Key Insights

- Ethereum (ETH) has dropped strongly in price lately, based on a combination of factors.

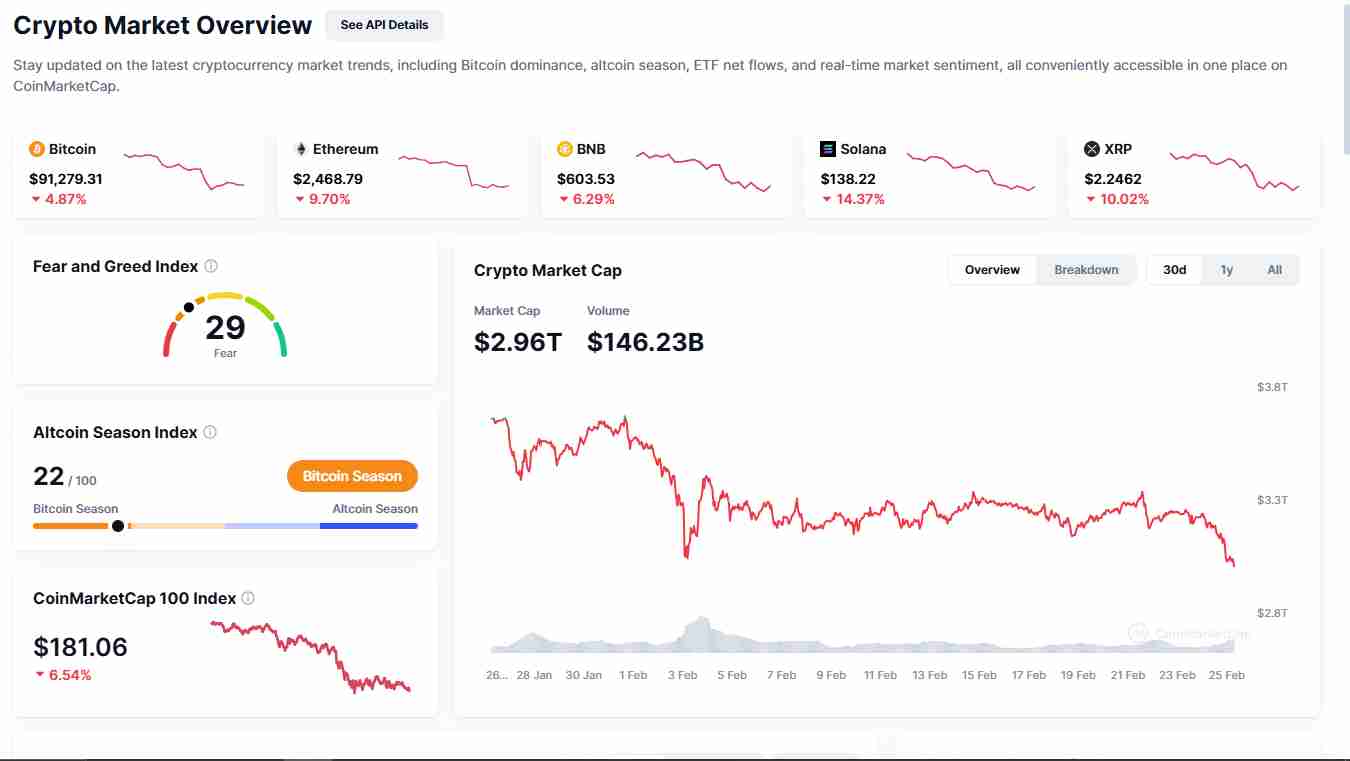

- The general market is currently in a decline, and Ethereum has followed Bitcoin and other major altcoins downward.

- Some of the major contributing factors to this trend are the tariff fears from the US and the recent hack on ByBit.

- Despite ByBit buying more than $700 million worth of Ethereum, prices have yet to reflect this move.

- Analysts believe ETH might continue downwards, but its risk/reward ratio remains strong.

Ethereum has been through some rough weather over the last few days after losing around 10% of its value.

The cryptocurrency’s trading volume has now dropped to a low of $31.75 billion, with its market cap sitting at around $300.9 billion.

Ethereum continues to show signs of bearish momentum and has dropped by around 25% over the last 30 days.

Are these losses due to market uncertainty? Why is ETH dropping today, and is any relief in sight?

The Broader Crypto Market Is in Turmoil

The overall crypto market was hit hard and dropped by around 5% overnight.

According to liquidation data from Coinglass, this move wiped out around $110 billion across the board, leaving the total crypto market cap sitting at just around $3 trillion.

One of the major factors behind this price drop was the recent price tariff announcement from US president Donald Trump.

Trump announced on 24 February that the tariff plans against Canada and China would be moving on “on time and as planned.”

The aftermath of this news caused widespread sell-offs and liquidations.

This in turn led to crashes across Bitcoin, ETH , Solana, XRP, and most other major cryptocurrencies on the market.

Technical Indicators Show Bearish Signs

The ETH price charts show that a strong bearish reversal occurred this week.

For example, there is currently an incoming bearish crossover between the 20-day and 50-day simple moving averages (red and blue lines).

This crossover will undoubtedly happen if ETH breaks beneath its next major support around the $2,300 zone.

If this happens, Ethereum might continue to fall in the short term, eventually hitting support somewhere around the psychological $2,000 zone.

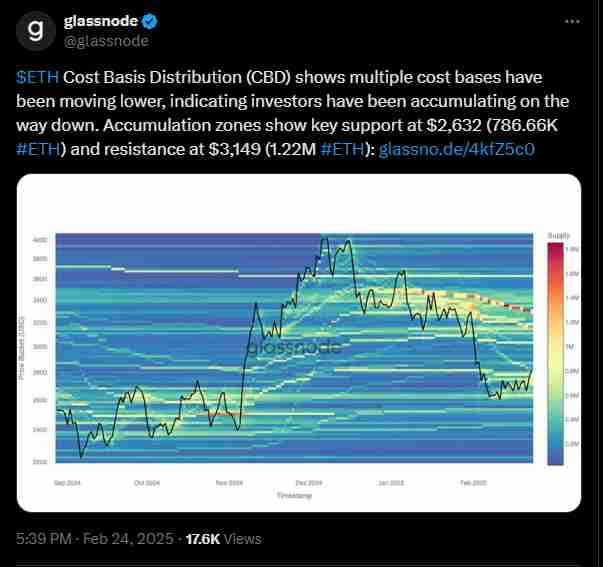

Critical Support and Resistance Levels for Ethereum

At the moment, ETH is currently at some strong crossroads.

To start with, the main resistance for the cryptocurrency sits somewhere around the $2,870 zone.

On the other hand, the main support zones sit somewhere between $2,530, $2,300 and $2,175.

The bearish momentum has held on for long enough, and ETH has lost the $2,530 zone.

This means that at a current price around $2,432, ETH might attempt a rebound towards retesting the $2,870 resistance mark.

If it is successful, it could continue onward to $3,300 as long as buying pressure increases.

On the flip side, if ETH loses $2,300, it could continue downwards to between $2,175 and $2,000.

Bybit’s $700M ETH Purchase Fails to Boost Prices

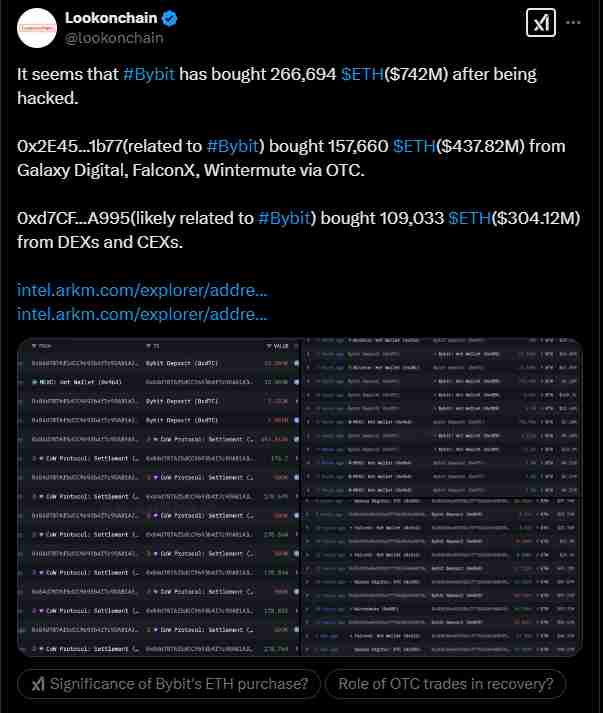

The incident at Bybit this week, where around $1.5 billion worth of ETH was stolen from the exchange by the North Korean Lazarus group, had strong implications for the market.

There were reports that Bybit purchased an extra $740 million worth of ETH to bolster its reserves—which would have been a major boost for prices.

Many traders expected Ethereum’s price to make a comeback and establish upward momentum.

However, these efforts have yet to materialize, and ETH continues to plummet.

Lack of Market Liquidity Adds Pressure

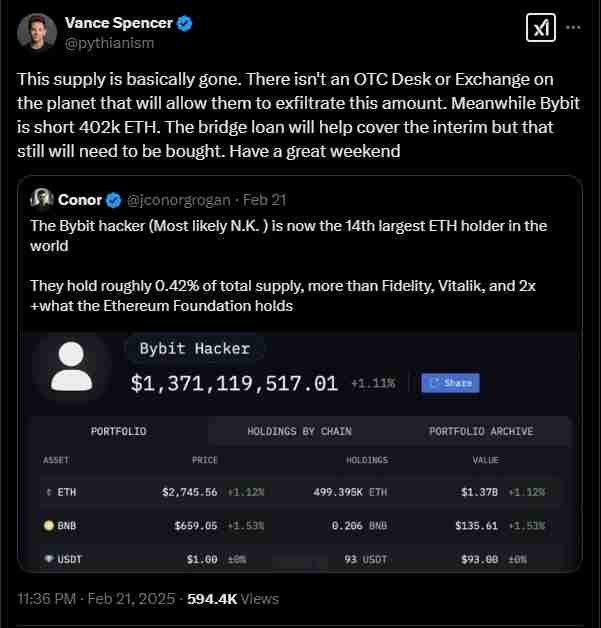

Another factor contributing to the ongoing crash is the lack of liquidity on the Ethereum network.

Per reports, the combined order book depth for ETH across the top 10 exchanges stands at approximately $52 million.

This means that this lack of liquidity is more than enough to completely nullify ByBit’s efforts.

ByBit has already recovered over 50% of the stolen ETH, according gto reports.

However, the uncertainty continues to linger as the selling pressure strengthens.

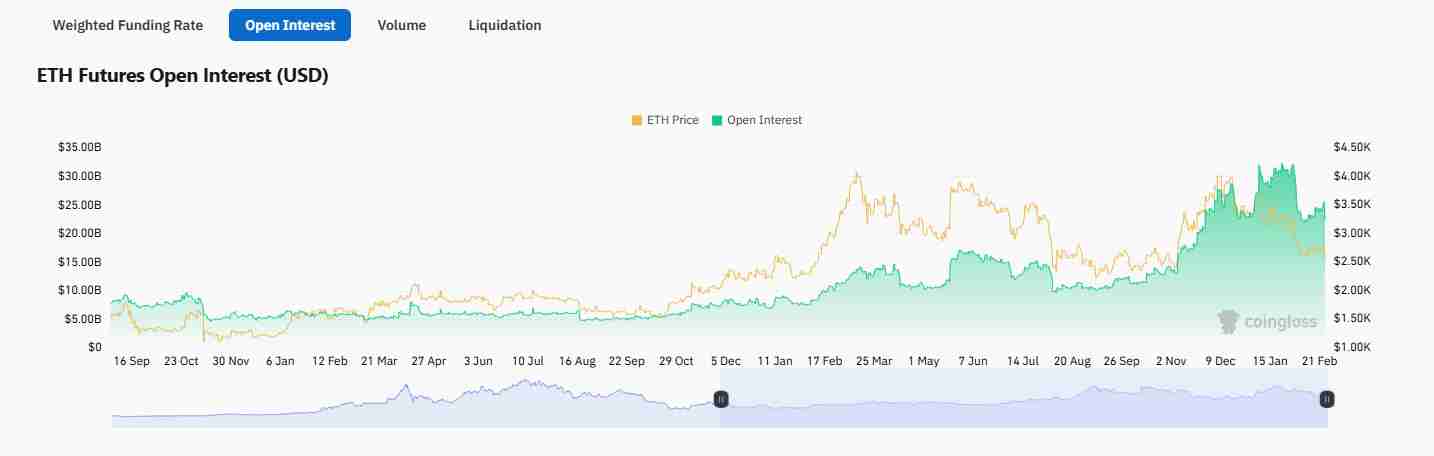

In addition, data also shows that traders have been closing their Ethereum positions at an alarming rate lately.

Ethereum’s futures open interest dropped from around 8.82 million ETH to 8.52 million ETH in a single day, according to Coinglass.

This shows a trend of position closing rather than doubling down on investments.

The liquidation data from Coinglass even shows that despite the harshness of Bitcoin’s liquidations, Ethereum’s corner has been relatively mute.

This indicates that traders might be closing their positions voluntarily to cut losses.

Can Ethereum Recover?

There have even been reports of issues with Ethereum’s staking rewards.

For example, the adjusted native staking yield for ETH currently stands at 2.4%. This is a lot lower than even Solana’s figures, around 4%.

In addition, Ethereum’s supply growth has also reached an inflation figure of around 0.6% inflation, moving it further and further from the ultrasound money narrative.

However, despite the ongoing challenges, analysts are still highly optimistic.

According to historical price patterns, Ethereum’s current market performance isn’t the network’s first rodeo.

Analysts generally believe that the risk-reward ratio for Ethereum is still favorable.

The worst-case scenario for Ethereum would be a total of a 20% decline, with a rally coming in and pushing the cryptocurrency up by around 200%.

Despite its struggles, though, Ethereum continues to show resilience compared to other altcoins.

Bitcoin, for example, has been sliding close to its February low of around $91,000 and is on the verge of breaking below.

Ethereum, on the other hand, is still strongly above its monthly low.

This has led analysts to believe that once the market stabilizes, the momentum might swing in Ethereum’s favor.