Key Insights

- The crypto market has been through a few ups and downs over the last few years.

- Amid these ups and downs, several trends and changes have occurred, from crypto to AI to regulatory oversight.

- Some of the most popular include the change in regulations, with Gary Gensler stepping down from the SEC.

- The crypto mining industry is also experiencing growth, along with demand for greener sources of energy.

- Venture capitalists are increasingly investing in the crypto space as the sector continues to expand.

The crypto landscape has been a major rollercoaster over the past few years.

However, the current year appears to be showing strong bullish signs, despite the ongoing bearish phase.

Everything from institutional adoption through the ETF market to innovations in AI is happening all at once, and the industry is changing at a rapid pace.

Here are some of the top trends for the crypto market for this year and beyond.

1. Bitcoin ETFs Fuel the Bull Market

Bitcoin surged by around 150% over the last year, in what many believe to be the beginning of a strong bull market.

The cryptocurrency started the year somewhere around the $44,000 zone before reaching the $70,000 zone in May.

Many analysts continue to predict that the cryptocurrency might have a high anywhere between $126,000 and $200,000 within a year.

One major catalyst that has fueled Bitcoin’s growth so far is the spot ETF markets.

The same is true for the Ethereum ETF market (although more sluggish) and has spurred calls for ETFs across the XRP, Solana, and even Cardano markets.

These investment vehicles allow investors to gain exposure to Bitcoin without directly buying the cryptocurrency , and is therefore easier for traditional financial investors to jump in.

So far, giants like BlackRock and Fidelity have emerged as leaders in the space, with BlackRock holding $15 billion in Bitcoin assets and Fidelity managing $9 billion at some point.

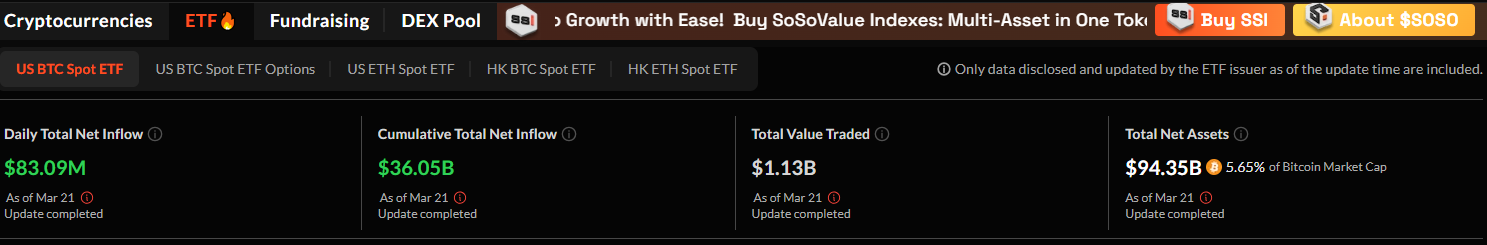

So far, the spot Bitcoin ETF market has a total of $94 billion in assets under management, along with a total value traded of more than $1 billion as of late March.

2. AI and Cryptocurrency

Artificial Intelligence continues to become more popular, especially in the crypto sector. So far, the crypto space has seen AI-related tokens become more and more tied to crypto projects.

These tokens saw exponential growth at the start of the year, around the time of Bitcoin’s rally towards the $110,000 zone.

The AI and crypto sector saw an all-time growth of around $2.7 billion in 2023 to nearly $30 billion today, even despite the ongoing dip.

The Artificial Superintelligence (ASI) token, or FET, is a prime example of this trend. This token has been one of the most resilient in the entire sector, especially after the merger between Fetch.ai, SingularityNET, and Ocean Protocol.

3. A Surge in Crypto Investment

The 2022 bear market was a harsh one for the crypto space. However, investor confidence started to return in 2023, when venture capitalists poured nearly $2 billion worth of capital into the sector within the fourth quarter alone.

Funding activity has remained strong since then, with nearly $500 million invested in blockchain startups in the second month of last year.

The Bitcoin mining sector has also been one of the biggest beneficiaries of this renewed investor interest.

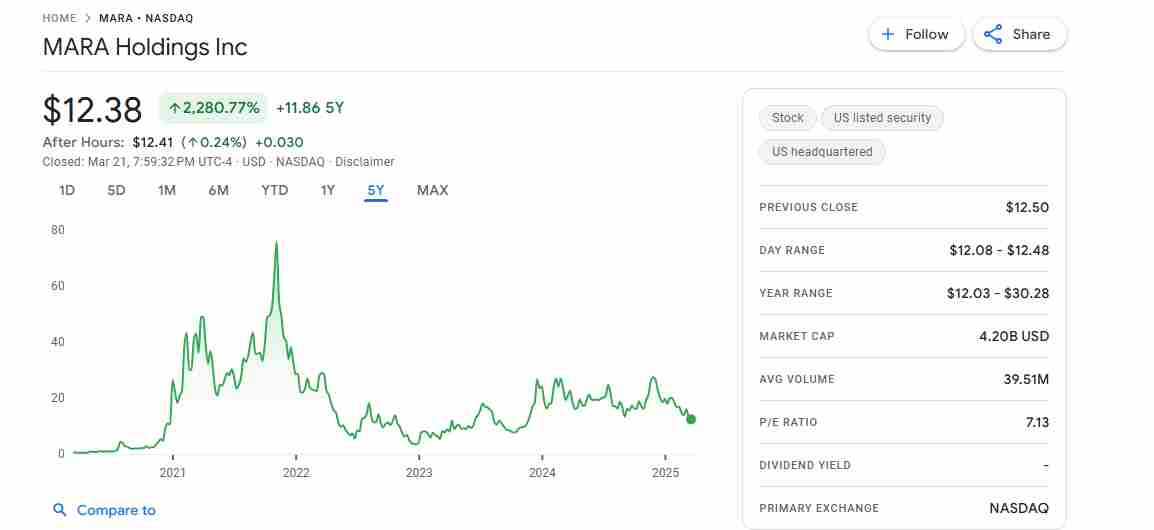

For example, publicly traded mining firms like Marathon Digital and CleanSpark have seen their stock prices skyrocket by 590% and 440%, respectively.

Google Finance data shows that Marathon Digital’s $MARA alone has held on to more than a 2,000% increase in share price over the last five years.

This is without mentioning the recent trend of acquisitions and expansion these mining companies have experienced since the last Bitcoin halving in April of the previous year.

4. Stricter Crypto Regulations

The collapse of FTX and other crypto-affiliated companies in between intensified the regulatory oversight on cryptocurrencies in the US.

The US Securities and Exchange Commission, in particular, ramped up its enforcement actions against crypto companies.

Some of the ripple effects of this move came with enforcement actions against other crypto companies like Coinbase and Binance.

Binance alone was ordered to pay up to $4 billion in fines for alleged misconduct.

On the other hand, the emergence of Donald Trump as the US president in November of last year brought in some fresh change to the US regulatory space.

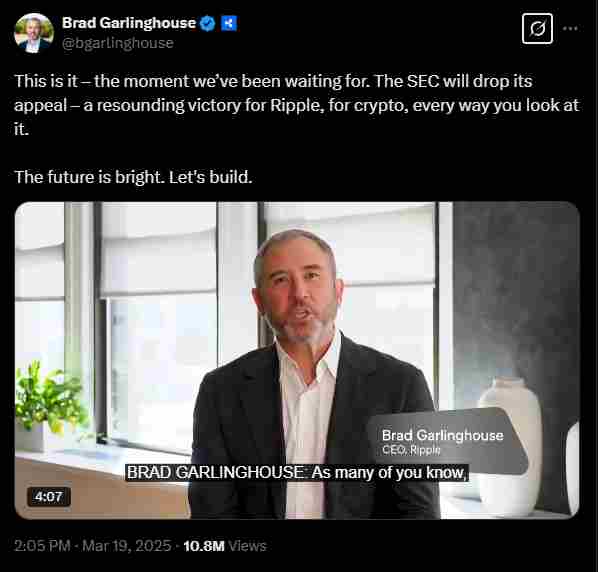

So far, the former SEC boss Gary Gensler has stepped down, and the agency has dropped most of its enforcement actions against major crypto companies.

In particular, Ripple (the issuers of the XRP cryptocurrency) has now been declared free of the four-year legal battle with the SEC, under the leadership of its new chair, Paul Atkins.

5. Crypto’s Growing Environmental Impact

The environmental concerns around the Proof of Work (PoW) consensus mechanism have always been a major issue.

According to the Cambridge Bitcoin Electricity Consumption Index, Bitcoin mining consumes around 1,174 TWh of electricity annually.

This is concerning because it is a lot more than the entire country of the Netherlands consumes.

To worsen matters, around 67% of this energy comes from fossil fuels. This has added more pressure on the environment and is a major contributor to carbon emissions.

Beyond the electricity issues, mining also requires a massive supply of water for cooling data centers. These problems have prompted calls for sustainable alternatives like green-energy sourcing and transitions to Proof of Stake consensus mechanisms, which require much less energy.

6. Real-World Adoption of Blockchain Technology

While crypto has been relegated to speculative trading in the past, the last few years have seen a major shift towards real-world applications.

As it stands, institutional interest in blockchain technology is growing, and many sectors, like supply chain management, finance, and healthcare, are starting to use decentralized solutions.

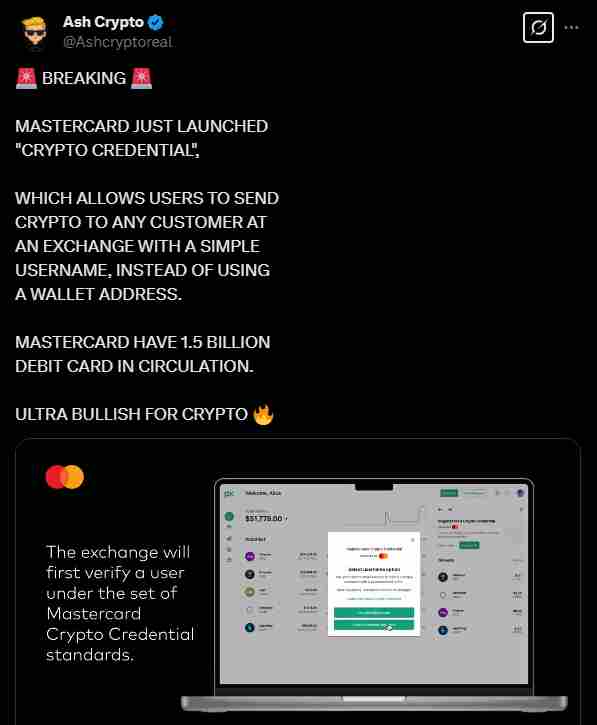

Major companies are now incorporating blockchain into their services, with payment giants like Visa and Mastercard experimenting with stablecoins for cross-border transactions.

7. The Rise of Layer 2 Solutions and Blockchain Scalability

Scalability is a major challenge for popular blockchains like Bitcoin and Ethereum.

Over the last few years, more and more layer-2 networks and other scaling solutions have been emerging across the space.

These solutions, like the Lightning Network for Bitcoin and rollups for Ethereum, are now allowing faster transactions more than ever.

Ethereum, in particular, is experiencing a major expansion in its Layer-2 networks like Arbitrum and Optimism.