Key Takeaways

- The crypto market is currently going through a bearish phase.

- Bitcoin crashed amid tariff updates from US President Donald Trump, bringing the rest of the market down with it.

- Several major cryptocurrencies experienced double-digit losses within short timeframes.

- Historically, Bitcoin tends to rebound in times like these and make new all time highs.

- The crypto market continues to watch for what might happen next with Bitcoin.

The crypto market got hit by a sharp downturn this week, right after US President Donald Trump’s announcement of import tariffs from Canada and Mexico.

This news sent shock waves across the crypto market and triggered liquidations of nearly $950 million as inflation concerns resurfaced.

Major players like Bitcoin and Ethereum suffered the most as investors rushed to adjust their positions.

Here’s how it all turned out.

Tariff Announcement Sparks Market Turmoil

Donald Trump announced the 25% tariff on Canadian and Mexican imports this week.

Said tariffs are expected to cover over $900 billion worth of goods—including automobiles, auto parts, and agricultural products.

More importantly, they will take effect by early March of 2025, ending the month-long pause on planned import taxes.

“We’re on time with the tariffs, and it seems like that’s moving along very rapidly,” Trump said during a press conference alongside French President Emmanuel Macron.

He defended his decision and said that foreign trade policies have long put the U.S. at a disadvantage.

Moreso, the tariffs will help to reduce the federal budget deficit and create new domestic jobs across the country.

However, this announcement scared investors, especially in risk-asset sectors like crypto, where there was a volatility surge after the news.

Bitcoin and Ethereum Lead the Sell-Off

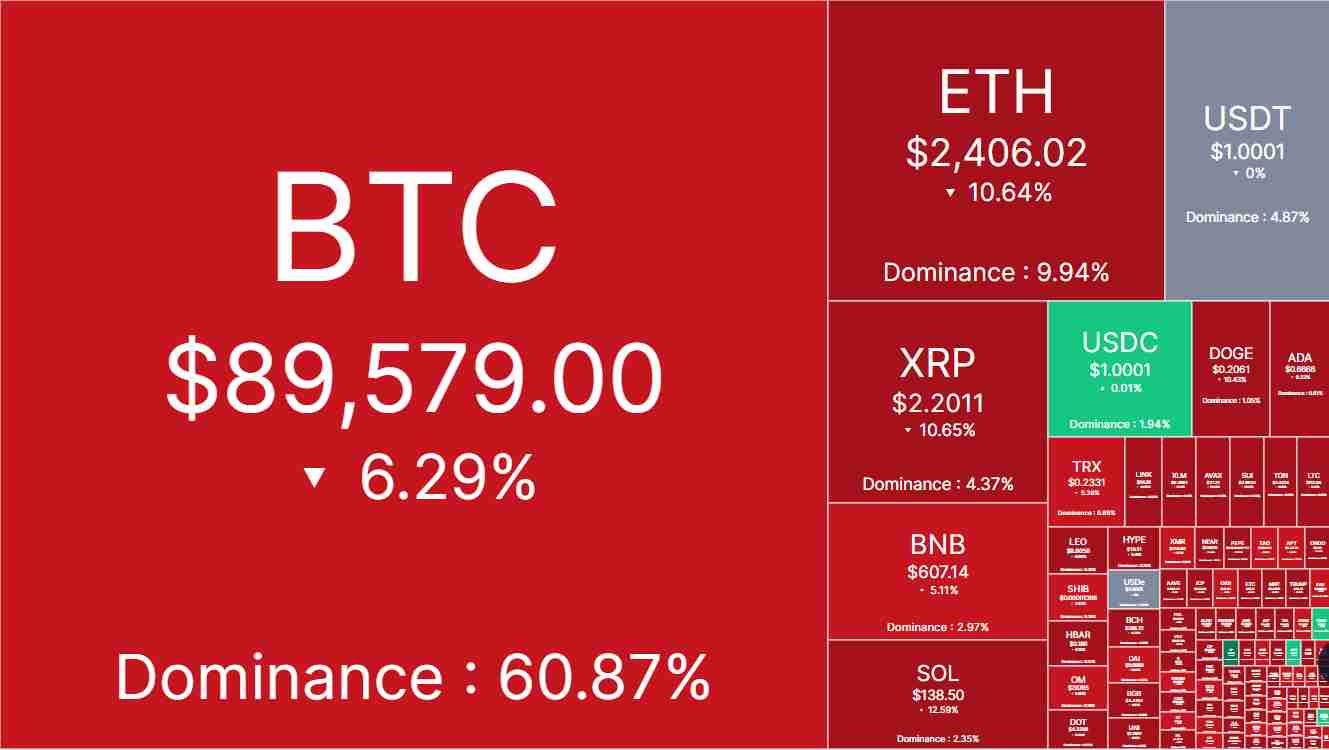

Bitcoin was the first to take a nosedive, plunging beneath the $95,000 zone before continuing downwards to the $91,000 zone.

Ethereum followed soon after, dropping by around 11% to the $2,400 zone.

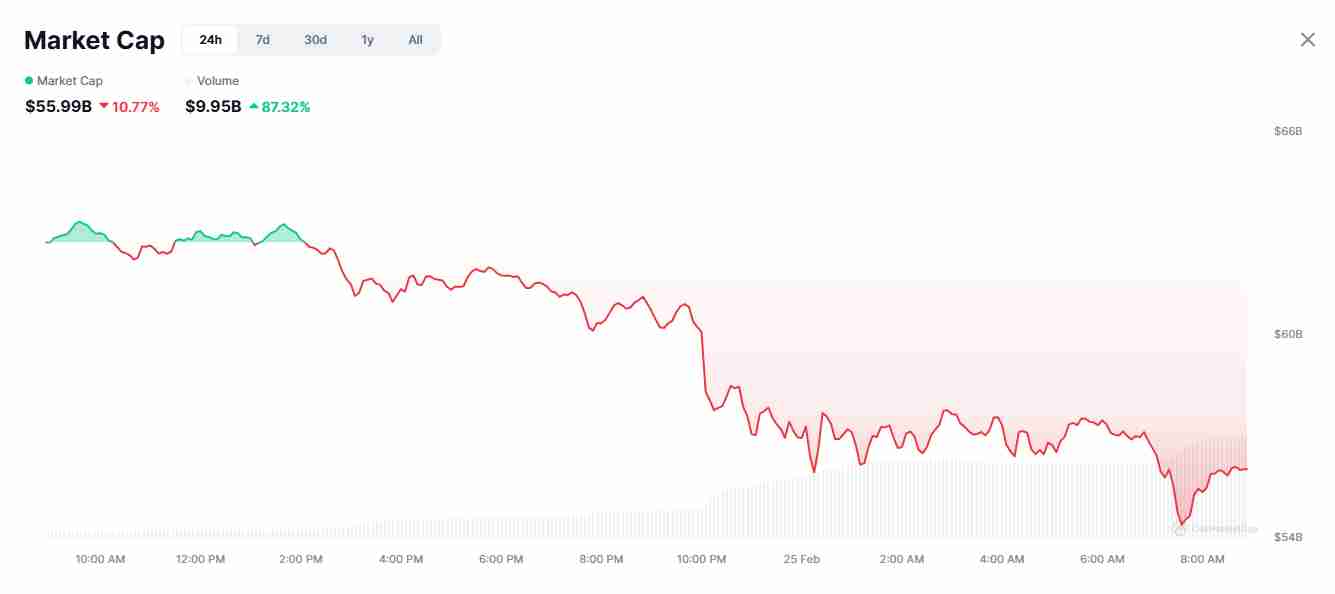

According to data from CoinMarketCap, the broader crypto market has suffered as well, with its total market cap shrinking by around 8% soon after the news broke.

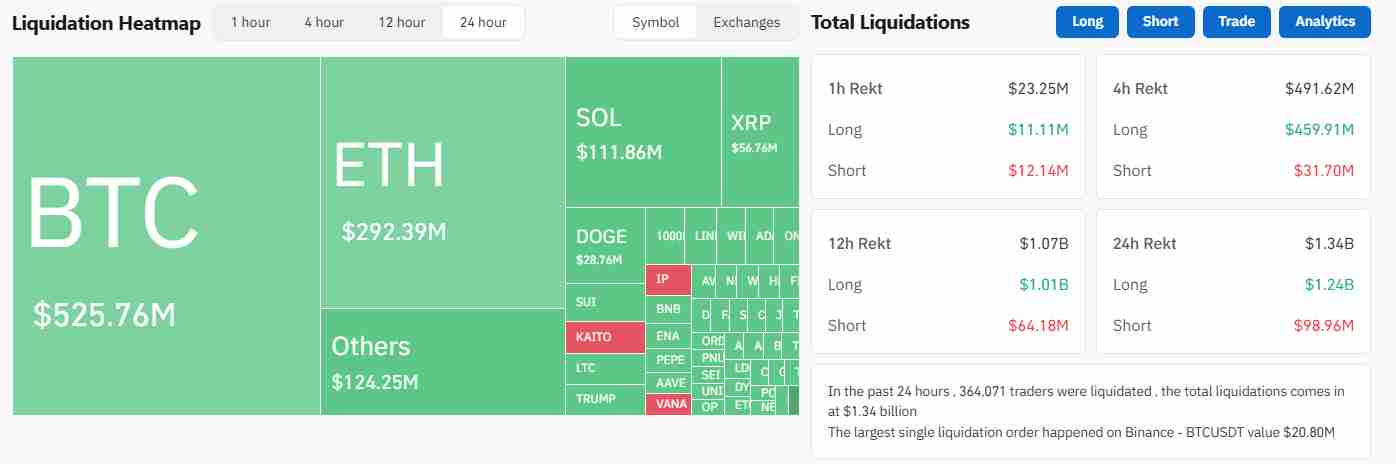

The turbulence also caused a massive wave of liquidations, with the bulls suffering the worst of it.

According to Coinglass data, nearly $1.4 billion worth of long positions were wiped out within 24 hours.

The Ethereum traders lost around $292 million of the total, with Bitcoin traders losing around $525 million.

Other major cryptocurrencies like XRP and Solana also took hits, with the former falling by 10% and the latter dropping nearly 16%.

Others, like Dogecoin, crashed by 13%, and Cardano lost around 11%.

Memecoin Implosion Amplifies Liquidation Cascade

The collapse of the memecoin market also fueled the liquidations further.

Several high-profile memecoins saw harsh selling pressure as more and more traders got liquidated.

Solana, which has been the hub for this memecoin activity, lost around $50 billion in market value over the last month.

This was mostly due to the endless string of memecoin scandals, like the Libra memecoin project tied to Argentinian President Javier Milei.

The Official Trump (TRUMP) token—backed by Trump himself—crashed hard as well and is now around 75% from its peak.

This decline in the prices of speculative assets has now created a bearish sentiment against the Solana network.

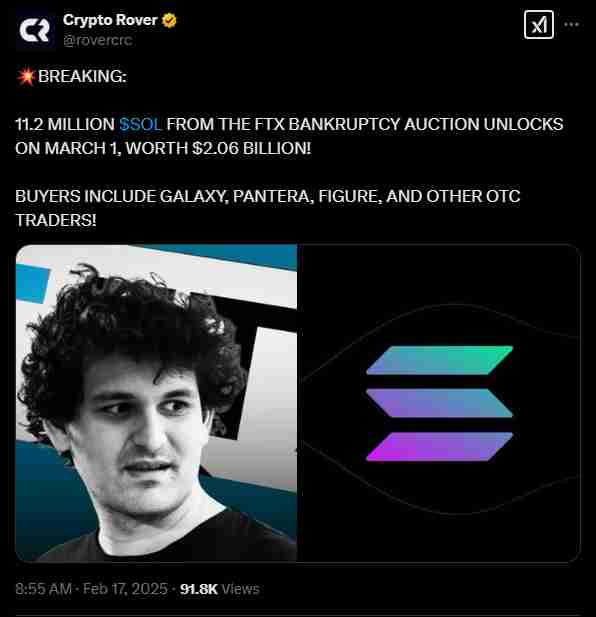

This is also without mentioning the incoming $1.72 billion SOL sell-off on March 1 by the FTX estate.

This event is expected to flood the market with even more tokens and crash prices even lower.

Bitcoin Dominance Rises as Traders Seek Stability

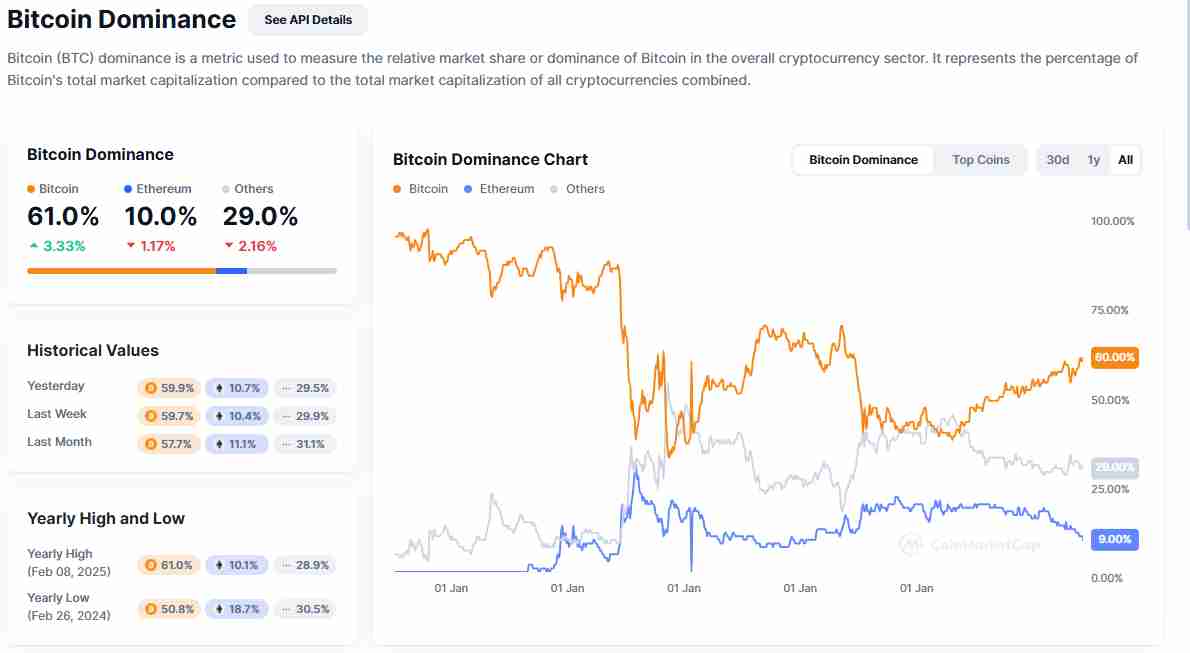

Another interesting aspect of this trend is Bitcoin’s dominance.

Despite the sharp decline, the crypto market has remained relatively stable compared to other altcoins.

So far, Bitcoin has dropped by around 6%, which is less than the experienced drops across the altcoin market.

The difference in these price drops has led to an increase in the Bitcoin dominance index (BTC.D).

In essence, despite the downturn, many traders are expressing less and less interest in the altcoins, especially with Bitcoin’s stability.

According to historical patterns, when Bitcoin crashes like this after making an all-time high, it tends to rebound and make an even higher high.

The same trend was recorded in 2017, when the cryptocurrency experienced multiple drawdowns amounting to a 28% dump.

It then rebounded and made a new all-time high around $20,000.

Bitcoin Reserve Bills Rejected in Several States

Meanwhile, the bitcoin reserve bill is currently facing serious friction.

According to reports, efforts to integrate Bitcoin into state reserves have now been blocked in several US states.

These legislative attempts failed in Montana, North Dakota, Wyoming, and South Dakota, among others.

Montana’s House Bill 429, for example, which proposed allocating $50 million to Bitcoin, precious metals, and stablecoins, was defeated in a 41-59 vote.

The same thing happened with North Dakota’s HB 1184 in a 57-32 defeat.

Even harsher versions of these events happened in Wyoming with its HB 0201 and South Dakota’s HB 1202.

These kickbacks show the ongoing skepticism around the crypto market lately.

There are now major concerns about the issues associated with holding Bitcoin as a reserve asset, and the downturn might be set to continue.

Looking Ahead

The ongoing concerns about inflation and the bearish market sentiment have left traders bracing for more volatility.

However, considering Bitcoin’s tendency to recover after similar dips, investors continue to remain optimistic.

The market’s next moves will likely be influenced by several other major factors.

For now, though, crypto investors continue to navigate the ongoing dip across the market as a whole.