Key Takeaways

- The crypto market crashed strongly over the week, with thousands of traders forced out of positions.

- According to speculation, this decline came from a series of sell-offs between Binance and Wintermute, its main market maker.

- While Binance has denied dumping large amounts of crypto to manipulate prices, the fears persist.

- There is also speculation about the US and Donald Trump manipulating the price of Bitcoin to stock up on a strategic reserve.

The price of Bitcoin crashed recently, bringing the rest of the crypto market down along with it.

The price of the cryptocurrency slipped underneath the $95,000 mark and was testing the $82,000 zone in as little as three days.

The RSI on the daily charts took a nosedive, and nearly every indicator turned bearish.

In the aftermath of the crash, however, there are now speculations that Binance might have been responsible for manipulating the market after selling large amounts of BTC, ETH, and SOL.

Here are all the speculations surrounding the crash.

Wintermute’s Large Withdrawals Spark Market Concerns

Right around the crash, Wintermute, Binance’s primary market maker, was observed to have been pulling large amounts of SOL from Binance.

The timing of this move came just days ahead of Solana’s $1.5 billion token unlock, which was set for 1 March.

Many commentators have speculated that Wintermute and other market makers may have been positioning themselves ahead of the possible price shift from the unlock.

According to insights from blockchain analytics platform Arkham Intelligence, the $SOL withdrawals haven’t been a one-time thing.

Wintermute had been making these consistent withdrawals from Binance, with each batch ranging between $2.6 million and $5 million.

The firm even withdrew notable amounts of Bitcoin and Ethereum, leading to more speculation about its actions.

While Binance has denied the allegations of collaborating with Wintermute to manipulate the market, the timing still has many traders feeling uneasy, especially with the incoming flow of new SOL into the market.

What’s Actually Happening?

These massive withdrawals have been denied by Binance. This means that if the exchange is to be believed, there was no market manipulation whatsoever.

At least not from Binance—so why did Bitcoin crash anyway?

One possible explanation for the movement of these tokens is that Wintermute could have simply been withdrawing SOL after purchasing it from Binance.

Another is that it could have been unstaking its previously held tokens.

One of the primary functions of a market maker is to provide liquidity to the market, and Wintermute could simply have been doing just that.

Another interesting theory is that Wintermute could merely have been reducing its exposure to Binance’s order books.

This could have happened as a result of the crash itself—meaning that Wintermute may not have caused the crash but was simply responding to it.

However, nothing is confirmed so far, and the speculation continues to grow about what exactly went down between these two entities.

The Impact on Crypto Markets

One more thing to note is that the timing of these withdrawals and the Solana unlock have strengthened the bears so far.

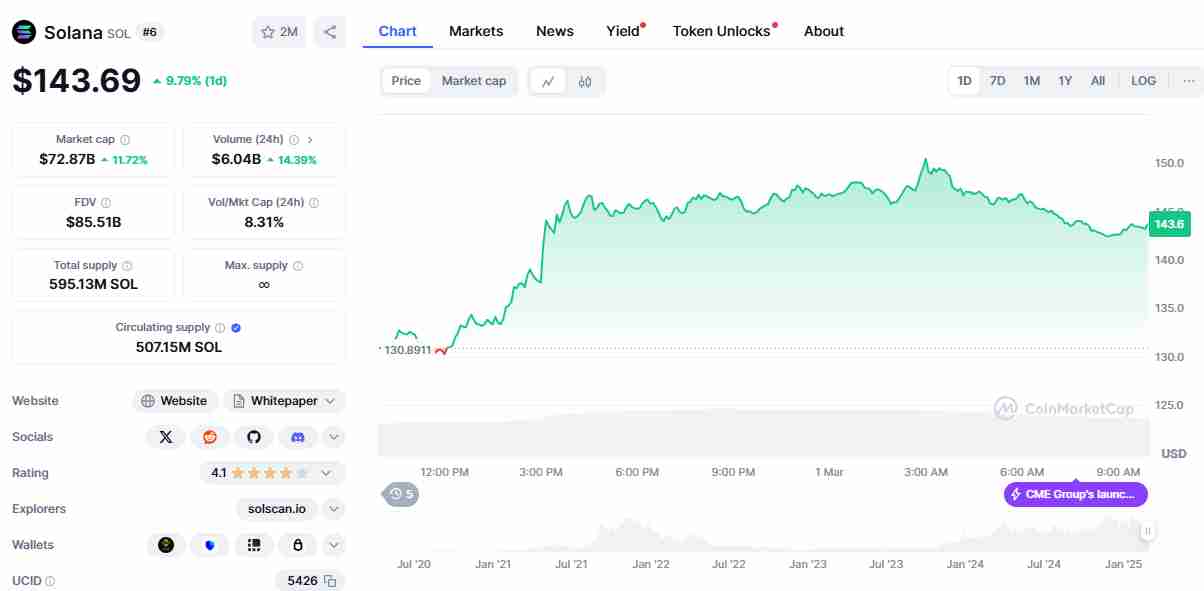

The cryptocurrency is currently up by around 10% over the last 24 hours at the time of writing.

However, it is still down by a staggering 16% over the last week.

It now trades at around $143, which is impressive considering its crash to $125 only a few days ago.

Considering this, a major reduction in liquidity at Binance (because of Wintermute’s actions) could make the market unstable from here.

When liquidity tanks, spreads become wider, and prices swing even more wildly as a result.

With this being said, traders will have to be cautious when interacting with the market over the weekend.

The fears still loom, though, over whether these movements are normal activities or signs of a larger, coordinated manipulation attempt.

Was Donald Trump Somehow Involved?

As if the market wasn’t dealing with enough trouble already, another unverified rumor emerged over the last few days.

This time, instead of Binance and Wintermute, these linked US President Donald Trump to the price manipulation scheme.

According to Crypto Rover in a recent post on X, Donald Trump might have orchestrated a market dump to accumulate BTC for a strategic reserve.

While there is no strong bit of evidence to support this claim, this rumor spread quickly, causing Bitcoin price fluctuations.

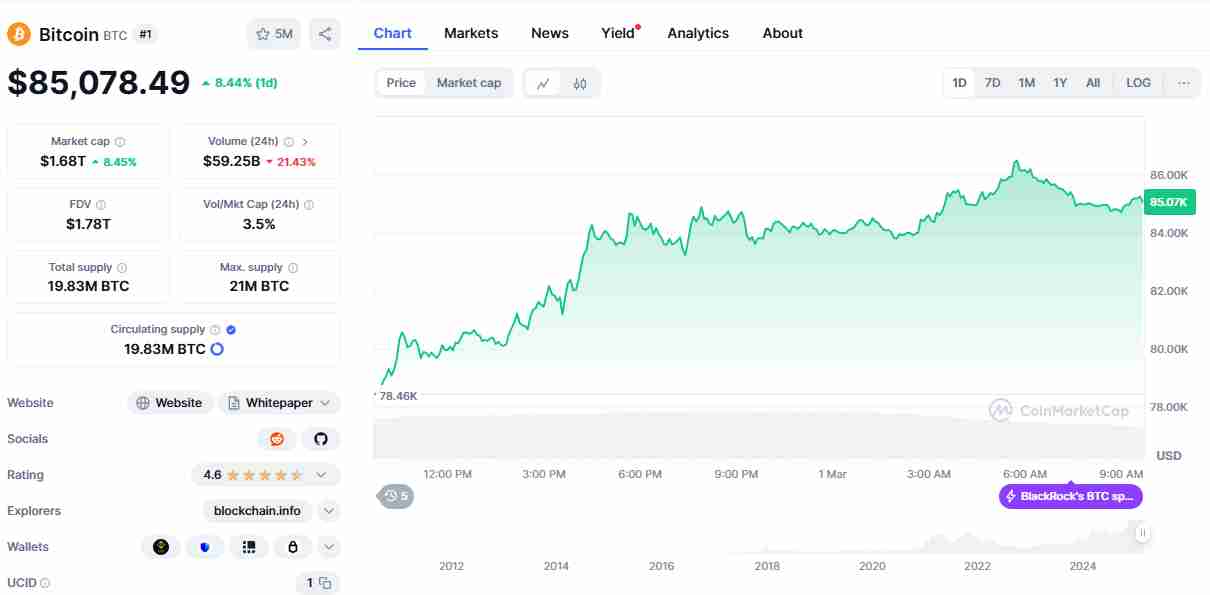

For example, after the tweet on Friday, the cryptocurrency dropped sharply to the $78,000 zone before rebounding almost immediately to the $85,000 zone where it now sits.

Trading volumes also mirrored price movements, after jumping from a $30 billion low to as high as $59 billion at the time of writing.

While this sudden shift led to the liquidation of over $100 million in bullish positions, it also affected the rest of the altcoin market.

Technical Indicators and Market Outlook

From a technical perspective, Bitcoin’s RSI dropped from bullish levels to as low as 30, which indicated that it was oversold.

The MACD also showed a bearish crossover between 26 – 28 February as more and more sellers capitalized on the downtrend.

The 28 February candlestick ended up as a long-tailed doji, indicating that many buyers jumped back into the market around the $78,000 zone.

This means that we might be seeing more of a recovery, with Bitcoin likely to reattempt taking the $90,000 zone once again.

However, despite the volatility, Bitcoin’s network fundamentals remain strong, with the number of its daily active users recovering as of 1 March.

Transaction volumes have also been on the rise, as illustrated earlier, with the addition of nearly $20 billion in processed volume over the last 24 hours before press time alone.

Overall, while Binance continues to deny selling off crypto to manipulate the market and there is no concrete evidence about Donald Trump and the US manipulating prices, the speculation remains strong.

Is the worst of Bitcoin’s crash gone, or is a stronger correction inbound?