.

As the current year continues to mature, analysts are starting to speculate on how much higher the cryptocurrency can go.

Could a massive explosion be forthcoming for this cryptocurrency?

Here’s what might happen to the price of Ripple’s native cryptocurrency in Q1 of 2025, along with the events that might fuel this growth.

XRP’s Long Road To Success

Initially, Ripple introduced XRP as part of its payments network.

Before becoming a popular asset among retail traders, cryptocurrency allowed financial institutions to conduct fast and cheap transactions across borders.

Ripple’s goal was to disrupt the global payments system—and it has made good on this mission ever since.

Ripple has now expanded to over 80 markets and works with over 100 financial institutions.

The network has also processed over $70 billion in transactions so far.

Despite its growth, XRP has yet to hit its full potential according to analysts.

The European Central Bank currently predicts that cross-border transaction volume is expected to hit a new all-time high of $290 trillion by 2030.

With XRP currently one of the leaders of this revolution, there could still be plenty of opportunity for cryptocurrency.

XRP’s “Bitcoin Moment” and ETF Approval

So far, one of the most promising catalysts for XRP this year is the approval of spot ETFs in the US.

The success of the spot Bitcoin ETFs last year provides a blueprint of sorts for what could happen with XRP.

According to data from Soso Value, the Bitcoin ETFs brought in around $37 billion worth of inflows in their first year of trading.

This makes them one of the most successful financial products in recent history.

The price of the cryptocurrency has also more than doubled since this approval, and analysts are starting to hope that XRP might follow a similar path.

Several asset management firms like 21Shares, BitWise, and WisdomTree have applied for spot XRP ETFs in recent months.

This means that if the SEC approves these applications, XRP could see a major boost in price—a lot like what happened with Bitcoin.

Many analysts have predicted that XRP could see its “Bitcoin moment” very soon this year.

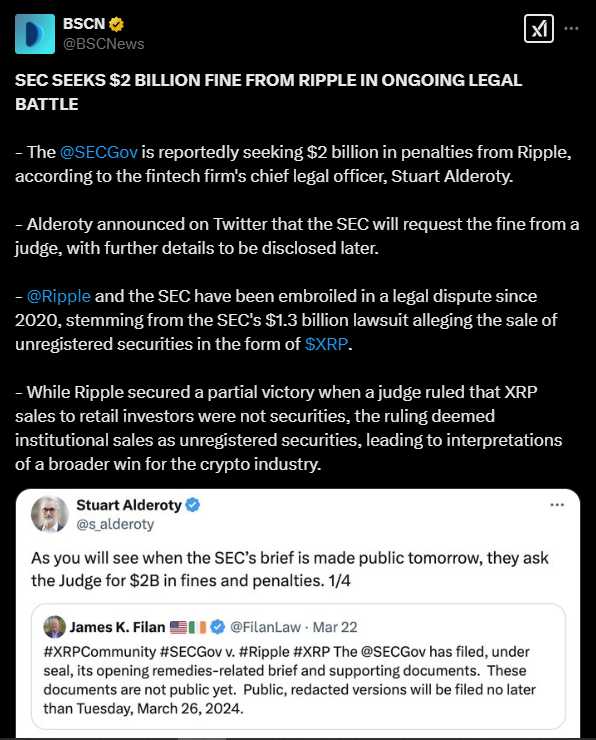

XRP’s Legal Battle With the SEC

Another major factor that could drive the price of XRP upwards in Q1 is the ongoing legal battle between Ripple and the SEC in the US.

These two entities have been locked in a legal battle since December 2020, after the SEC accused Ripple of selling XRP as an unregistered security.

Recent developments in the case now show that the battle could be coming to an end.

In July of 2023, US District Court Judge Analisa Torres issued a split ruling in partial favor of Ripple.

Torres ruled that while XRP sold on exchanges to retail investors did not count as an unregistered security offering, the same sale to institutional investors was.

The partial victory in favor of Ripple caused a 70% price spike at the time, and investors are expecting the same to happen if Ripple emerges victorious when the case eventually closes.

How Could the ETF Approval Affect XRP?

As mentioned earlier, the approval of a spot ETF for XRO could influence its price over most of 2025.

The SEC’s approval of the Bitcoin ETFs and the events that followed proved that investors interested in a cryptocurrency will jump on investments as soon as a newer and simpler way to do so emerges.

Given the relative ease of buying and storing a possible XRP ETF, an approval could attract a fresh wave of investors who had been hesitant to buy earlier.

The optimism over this approval has also hit an all-time high, with PolyMarket odds of an XRP ETF listing now soaring from 70% to around 80%.

This shows that the confidence among traders is on the rise, and a major shift could be incoming.

Market Sentiment and Investor Confidence

At the time of writing, XRP is showing strong signs of positive momentum.

The token has reclaimed its most important resistance levels and is trading at around $2.7.

The cryptocurrency is now trading atop an ascending trendline shown above, after breaking above its 50-day SMA once again around $2.58 on 14 February.

The cryptocurrency is now testing support around the crucial $2.68 zone and could rebound from here to target its previous local high of around $3.4.

The only invalidation of this outlook would be a break below the ascending trendline pictured above, around the $2.27 price level.

A break below $2.27 would signal another major lower low and a possible bearish continuation towards the $1.98 zone.

At this point, XRP would also have fully formed a head and shoulders pattern, which is bad news for the bulls.

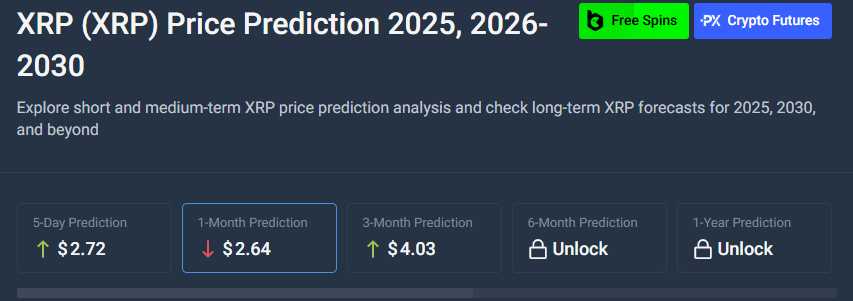

Overall, AI predictions from CoinCodex show that XRP is headed for a strong Q1.

The prediction models expect the cryptocurrency to hit a new all time high of $4 in the next three months.

CoinCodex also predicts that XRP will peak at around $4.3 in April.

Overall, while the outlook for XRP in the first quarter is generally positive, some of the biggest risks include the SEC somehow winning the fight against Ripple, or a possible rejection of the XRP ETF applications.

Still, XRP has massive potential for growth, regardless of what happens.