Key Takeaways

- There is an ongoing trend of indirect crypto exposure among major US states.

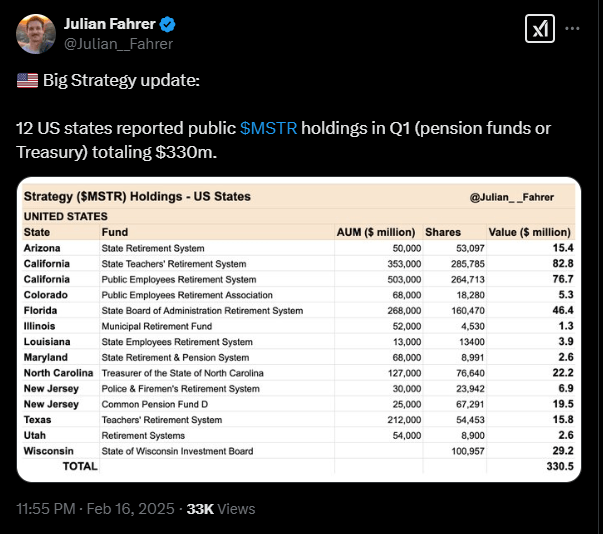

- According to analyst Julian Fahrer, around 12 US states now hold shares of Strategy (previously MicroStrategy).

- These states hold a combined $330 million in crypto-related stock, in an encouraging trend of investments.

- Strategy itself continues to expand, buying more and more Bitcoin and outperforming the crypto market.

- This trend is expected to continue further into the future, as more states jump on the bandwagon.

Bitcoin continues to gain traction across the globe, especially with the boom of several new financial products.

This time around, US state pension funds and treasuries are now turning towards indirect exposure by raking in hundreds of millions worth of crypto products.

By the end of 2024, around 12 US states collectively held $330 million in MicroStrategy (now Strategy) stock.

This comes as a major indicator of state funds capitalizing on Bitcoin’s growth without directly having to buy the asset.

Here’s everything to know:

California Leads The Way

Over the year, California emerged as the leading state investor in this stock. The state’s Teacher Retirement fund alone holds around 285,785 shares of the company, which is valued at around $83 million as of 14 February.

Additionally, the state’s Public Employees’ Retirement System (CalPERS)—which manages around $149 million worth of portfolio assets—holds 264,713 shares of the company, valued at around $79 million.

This stands at more than half its entire holdings and shows a strong commitment to Bitcoin’s growth.

Not only this, California’s pension fund holds other kinds of crypto-related stock aside from Strategy.

The state’s pensioners also hold investments in Coinbase (COIN) with the Teacher Retirement Fund’s holdings in Coinbase being valued at around $76 million.

This means that California’s Teacher Retirement Fund holds nearly $160 million worth of crypto-related stock.

This shows a deepening state of crypto involvement, as far as California is concerned.

The Appeal of Indirect Bitcoin Exposure

One of the major reasons for these states jumping on the Bitcoin bandwagon is the ease of gaining exposure to the asset without having to buy it outright.

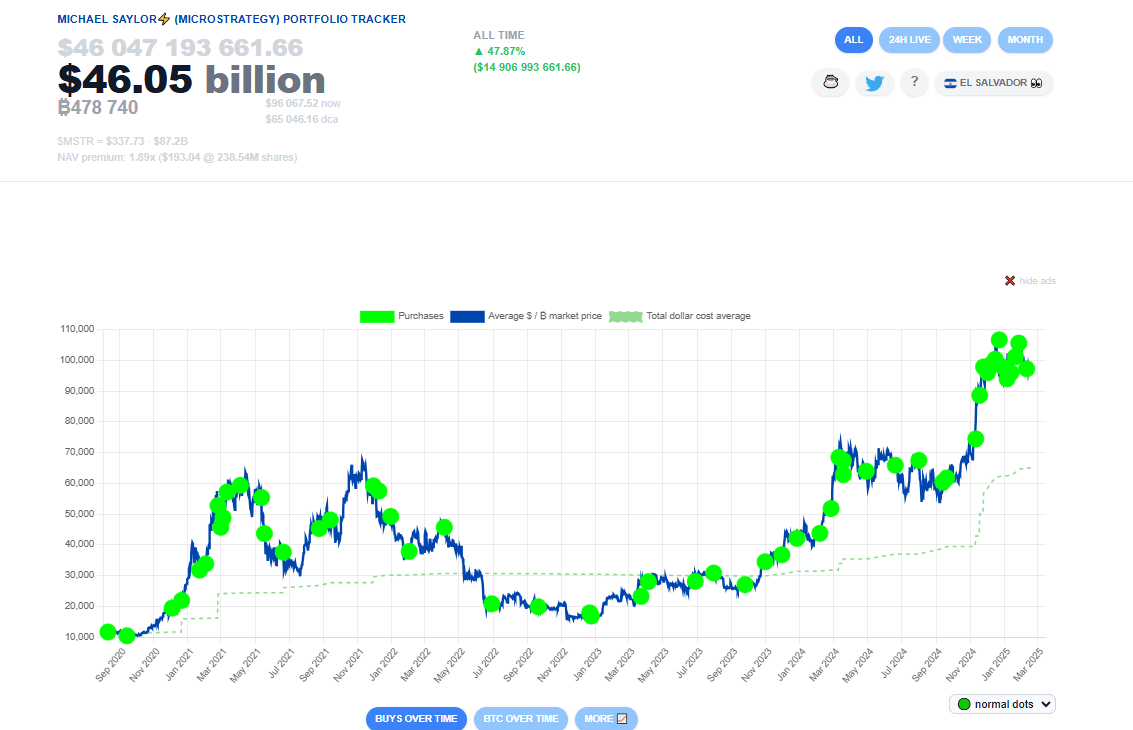

Strategy has built a reputation for itself as a Bitcoin Treasury company and holds around 478,740 BTC, according to Saylor Tracker.

This tranche of Bitcoin is worth around $46 billion at current market prices and might be the cause of the ongoing confidence.

Pensioners investing in Strategy stock means that they wish to gain exposure to to the cryptocurrency’s upside, without having to directly own the asset (owing to the regulatory and volatility issues).

What About Other Countries?

Other states like Florida, Wisconsin, North Carolina, and New Jersey have also made major investments in strategy over the year.

For example, Florida’s State Board of Administration of the Retirement System holds around 160,470 shares of Strategy.

This tranche is valued at around $46 million, with Wisconsin’s State Investment Board holding 100,957 shares worth $29 million.

Meanwhile, North Carolina’s treasury has $22 million invested, along with New Jersey’s Police/Firemen’s Retirement System and its Common Pension Fund holding $26 million.

These investments show a growing trend of states making efforts to diversify their portfolios by adding bitcoin exposure.

The corporate stock method is also a positive trend, as it shows an effort to reduce their reliance on traditional asset classes.

Strategy’s Impressive Performance

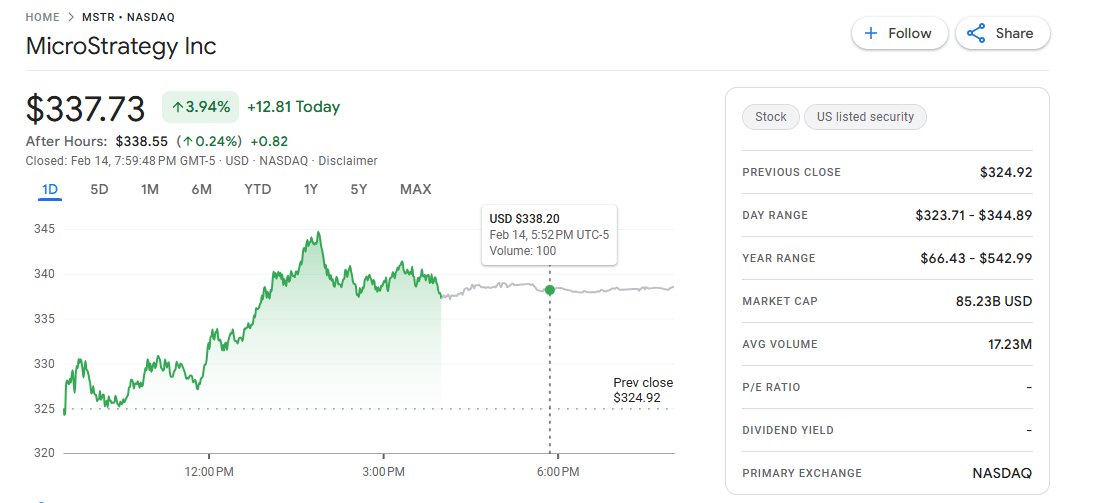

These states’ interest in Strategy stock is not without reason. The performance of the company’s stock has been remarkable so far, showing the company’s growing influence in the crypto space.

Strategy’s stock surge has also reflected the general bullishness of the crypto market.

Since the start of 2025, the company’s stock has risen by an impressive 16.5%.

More impressively, it has been up by around 383% since February of last year.

This means that Strategy itself is now outperforming the crypto market itself, which has seen a mere 62% increase during the same period.

Because of this, Strategy has become an attractive option for institutional investors, including State Pension Funds who are seeking exposure to Bitcoin’s growth without having to directly invest in the cryptocurrency.

The company’s strategic focus on Bitcoin has also paid off clearly, and has cemented its position as one of the major players in crypto.

Strategy Continues To Expand

Strategy continues to demonstrate an unwavering faith in Bitcoin. The company recently acquired an additional 7,633 BTC between 3 and 9 February of this year, at an average price of around $97,255 per coin.

This acquisition continues to solidify the company’s position as a Bitcoin juggernaut, with the cryptocurrency now a major part of its balance sheets.

Strategy’s continuous expansion into Bitcoin continues to make it a go-to option for institutional investors looking to gain indirect exposure to crypto.

State pension funds and treasuries are also using crypto as a way to explore Bitcoin’s benefits and stave off some of the direct risks of holding the asset.

Other States Exploring Bitcoin

The trend of states investing in Bitcoin is not limited to Strategy stock.

There have been increasing calls for state treasuries to buy Bitcoin, with states like West Virginia for example, recently proposing the inflation protection act of 2025.

This bill is aimed at allowing the state treasury to allocate funds to digital assets like Bitcoin, along with precious metals.

In the same vein, Utah has also passed a bill, allowing its state treasury to invest in Bitcoin, altcoins and even stablecoins.

Kentucky has introduced a similar legislation that will permit up to 10% of state funds to be allocated to crypto and other digital assets.

These trends across major US states show a growing trend of crypto adoption, even in government either through direct exposure or via proxy as we have seen with Strategy and Coinbase.

As the market continues to mature over the years, more states will likely follow suit and add crypto to their portfolios in the future.