Key Insights

- Litecoin (LTC) is currently reflecting the broader market decline with its price trajectory.

- Despite the decline, the $94 zone appears strong enough to hold prices up.

- A Litecoin recovery could come in at this point, leading to a rally above the $100 zone and towards $130.

- Many traders see any prices below $100 as a prime accumulation zone for LTC.

- Litecoin could be set to take on the $200 zone or even move higher up to $230 if the bullish conditions persist.

Litecoin is one of the longest-standing cryptocurrencies on the market.

This asset has been navigating the broader crypto decline for weeks and has even experienced a notable drop to as low as the $94 support level.

However, despite this setback, several indicators show that LTC could be preparing for an incoming bullish run.

Here are some of these factors and how they point towards a possible price jump towards the $200 mark.

The Recent Dip—Profit-Taking or Market Shift?

LTC is currently down by around 20% on the weekly timeframe. This decline has led to questions about its short-term trajectory.

While many analysts have attributed the Litecoin dump to profit-taking, long-term holders may not have cashed out their holdings after LTC’s bullish run in early February.

Notably, the price of XRP was initially fueled by the positive sentiment around US President Donald Trump establishing crypto reserves for various cryptocurrencies.

However, traders soon realized that not only did the reserve plans not include Litecoin, they also featured no plans to actively buy any cryptocurrencies.

Because of this, selling pressure started and intensified, bringing the price down to its current levels.

While the ongoing decline seems concerning, it just might present the best buying opportunity for traders who see any sub-$100 prices as a valuable accumulation range.

Technical Indicators Signal Rebound

Despite the downturn, many technical indicators show that LTC could be on its way towards recovery.

One of these indicators is its RSI, which currently sits in oversold territory on the daily timeframe.

When this happens with the RSI of an asset, it typically means that said asset is undervalued and could be ready for a reversal to the upside.

In addition to the RSI readings, Litecoin appears to be trading within a parallel channel, where the 200-day SMA coincides with the lower boundary of said channel.

This puts a great deal of credibility on the ability of the $93 zone to hold LTC up.

If the bulls are able to build and sustain some momentum from here, LTC could be set for a major rally in the coming weeks.

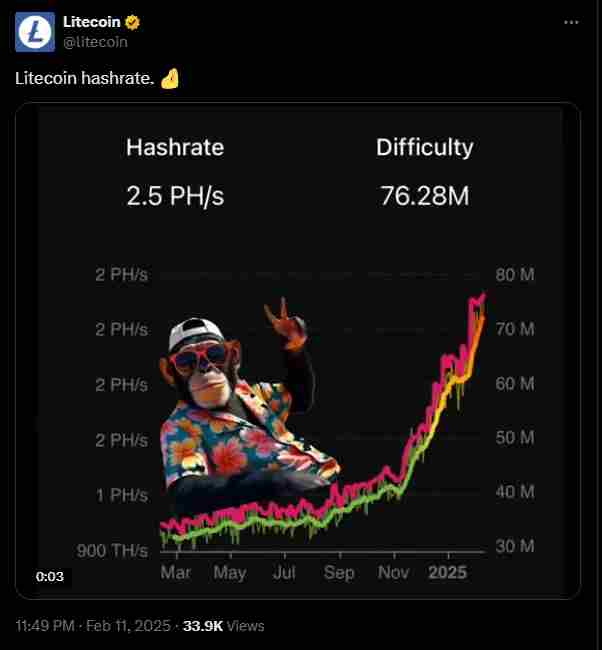

Hash Rate at an All-Time High

Aside from the 200-day SMA and the parallel channel, Litecoin’s network fundamentals are strong as well.

This has reinforced the idea that its price could soon recover.

For example, the network’s hash rate recently hit an all-time high. This is bullish because it typically means that miners have confidence in the network’s long-term stability.

The higher hashrate also puts some degree of confidence in Litecoin. The LTC network is now more resilient to attacks and is therefore stronger in the crypto market.

The increase in miner participation is a bullish sign and shows long-term commitment from those securing the network.

Key Resistance and Support Levels to Watch

Litecoin is currently testing a crucial support level from a technical perspective.

The $94 zone continues to hold the cryptocurrency up so far—if this zone continues to act as a floor, LTC could be on the verge of targeting higher resistance zones.

Overall, some of the key resistances include the $130-$140 range (which LTC has struggled to break in recent months).

Another is the $180 zone, which could open the door to higher highs around $200, which the bulls have set their eyes on.

If the bulls still have enough fuel left in the tank, LTC could trek further up to the $230 mark.

So far, many traders see LTC’s ongoing dip as a major accumulation zone, with experts like Valeriya accurately predicting the dip towards the $94 zone and noting that a rebound is likely to take LTC towards $147 shortly after.

Historically speaking, Litecoin has been one of the most resilient cryptocurrencies, especially during market downturns.

The cryptocurrency even held its ground throughout the February dip, while Bitcoin lost more than 25% of its value.

This puts even more confidence in the ability of the $94 zone to hold LTC up and even help it recover faster than other altcoins.

Will Litecoin Reach $200?

In the future, several factors could influence Litecoin’s ability to register higher highs.

Some of these include the broader crypto market’s performance and adoption in terms of the much-anticipated Litecoin ETFs.

Litecoin tends to follow Bitcoin’s price movements sometimes, which means that its chances of success could be tied to the flagship cryptocurrency from a historical perspective.

If the Litecoin price rebounds from the $94 zone and another downturn occurs, the cryptocurrency could struggle to maintain levels above $130.

Overall, the average price outlook for Litecoin in 2025 sits at around $165, assuming that the market conditions remain steady.