Key Insights

- The crypto market is in the middle of a slowdown, with Bitcoin and several altcoins posting losses.

- The reason for the downturn appears to be more fundamental than technical.

- Some possible reasons stem from the upcoming FED meeting and the Bank of Korea shunning Bitcoin as part of its reserves.

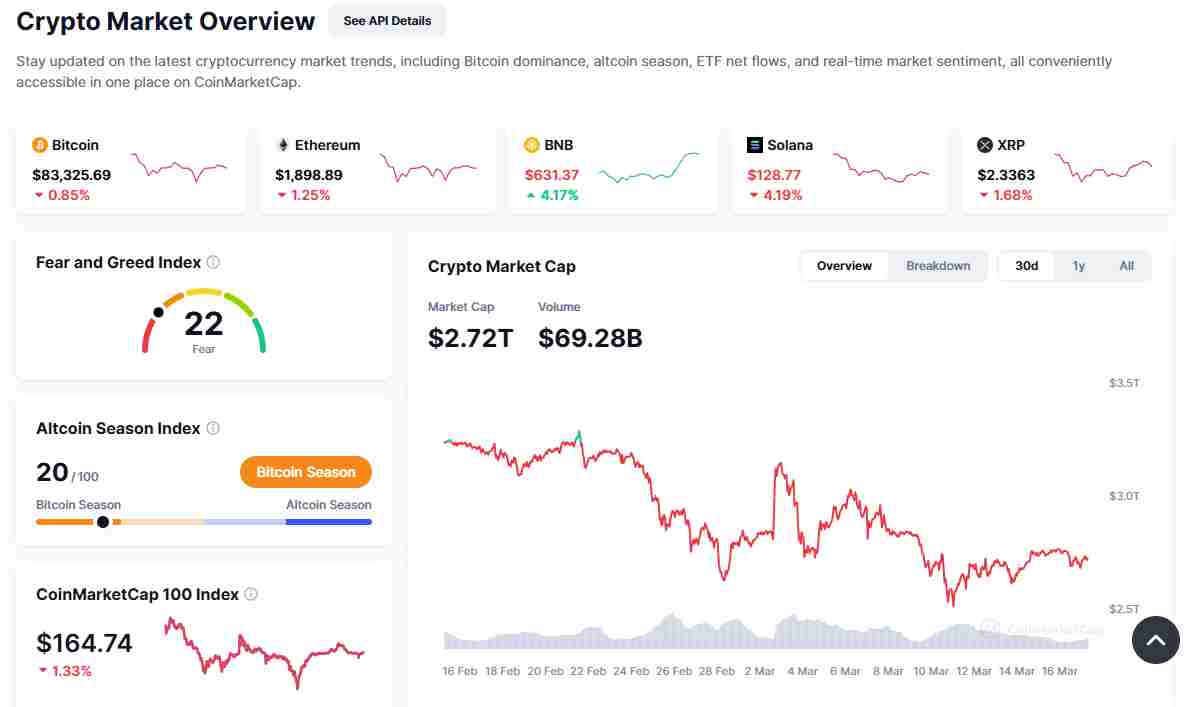

- The total crypto market cap currently sits at around $2.72 trillion, and is struggling to break past the $2.75 trillion resistance level.

- If Bitcoin successfully breaks above $85,000, it could move further upwards to the $87,041 zone and even tilt the market in favor of the bulls.

The crypto market is in the middle of a slowdown, with Bitcoin and several altcoins posting losses.

While the overall volatility of the crypto space has decreased, many major cryptocurrencies like XRP, Solana, Cardano, and Dogecoin have seen sharp declines.

In addition, the total crypto market cap (TOTAL) has struggled to break through key resistance levels.

All of the above has created a sense of caution across the crypto market.

So what is going on, and what is driving this downturn?

Key Market Developments

As far as the market goes, the reason for the downturn appears to be more fundamental than technical.

For example, a US court recently ordered crypto platform Debiex to pay $2.5 million in penalties and restitution.

This fine came after the firm failed to respond to a CFTC lawsuit after being accused of running a romance scam and defrauding investors out of $2.26 million.

In addition, the Bank of Korea (South Korea’s central bank) has confirmed that it has no plans to include Bitcoin in its foreign exchange reserves.

Per details, the main issue with Bitcoin, according to the Bank of Korea, is its volatility.

On top of this, the US Federal Reserve is preparing for its next policy meeting, where it is expected to discuss the next interest rates.

Investors generally expect the interest rates to remain unchanged.

However, regardless of the outcome of the meeting, the Fed’s stance on inflation and economic conditions could have ripple effects across the stock and crypto markets.

Crypto Market Cap Holds Steady but Faces Resistance

The total crypto market cap currently sits at around $2.72 trillion and is struggling to break past the $2.75 trillion resistance level.

According to data from TradingView, the market lost around $20 billion in capitalization over the last day on Sunday.

This battle between support and resistance has been keeping the market in the consolidation phase, especially with the limited volatility preventing major price swings.

If the crypto market continues to drop further, it might see some support around the $2.63 trillion level.

However, a breakdown beneath this price level will trigger further declines for the sector as a whole.

On the flip side, a breakout above the $2.75 trillion zone would signal a renewal of bullish momentum.

The crypto market will have a great chance at targeting the $2.93 trillion – $3 trillion mark if this happens.

Bitcoin Struggles Below Key Resistance

According to data from TradingView and CoinMarketCap, Bitcoin is currently trading around the $83,691 price level.

The cryptocurrency is holding above critical support at $82,761, but is still struggling to break above the $85,000 resistance.

If Bitcoin successfully breaks above this barrier, it could move further upwards to the $87,041 zone and even tilt the market in favor of the bulls.

On the flip side, if Bitcoin fails to maintain support around the $82,761 zone, it could lead to a drop towards the $80,000 zone and open the doors to another crash.

CoinMarketCap data shows that the global crypto market cap has declined by 0.80% in the past 24 hours.

This figure now stands at around $2.73 trillion, while the trading volumes have surged by 37.64% to $65.28 billion (likely because of the resumption of trading activity in the ETF market between Sunday and Monday).

The total defi trading volume has hit the $5.12 billion mark, making up 7.84% of the total market volume.

On the other hand, the stablecoin market now accounts for around $61.15 billion in trading volume and stands at around 93.67% of the market’s total daily transactions.

Finally, Bitcoin dominance in the market remains strong and holds around a 60.72% share of the total trading volume.

Altcoins Show Mixed Performance

While Bitcoin and Ethereum have remained relatively stable, the rest of the market is in the middle of strong declines.

Ethereum has declined by around 1.5% to a new low of around $1,900, while Tether (USDT) is holding steady at $1.

Solana is down by around $4.4 to the $128 zone, while Pi Network, one of the worst performers, is down by 7.70% to $1.39.

Bitcoin’s Drop Ahead of Fed’s Interest Rate Decision

Bitcoin itself has lost more than 1% of its value on Monday, especially with investors exercising caution ahead of the 18 March FED policy meeting on March 18.

As mentioned earlier, investors expect the interest rates to remain unchanged, and are watching for any signs of how inflation and tariff policies will affect the FED’s decision.

In addition to investor fears, 21Shares recently announced the closure of two of its ETFs amid the ongoing market downturns.

Per reports, the ARK 21Shares Active Bitcoin Ethereum Strategy ETF (ARKY) and the ARK 21Shares Active On-Chain Bitcoin Strategy ETF (ARKC) will become inactive on 27 March.

Investors are expected to receive cash distributions upon liquidation.

What The Future Holds

Despite the current market struggles, analysts are still optimistic about Bitcoin in the long term.

In a recent tweet, economist Timothy Peterson predicted that BTC could reach new all-time highs by June.

This level could be as high as $126,000 for the cryptocurrency, considering Bitcoin’s seasonal trends.

According to Peterson, Bitcoin has historically seen the majority of its annual gains in April and October.

In essence, if historical patterns hold, Bitcoin could see a 50% surge in the coming months.

Overall, the short-term volatility has been a major hurdle so far. However, long-term indicators show that Bitcoin and the broader crypto market could see a comeback later in the year.

As always, investors should remain cautious and be alert for any price swings.