What Does Day Trade Mean in Crypto?

Day trading is a type of trading in which both the trade placement (buying) and the trade square-off (selling) take place on the same day. This quick trading strategy does not carry over any trades to the next day.

A benefit of this trading strategy is that traders can make quick profits from the trade and do not have to wait for long to realize profits.

Day trading originated in the stock markets with definite opening and closing times. Closing a trade within a day protected traders from any overnight shocking news or unexpected market behavior that might disrupt their profits.

However, in the world of crypto, exchanges function 24/7, and the main motive of day trading remains to capture quick trends and make quick profits from them. Sometimes, such a short trading activity is called “Scalping.”

Why Are Users So Attracted Towards It?

Users are attracted to day trading because of the lure of instant profits. Though it’s a little difficult to believe that money can be made so quickly, several proven traders do so on a regular basis.

Unlike widely believed, day trading does not only include direct crypto buying and selling. Sometimes, it includes arbitrage trades where users exploit the different prices to buy cheap and sell at a higher price. Further, there are also leveraged trades where the risks and rewards are much higher, even a hundred times more than normal trading.

However, it is not an easy way to make money. To consistently profit from day trading, crypto users need to learn all the possible scenarios a trade can go through. They must also practice their trading skills on dummy apps before trading with real funds.

There are several guides, trading platforms, telegram groups, subreddits, and even YouTube channels where traders can easily learn trading skills.

Step-By-Step Day Trading Guide on a CEX

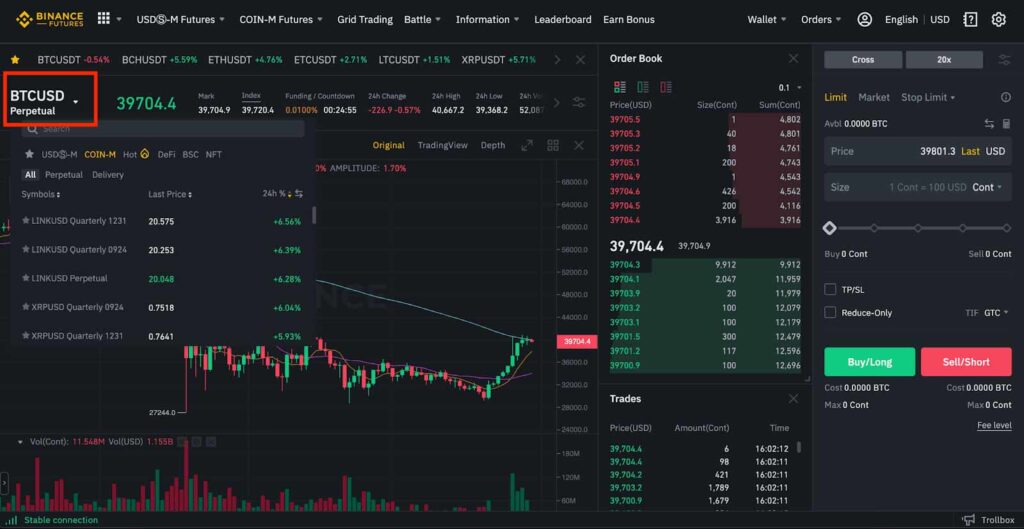

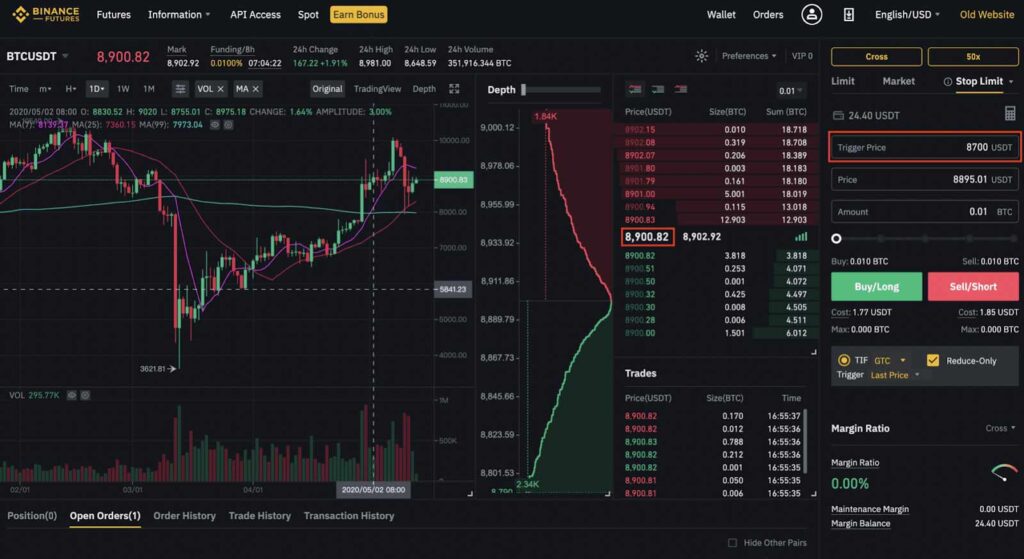

Whether you use Binance, Coinbase, OKX, or any other trading platform, most of the steps shown in the guide below are similar for all centralized exchanges (CEX).

- You are ready to place a trade once your exchange wallet is loaded with fiat money or stablecoins.

- From the markets page, choose a trading pair that you wish to trade. Always ensure they have enough liquidity so that you can enter and exit the trade the way you want. Below is the screen that appears when you select the Bitcoin/USDC trading pair on Binance.

Note that for easy calculation, traders mostly choose stablecoin-based trading pairs like BTC/USDT, BTC/FDUSD, ETH/USDC, ETH/USDT, and similar ones. Other pairs, like BTC/ETH, make it difficult to calculate profit or loss because both cryptos are moving in their own manner.

- Then, choose the leverage you want; for an ordinary trade, this leverage is 1x. It can go higher, say 100x, giving you 100 times more profit but also posing a 100 times risk.

- Once your trade is placed, wait for your desired levels to arrive and exit the trade to realize the profits. Sometimes, you also might have to exit the trade because it went in opposite direction and your stop-loss was triggered.

Here, it is important to remember that stop-loss should be used to limit the loss if your trade goes wrong. It is usually set before a trade is setup and prevents losses higher than a certain level, say 5%.

Can You Day Trade on DEXs?

Yes, you can also day trade on DEXs. There are a few differences, though. For day trading on DEXs, you need a wallet, preferably a multi-token wallet like MetaMask, Trust Wallet, 1-inch Wallet, etc. The wallet should have enough USDT or any other stablecoin you prefer.

Once on a DEX, you can place a trade to buy any asset like Polygon, Ethereum, BNB, Solana, or any other crypto based on your preference and analysis. This is usually done through swapping, where stablecoins are swapped for cryptocurrencies.

You then need to hold the stablecoins for as long as you want to hold the trade. Once your profit levels arrive or you hit a stop-loss, you can finish your trade by swapping the asset with any stablecoin.

Top Day Trading Strategies

Here are some of the commonly used day trading strategies. Try to understand them in detail and practice them as much as needed before using them with real funds.

- Breakout Trading: Here, traders wait for a certain price to appear, called the breakout level, above which the momentum increases drastically in crypto. This is where users buy longs or sell shorts to make money.

- Trend Reversal Trading: In this type of trading, the user waits for a change in the crypto price trend, and as soon as it changes, traders place a trade here.

- Moving Average Crossover Strategy: In the moving average crossover strategy, traders wait for two moving averages, like 50EMA,100EMA, or 200EMA, to cross with each other and then place a trade accordingly.

Swing Trading: In swing trading, traders benefit from the small bouts of volatility in the markets and trade based on the frequent rises and falls in crypto prices.

Frequently Asked Questions

What is the 3-5-7 rule?

In day trading, traders take subsequent profits at 3%, 5%, and 7% to avoid losing all gains. This makes sure that some profit is realized in a trade.

Is day trading equal to gambling?

Trading just on instinct is gambling, but with informed opinions, charts, strategies, and news, users can maximize their chances of profit.

![Top Altcoins in October [2024] You Should Look Out For 20 Top Altcoins in October [2024] You Should Look Out For](https://cryptolandoff.com/wp-content/uploads/2024/10/Top-Altcoins-in-October-2024-You-Should-Look-Out-For.jpeg)