Key Insights

- XRP price has trekked further and further to the underside over the last week.

- This decline in prices is mostly due to the general market downturn.

- XRP is down by around 10% over the last day at the time of writing, which directly mirrors Bitcoin’s price movements.

- There has also been a notable decline in its open interest, indicating that investors have either closed their positions or are refusing to open more.

- If XRP is unable to hold the line at $2, a crash towards $1.26 remains ever possible.

The crypto market has been a battlefield for XRP so far, especially with the bulls and bears clashing over some key price supports.

Despite attempts at recovery, the bulls have been unable to overpower the bears, and traders continue to get pushed towards the edge.

Is more pain incoming for this cryptocurrency, or is some relief overdue?

XRP’s Fight Against Resistance

XRP has been strongly volatile over the last few days, especially as it struggled to maintain its standing above the $2.50 zone.

The bears eventually won around this price level, crashing prices down to a new support level around the $2.05 price zone.

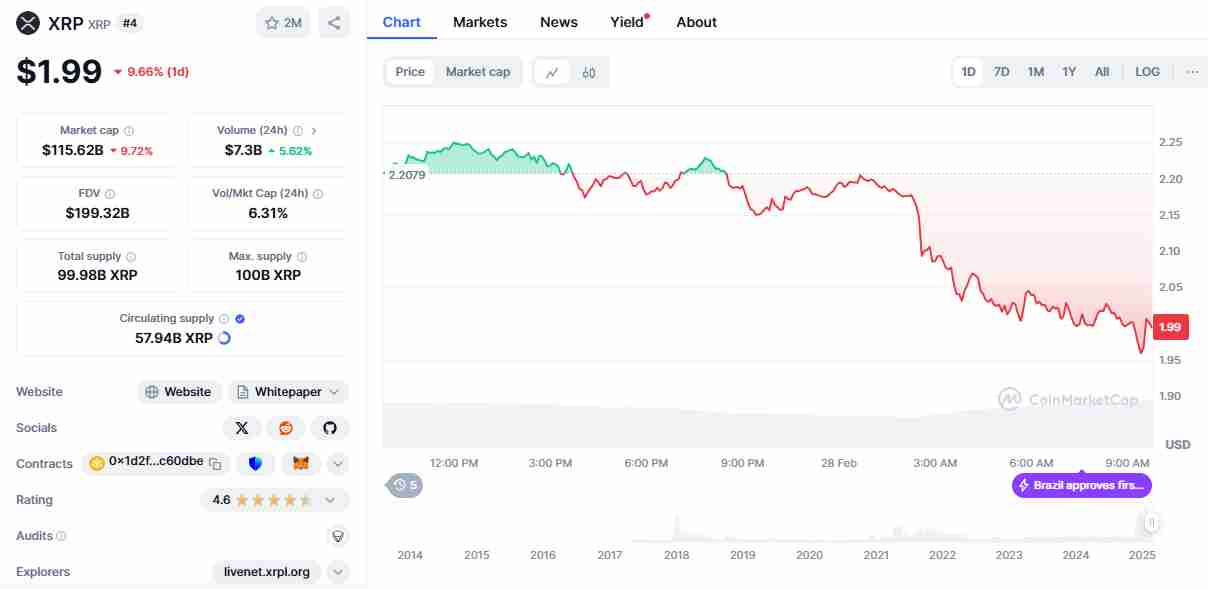

According to CoinMarketCap, XRP now trades around the $1.99 zone at the time of writing, with the bulls losing more and more control over this support too.

So far, XRP has crashed by a bitter 10% over the last 24 hours and will need to struggle to overcome the $2.33 and $2.45 zones for any chance at a rebound.

If a rebound does occur though, the cryptocurrency could rally further upwards to the $2.50 (and possibly the $2.62) zone on the 4-hour chart.

On the other hand, if the control over the $2 support continues to slip, the next downturn could lead to a crash towards $1.26 or lower.

The technical indicators on the daily chart show a mixed picture, though.

For example, the Moving Average Convergence Divergence (MACD) shows that a bullish shift could be incoming.

This move is reflected by the RSI, which is now hovering right over oversold territory.

The described trends show that the bears are stronger than the bulls by a wide margin. However, XRP price remains in an indecisive state, with the next few days determining whether we see a break below $2 or a rebound towards $2.5.

Market Trends and Bearish Pressure

The ongoing bearish trend on XRP price hasn’t done much to ease the tension.

This is because of the general market downturn affecting Bitcoin and the altcoins.

So far, Bitcoin has lost nearly 30% of its value this week alone, dragging the rest of the altcoins down with it.

This trend was the major cause of XRP price breaking below the aforementioned key resistances and why the cryptocurrency could be in for a retest of the $1.5 zone if the bearish trend persists.

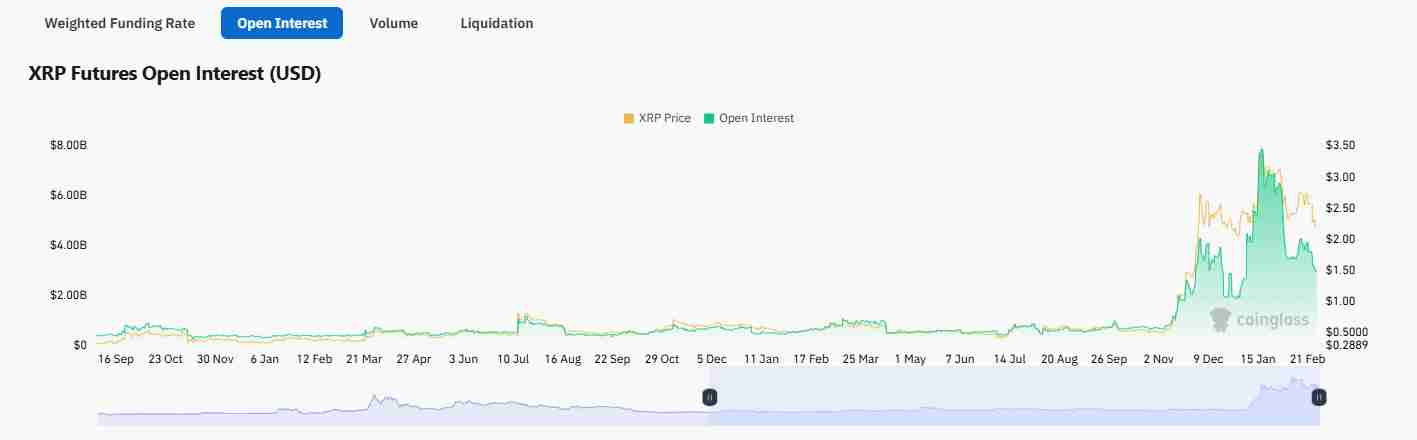

There has also been a notable drop in the cryptocurrency’s open interest to an eight-week low, according to insights from Coinglass.

This indicates that investor interest is waning on XRP, especially after its rally to the $3.4 price level.

Additionally, Coinglass data shows that XRP’s OI has decreased by 20%, which is very similar to patterns we have seen in bear cycles.

The cryptocurrency’s funding rates have also turned negative, with more than $70 million worth of bullish positions liquidated across the board between 24 and 25 February alone.

This further reinforces the outlook that bearish sentiment is growing, and a recovery could be difficult.

Short-Term Holders Sell as Whales Accumulate

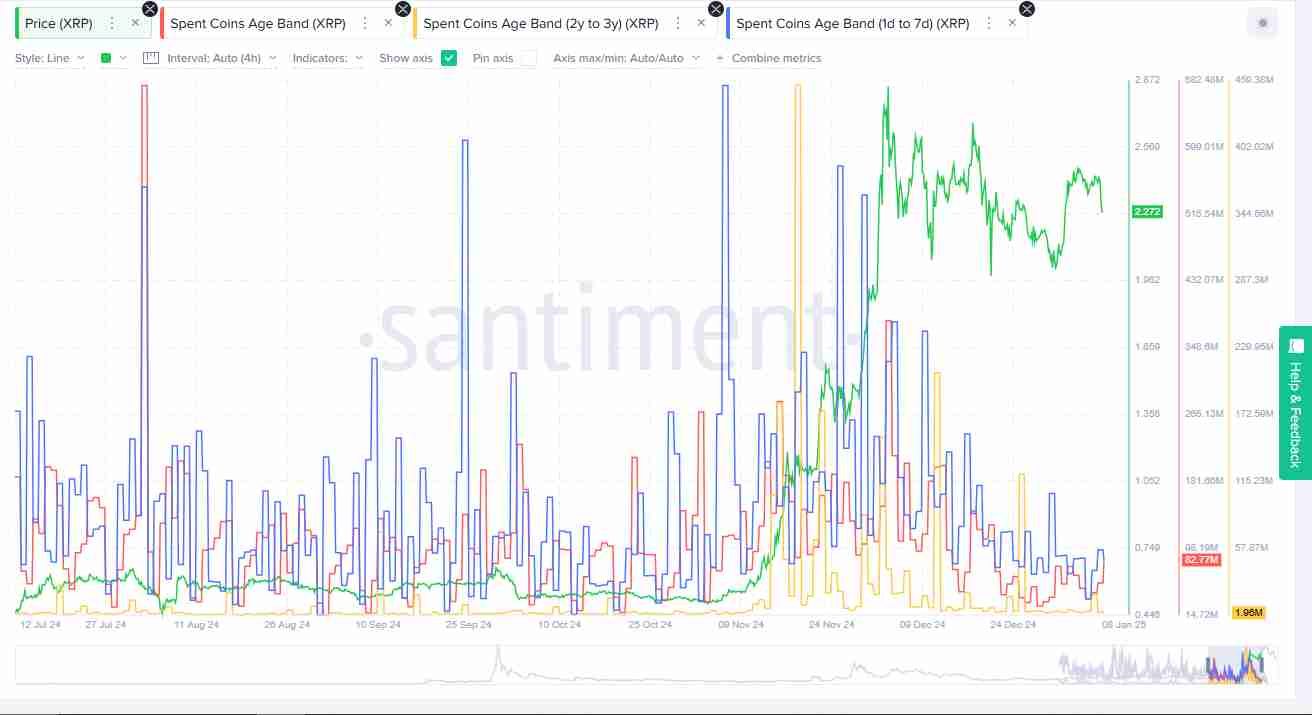

More interesting aspects of XRP’s price action are the way that short-term XRP holders led the selling activity.

While this was happening, whales saw the opportunity and capitalized on the dip.

According to the Spent Coins Age Band metric, which tracks how long tokens are held before being sold, traders who held the cryptocurrency for less than 180 days were the most active sellers.

This data, according to Santiment, shows that short-term holders were cutting losses, while mid-term holders were securing profits.

Large transactions on XRP, however, went to the upside by around $3 billion, according to data from IntoTheBlock.

This indicates that while the fish panicked, the whales doubled down.

Will XRP Hold the Line?

The XRP price is currently battling to maintain its standing around the $2 price level, especially after crashing so hard over the last week.

However, the facts remain that if the cryptocurrency fails to hold the line above $1.96, the token could slip toward the underside and test the $1.26 price level.

The RSI and MACD are currently showing levels beneath neutrality, indicating that the bears have the upper hand.

For XRP to regain strength, it must break decisively above the $2.45 resistance level.

If this happens, it could open the door to more upside, where we might see a retest of $2.5 or even $2.62.

On the other hand, a daily close below the $2,000 zone could cement the bearish outlook and push XRP lower.

Traders need to remain on high alert because what happens next with XRP will depend on the broader market sentiment as well as technical triggers and other institutional developments.

As it stands, the next few days will be highly important for XRP, especially in determining where it goes next.

Is XRP set to reclaim lost ground or spiral further downwards? Only time can tell.