Key Takeaways

- Cardano (ADA) continues to attempt a rebound after multiple rejections from important resistances.

- The cryptocurrency registered its first green candlestick on Tuesday after five days of bearish candlesticks.

- A successful break from the $0..72 mark could trigger a rally further up to the $1 mark.

- A break below the $0.65 and $0.6272 price levels, however, could lead to a bearish continuation.

- Open interest and funding rates remain negative for Cardano, indicating the need for caution among investors.

Cardano has been facing strong resistance near the $0.72 mark over the last week.

This resistance has been single-handedly responsible for the cryptocurrency’s price rejections multiple times, as the bears apply more and more selling pressure.

On the other hand, Cardano has some strong support around the $0.64 price level, where buying pressure has helped stabilize things.

Let’s go over what’s happening with ADA lately and what the buyers need to do to establish another rally towards the $1 mark.

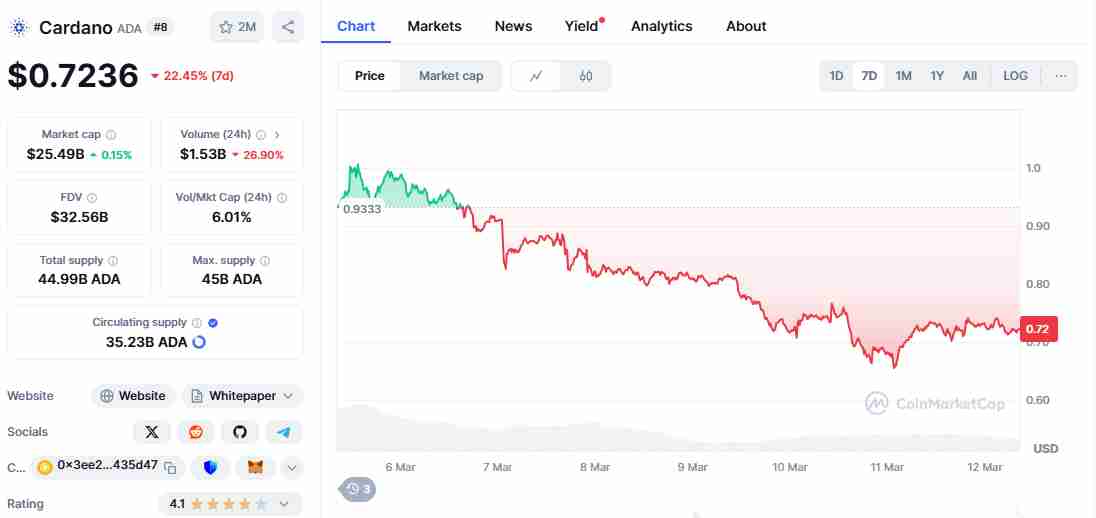

ADA’s Recent Price Movement

ADA moved slightly further downwards over the last two days.

However, the cryptocurrency found support around the $0.64 price level on Tuesday and is making an attempt at a recovery.

The $0.64 price level coincided with the cryptocurrency’s 200-day Simple Moving Average (SMA) and was responsible for the increase in purchasing pressure.

In essence, if the $0l64 price level holds, Cardano could be on its way to confirming a bullish reversal as positive sentiment returns for traders.

On the technical front, the Relative Strength Index (RSI) has been accurate at identifying ADA’s market conditions.

When the RSI moves above the 70 mark, it indicates that the bulls are strongly in control, and that the market is overbought.

This leads to price pullbacks as these bulls move to secure their profits.

On the other hand, when the RSI drops below the 30 mark, it shows oversold conditions and attracts buyers who are looking for a possible rebound.

At the time of writing, the RSI shows a reading of 45.90, indicating that while the bears are slightly stronger than the bulls, the latter are gaining strength and driving prices higher.

Cardano also registered its first green candle on Tuesday, after five consecutive days of selling pressure.

This has led to questions:

Could this recovery trigger a price surge to reclaim the lost $0.92 level? How likely is $1 for Cardano soon?

Market Performance and Sentiment

The last week has seen ADA lose a staggering 23% of its value, especially in light of the general crypto market’s downturn.

Tuesday’s bullish candlestick has led to some renewed optimism about ADA though, with the cryptocurrency now trading at around $0.7161.

In essence, this sudden reversal could be the start of a ADA bottom.

According to the charts, ADA is currently trading between the 50% and 64.39% Fibonacci retracement levels.

These two levels sit between the $0.6439 and $0.7441 price levels.

This said, if we see a clearing of the $0.7441 price level with a daily candlestick, it could lead to a target of the crucial $0.844 zone, which successfully held ADA up between November of last year and February before breaking.

Mixed Technical Indicators

While the price movement of Cardano shows that a recovery is possible, funding rates on the cryptocurrency remain highly negative, at around -0.0147%.

This continues a long-term trend of negative funding rates, which has been the norm for Cardano since early March.

While the RSI sits near the neutral zone and indicates a possible reversal for Cardano, the signal line still sits underneath the MACD, indicating that the bears still have the upper hand.

This is also without mentioning the sharp decline in Open Interest for Cardano, which indicates that leveraged investors are either abandoning their positions or are reluctant to open new ones considering the recent decline.

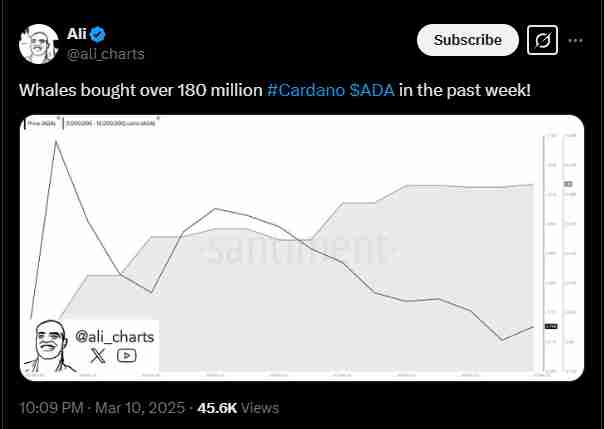

Whales Accumulate ADA

A source of relief for Cardano investors, however, has been the behaviour of the whales.

This cohort of investors has displayed strong dip-buying tendencies and continues to accumulate the cryptocurrency despite the downturn.

Independent analyst Ali Martinez recently pointed out that the whales bought a staggering 180 million ADA tokens over the past week.

This influx of tokens among entities with 1 million to 10 million ADA tokens amounts to a collective $6 billion, adding some bullish sentiment to Cardano’s future.

Such a large crypto accumulation rate among the whales often signals a confidence that a price rebound is about to happen.

If the accumulation continues, it could contribute to the upward pressure on ADA’s price and increase how likely a bullish turnaround is.

In the meantime, Cardano’s price continues to gain traction.

As mentioned earlier, retail investors should keep an eye out for what happens around the 67.8% Fibonacci retracement level at $0.7351.

A breakout could trigger further buying activity and allow Cardano to target the next major resistance level at the 78.6% zone, around $0.9216.

On the other hand, the major support sits between the $0.65 and $0.6272 price levels for Cardano.

This means that if the bearish momentum continues, these levels could serve as major defence zones against further decline.

Can ADA Rebound?

Cardano currently stands at a critical price level, especially as it attempts to recover from the recent downturn.

While prices are currently highly volatile at the time of writing, investors should keep an eye out for factors like key technical levels and whale accumulation to confirm a bullish reversal where possible.

On the flip side, traders should remain cautious, as a break below the $0.65 and $0.6272 price levels could trigger further declines for the cryptocurrency.