Key Takeaways

- The crypto market recovered moderately on Monday, before crashing to $82,700, with most of the rest of the market trading in the red.

- The much-anticipated FOMC meeting is ongoing, where FED chair Jerome Powell is expected to make the next interest rate announcement.

- Investors typically expect that the Federal Reserve will keep its interest rates steady.

- However, there is growing speculation that there might be unexpected outcomes, and prices will crash across the crypto and stock markets.

- Donald Trump is in support of rate cuts, but analysts like Ki Young Ju believe that the Bitcoin bull cycle is over.

The crypto market recovered moderately on Monday, with Bitcoin climbing above the $84,000 zone alongside gains in the US equity market.

This volatility comes amid the ongoing FOMC meeting, where FED chair Jerome Powell is expected to make the much-anticipated interest rate announcement.

All eyes are on the crypto and stock markets, considering the possible effects such an announcement might have on prices.

Despite Monday’s optimism, analysts are warning that another downturn may be on the horizon.

Market watchers are closely monitoring the situation, and here are some of the things to expect from crypto once the announcement has been made.

Bitcoin and Crypto Market Gains, Then Crashes

Bitcoin rose to $84,000 on Monday, causing a broader uptrend in the crypto market.

The total crypto market also saw around a 2% increase within the same timeframe, with major cryptocurrencies like Ethereum seeing a 2.8% increase after stabilizing above the $1,900 mark.

Other cryptocurrencies like SUI, AAVE, ICP, and NEAR surged over 5%, with Solana rising by 3%.

Ethena emerged as one of the best performers with a notable 7% rally after the news of a proprietary blockchain initiative with Securitize.

Despite these positive movements, Bitcoin is back to trading at around $82,700, with most of the rest of the market trading in the red.

Some of these developments have led some analysts towards a cautious stance.

As it stands, a prolonged correction in U.S. equities could have unexpected consequences—the most prominent of which is a Bitcoin drag to the March 2024 peak range of $73,000-$74,000.

The FOMC Meeting and Its Potential Market Impact

The upcoming FOMC meeting, which is scheduled for 18–19 March, is expected to play a major role in shaping market sentiment.

Investors typically expect that the Federal Reserve will keep its interest rates steady.

However, there is growing speculation that policymakers might pause or even stop the central bank’s balance sheet runoff.

This is more popularly known to investors as quantitative tightening (QT).

According to David Duong, the head of research at Coinbase Institutional in a recent report, the FED may halt its QT program since bank reserve levels have reached 10-11% of GDP.

This 10 – 11% market is typically considered healthy for financial stability.

In addition, if the Fed hints at a change in policy, liquidity conditions could improve and crypto could rally after all.

Could President Trump Influence Crypto’s Trajectory?

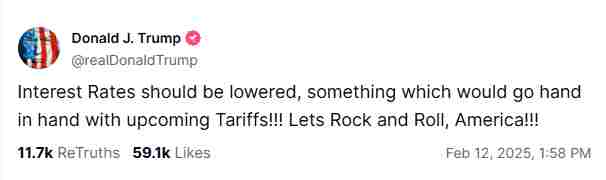

Beyond the FED’s decisions, some industry leaders believe that President Donald Trump could play a major role in the growth (or decline) of crypto.

Trump himself has expressed support for rate cuts in the past, and has even dubbed himself the “Crypto President.”

So far, his administration has shown that it is willing to engage with the digital asset industry, and some believe that he could even pressure the Fed to reconsider its stance.

One of the most recent examples of Trump’s influence on financial markets was his endorsement of Tesla products at the White House on 10 March.

Tesla stock had been struggling before this endorsement. However, Trump’s comments helped the company see a noticeable uptick.

Considering the strong correlation between Tesla and the crypto market, a similar move in favor of the digital asset market could turn out to be bullish indeed for Bitcoin and other cryptocurrencies.

The Role of Inflation and Market Sentiment

The recent Consumer Price Index (CPI) data showed lower-than-expected inflation.

This development fueled optimism among crypto investors, and led to a price rally in early February.

If the inflation rates continue to decline, it could pressure the FED to introduce rate cuts instead of hikes.

This could do much to create a favorable environment for risky assets like Bitcoin.

However, inflation isn’t the only concern for the central bank.

Other issues like the Tariff war, global trade tensions, and the fears of an economic slowdown could do much to influence the FED’s decision.

At the same time, the market’s sentiment is still very fragile.

While the extreme fear readings on the Fear and Greed index have subsided, the crypto market still lacks a strong narrative to drive its growth further.

Without a compelling catalyst to drive prices up, short-term rallies might struggle to mature into longer-term ones.

As such, volatility will skyrocket and prices will continue to decline over the long term.

What’s Next for Bitcoin?

The next few weeks will be a very important period for Bitcoin and the rest of the crypto market.

If the FED supports a shift in policy that halts its quantitative tightening, it could create a more favorable environment for crypto in the US and the rest of the world.

However, if policymakers maintain their current stance, Bitcoin could be in for some fresh selling pressure—especially if U.S. equities enter a correction phase.

CryptoQuant CEO Ki Young Ju believes that the Bitcoin bull cycle is over, and that the market will likely move sideways or downwards for the next 6 – 12 months.

However, any intervention from Trump could change the trajectory of the market as a whole.

If he continues to advocate for rate cuts, it might provide the market with a much-needed confidence boost.

For now, all eyes are on the FOMC meeting and investors are watching closely for any signs that the FED might change its stance.

Until then, traders should prepare for more volatility as the market picks out its next direction.