Key takeaways

- The Bybit hack continues to pull in more and more debates, a week after the infamous hack.

- Some of these debates now revolve around implementing a “rollback.”.

- A rollback is a way to reverse the transaction ordering on a blockchain, essentially allowing developers to remove certain transactions.

- However, the implications of such a move would be immense for the rest of the Ethereum community.

- Considering how interconnected the Ethereum network is, the chances of a rollback remain unlikely.

The chatter around the devastating $1.5 billion Bybit hack has died down somewhat, but the crypto industry continues to feel its effects.

Some industry figures are now calling for an Ethereum network rollback to “reverse the damage” and recover the stolen funds.

However, several Ethereum developers have drawn out issues with the idea, warning that such a move would not only be impossible but will also have major consequences.

So what is an Ethereum rollback, and why the buzz about it?

Let’s find out.

Understanding the Bybit Hack

The event in question—ByBit’s hack—occurred only last week on 21 February, when hackers exploited the exchange’s systems and manipulated it into sending $1.5 billion to their wallets.

Naturally, a great fix for this would be a rollback.

Think of a rollback as a way to “undo” certain transactions or blocks in a blockchain.

This would essentially allow developers to “reverse time” in a way and make it so that the Bybit hack never happened.

Something like this happened during the infamous DAO hack of 2016, where a staggering 3.6 million ETH was stolen.

Developers were able to create a rollback, which hard-forked the Ethereum network and allowed the recovery of said funds.

However, ByBit’s situation is different in several ways.

For example in the DAO’s case, the platform had a built-in fail-safe that prevented withdrawals for a month.

This timeframe allowed developers to put things in place for the rollback and recover the funds.

The funds stolen from Bybit, on the other hand, were almost instant, with the hackers moving the stolen funds across various wallets immediately after.

Why a Rollback Is Nearly Impossible?

According to Ethereum core developer Tim Beiko, reversing the Ethereum network to its pre-hack state is infeasible for several reasons.

One of these reasons is that no protocols were violated during the Bybit hack.

This means that the transactions appeared valid under Ethereum’s rules:

There was no instance of valid rule breaking that would justify a rollback without affecting the other legitimate transactions.

Another reason is that Ethereum has evolved by a great deal since 2016, with more dapps, cross-chain bridges, etc already deployed on it.

A rollback on such an interconnected network would have a ripple effect, where more exchanges and lending protocols would suffer harsh consequences.

Finally, transactions on Ethereum are final once confirmed.

This means that rolling back the network would undo the hacker’s moves successfully.

However, it would also undo every last transaction that occurred afterwards and harm innocent users.

Beiko reiterated that if the rollback occurs (even if supported by the community), chaos would likely ensue.

The Debate Over Ethereum’s Decentralization and Security

One more problem with this rollback suggestion is the debates around Ethereum’s core principles.

Supporters continue to argue that rolling back the network would prevent stolen funds from being misused (especially how the funds have been traced to North Korea’s lazarus group).

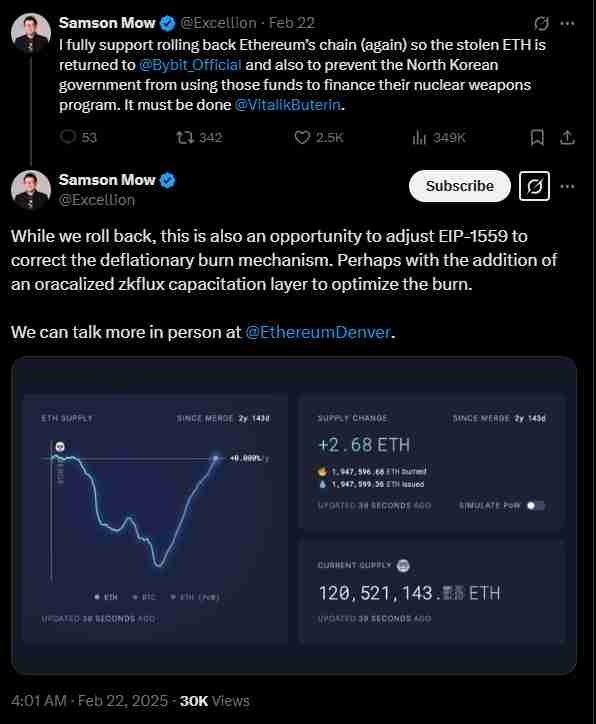

Said funds would likely be used to fund cybercrime and weapons programs, and according to Jan3 CEO Samson Mow, a rollback would be justified in this scenario.

Critics like Anthony Sassano, on the other hand, continue to maintain that “That’s not how any of this works.”

Interestingly, Bybit CEO Ben Zhou has maintained a neutral stance, stating “I am not sure it’s one man’s decision […] It should be a voting process”

Could Ethereum Even Execute a Rollback?

Bitcoin works via a chain of transactions that could theoretically be reversed.

However, Ethereum’s model is a lot more complicated, considering how it adds smart contracts to the mix.

It also updates account balances through the help of smart contracts, which means that there is simply no easy way to “rewind” the blockchain.

Ethereum’s history also shows that it requires a hard fork to implement major state changes.

This is exactly what happened in the DAO hack mentioned earlier.

Even if possible, such a drastic move would require a massive vote. Considering how the Ethereum network contains everything from lending/borrowing protocols to staking protocols (not to mention other exchanges), this vote is unlikely to pass

The Implications Would Be More Than Just Money

Another factor to consider is the implications of such a move.

The implications of an Ethereum rollback would involve far more than Bybit’s $1.5 billion loss.

Beiko iterated that the financial damage from such a move would likely be far more than the stolen funds.

Everyone—defi platforms, businesses, investors, whales, and even regular users—will feel the heat.

In addition, such a move would set the ball rolling in the wrong direction.

If a whole rollback is implemented for Bybit, will similar actions be expected for hacks in the future?

If rollbacks became the go-to solution to unfortunate incidents in the crypto space, Ethereum’s stability and decentralization could take a massive hit.

What’s Next for Bybit and Ethereum?

Bybit continues working to recover the funds from the Bybit hack. There are also ongoing discussions with Ethereum co-founder Vitalik Buterin and the Ethereum Foundation. In the meantime, the war rages on about whether or not to implement a rollback.

Ultimately, the implications of such a move on the financial and technical fronts make it virtually impossible.