Recently, Ethereum (ETH) generated a powerful technical bullish setup. This suggests considerable potential for a run-up in its price. The overall bullish market dynamic has been instrumental in driving great highs for major cryptocurrencies.

Analyzing key trends in price action, MACD, and RSI, it seems that Ethereum is ready to break important resistance levels and drive new year-end highs.

Price Breakout Over $3,540 Resistance

This breakout positions Ethereum to target $3,800 in the near term—the key psychological and technical level; if this level holds, Ethereum’s rally is likely to continue towards the yearly high of $4,100 by December. Such a landmark could further entrench investors’ confidence and increase buying pressure.

This breakout positions Ethereum to target $3,800 in the near term-the key psychological and technical level, if this level holds Ethereum’s rally is likely to continue towards the yearly high of $4,100 by December. Such a landmark could further entrench the confidence among investors and increase buying pressure.

MACD Analysis: Second-Order Divergence

The Moving Average Convergence Divergence indicator is a powerful tool for analyzing the strength and direction of a trend. Ethereum’s MACD setup further consolidates the bullish scenario.

First-Order Divergence: When the MACD line, or the smaller term moving average, had crossed above the signal line (longer-term moving average), a bullish crossover was given, and upward momentum was triggered.

Second-Order Divergence: After this crossover, the MACD lines somehow narrowed, suggesting convergence and a possible weakening trend. That would have ended because the lines diverged once more in the close of the timeframe, demonstrating renewed bullish momentum.

This second-order divergence is important because it indicates a sharp increase in buying pressure after some sort of hesitation. Added to the price breakout, this means Ethereum is ready for further short- to medium-term movement upward.

RSI Nears Overbought Territory

The Relative Strength Index, an important technical indicator, is closing in on 70. The RSI measures the speed and magnitude of price changes to determine whether an asset is overbought or oversold:

- RSI below 30: This indicates conditions under which the asset is oversold; it can signal a buying opportunity.

- RSI Above 70: Suggests overbought conditions, meaning strong bullish momentum but a potential risk for price correction.

In Ethereum’s case, the RSI nearing 70 says a lot about robust upward pressure. At the same time, the indicator suggests that ETH may enter overbought territory soon, which is often associated with strong rallies during the beginning of a bull run. This only heightens the likelihood of ETH attaining higher price targets in the near term.

Ethereum’s Strength Amidst Broader Market Trends

Ethereum’s steady run this bull season stands out within the broader backdrop of other cryptocurrencies experiencing sharp price surges:

- Bitcoin (BTC): The market leader, dominating the bull market, surged from $66,000 to $100,000 in less than a month.

- Ripple (XRP): After a prolonged bearish phase since 2022, XRP broke out and crossed $1, signaling a significant trend reversal.

- Cardano (ADA): Similarly, ADA surpassed the $1 mark, regaining investor attention.

While these assets have shown dramatic movements, Ethereum has trended steadily but steadily upwards. This stability, coupled with the triple bullish indicator setup, places ETH as a strong contender to gain even more.

Likely Price Targets

Given the current technical and market conditions, here are Ethereum’s likely price targets:

The short-term target is $3,800, which can be reached within the week. It forms a vital resistance level and psychological barrier to investors.

The target at Year-end is $4,100, or the yearly high of Ethereum. This will be seen as a major accomplishment, further validating the bullish scenario.

Recovery of Ethereum After ETF and Whale Selling Pressure

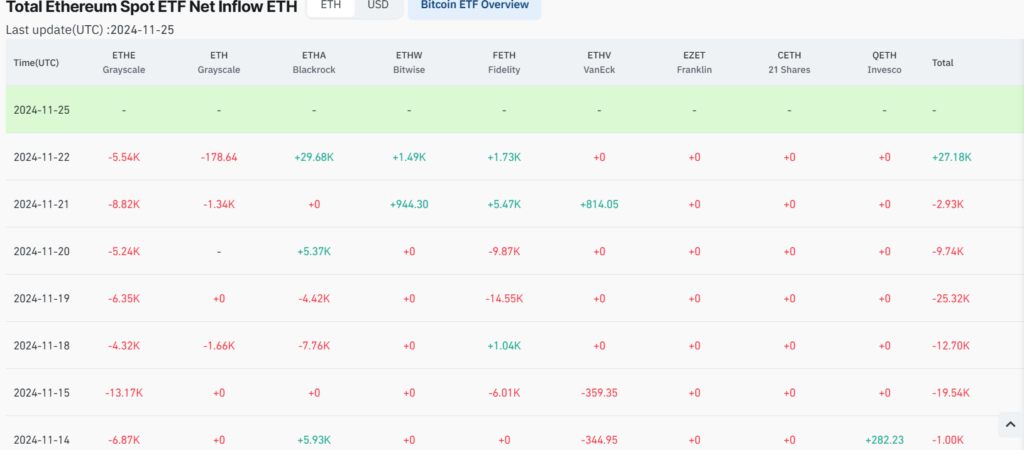

Ethereum’s recent bullish setup comes after a period of underperformance, largely attributed to the poor reception of ETH-based Exchange-Traded Funds (ETFs).

Unlike Bitcoin ETFs, which generated roughly $1 billion approx inflows this week, Ethereum ETFs failed to meet investor expectations, leading to selling pressure on ETH.

Adding to that, the large Ethereum holders known as “whales” were selling considerably during that phase. Whales’ selling pressure is a significant cause for market instability, for their huge transactions may come to have a counter effect on the price. This heightened selling added to further problems of ETH, keeping the cryptocurrency below key resistance levels throughout most of the past month.

However, in recent times, sentiment seems to be shifting since whales have returned as net buyers of Ethereum. Last week, the Whale Wallets bought ETH worth approximately $59 million. This is an indication that renewed confidence is building in the cryptocurrency’s potential. Such accumulation often precedes the rally in prices since it indicates positive sentiment among influential market participants.

With decreased selling pressure, increased whale activity, and good technical indicators on Ethereum’s side, it might be expected that ETH will rebound. This renewed strength might take it to entirely new highs, therefore undoing some of the underperformance recorded earlier.

Conclusion

The triple bullish setup for Ethereum, following a price breakout above $3,540, MACD second-order divergence, and RSI nearing overbought territory, highly supports the case for a sustained rally. Though Bitcoin, XRP, and ADA may have snatched headlines with their movements, steady, technically driven growth from Ethereum offers a compelling narrative.

Investors would watch for breakdowns of $3,800 and $4,100 because Ethereum seems well-positioned to take advantage of its momentum and deliver robust performance through year’s end.