Key Takeaways

- Ethereum has consistently underperformed compared to Bitcoin for years.

- Analysts say the cryptocurrency is now at an all-time low with investor sentiment.

- This is a good sign and could indicate that a comeback could be imminent.

- Technical and on-chain indicators show the highly important $2,700 – $2,800 zone.

- Ethereum appears to be working on a break above this range and could be ready to hit a yearly high of $6,000 soon.

Ethereum has been in a slump lately. However, according to technical insights and industry experts, the cryptocurrency might be gearing up for a major move to the upside.

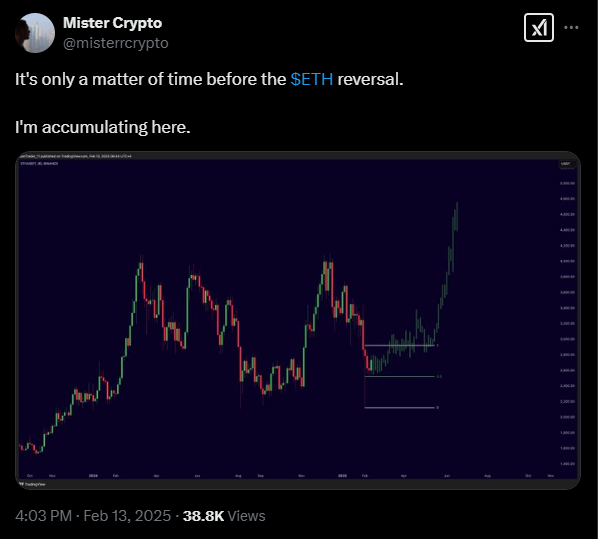

Some of these experts have claimed that Ethereum is now at “peak bearishness.”

In essence, the cryptocurrency could be primed for a major comeback. What does this mean for the future of Ethereum, and why are experts suddenly turning up bullish?

“Peak Bearishness” and the Current Market Sentiment

Ethereum’s current market sentiment is at an all-time low. This means that a turnaround could be closer than anyone expects.

This kind of market sentiment is often referred to as “peak bearishness” and occurs when the pessimism around an asset hits its highest point.

At this level, the ‘paper hands’ (also known as investors who panic-sell during downturns) tend to offload their holdings and leave assets available for “diamond-handed” investors to purchase.

Interestingly, Bitcoin faced a similar situation in 2023, before the launch of Ethereum ETFs in early 2024.

Based on the performance of Bitcoin, Ethereum may experience a similar reversal.

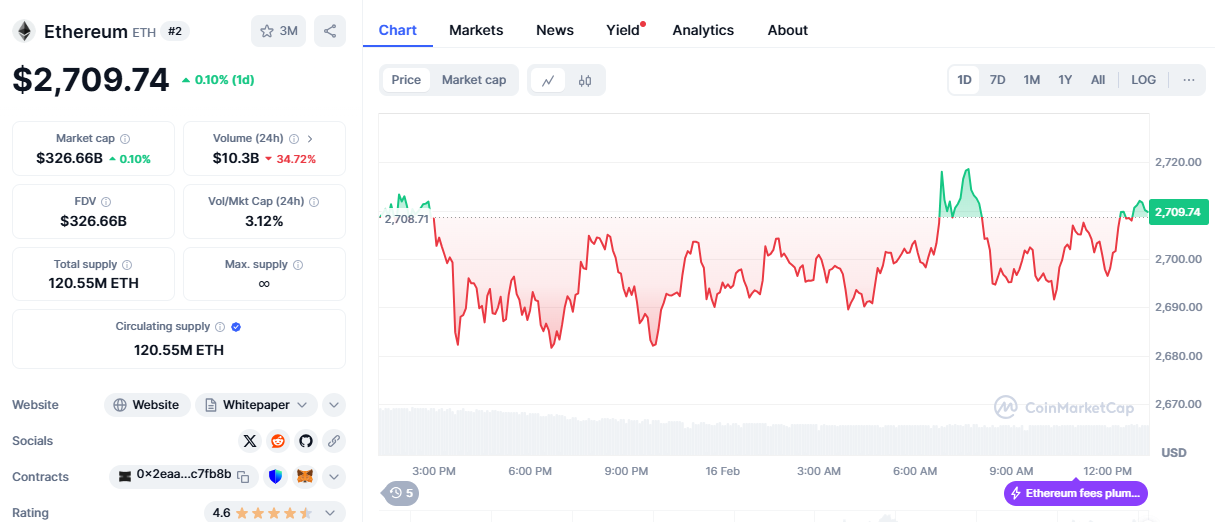

At the time of writing, Ethereum now trades at around $2,700 and is up by around 2% over the last week.

Despite Ethereum’s break below the $3,000 mark In January, the cryptocurrency still has a chance to retest the $4,000 mark in the near future, with analysts like Ali predicting a high of 46,000 by the middle of the year.

If this happens, it would stand as a near 50% price gain for Ethereum within only a few months.

Ethereum’s Struggles with Weak Sentiment and ETF Expectations

Ethereum’s poor investor sentiment has been highlighted by several other voices in the crypto industry.

For example, Unchained Podcast host Laura Shin recently pointed the issue out.

Shin commented on comments from Ethereum co-founder Vitalik Buterin garnering more attention than even a possible Ethereum ETF from 21Shares that (might) include staking.

The cryptocurrency initially reacted to the 12 February filing for this ETF with a 3.5% price increase.

However, these gains evaporated in a mere 24 hours as investors lost interest once again.

Will Ethereum Break the $2,700 Resistance?

According to the current Ethereum charts, the cryptocurrency is attempting to break above the critical resistance of around $2,700.

At the time of writing, Ethereum appears to be winning the fight somewhat, with a current price of around $2,711.

If the cryptocurrency manages to maintain its position above this price level, it could be a major pointer for a change in sentiment.

This could lead to more significant price gains as the cryptocurrency starts to target the $3,000 zone once again.

On the other hand, Ethereum could turn bearish and decline further if the bears are successful in pushing it below the $2,700 zone once more.

This resulting slump could take Ethereum further down to a low of $2,350.

The four-hour chart above also shows that Ethereum has been consolidating in a narrow range, especially with the cryptocurrency approaching such an important milestone.

Ethereum’s behavior around the $2,700 zone will determine whether or not it shifts into a bullish pattern.

Technical Indicators Show a Bullish Shift

The technical indicators in the charts indicate that the bulls might be growing in strength.

For instance, the daily and hourly charts indicate a resurgence in the bull market.

Even the MACD is testing the red moving average line, after the histogram bars crossed above the neutral level.

This shows that a bullish shift could indeed be on the way for Bitcoin’s biggest competitor.

In the same vein, the recent announcement of the Ethereum Pectra upgrade for the Holesky and Sepolia testnets in February and late March has lifted market sentiment somewhat.

This upgrade (which features data availability and UX improvement for validators) is expected to reduce gas fees and improve network performance.

This could increase Ethereum’s appeal to retail and institutional investors and bring a bullish reversal further into view.

Ethereum’s Price Action and the Road Ahead

Ethereum itself has failed to break above the $4,000 zone recently and even made two failed attempts in December of last year.

Now with the cryptocurrency hovering around the $2,700 mark, many continue to ask whether Ethereum will find its footing eventually or continue to slide downwards.

As far as the technical indicators show, Ethereum breaking above the $2,817 level could signal the start of a new bullish trend.

However, if the cryptocurrency continues to consolidate, the bears might gain strength and cause a pullback towards the $2,350 support zone.

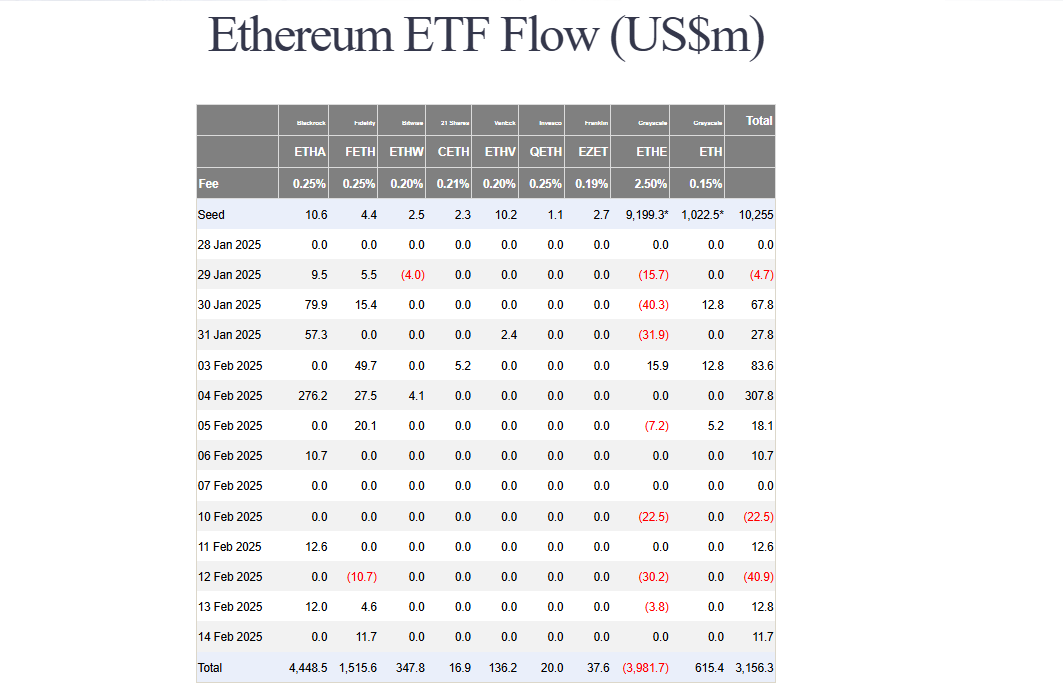

So far, the spot Ethereum ETF market has yet to show any serious signs of bullish strength, with one of the harshest outflows of $40 million hitting the market on 12 February.

Overall, the cryptocurrency’s ability to hit $4,000 is undoubted by analysts all over the internet.

The real question is: When will Ethereum reverse its bearish sentiment, and when will we see a reclaim of the $3,000 zone?