Key Insights

- Litecoin (LTC) has been resilient so far, despite the ongoing market downturn.

- The cryptocurrency’s stability likely comes from its recent inclusion in the Hashex Nasdaq Composite Crypto Index.

- According to the daily charts, the cryptocurrency has been struggling to break above its 200-day EMA.

- Litecoin just broke below a range between $139 and $93 (which had been in place since November 2024).

- If LTC follows this bearish script, analysis shows that it could be in for a possible price drop of up to 32% towards $70 or $50.

- A break above the $103 zone would invalidate all of the bearish signals.

While most cryptocurrencies are now struggling on major timeframes, Litecoin is moving against the tide.

Despite a prior two weeks of intense bearishness, several aspects of the market are turning green again, and Litecoin in particular is up by around 2% over the last 24 hours.

So far, the cryptocurrency is showing resilience, and investors are watching closely as LTC attempts to retake the psychological $100 mark once again.

Why Are Expectations for Litecoin High?

Litecoin last traded above the $100 mark at the start of the month.

However, considering its recent performance, it might not be long before it reclaims this price level.

Despite this bullish momentum, the cryptocurrency faces some technical challenges that could influence its price trajectory in the coming weeks.

The strong position of this cryptocurrency comes from its recent inclusion in the Hashex Nasdaq Composite Crypto Index.

The calls for a Litecoin ETF have become louder over the last few months, with major players now filing versions of LTC ETFs and awaiting approval from the SEC.

Additionally, LTC is also benefiting from its unique value proposition.

Just like Bitcoin, LTC is a decentralized payment network. This means that it offers fast and cheap transactions and is a viable alternative to Bitcoin itself.

This intrinsic use case helps the cryptocurrency to retain a level of stability that other cryptocurrencies often lack.

In addition, LTC has gained just 8.8% over the last year—which is on the low side.

However, it did experience a staggering 104% surge in the year before that, which allowed it to outperform many other cryptocurrencies within that timeframe.

This shows that while Litecoin might not be great for investors looking for fast returns in the short term, it is still a top choice for long-term investors looking or reliability.

What Do the Charts Say?

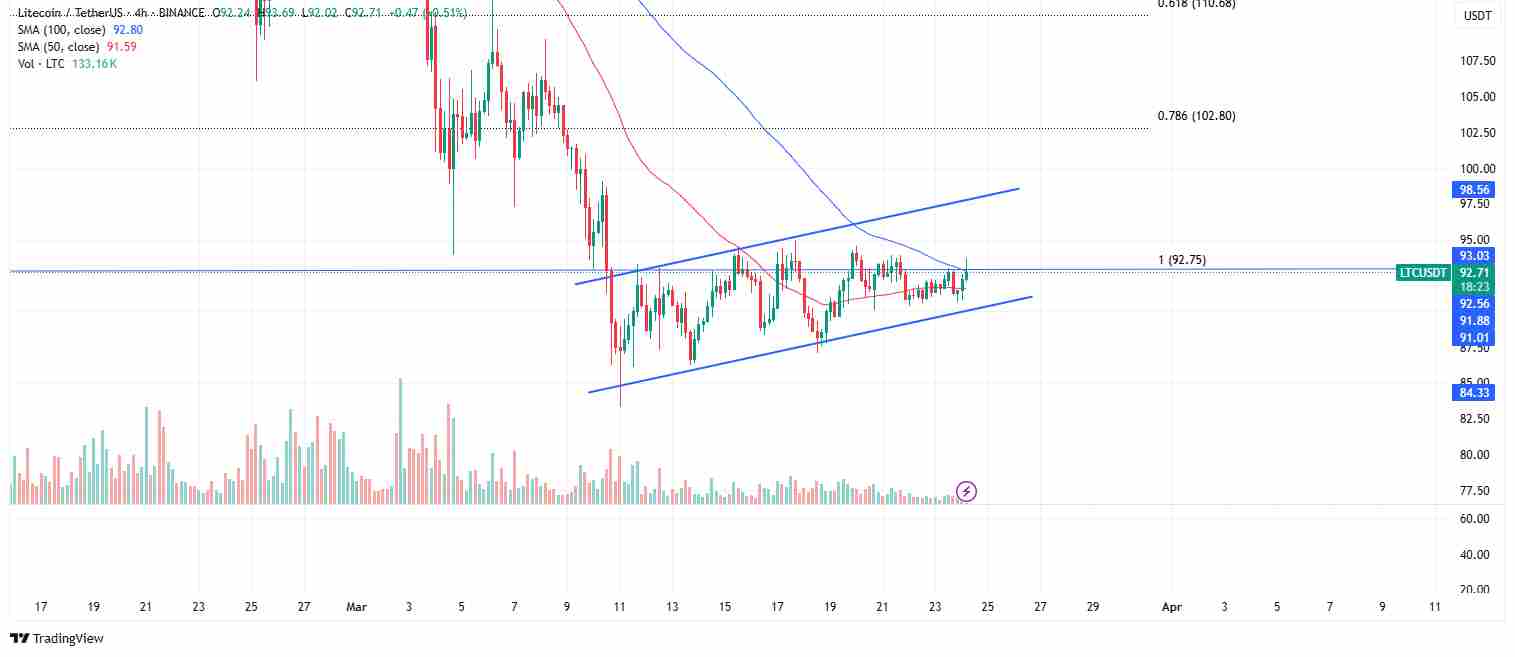

The charts point towards a few bearish indicators for Litecoin as it stands. To begin with, the cryptocurrency has now formed a looming death cross on the daily chart.

For some context, this formation is a bearish indicator that traders should monitor.

As shown by the daily charts, the cryptocurrency has been struggling to break above its 200-day EMA.

Typically, when a sustained move above this level occurs, it often means that the bulls are back in control.

However, Litecoin has failed to break through and is leading to investor concerns about its strength.

This death cross looms between the 50-day SMA and the 100-day SMA, indicating that downward momentum is increasing.

If both of these indicators cross over one another, Litecoin could be in for a major sell-off.

Other Bearish Signals

Aside from the issue that Litecoin just broke below a range between $139 and $93 (which had been in place since November 2024), the cryptocurrency is also trading within a bear-flag pattern.

If Litecoin follows this bearish script to the letter, analysis shows that it could be in for a possible price drop of up to 32%.

This would be similar to what happened back in March, where Litecoin might test the $70 to $50 range.

The next few weeks will be critical for Litecoin’s price action.

If the cryptocurrency successfully breaks above its 200-day MA and sustains its gains, it just might push above the $100 mark and solidify its position as one of the most stable cryptocurrencies on the market.

Investors should also note that a break above the $103 zone would invalidate all of the bearish signals above and even lead to a rally towards higher highs.

On the other hand, if Litecoin is unable to clear the $95 zone, a steeper correction could be inbound.

Whether LTC reaches the $100 zone soon or faces setbacks along the line will depend on how well it manages these challenges.

Investors should keep a close eye on the $95 range to confirm bullish dominance. They should also keep an eye out for the $103 zone to confirm that the bulls are indeed back in action.

As always, remember to conduct proper research and analysis before making any major investment decisions.