Key Takeaways

- ByBit was hit with a major hack this week that saw around $1.5 billion stolen.

- This hack is now labeled as the largest in crypto history by major security firms.

- Following this hack, Bybit’s ethereum reserves have rebounded strongly and are holding up well.

- Such a quick rebound shows a great deal of investor confidence and could be a signal that the bull run is returning.

- Meanwhile, the Lazarus group continues to launder the stolen funds despite the 10% bounty offered by Bybit.

The crypto industry recently took a kick to the shins, with one of the largest hacks in history hitting ByBit.

The hack, reportedly carried out by the North Korean Lazarus group, saw around $1.5 billion worth of ETH stolen from the exchange.

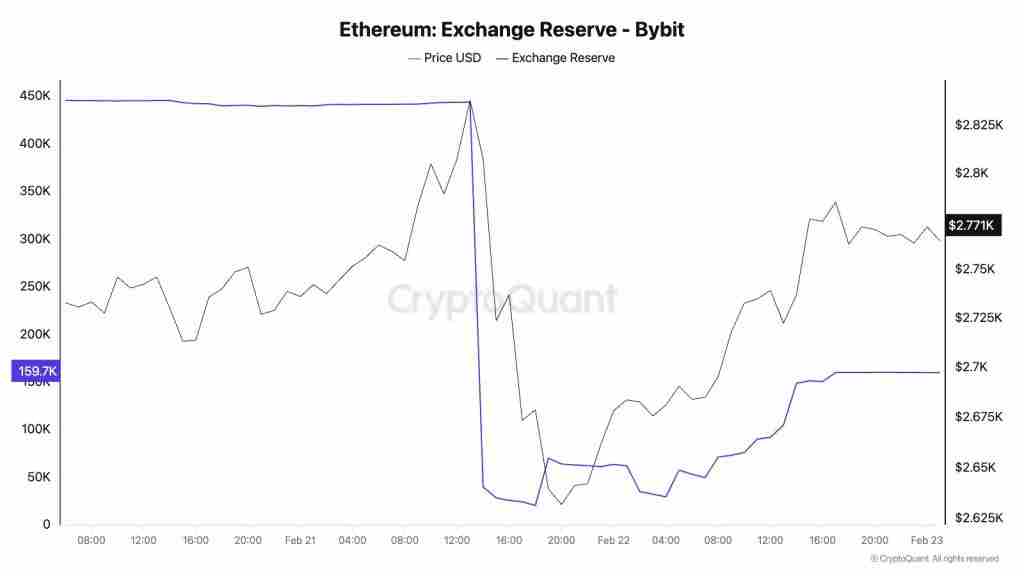

However, in the aftermath of the attack, Bybit’s Ethereum reserves have been shown to be recovering rapidly.

This is a great signal for Ethereum and the rest of the market in terms of market confidence, and here’s what these events could mean for the market as a whole.

The Bybit Hack

This incident is now being referred to as the largest crypto hack to date.

ByBit was attacked by malicious actors in an attack that led to most of its Ether reserves being drained.

According to a CryptoQuant report, the exchange’s ETH reserves crashed from 443,691 ETH to a devastating 63,807 ETH.

This drop caused a crash in the price of Ethereum by around 4%; even though ByBit still has not disclosed the exact amount of ETH lost yet.

Despite the scale of the attack, the exchange’s response was swift, with ByBit managing to stabilize things and recover a portion of the stolen funds.

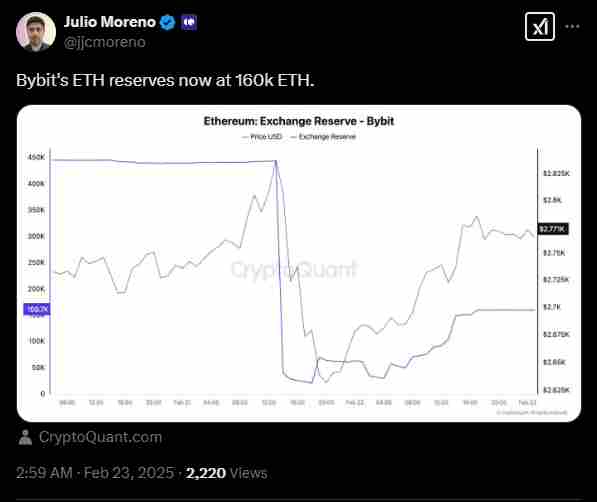

The latest data at the time of writing shows that the exchange’s reserves have rebounded to around 160,000 ETH, showing that ByBit is recovering gradually and is regaining the confidence of its customers.

Recovery and Efforts to Regain Trust

Bybit’s efforts to recover after the attack have been ongoing.

Julio Moreno, the head of research at CryptoQuant, reiterated that despite the setback, Bybit’s net inflows have increased.

Within such a short time span, around 1.6 million ETH has returned to the exchange’s cold wallets.

This inflow of Ethereum shows that traders are feeling more secure about the platform’s stability and are trading as usual.

In addition, Ben Zhou, the exchange’s CEO, took to X to express gratitude to the crypto community for its support.

A Deeper Look at the Hackers’ Moves

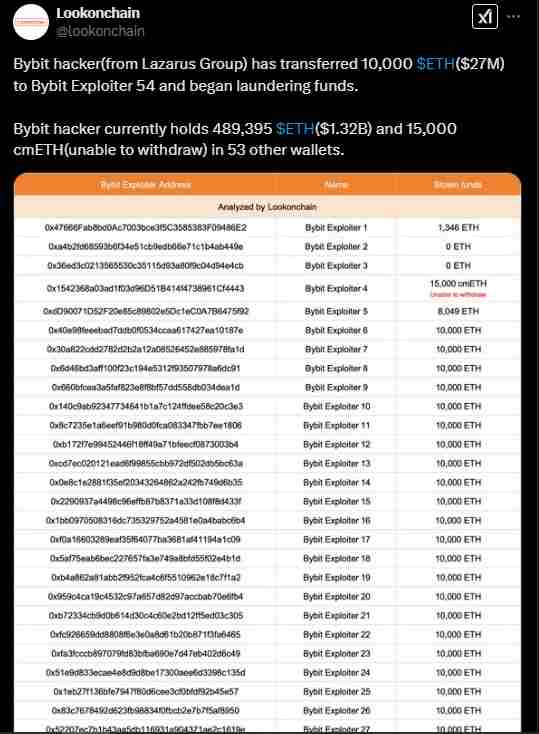

Soon after the attack, Arkham Intelligence, in collaboration with on-chain sleuth ZachXBT, identified the North Korean Lazarus Group as the masterminds behind the attack.

According to insights from LookOnChain, the hackers have begun moving the funds around.

The syndicate recently moved over 10,000 ETH (worth around $27 million) to a wallet labeled “Bybit Exploiter 54.”

This wallet has been the major laundering tool for the funds, with around 489,395 ETH (worth over $1.3 billion) still under the control of the hackers.

This is alongside the 15,000 Mantle Restaked ETH (cmETH) spread across 53 more wallets.

Funds Recovered and Bounty Program

In terms of financial recovery, some of the stolen funds have already been tracked and recovered.

For example, Mudit Gupta, Chief Information Security Officer at Polygon, reported that around $43 million had been recovered.

Tether CEO Paolo Ardoino also confirmed that 181,000 USDt (Tether) stolen during the hack had been frozen.

Bybit even offered a bounty program, offering up to 10% of the recovered amount (about $140 million to the attacker(s) or whoever helped recover the stolen funds.

Does This Support the Bull Run Theory?

The rebound of ByBit’s exchange reserves has led to speculation about whether this recovery has deeper meanings.

Such a quick recovery shows that traders are regaining confidence at an unparalleled rate.

It also means that investors are preparing for a larger move across the crypto market.

This, of course, points towards the start of a possible bull run, as higher exchange reserves typically point toward an increase in market activity.

The increase in reserves (especially after such a major hack) shows that investors are still willing to deposit their assets.

More trading activity equals more market participation, which in turn fuels a bull run.

Despite the positive signs ongoing in ByBit’s recovery, it is important to understand that the crypto market is a highly volatile one.

This means that it is still vulnerable to factors like global economic conditions, inflation, regulatory changes, and macroeconomics from major world economies.

The security concerns at Bybit are also another factor in need of consideration.

Centralized exchanges continue to come under attack by malicious actors, leading to calls for higher security to protect user funds.

Despite the hack, ByBit has shown resilience, not just in terms of its reserves but also in its efforts to rebuild user trust.

The recovery of its reserves is a major case study in crisis management.

Whether this event translates into a broader bull market in the future remains to be seen. However, the increased participation from investors shows a growing trend of bullishness.